| | In today’s edition: Dubai makes a big bet on its financial district, Qatar home sales rise, and Muba͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Dubai doubles down on DIFC

- Mubadala’s proptech bet

- Qatar real estate picks up

- UAE tycoon sues Lebanon

- Regional HQs get cute

- Riyadh’s giant cube on hold

Saudi Arabia is really into Valentine’s Day now. |

|

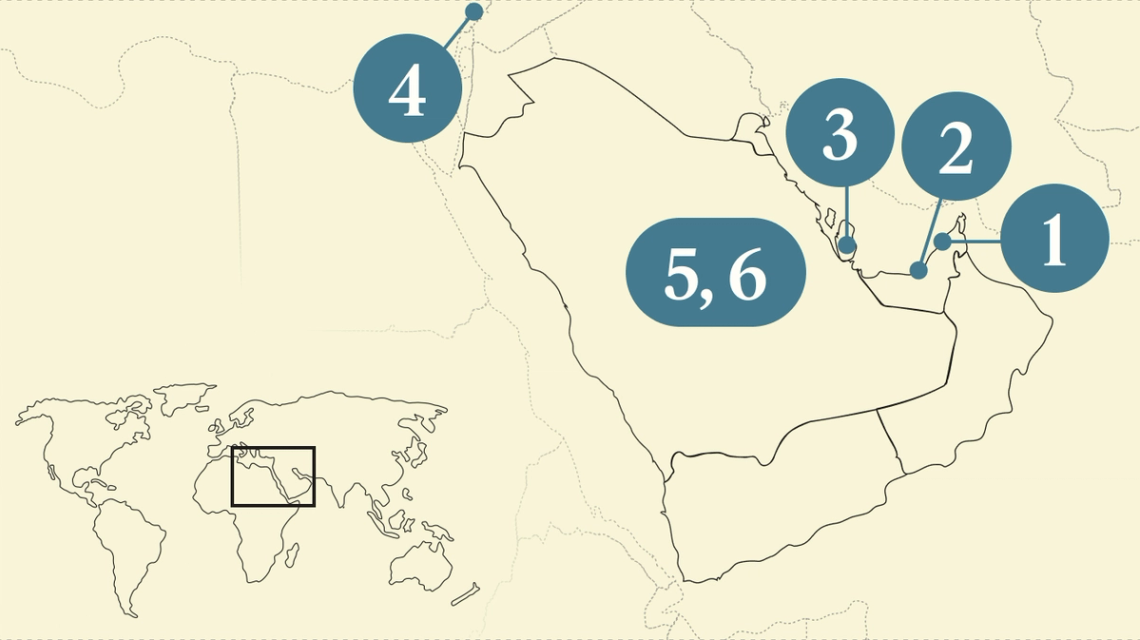

Dubai’s mushrooming financial district |

Christopher Pike/Reuters Christopher Pike/ReutersDubai is doubling down on efforts to fend off regional rivals trying to dethrone it as the Gulf’s top financial hub. Ruler Sheikh Mohammed bin Rashid launched a 100 billion dirham ($27.2 billion) expansion of the Dubai International Financial Centre on Tuesday, aiming to more than double the district’s footprint by 2040. Nearly half will be office space, lifting pressure on a zone that is already operating at full capacity, Bloomberg reported. There will also be roughly 4,000 apartments, aimed at easing the long commutes for at least some of the area’s workforce. Around 48,000 people work in the DIFC today, and officials expect that to climb to 125,000 once the expansion is complete. Dubai’s financial industry has surged since the pandemic, with asset managers, family offices, hedge funds, and private equity firms drawn by friendly regulation, low taxes, and a lifestyle that rivals global cities. But competition is intensifying. Abu Dhabi, Doha, Riyadh, and, to a lesser extent, Kuwait have more capital and want to lure the same bankers, consultants, and investors. This expansion is a clear signal that Dubai intends to defend its lead. — Mohammed Sergie |

|

Property Finder’s latest fundraise |

The amount Mubadala Investment Co. is pouring into the swelling war chest of Property Finder, the Dubai-based real estate portal that has now raised nearly $1 billion in equity and debt financing from a host of blue-chip backers. The latest $170 million fundraise included another unnamed UAE sovereign wealth fund — which ponied up $75 million as well — and Property Finder’s very first investor, Saudi-backed BECO Capital. The deal follows a $525 million round last September with participation from Blackstone, and $250 million in debt financing from Ares Management and HSBC. A construction and population boom in Dubai has created one of the world’s hottest property markets, a phenomenon that industry watchers say appears robust enough to avoid a bust. Despite that, classifieds rival Dubizzle pulled its IPO last year after its prospectus revealed four years of losses. In the property portal wars — fought hard in this corner of the world, where transaction volume is high — sovereign wealth funds appear to have picked their winner. — Kelsey Warner |

