| | In this edition: Kenya fears over UN cuts, Google’s AI pact with Ghana, and three African films ente͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- China’s Africa loans fall

- Zambia unlocks IMF funds

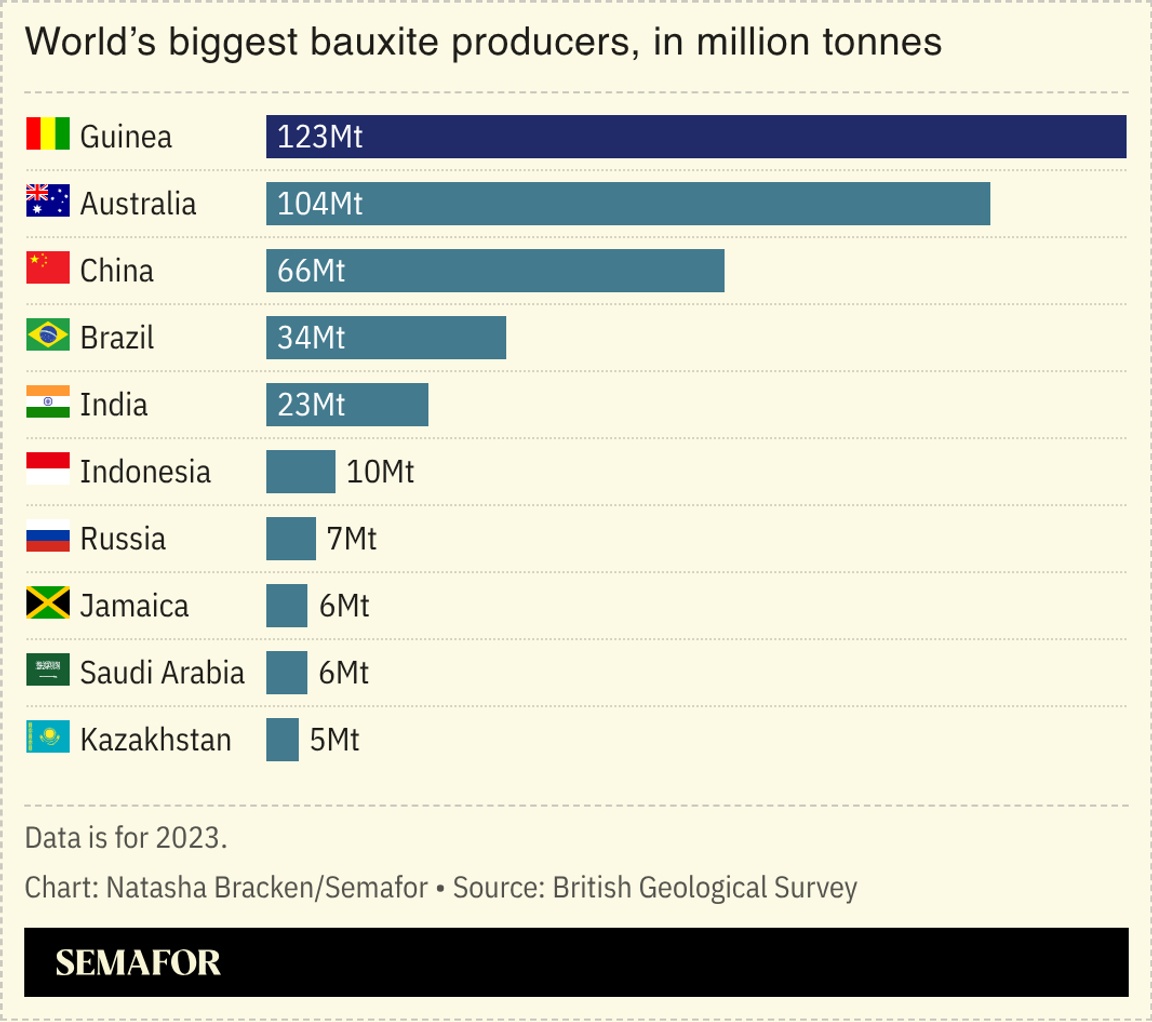

- Guinea’s bauxite exports rise

- Kenya fears over UN cuts

- Zimbabwe inflation plummets

- Nigeria coup probe

Three African films enter Berlin’s Golden Bear race. |

|

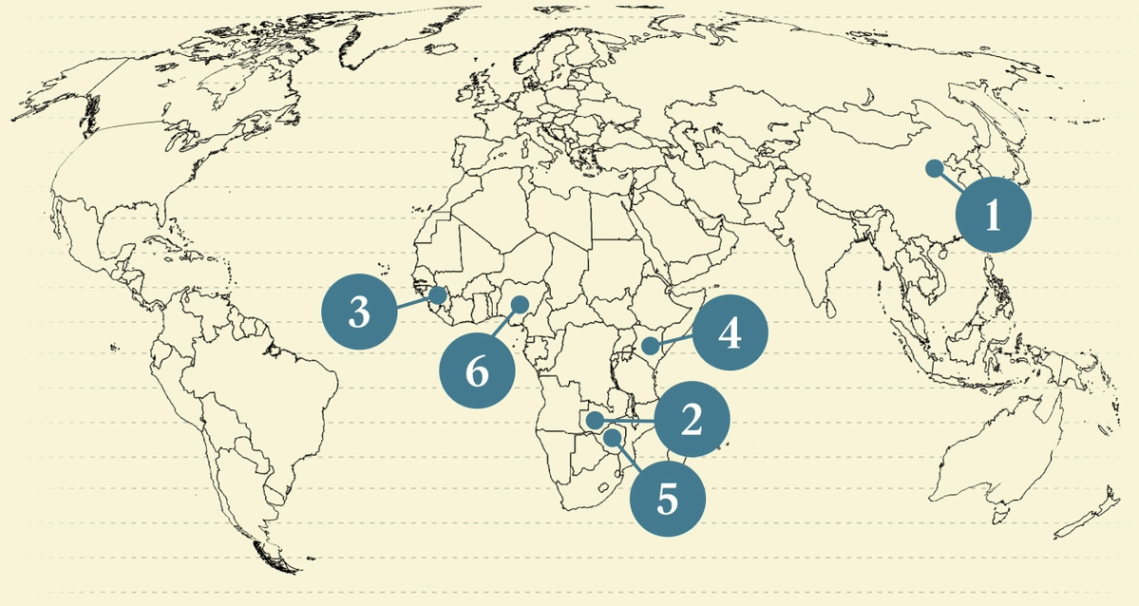

Next week’s inaugural critical minerals summit in Washington marks the White House’s latest attempt to build a counterweight to China’s dominance of African mineral supply chains. DR Congo President Félix Tshisekedi is expected to attend as Washington and Kinshasa work on the details of a strategic minerals partnership. Ministers from Guinea, Kenya, and Zambia are also on the guest list, according to people familiar with the plans, with more confirmations expected in the coming days. Announced by US Secretary of State Marco Rubio in a post on X, the event follows earlier initiatives on critical minerals launched by the Biden administration. But the future of those prior efforts are uncertain: “These initiatives were launched with a lot of fanfare, but many of the projects are now sitting in limbo,” said Zainab Usman, a senior research scholar at Columbia University’s Center on Global Energy Policy. For African governments, the central challenge is realizing ambitions to move beyond only exporting raw minerals to processing and refining them, too. Many mineral-rich countries now want economic backing to move up the value chain. At the same time, the US under President Donald Trump — apparently drawing lessons from China’s grip on downstream processing — is exploring how to secure its own position in that part of the supply chain, including through pacts that would encourage American companies to invest. The opportunity is real, said Tony Carroll, a board member of Mining Indaba, the international mining conference taking place in Cape Town next month. “If the US wants dedicated supply, that has to come with something — security support, infrastructure, or both,” he said. “That’s where the real negotiations are.” |

