| | In this edition, the debate over an AI collapse gets heated between the CEOs of Anthropic and Robinh͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Lutnick’s banker leaves DC

- No-comment Powell

- Wall St. likes Trump accounts

- ‘Pivot to China’

- Software wipeout

Oil prices flare on Trump’s Iran saber-rattling … Porn stars brace for AI… A nest egg for Olympians |

|

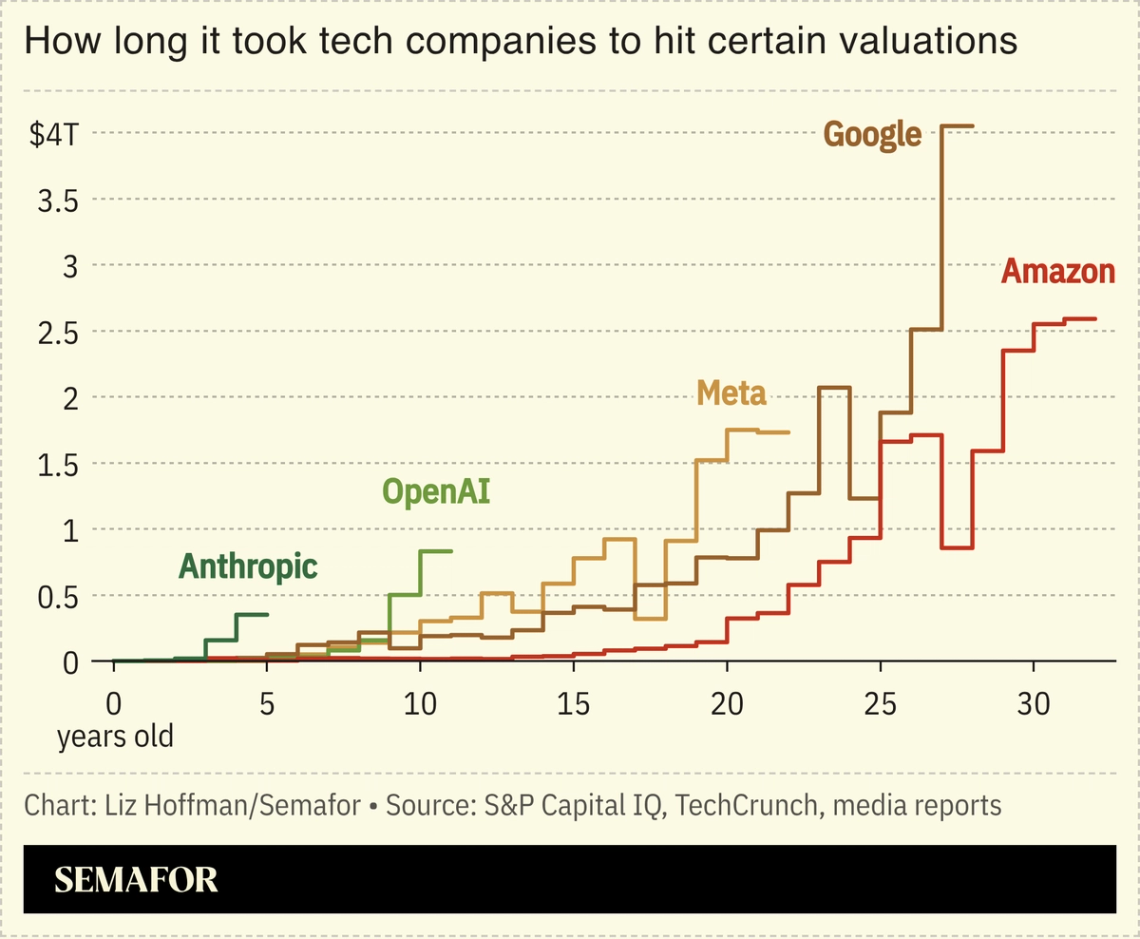

Anthropic CEO Dario Amodei’s essay this week warns about AI’s dystopian dangers — biological weapons, supercharged dictatorships, mass brainwashing. Robinhood CEO Vlad Tenev read it and responded: You’re worried about the wrong apocalypse. Tenev agrees that AI is societal poison but for reasons less suited to an episode of Black Mirror and more suited to this newsletter: AI is exacerbating the “extreme economic concentration of power in the hands of AI’s Silicon Valley backers.” (For the dangers of self-spawning mirror-image bacteria, I’ll refer you to Semafor’s tech editor, Reed Albergotti.) Tenev is talking his own book: Allowing retail shareholders to invest in AI startups would be great for Robinhood. And Robinhood’s embrace of gamified YOLO investing doesn’t suggest a deep commitment to financial health. But he’s right about the staggering scale of wealth accruing to a select few in Silicon Valley, and how dangerous that can be. Ray Dalio and others have drawn uncomfortable parallels to historical periods where it ended in violent revolution. Anthropic, not yet five years old, is as valuable as Google was at 15 and Amazon was at 22, long after those companies had gone public. Google was worth $23 billion at its IPO in 2004. Nearly all of its current $4 trillion valuation has happened in the hands of public stockholders. For future public shareholders of OpenAI or Anthropic to capture Google-sized gains, they would need to reach valuations in the tens or hundreds of trillions of dollars. Barring a collapse in AI valuations or a seismic redistribution of wealth like the proposed tax currently freaking out California billionaires, the gap may already be too big to close. “Those early gains [are] gone,” David Schwimmer, CEO of the London Stock Exchange Group (also not a disinterested party in this public-versus-private debate), told me in September.  Amodei might be overstating his threat, penning the AI era’s version of Kennan’s Long Telegram that puffs up an exaggerated threat. Or he’s right, and the billionaires can wait out the robot apocalypse in their bunkers or in space. But Tenev is certainly right. The AI race is pouring gasoline on social unrest and deepening anger toward the superrich. “AI becomes sentient and society collapses” and “the masses take up pitchforks against the elite and society collapses” get you to the same place. Amodei is worried about one risk, Tenev is raising the other. |

