|

|

It’s time to make a portfolio switch.

We will sell a low-growth company for another company with more upside potential.

Let’s tell you everything you need to know.

Let’s play a game

Let’s play a game before telling you which company we’re buying and selling.

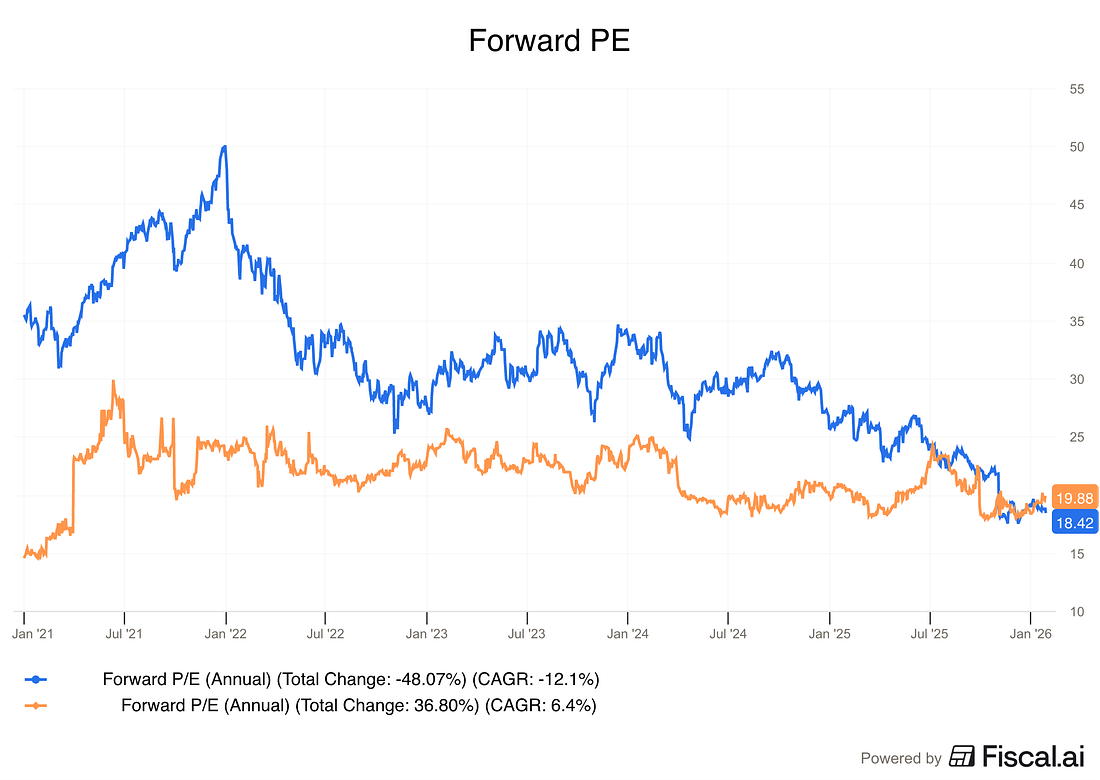

In the chart below you can see the Forward PE of both companies.

Orange line: the company we’re selling

Blue line: the company we’re buying

|

The company we’re buying became 61% (!) cheaper since 2022.

It’s now cheaper than the company we’re going to sell.

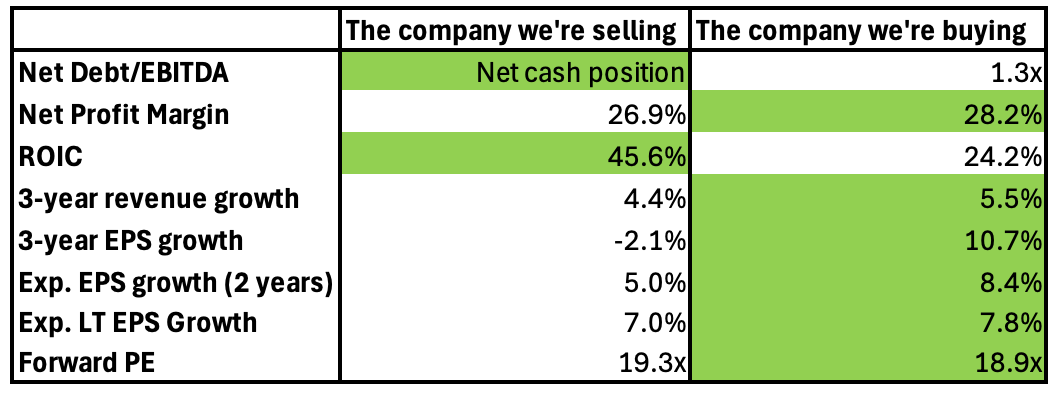

Now let’s compare the fundamentals of both companies:

