|

👋 Howdy Partner,

Investing is simple, but not easy.

Most people overcomplicate it with complex strategies and hot tips. In reality, the most successful investors base what they do on a few timeless principles.

Today, we are breaking down 10 Finance Concepts that you should know.

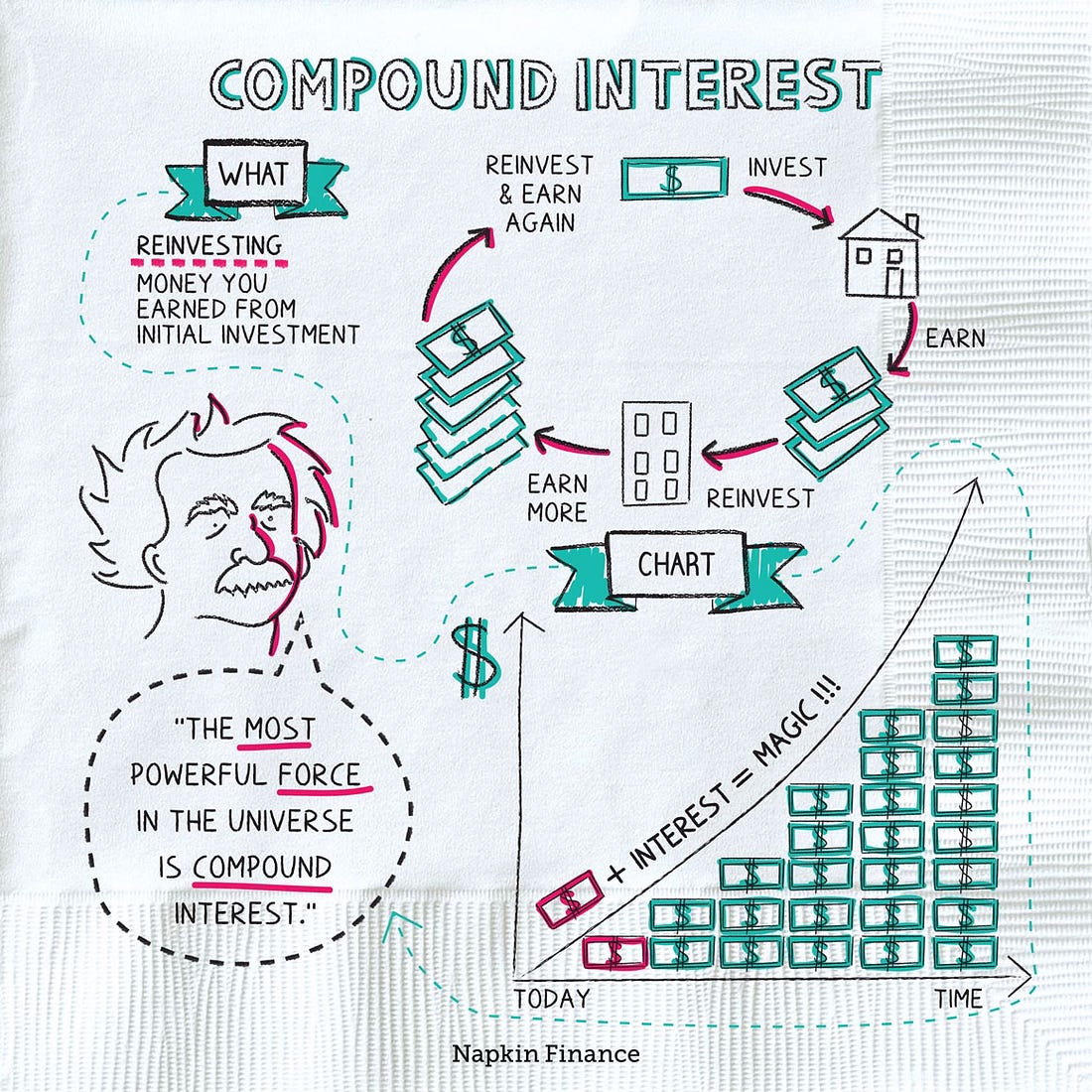

1. Compound Interest

Albert Einstein supposedly called it the eighth wonder of the world for a reason.

(In reality it was probably a clever advertisement writer for a savings and loan company.)

Regardless of who said what about compound interest, you should understand it, and use it to your advantage.

Compound interest is when your money makes money, and then that money makes money.

Start with $10,000 invested at a 10% annual return (like the historical S&P 500 average), and in 30 years, it could grow to over $174,000 - most of that from reinvested gains, not your initial capital.

