| | Iran responds to Western pressure over its crackdown on protests, the UK and China seek closer ties,͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Iran hits back at US

- US warns Canada on trade

- FBI probes 2020 election

- Gold, copper hit records

- MSFT, Meta diverge on AI

- UK, China seek closer ties

- China airlines avoid Japan

- China luxury rebound hope

- Ghana’s economic recovery

- Spectacular fossil find

An operatic adaptation of a Scandinavian novel addresses ‘alcoholism, career disappointment, crises of faith and despair.’ |

|

Iran hits back at US threats |

Majid Asgaripour/WANA via Reuters Majid Asgaripour/WANA via ReutersIran hit out at growing Western pressure over its nuclear program and a crackdown on protests. The threat by the country’s foreign minister that Tehran’s forces had their “fingers on the trigger” came amid growing signs that the Washington was readying fresh strikes on Iran: US President Donald Trump warned of a “massive Armada” heading to Iran, adding that “time is running out” for the country’s leaders to agree a deal over its nuclear program. Trump had previously suggested he would carry out strikes over Iran’s response to nationwide protests that left thousands dead, but later backed off. The EU, meanwhile, ramped up its diplomatic offensive: The bloc is expected to add Iran’s Revolutionary Guard to its terror blacklist. |

|

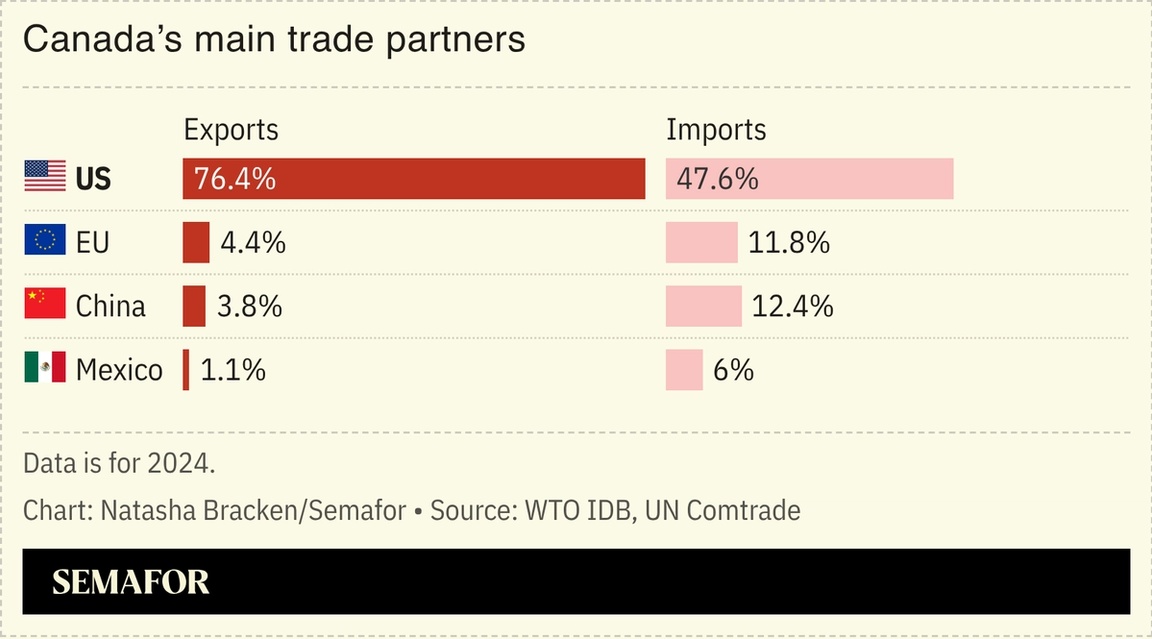

US warns Canada on trade talks |

The US Treasury secretary warned Canada’s leader against “virtue signaling” ahead of the impending review of a key, continental trade pact. Scott Bessent’s remarks came after Canada’s Prime Minister Mark Carney denounced Washington’s “rupture” of the global order and agreed to lower tariffs with China, sparking a threat of 100% duties from US President Donald Trump. Carney said this week he stood by his comments. Despite recently making moves to diversify its trade, however, Ottawa remains heavily reliant on the US for the majority of its exports and a large share of its imports. Meanwhile, the US trade representative said negotiations had started with Mexico, the third signatory of the trade agreement. |