|

China loans to Africa down |

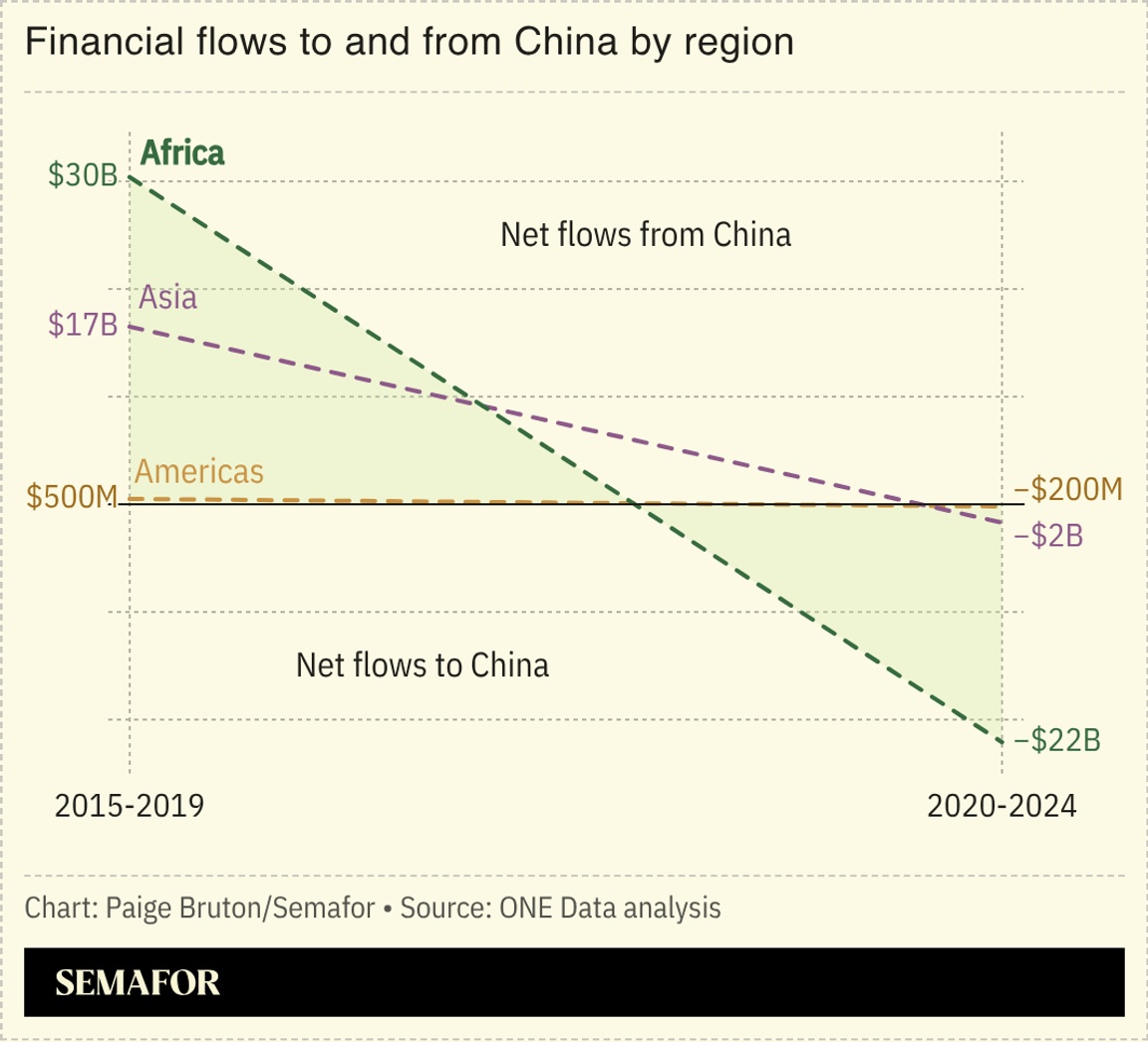

African nations are now sending more money in debt repayments to China than they are receiving in new loans, a new report found. The shift highlights the impact of two trends that illustrate Beijing’s changing relationship with the continent: the sharp contraction in new Chinese lending, set against growing foreign direct investment from China into Africa. The continent has experienced “the most dramatic reversal in Chinese finance” of any region, according to analysis from ONE Data, a partnership between Google and the ONE Campaign advocacy group: Africa went from receiving $30 billion in net flows from China between 2010 and 2014 to paying out $22 billion over the last five years. David McNair, executive director of ONE Data, told Semafor the drop in lending reflected a period in which China’s economy faltered and its priorities shifted. “It will be fascinating to see how China responds to the changing of the international order,” he said. The analysis comes after research by Boston University showed Chinese lending to Africa has plummeted amid Beijing’s shift in focus to strategic investments, while a separate report by Australia’s Griffith University and Shanghai’s Green Finance & Development Center indicated the number and value of new investment and construction deals by Chinese entities in Africa surged to a record high last year. — Alexis Akwagyiram and Preeti Jha |

