| | In today’s edition: Qatar’s QIA pours money into other funds, the UAE is catching up with Saudi non-͏ ͏ ͏ ͏ ͏ ͏ |

| |   Doha Doha |   Singapore Singapore |   Washington DC Washington DC |

| Gulf |  |

| |

|

- QIA pushes fund of funds

- Doha backs Abu Dhabi VC

- Tahnoon’s Trump crypto deal

- UAE non-oil exports surge

- Riyadh courts private capital

- IMF urges Bahrain reforms

- The NBA in Abu Dhabi

Qatari-backed films secure Oscar nominations. |

|

Doha triples down on fund of funds |

Mohsin Pirzada. Sam Barnes/Web Summit Qatar via Sportsfile. Mohsin Pirzada. Sam Barnes/Web Summit Qatar via Sportsfile.The Qatar Investment Authority has tripled the size of its Fund of Funds program to $3 billion and added a coveted perk: access to subsidized computing power from Qai, the state-backed AI infrastructure platform. The program has deployed capital to 12 firms so far, with commitments ranging from $50 million to more than $150 million per fund, Mohsin Pirzada, QIA’s head of funds investment, said in an interview with Semafor at Web Summit Qatar. Venture capital funding for startups in Qatar has risen about 80% over the past year, Pirzada said. The government aims to foster new companies focused on deep tech, materials science, food security, and energy. Exits are a major bottleneck, but QIA’s program aims to help address this: One of the firms to receive funding is Ion Pacific, which focuses on secondaries and other financing to provide liquidity to investors. — Mohammed Sergie |

|

Shorooq secures Qatari support |

Shorooq founding partners Mahmoud Adi and Shane Shin. Courtesy of Shorooq. Shorooq founding partners Mahmoud Adi and Shane Shin. Courtesy of Shorooq.Abu Dhabi-based alternative asset manager Shorooq has raised $200 million to address what it sees as a gap in the market for late-stage and pre-IPO companies, drawing Qatar as a backer for the first time alongside other sovereign and institutional investors. “Over the next two to three years, we expect the opportunity set to be strongest in companies that have already proven their economics but now need patient, structured capital to scale and professionalize ahead of public markets,” Mahmoud Adi, founding partner at Shorooq, told Semafor. The Qatar Investment Authority’s participation was announced on the sidelines of Web Summit Qatar and fits in with its wider $3 billion Fund of Funds program. As part of the deal, Shorooq plans to open a Doha office. The firm has previously raised money from Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala; it now has more than $1 billion in assets under management across venture, private equity, credit, and real assets. — Kelsey Warner |

|

Abu Dhabi’s investment in Trump |

Evelyn Hockstein/Pool/Reuters Evelyn Hockstein/Pool/ReutersA senior UAE royal poured $500 million into a cryptocurrency company run by US President Donald Trump’s family in early 2025, just before he was inaugurated for his second term, according to a report by The Wall Street Journal. The investment by Sheikh Tahnoon bin Zayed Al Nahyan in World Liberty Financial (WLF) gave him a 49% stake and also involved $31 million flowing to entities affiliated with the family of Trump’s Middle East envoy Steve Witkoff. The revelation has raised ethics concerns in Washington and adds another dimension to previously known links between WLF and the Abu Dhabi deputy ruler and federal national security adviser. In March, technology fund MGX — which is chaired by Tahnoon — invested $2 billion in Binance, the world’s largest cryptocurrency exchange, in a transaction using a WLF stablecoin. Later that month, the US administration cleared the way for the UAE to buy 500,000 advanced Nvidia AI chips per year. |

|

UAE’s non-oil exports catching up with Saudi |

Satish Kumar/Reuters Satish Kumar/ReutersUAE non-oil exports rose 45% to hit 813 billion dirhams ($221 billion) last year, according to Prime Minister and Dubai ruler Sheikh Mohammed bin Rashid Al Maktoum. Overall, UAE non‑oil trade reached 3.8 trillion dirhams, thereby passing the $1 trillion mark for the first time. The rapid growth means the UAE is closing the gap on its neighbor Saudi Arabia, which has an economy twice as large. Saudi non-oil exports for the first 11 months of last year totaled 1 trillion riyals ($284 billion). Both countries have been pushing to diversify their economies and build new industries for a post-oil future, with heavy investments in areas such as artificial intelligence, tourism, and logistics. Saudi GDP expanded 4.9% in the fourth quarter of 2025, the fastest rate since 2022, according to official preliminary estimates. Growth was estimated at 4.5% across 2025 as a whole. In December, the UAE central bank projected the UAE economy would grow by 5% for the year. — Matthew Martin |