|

Visitors viewing a building model at Cityscape Doha. Noushad Thekkayil/NurPhoto/Reuters. Visitors viewing a building model at Cityscape Doha. Noushad Thekkayil/NurPhoto/Reuters.Qatar’s residential market saw a rise in activity last year, with the total value of home sales increasing 44% to $7.2 billion even as prices eased, according to real estate consultancy Knight Frank. Activity remained concentrated in Doha and Al Wakrah, to the south of the capital. Sales prices for apartments and villas edged down by 1-2%, but demand held up in premium waterfront areas such as The Pearl. Overall, the number of transactions was up 50% year-on-year to more than 6,800. The pickup comes after a sluggish period following the men’s football World Cup in 2022, when a surge in short-term accommodation and slower population growth weighed on prices. |

|

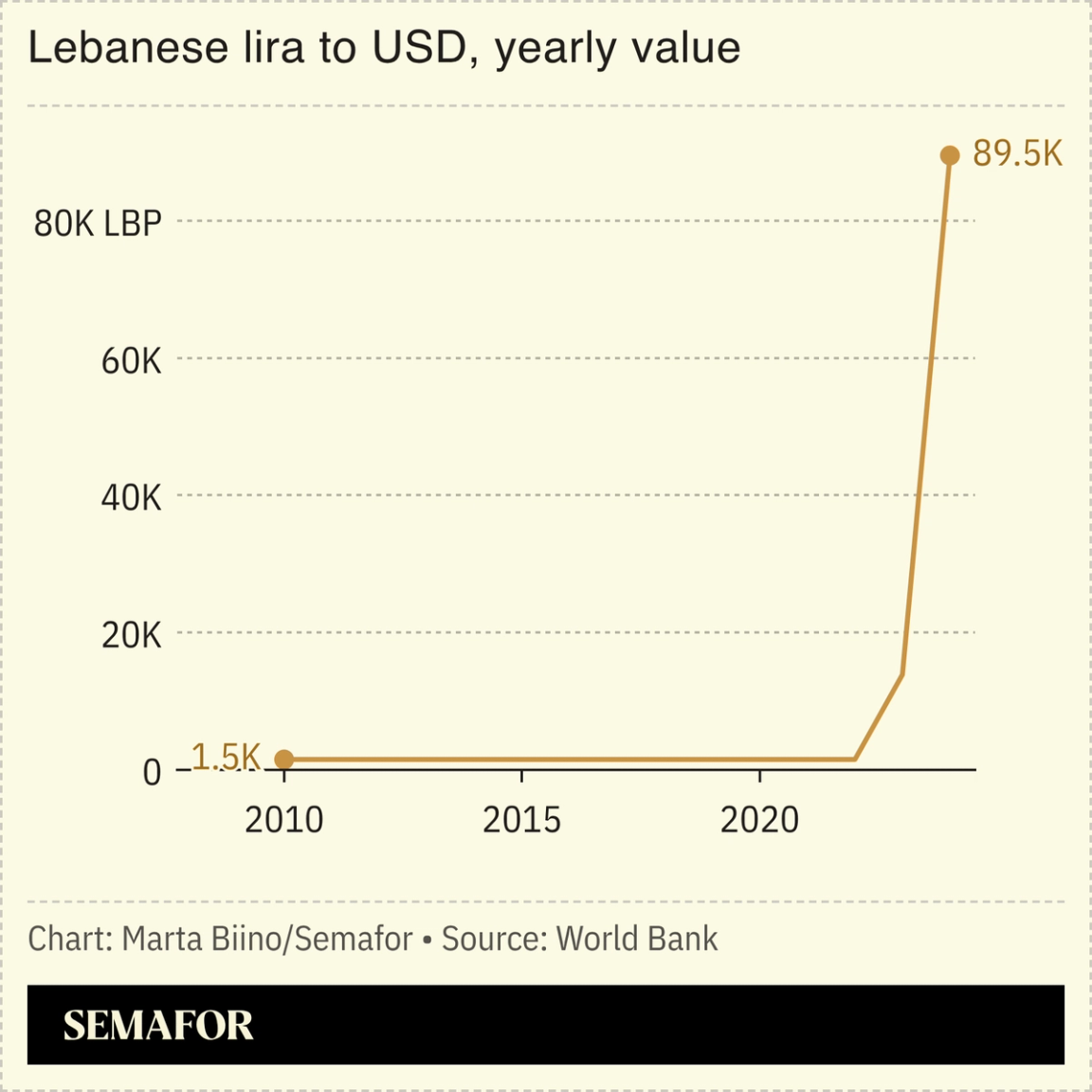

Al Habtoor sues, exits Lebanon |

The Dubai billionaire who last year threatened to slice up the Metropolitan Palace Hotel in Beirut and ship it out on barges is calling it quits on Lebanon once and for all. Al Habtoor Group — helmed by the outspoken real estate and hospitality billionaire Khalaf Al-Habtoor — issued a statement on Wednesday saying it was ceasing all operations in the country, against the backdrop of legal action against the Lebanese government. The conglomerate, which since opening a hotel in Beirut in 2001 has invested more than $1 billion across the country’s hospitality, retail, leisure, real estate, and finance sectors, said it has suffered losses exceeding $1.7 billion. Al Habtoor Group pointed the blame at Lebanese authorities and the central bank, Banque du Liban, which it alleges prevented it from accessing and transferring its funds held in Lebanese banks. — Kelsey Warner |

|

Visa’s inventive HQ approach |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersSaudi Arabia’s regional headquartering policy is yielding some newfangled definitions of a corporate territory. Visa is the latest entrant, with the UAE, Kuwait, and Qatar organized under a corporate office in Dubai, and Saudi Arabia, Bahrain, and Oman managed as a separate region out of Riyadh (both are nested under Central and Eastern Europe, Middle East, and Africa). The move from the US payments giant comes two years after the kingdom brought in a rule that any company wanting to bid for government contracts would have to set up their regional headquarters in the kingdom. Visa did not respond to a request for comment. On Tuesday, the Saudi government said more than 700 international companies had set up their regional HQ in the country so far. — Kelsey Warner |