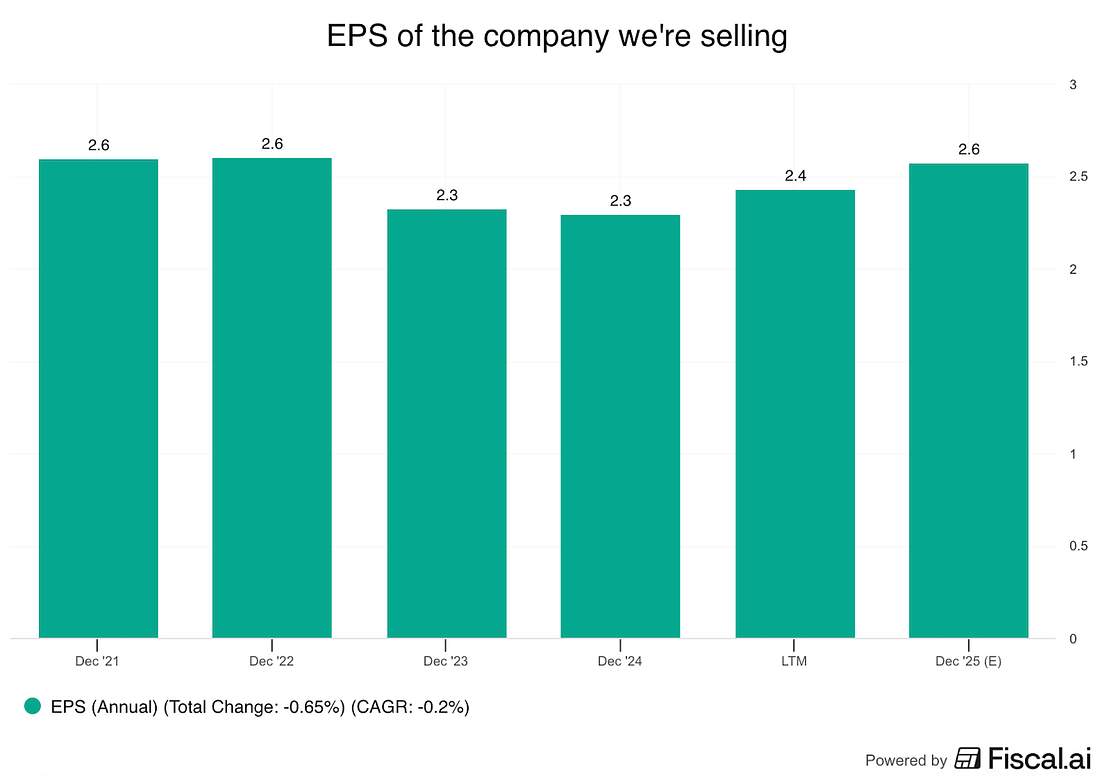

I’m mainly concerned for the low growth outlook of the company we’re selling.

|

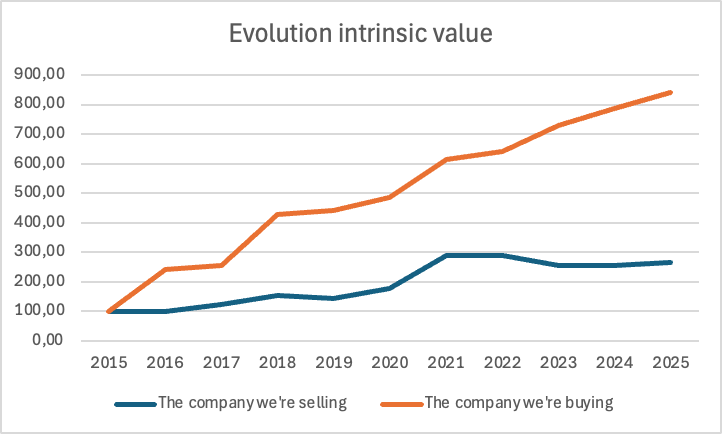

If we compare the evolution of the intrinsic value for both companies, we get the following:

Hopefully I convinced you now that the company we’re buying is a better company than the one we’re selling.

Now let’s dive into the names...