Key Takeaway: Time is your best friend. Start early, reinvest dividends, and let patience do the heavy lifting.

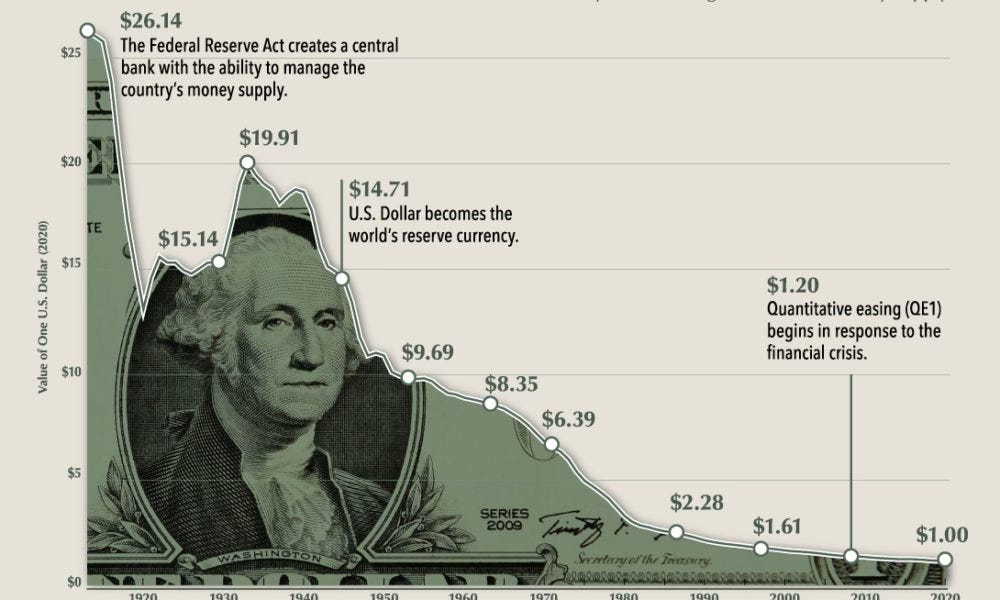

2. Inflation

Inflation is the rise in prices over time, which reduces what your dollar can buy.

If prices rise by 3% every year, your $100 will only buy $41 worth of goods in three decades.

That means your money has to earn at least the rate of inflation to keep its purchasing power over time.

Savings accounts yielding 1% won’t do it.

Key Takeaway: Beat inflation by investing in assets that outpace it like stocks, or real estate. Think of companies like Coca-Cola, which can raise prices without losing customers.

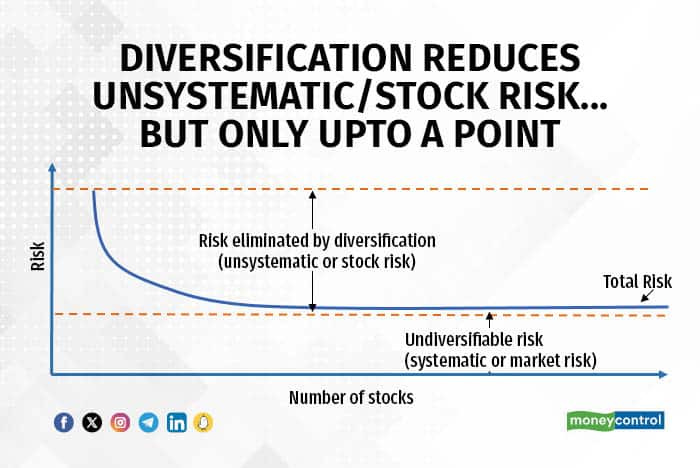

3. Diversification

Diversification spreads risk across different assets, sectors, or geographies.

But more diversification isn’t always better.

Charlie Munger calls it “Deworsification” when you buy too many things you don’t understand.

If you only have 1 stock, adding a second one does spread out the risk, but the benefits of adding more decay quickly.

Most studies find owning more than 20 - 25 stocks doesn’t add any benefit.

Key Takeaway: Own a concentrated portfolio of 15–25 high-quality businesses you know inside and out. If you want diversification beyond that, owning other asset classes like bonds or real estate is a better bet than adding more stocks.

4. Risk vs. Return

In the short term, stocks are volatile.

In the long term, they have higher returns than other asset classes.

The image shows the VIX and MOVE indexes.

The VIX tracks how much investors expect stock prices to move up and down.