|

FBI probes 2020 election records |

US Director of National Intelligence Tulsi Gabbard. Elijah Nouvelage/Reuters US Director of National Intelligence Tulsi Gabbard. Elijah Nouvelage/ReutersFBI agents searched offices in the US state of Georgia containing records of the 2020 election, a vote which President Donald Trump has contested. The US leader narrowly lost Georgia in 2020, and alleged election fraud; he in turn was indicted for attempting to subvert the count, although the case fell apart. Earlier investigations found no evidence of widespread corruption in the election. The FBI warrant said the records may contain “evidence of the commission of a criminal offense.” The search appears to be “the most public step by law enforcement to pursue Trump’s claims of a stolen election,” The Associated Press reported. The justice department has recently investigated several other perceived political enemies of Trump, The Hill noted. |

|

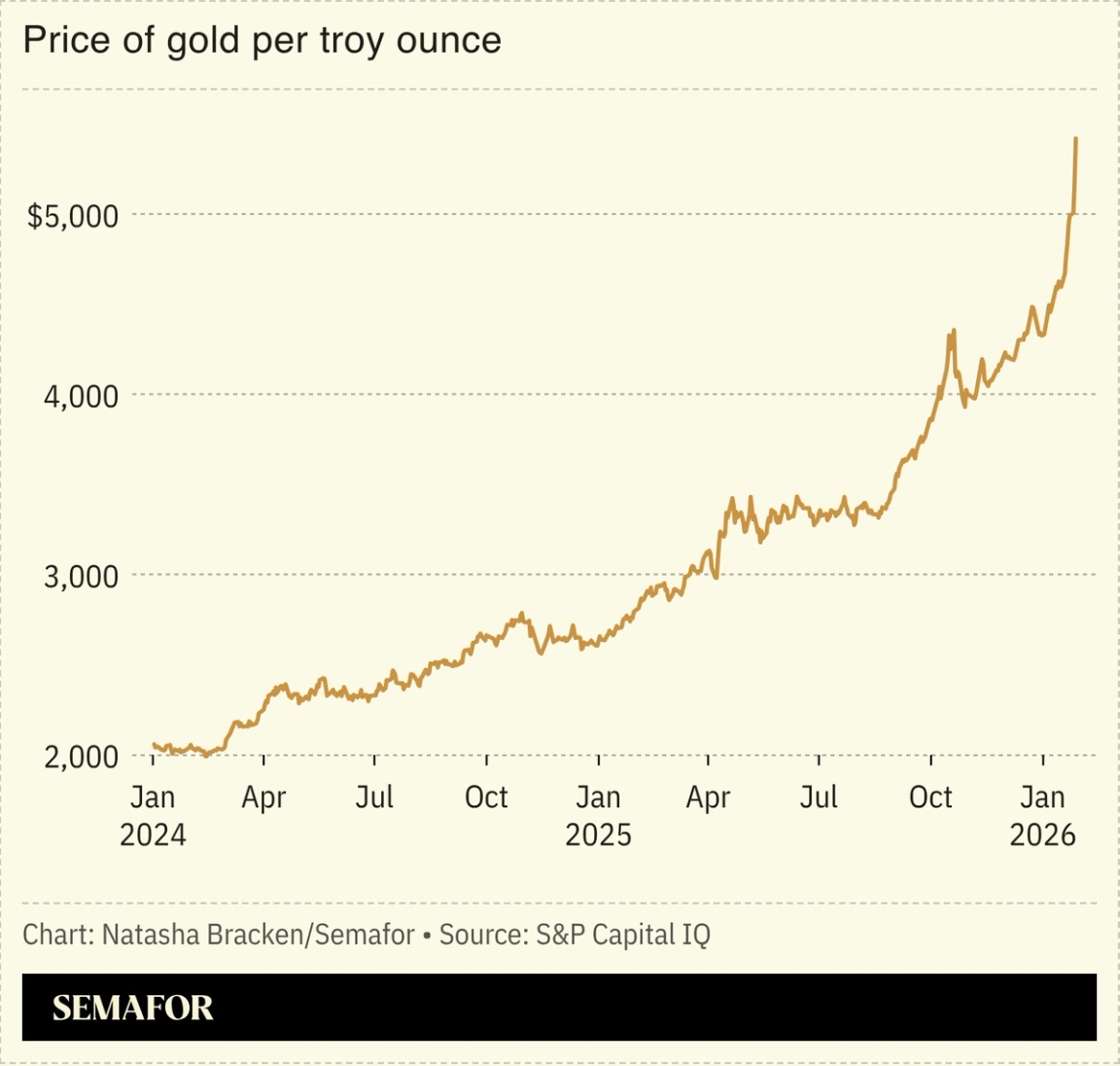

Haven assets hit record highs |

Gold, silver, and copper hit record highs on geopolitical turmoil and industrial demand. Confidence in the dollar has fallen in the wake of US President Donald Trump’s renewed attacks on the Federal Reserve, Bloomberg reported, and investors are seeking haven assets. Goldman Sachs had forecast that gold might hit $5,400 an ounce by the end of 2026, but yesterday it reached $5,600. Copper, already in demand for its uses in the energy transition, is also increasingly becoming a target of speculators, analysts told the Financial Times, with prices up 6% overnight. Silver, meanwhile, extended a “frantic” rise, up almost 60% since the start of the year. |