|

Washington’s banker departs |

From left: Michael Grimes, Linda Yaccarino, X CEO, and Claudio Madrazo. Leigh Vogel/Getty Images for Uber, X and The Free Press. From left: Michael Grimes, Linda Yaccarino, X CEO, and Claudio Madrazo. Leigh Vogel/Getty Images for Uber, X and The Free Press.Michael Grimes brought Silicon Valley-style investing to the White House. Now the longtime advisor to Elon Musk is heading back to California. The tech industry’s speed-dial banker is leaving the US Commerce Department, where he ran the government’s venture arm, people familiar with the matter told Semafor. Commerce Secretary Howard Lutnick will take over the effort, which has overseen most of the White House’s investments in the private sector — an unprecedented bit of industrial policy and Trumpian dealmaking aimed at bulking up national-security sectors. Hundreds of billions of dollars promised by Japan, Taiwan, and South Korea as part of trade deals with the US would give the Commerce fund more than $1 trillion in firepower, creating the outlines of a sovereign-wealth fund larger than Saudi Arabia’s. Lutnick has been recruiting from Wall Street banks and private-equity firms in recent weeks to scout projects, some of the people said. |

|

Powell: ‘I have nothing for you on that’ |

Fed Chair Jerome Powell’s brick-wall response to political questions guaranteed a lack of fireworks at a meeting where the Fed board, as expected, left interest rates unchanged. Powell declined to comment at least 10 times to reporters’ questions on Trump, Congress, the dollar, and essentially anything outside of the Fed’s view of jobs and inflation. But that was precisely the point: A boring Fed is what helps stabilize whipsawing markets. - Whether the Fed responded to subpoenas: “I have nothing for you on that.”

- His Jan. 11 video statement: “I’m not going to expand on it or repeat it.”

- Treasury Secretary Scott Bessent’s criticism: “I don’t respond to comments by other officials.”

- The transition to a new Fed chair: “I don’t have anything for you on that.”

- Whether he will remain as a Fed governor: “There’s a time and place for these questions.”

- The dollar’s recent slide: “I have nothing for you.”

- Canadian Prime Minister Mark Carney’s Davos speech: “I can’t comment.”