|

Zambia completes IMF program |

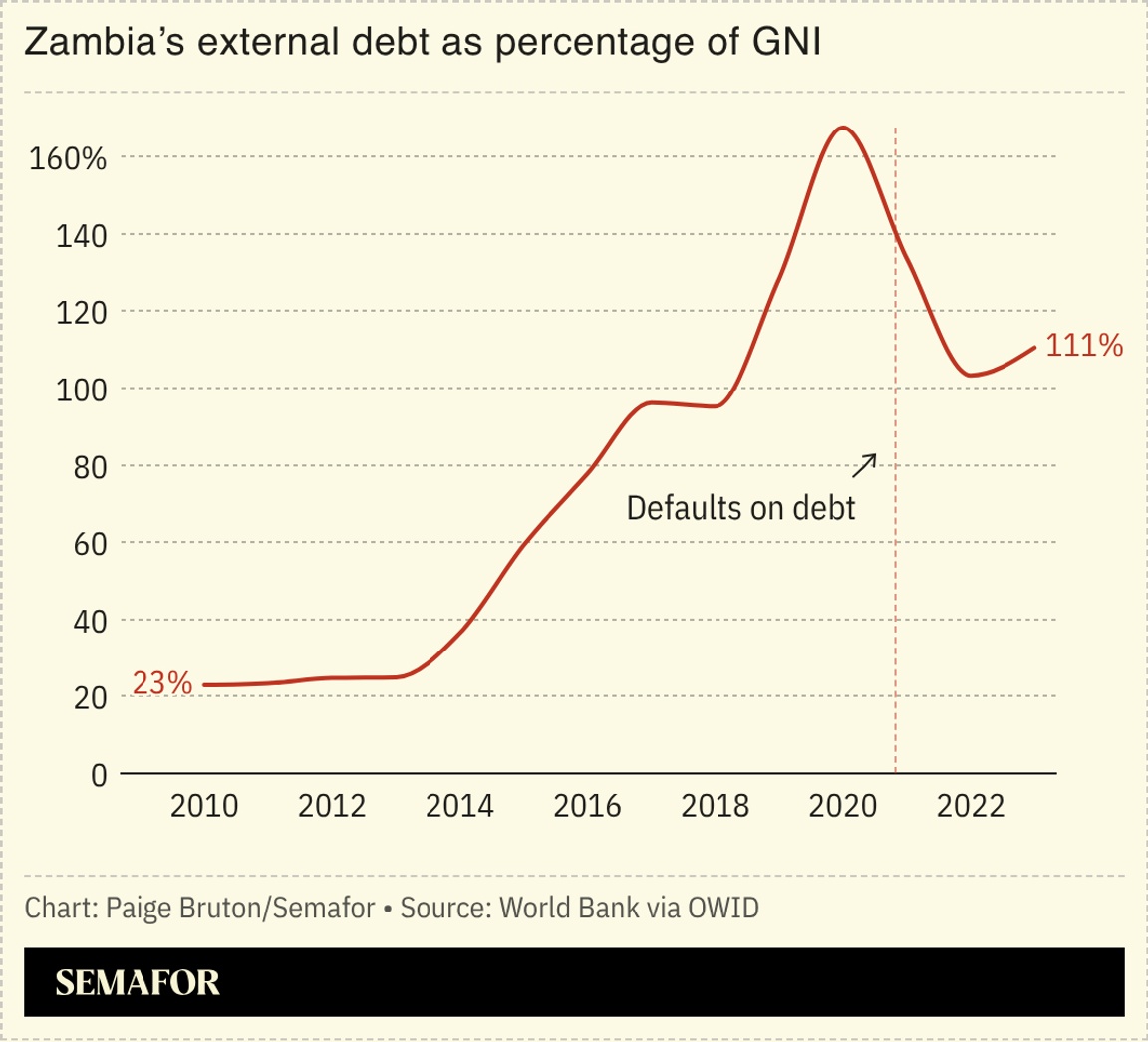

Zambia unlocked the final tranche of a $1.7 billion IMF program, underscoring huge progress by the southern African nation. The country had been the first African nation to default on its borrowing during the COVID-19 pandemic, and is restructuring loans worth some $13 billion — including debts to Chinese creditors which make up its biggest obligations. Zambia’s program was approved in 2022, two years after a sovereign debt default imposed economic strains whose effects have not fully gone away. The IMF said that while Lusaka’s performance since then was “broadly satisfactory,” the country “remains at high risk of overall and external debt distress.” A number of other African nations including Gabon and Mozambique have also recently lowered their risks of debt distress, but others like Senegal remain on edge. |

|

Guinea’s bauxite exports surge |

Guinea’s bauxite exports jumped by 25% last year to meet soaring demand from China, with a record three-quarters of the exports going there, Reuters reported. Beijing has significantly benefited from Guinea’s mining boom: The West African nation became the world’s biggest exporter of the aluminium ore in 2023, overtaking Australia, and bauxite forms a key pillar of its economy. The rock is mostly used to make aluminum, but has other uses including in sandpaper and polishing powders. Junta-ruled Guinea is also home to vast deposits of iron ore, which China sources through the Simandou mine that began operations last year. |