|

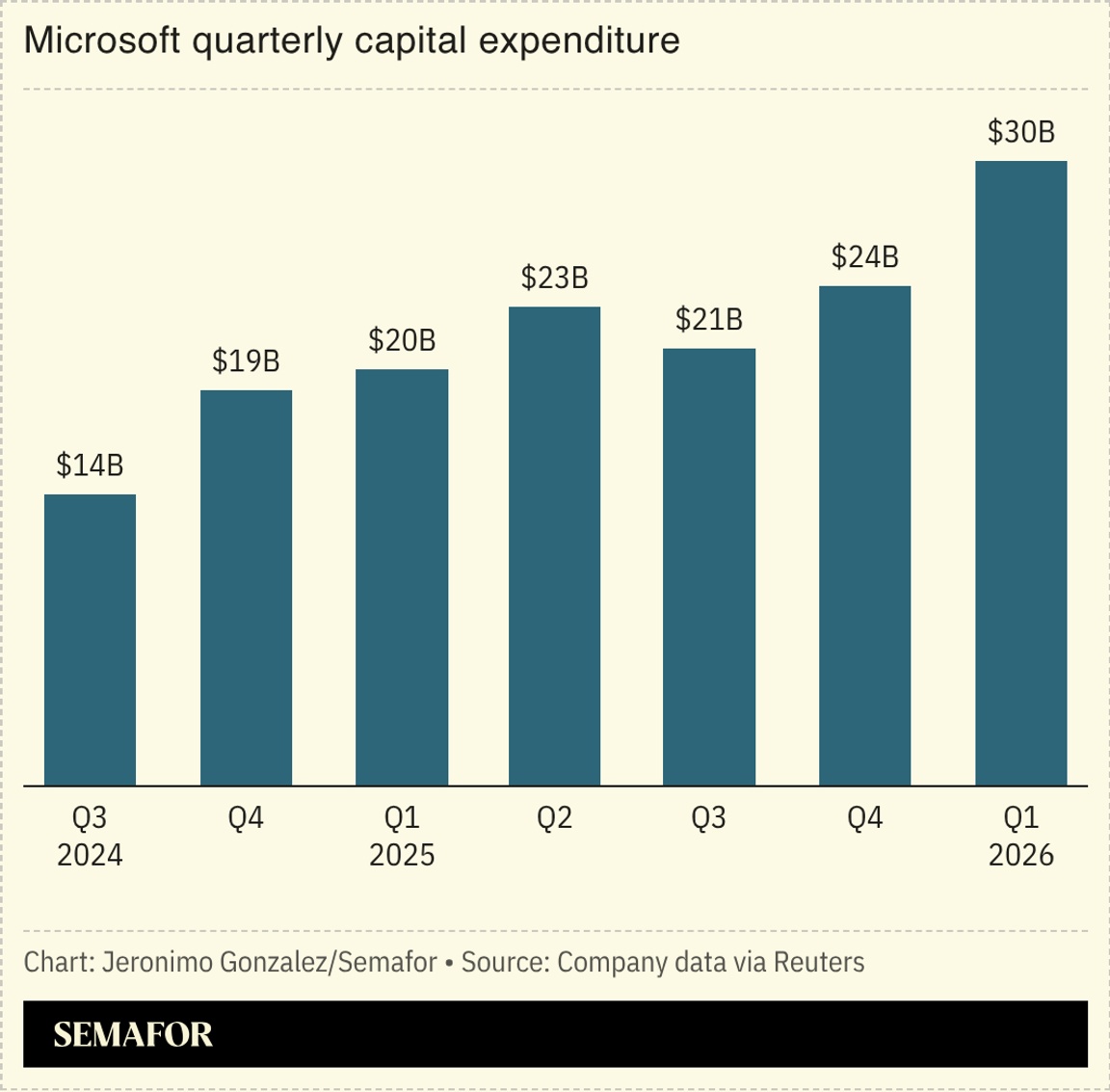

Investors split on Big Tech AI growth |

Meta and Microsoft reported rapid profit growth, but their share prices diverged in what analysts said were investors’ differing perceptions on the tech giants’ AI fortunes. Microsoft’s cloud division, central to its AI ambitions, saw growth slow, and the tech giant faces data-center supply constraints and is increasingly reliant on its deals with OpenAI. Meta, by contrast, seems confident in future expansion, and “investors have dopamine receptors, too,” Semafor’s technology editor wrote: No doubt many are worried they should have jumped on the last round and don’t want to miss out. “The bottom line is that for both companies, growth is important,” The Information’s co-executive editor wrote, “but the cost of that growth is even more important.” |