Powell did, however, indulge reporters with advice for his eventual successor: “Don’t get pulled into elected politics. Don’t do it.” |

|

Wall Street lines up behind Trump accounts |

Aaron Schwartz/Reuters Aaron Schwartz/ReutersMore big Wall Street banks are throwing their weight behind “Trump Accounts.” Bank of America, JPMorgan, and Wells Fargo said they would match the $1,000 the government is putting into their employees’ eligible children’s retirement accounts. Visa even said it will let its cardholders tap their cash rewards to deposit them into their Trump accounts — turning Americans’ fondness for debt into an asset for the next generation. (Baby’s first points!) Treasury Secretary Scott Bessent said 600,000 families have already signed up for accounts since tax-filing season started on Monday. The real prize is yet to come: the Treasury is set to choose a firm to manage the accounts in the coming weeks, according to a person familiar with the matter. It has told interested bidders that it wants a custodian bank that already has federal contracts, a group that would also include Bank of New York, Charles Schwab, and State Street — which helps explain why all three were early supporters of Trump accounts. The contract itself is likely not a huge moneymaker, but it’s a way to acquire millions of customers whose wealth might grow over time. |

|

‘Middle power’ economies cozy to China |

Carl Court/Pool via Reuters Carl Court/Pool via ReutersBritish Prime Minister Keir Starmer’s visit to China, complete with a diplomatic assist from its corporate national champions, shows more countries hedging their economic bets on the US. Starmer’s trip follows a landmark trade deal between the EU and India, Canada’s move to import Chinese electric cars, and recent or upcoming trips to Beijing from several Western leaders. “I’m a British pragmatist applying common sense,” Starmer said. (That pragmatism also involved the UK delegation leaving their phones at home, the Financial Times reported.) One question is where this “middle power” diplomacy leaves “middle power” multinationals. Starmer enlisted executives from HSBC, Standard Chartered, and Jaguar on his trip, and unveiled a $15 billion investment by AstraZeneca into its Chinese operations. |