|

Saudi turns to private capital |

The amount Saudi Arabia aims to raise from private investors by 2030 under a new national privatization strategy. The authorities aim to sign more than 220 public-private partnership (PPP) contracts across 18 sectors, including transport, water, and airports, shifting more funding and service delivery away from the state. A government spokesperson told Semafor that the new strategy was designed to be more execution-focused, with clearer risk allocation and projects structured in ways that should boost investor confidence. It comes amid a broader reassessment of the government’s spending priorities, including the suspension of work on Riyadh’s Mukaab skyscraper and the scaling back of NEOM. Saudi Arabia has tried versions of this before, but earlier privatization drives delivered little, with only a handful of asset sales completed. Major PPP proposals such as a coast-to-coast rail line known as the Saudi Landbridge have sat in planning for years, while efforts to sell the Ras Al Khair desalination plant were scrapped in 2021 due to weak investor interest. |

|

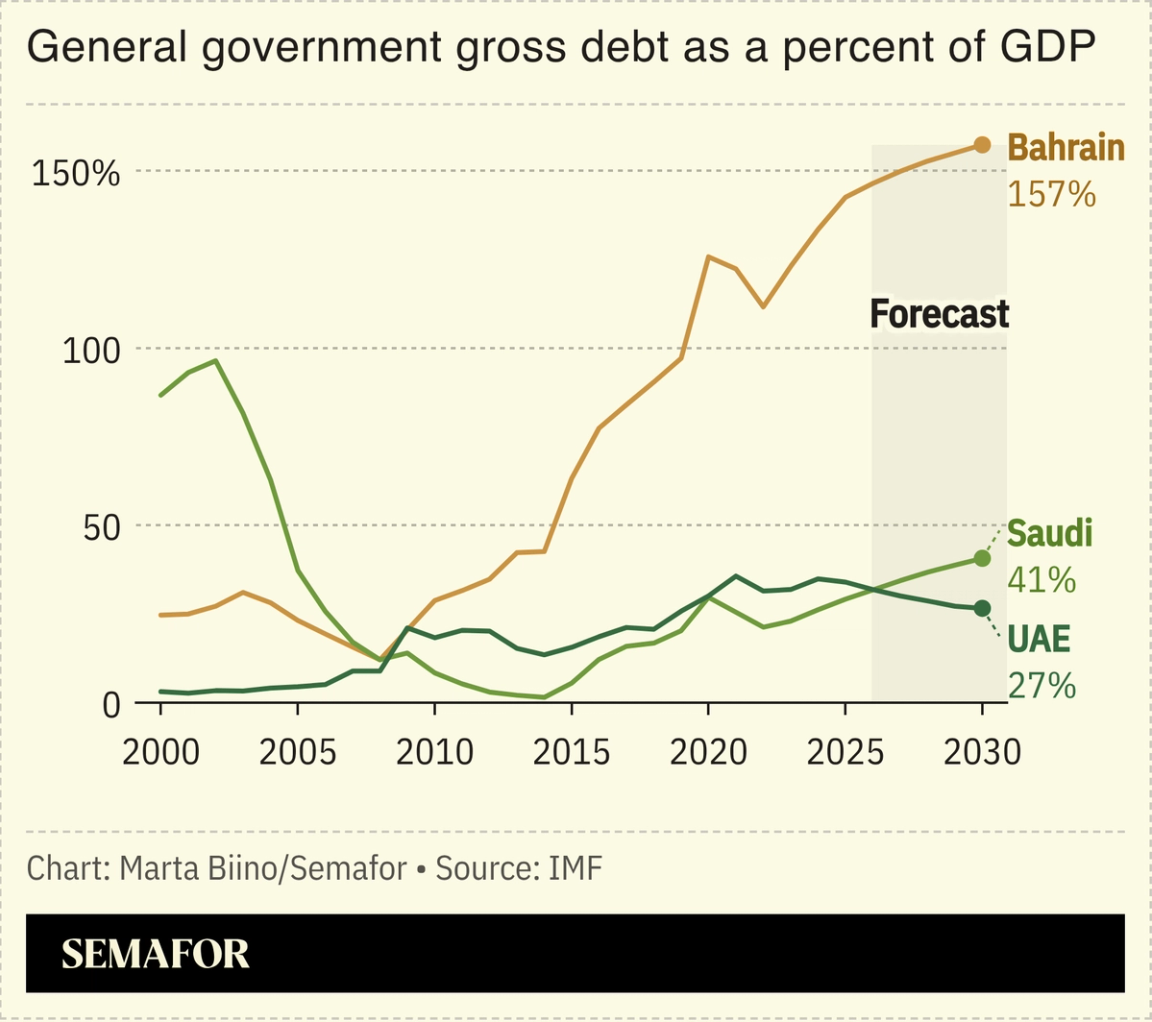

IMF warns Bahrain over debt |

The IMF has warned Bahrain that it “urgently” needs to cut spending or raise taxes in order to keep its mounting debt burden under control. In a review of the country’s economy published in late January, the fund acknowledged some recent budget reforms — including a corporate income tax and changes to utility prices — but said more changes were needed. “Delayed or insufficient fiscal adjustment could exacerbate debt sustainability concerns and financing challenges,” it added. Bahrain’s budget deficit rose to 11% of GDP in 2024, while its overall debt-to-GDP ratio increased to 134%. Credit ratings agencies have taken a dim view of its finances, with the country’s sovereign debt now deep in junk bond territory. |

|

An NBA game in Abu Dhabi in 2025. Raghed Waked/Reuters. An NBA game in Abu Dhabi in 2025. Raghed Waked/Reuters.Abu Dhabi will host an NBA Global Academy for high-school-age players, as part of an expanded partnership with the US professional basketball league. More top-tier preseason games are also promised for the Emirate, which has hosted fixtures since 2022. The deal highlights how Gulf countries use international sports stars and leagues to both appeal to tourists and encourage their