|

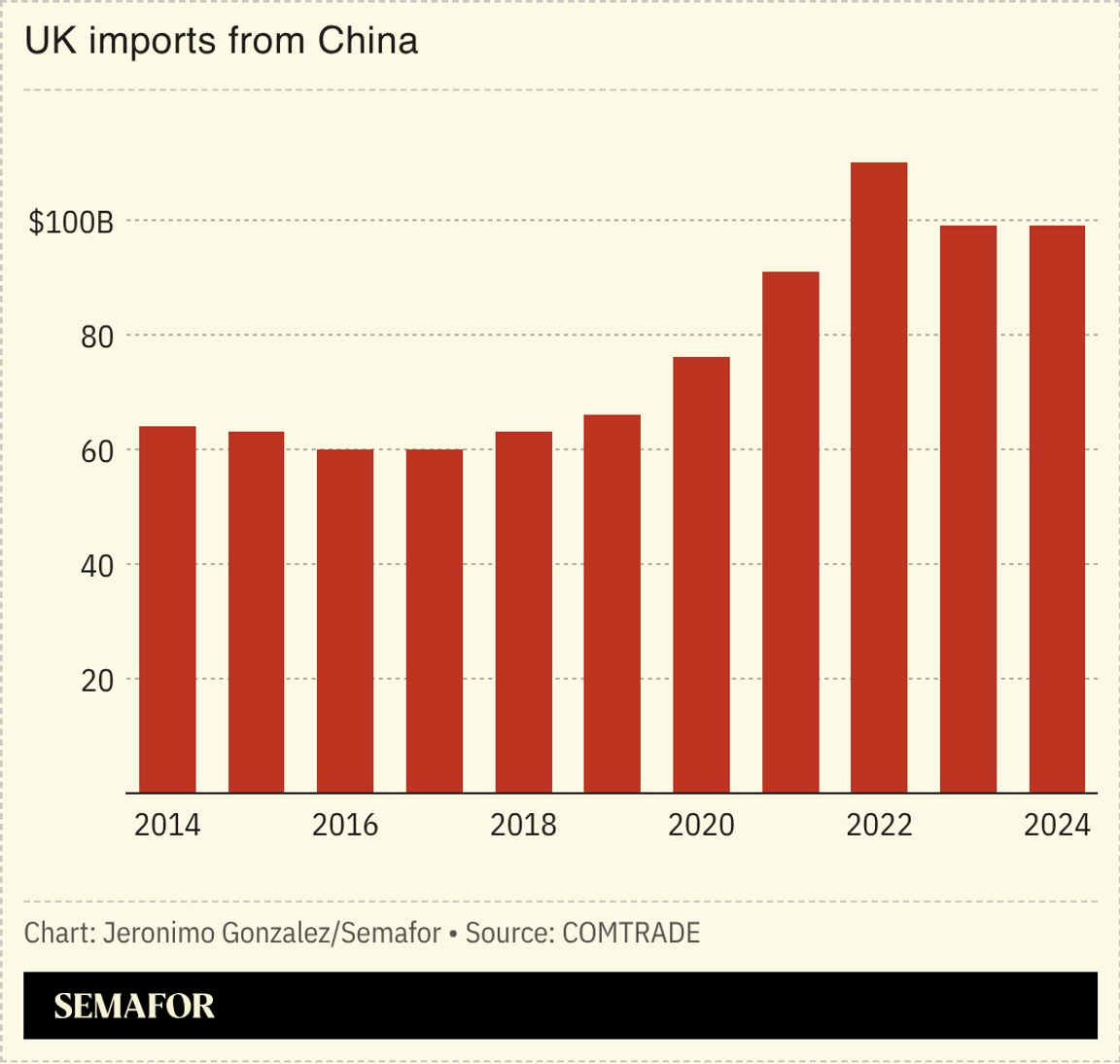

UK, China seek closer ties |

British Prime Minister Keir Starmer hailed progress on lowering tariffs with China, arguing for a “more sophisticated” relationship after talks with Chinese leader Xi Jinping. Starmer is the latest in a string of Western leaders to visit recently, a sign of Beijing winning over US allies put off by Washington’s unpredictability and protectionism, according to Western analysts. The UK leader, by contrast, has portrayed himself as a “pragmatist applying common sense.” Like the Canadian leader before him and Germany’s due next month, however, he is trying to maintain a tricky balance, wary of angering Washington and suspicious of Beijing’s intentions, while aiming to boost growth and gain greater access to the world’s second-biggest economy. |

|

Chinese airlines cancel Japan flights |

Aly Song/Reuters Aly Song/ReutersChinese airlines cancelled all flights on 49 routes to Japan as relations between the Asian powers worsened. China was angered by Japan’s prime minister suggesting last year that Tokyo could get involved in any conflict over Taiwan, which Beijing claims as a renegade province. Since then, China has urged citizens to refrain from visiting Japan, and on Monday its foreign ministry warned of “serious safety threats” for Chinese tourists. Travelers from China are not staying home, though: Flight data shows that South Korea is on track to overtake Japan as the top destination for Chinese tourists during the upcoming Lunar New Year holiday, while Vietnam is also seeing an upswing in visitor numbers. |