|

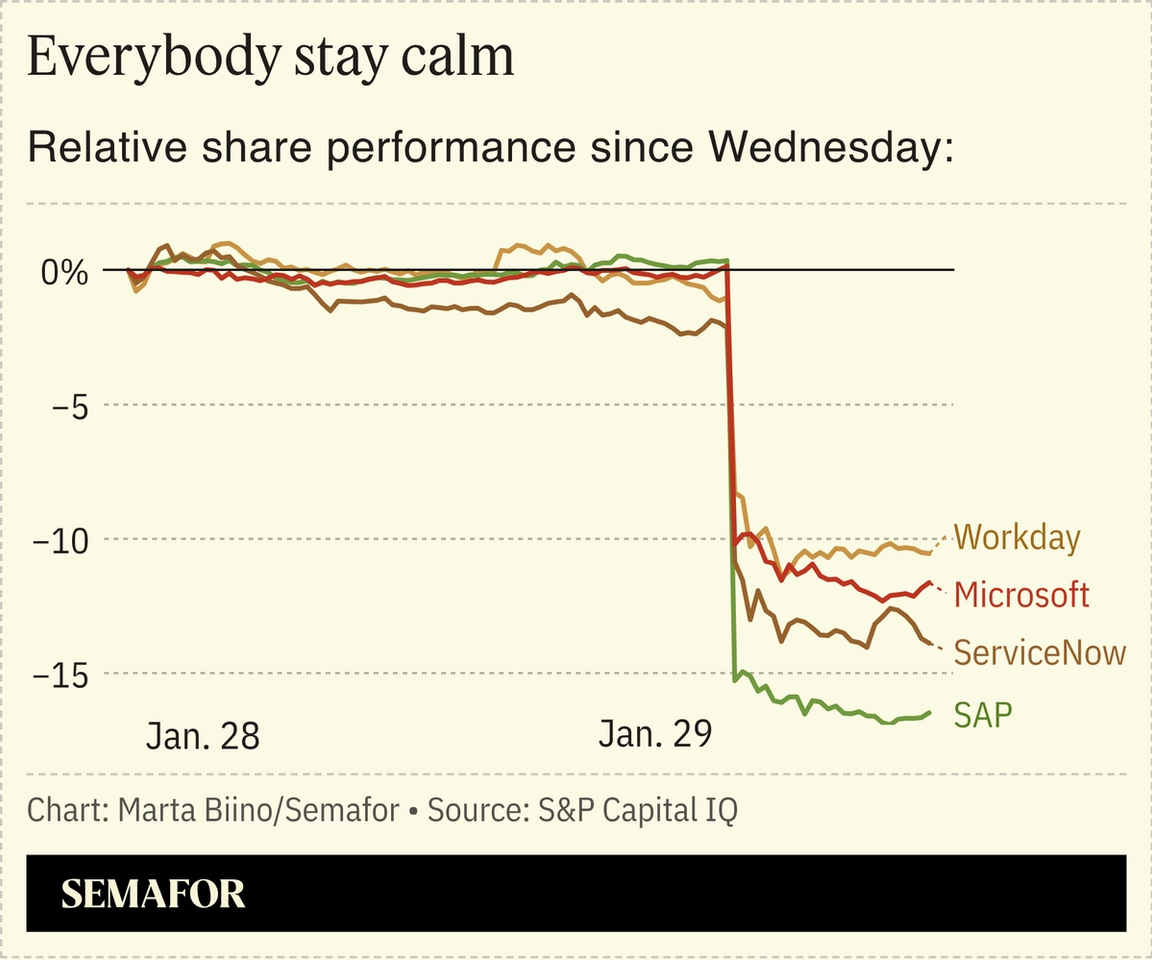

Software sells off on AI fears |

Software stocks are plunging as investors panic about what AI will do to their business models — and quickly — after Microsoft reported slowing cloud revenue and soft guidance. Shares of German software giant SAP fell as much as 17%, while Workday and ServiceNow dropped more than 10%. “Very much a ‘get me out of this group’ type [of] selling,” Jefferies’ traders wrote in a note to clients Thursday morning. Vendors of corporate software — think sales trackers, HR portals, and financial-planning tools sold under easily cancelable contracts — are seen as vulnerable to AI. “Hold on,” software investor Orlando Bravo told Semafor in a recent interview. “AI for the right software company is an incredible growth opportunity, but they have to do something about it. Now, as many of these companies execute correctly, you will see a resurgence back on those multiples.” |

|

What smart money knows — Polymarket is the world’s largest prediction market, with a 90%+ accuracy track record. In The Oracle by Polymarket, you’ll meet the forecasters who spot what others miss: the political outsider who bought Mamdani at 8%, the trader who cracked Google’s search algorithm. From elections to finance to sports, learn to see the world like a world-class forecaster. Get the free newsletter. |

|

➚ BUY: Horoscopes. SpaceX is reportedly targeting mid-June for its IPO, timed to coincide with Elon Musk’s birthday and “a rare planetary alignment.” ➘ SELL: Isotopes. The Department of Energy made sweeping changes to relax nuclear safety rules in secret and shared them directly with companies they regulate, NPR reports. “Not the best way to engender the kind of public trust,” Biden’s top nuclear regulator said. |

|

Companies & Deals- Steering into the squid: There’s now zero doubt that Tesla shareholders who thought they were investing in electric vehicles should find an exit ramp. Musk is scrapping two car models and investing $2 billion of Tesla’s money into xAI.

- All politics are local: To comply with Saudi Arabia’s rules requiring companies bidding for government work to make Riyadh their regional headquarters, Visa simply redefined its Middle East region, splitting it in two.

- Practical magic: Beijing approved Tencent, Alibaba, and ByteDance to buy Nvidia’s H200 chips as Beijing’s “extreme hunger for high-quality computing power” takes priority over trade tensions.

Watchdogs- Shaking the trees: Crypto PAC Fairshake’s $193 million war chest, filled with big checks from Coinbase, Ripple, and a16z, sets up a repeat of a 2025 lobbying blitz that helped pass landmark legislation on stablecoins.

- Yes, we Khan: Colorado is weighing a law to cap concession prices at airports, sports stadiums, and hospitals, borrowing an idea that, as Semafor reported, former FTC Commissioner Lina Khan has been pushing in New York City.

Markets- Out of the money: Traders are placing long-shot bets that the European Central Bank will deliver a surprise interest-rate cut, Bloomberg reports, a zig-where-others-zag move after a run-up in the euro.

- Call a krankenwagen: Deutsche Bank had just closed its most profitable year ever, and putting its scandal-plagued past behind it, when German authorities raided its Frankfurt offices as part of an investigation into the lender’s dealings with a sanctioned Russian oligarch.

|

|

|