|

Kenyan worries over US cuts to UN |

| |  | Joseph Maina |

| |

James Wakibia/SOPA Images/LightRocket via Getty Images James Wakibia/SOPA Images/LightRocket via Getty ImagesWashington’s withdrawal from dozens of UN-affiliated bodies is sending ripples through Nairobi, with growing concerns over how the disruptions in US funding could overhaul the UN’s largest hub in the Global South. The US began withdrawing from 66 international organizations this month, including 31 UN entities. UN-Habitat, a Nairobi-based agency for human settlements and sustainable urban development, is explicitly included in the US withdrawal list. No full withdrawal has taken place so far and no planned relocations out of Nairobi have been reported, with worries instead focusing on the city’s local economy. Between $250 million and $350 million in annual US-linked funding of Nairobi-based UN operations is at potential risk, according to local analysts. The UN presence in Nairobi, dating back to 1972, has supported a workforce comprising thousands of international and Kenyan staff as well as a wider ecosystem of contractors, consultants, civil-society organizations, and diplomatic missions. “The loss of such major financial support will have negative impacts on people’s jobs and welfare,” Maria Nzomo, a former Kenyan ambassador to the UN in Geneva, told Semafor. |

|

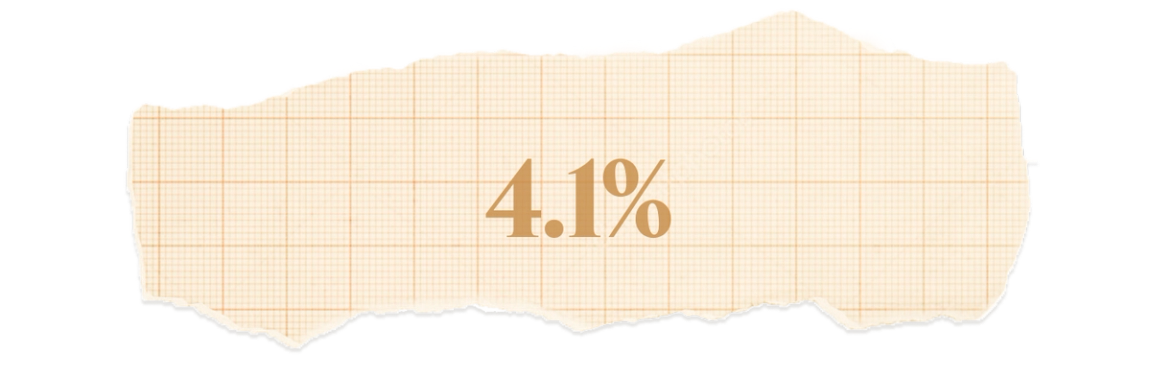

Zimbabwe inflation drops to single digits |

Zimbabwe’s annual inflation rate in its local currency in January — the first time the figure has fallen to single digits since 1997. Authorities hailed it as a “historic milestone” after decades marred by hyperinflation and currency collapse. The shift follows the rollout of central bank policies aimed at stabilizing prices since the gold-backed ZiG currency was launched in 2024. The ZiG — short for Zimbabwe Gold — is the country’s sixth attempt since 2009 to replace the US dollar as the nation’s main form of tender. Harare, which has prioritized de-dollarizing its economy, wants the ZiG to be Zimbabwe’s sole currency by 2030. Policymakers across Africa are trying to ease inflation to stabilize currencies, restore investor confidence, and rebuild household purchasing power after shocks caused by the COVID-19 pandemic and supply-chain disruptions. |

|

Nigeria to try alleged coup-plotters |

Nigerian soldiers from the Multinational Joint Task Force. Joris Bolomey/AFP via Getty Images. Nigerian soldiers from the Multinational Joint Task Force. Joris Bolomey/AFP via Getty Images.Nigerian military authorities are set to try more than a dozen officers over allegations that they planned to overthrow the government last year, capping months of concerns about security in Africa’s largest democracy after a series of military takeovers in neighboring nations in recent years. The Nigerian army arrested 16 service members in Oct. 2025 in what it initially described as a “routine exercise” over indiscipline and regulation breaches. Authorities, including the president’s office, dismissed news reports at the time linking the move to a coup plot and as the reason for the cancellation of Independence Day commemorations that month. The army’s move to now try the officers before a military judicial panel on coup plotting charges comes as campaigning for the 2027 presidential elections gets underway. Atiku Abubakar, a former vice president and presidential candidate expected to contest again next year, compared life under President Bola Tinubu to Nigeria before the return to civilian rule. “Not even the military regimes before 1999 damaged our national life and consciousness in the way this administration has done,” Abubakar was quoted as saying at a book launch this week. |

|

Business & Macro |

|

|