|

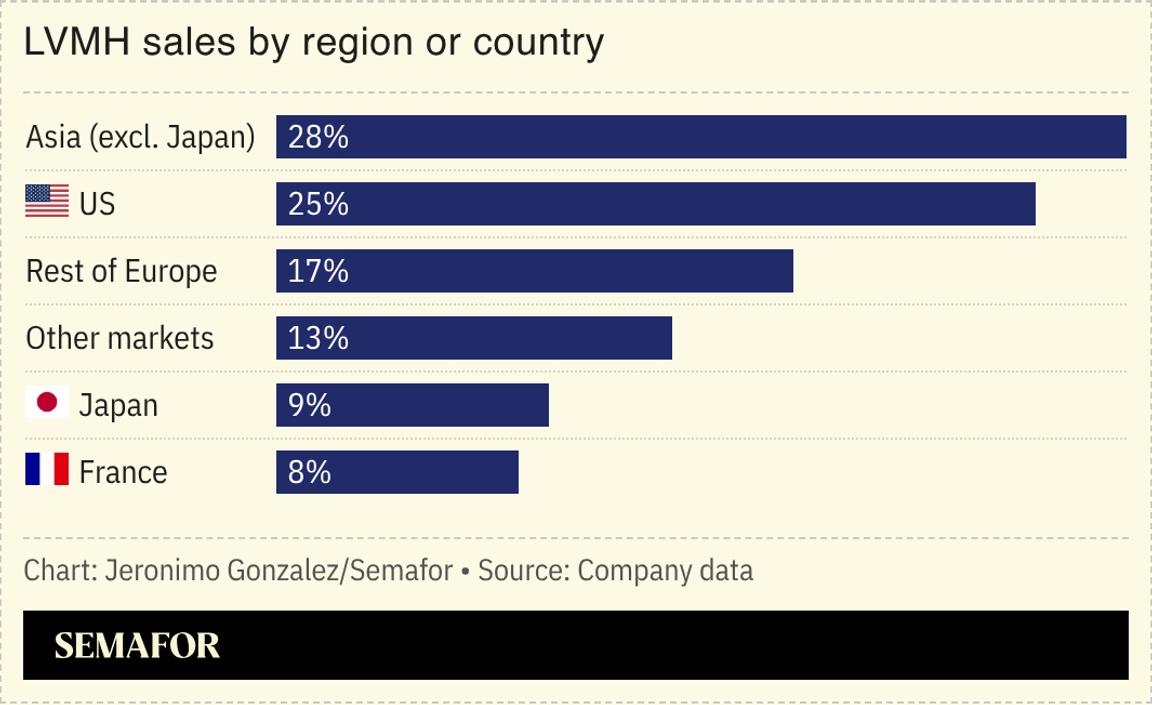

Hopes for China luxury rebound |

China’s luxury market is expected to rebound in 2026, a reprieve for European fashion houses heavily reliant on the giant market. Premium spending in China — which consultancy Bain said has become the “cornerstone of luxury market growth” — plummeted last year, dragging down firms’ share prices: LVMH’s has fallen by almost a quarter in the last 12 months, wiping more than $100 billion off its valuation. China’s slowdown and a slumping real estate market have led millions to cut spending, while local labels are competing with foreign luxury players. “Some brands are very special, like Louis Vuitton and Chanel,” one Beijing shopper told the Financial Times. But Chinese ones were, she added, now “very good,” too. |