|

Courtesy of New Murabba Development Company Courtesy of New Murabba Development CompanySaudi Arabia has suspended work on the cube-shaped Mukaab skyscraper in Riyadh, while it reassesses the feasibility of building the 400-metre-tall structure, Reuters reported. Other parts of the wider New Murabba development are expected to still go ahead. In mid-January, the government’s Public Investment Fund appointed US firm Parsons as the lead design consultant for the site’s utilities and transport systems. The decision to put the giant cuboid on hold is further evidence of a new mood of realism in the Saudi corridors of power, alongside a rethink of The Line and other aspects of the Neom gigaproject in the country’s remote northwest. |

|

Debt- Saudi Aramco raised $4 billion in its first bond sale of the year. The oil giant has issued $17 billion in debt over the past two years to help pay for dividends and investments. — Bloomberg

Defense- Qatar launched a regional military exercise on Jan. 26 with forces from its Gulf neighbors and the US. The 10-day Arabian Gulf Security 4 drill is aimed at improving security cooperation. It comes at a time of heightened tensions between the US and Iran; both Saudi Arabia and the UAE have said they will not allow their territory to be used in any attack on Iran. — The National, The Wall Street Journal

Tech- Abu Dhabi’s Mohamed bin Zayed University of Artificial Intelligence launched an updated version of its AI model, K2 Think, which researchers say performs at similar levels to leading open models from the US and China. — Financial Times

- Chinese tech giant Tencent, which already sells cloud services out of Saudi Arabia, is looking to expand in the region in the next 18 months, its CEO said. — CNBC

Transport- Commuters in Dubai spend 35 hours a year stuck in traffic, the equivalent of a full working week. Riyadh is not far behind with 34 hours of delays each year, compared to 18-19 hours in Abu Dhabi, Doha, and Kuwait City. — AGBI

|

|

A couple at Harrat Viewpoint, AlUla. A decade ago, people could get arrested for wearing red on Valentine’s Day. The government’s luxury tourist spot is now promoting itself as a location to propose on Feb. 14.  Courtesy of Royal Commission of AlUla Courtesy of Royal Commission of AlUla |

|

|