citizens off the couch and onto the field of play: Basketball participation has grown 60% in the UAE in the past four years. It also echoes the way sovereign wealth is used to attract foreign capital and expertise. In some cases, the connection is even more explicit: Saudi Arabia’s Public Investment Fund is seeking investors for its LIV golf venture, with Citigroup hired to run the process, Bloomberg reported. LIV launched in 2022 and has signed up star players like Phil Mickelson and Jon Rahm, but has struggled to win over fans amid hostility from the PGA Tour establishment. |

|

Defense- The US State Department approved the sale of a Patriot missile defense system worth $9 billion to Saudi Arabia. Lockheed Martin is the main contractor.

Deals- Abu Dhabi’s Mubadala Investment Co. is in talks to join a KKR-led consortium bidding to take control of Singaporean data center operator STT GDC. The deal could value STT at more than $10 billion. — Bloomberg

Government- Yaqoub Al-Refai was named finance minister in a Kuwaiti cabinet reshuffle on Feb. 1. Other appointments included Sheikh Jarrah Jaber Al-Ahmad Al-Sabah as foreign minister, Osama Boodai as minister of commerce and industry, and Abdulaziz Al-Marzouq as minister of state for economic affairs and investment. — Kuwait Times

- Ahmed Traboulsi — a former goalkeeper for Kuwait’s national football team — is the latest high-profile figure to get caught in a citizenship crackdown, with his nationality revoked by a government committee. — The New Arab

Infrastructure- Sudan’s Ministry of Transport and Infrastructure will grant Saudi firms priority in reconstruction projects. Saudi Arabia and the UAE are competing for influence in the war-torn country. — Sudan Tribune

|

|

Amer Hlehel, Clara Khoury, Motaz Malhees and Saja Kilani pose on the red carpet with a picture of Hind Rajab. Remo Casilli/Reuters. Amer Hlehel, Clara Khoury, Motaz Malhees and Saja Kilani pose on the red carpet with a picture of Hind Rajab. Remo Casilli/Reuters.Two films supported by the Qatar government-backed Doha Film Institute have been nominated for Oscars this year, adding to its steady run of Academy recognition. The Voice of Hind Rajab was nominated for Best International Feature, while Cutting Through Rocks earned a nomination for Best Documentary Feature, taking the DFI’s total Oscar nominations to 12 over the past decade. The Voice |

|

|