|

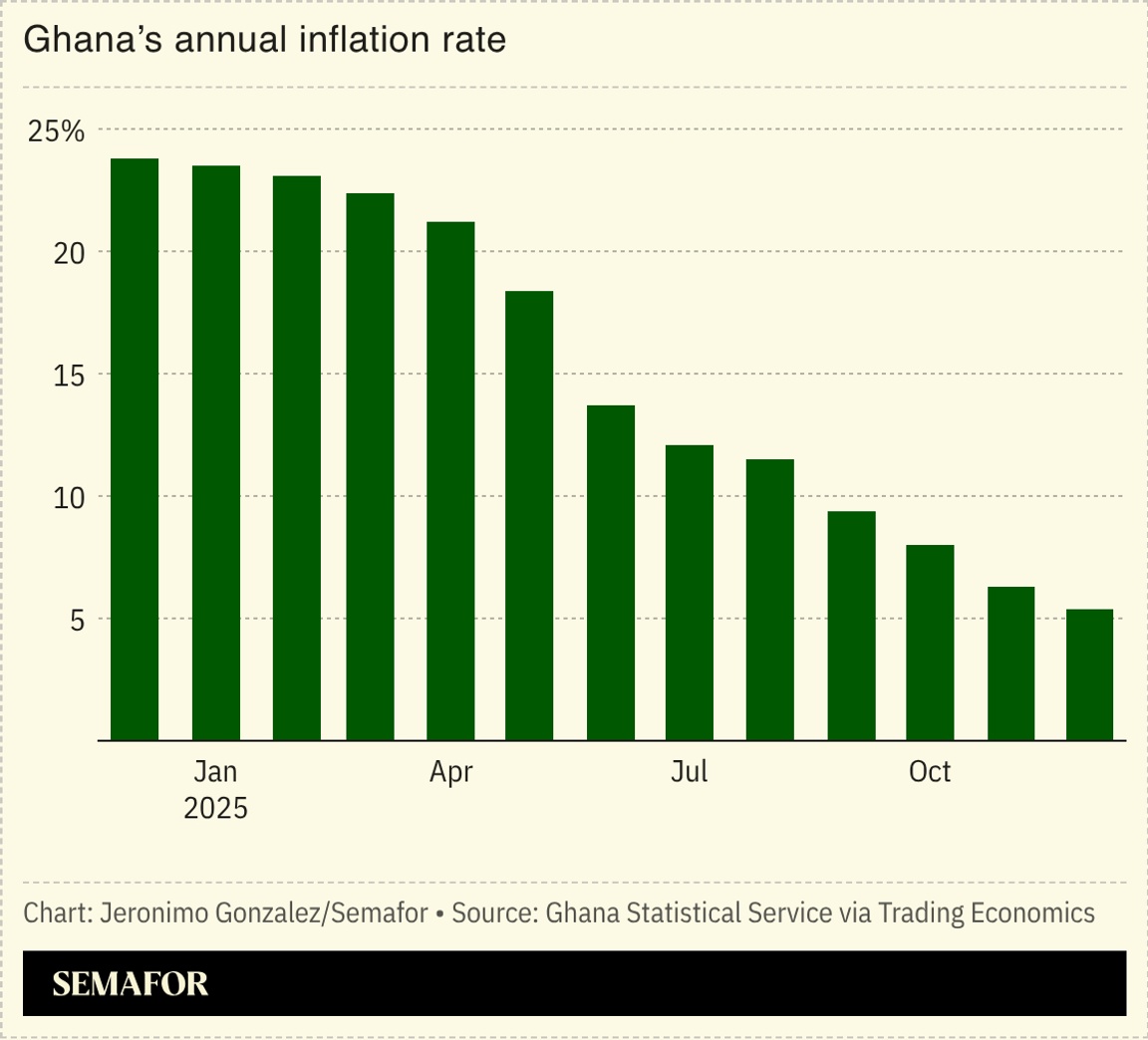

Ghana’s economic crisis eases |

Ghana slashed its main interest rate by 2.5 percentage points, a sign that the country’s worst economic crisis in a generation may be easing. Consumer inflation has fallen by almost 90% since 2023 in the West African nation, which for years faced soaring prices and cooling growth. Accra’s remarkable turnaround — even Ghana’s president has said he has been surprised at the pace of change — has lifted many out of poverty, with the share of the nation’s population living on less than $1 a day dropping by around 10% in 2025. But challenges persist: West African economic growth is expected to cool this year, the UN predicted. |

|

New fossils reveal early life |

A fossil found in Perú. Gerardo Marin/Reuters A fossil found in Perú. Gerardo Marin/ReutersA huge find of 512-million-year-old fossils in southern China offered new insights into the first boom of complex life. The “Cambrian explosion,” around 530 million years ago, saw an efflorescence of diversity. Before then, fossils revealed simple, mostly microbial life; in a brief few million years afterward, things like modern animals, and many weirder and since-lost things, emerged. Most of what we know of the period comes from one famous site, Canada’s Burgess Shale; the new find has unearthed 8,681 fossils of ocean animals, including rarely preserved soft tissue. The discovery dates to shortly after the Sinsk event, the first known mass extinction, which halted the Cambrian flourishing, and preserves “in vivid detail almost an entire ecosystem,” New Scientist reported. |

|

|