| | In this edition: US extends AGOA, MTN targets fintech acquisitions, and why work concerns topped a s͏ ͏ ͏ ͏ ͏ ͏ |

| |   Kinshasa Kinshasa |   Pretoria Pretoria |   Lilongwe Lilongwe |

| Africa |  |

| |

|

- US extends AGOA

- Glencore’s DRC deal

- DA leader to step down

- MTN targets fintechs

- $1B bond controversy

- Work concerns top agenda

A festival with African roots in the Brazilian city of Salvador. |

|

US extends AGOA trade pact |

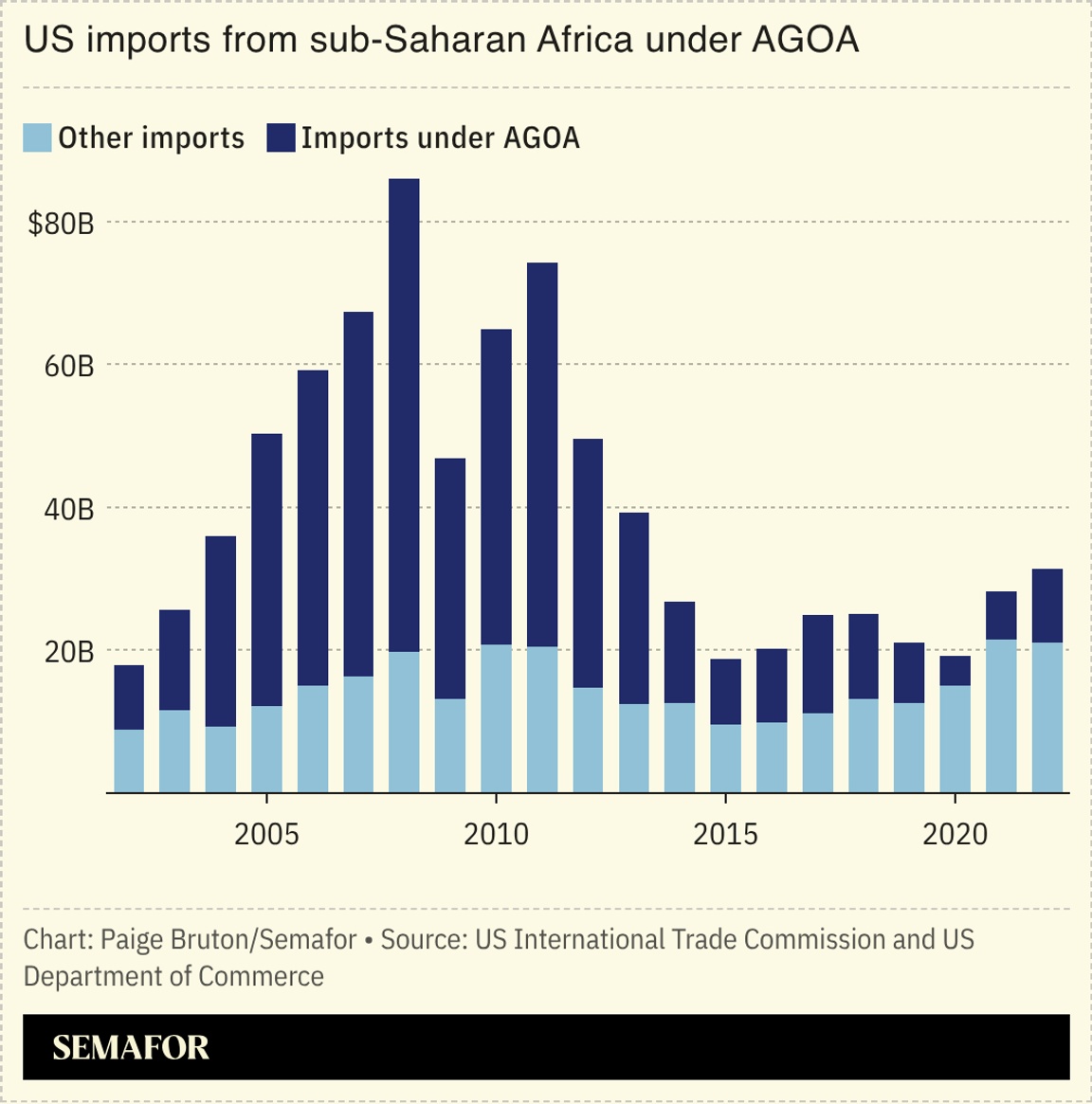

The US extended a trade deal giving African countries duty-free access to the American market, though prolonging it for just a year put exporters in a tough spot. The African Growth and Opportunity Act has been a key force in driving African exports to the US since it was first implemented in 2000, though it has also expanded Washington’s trade deficit with the continent. AGOA expired in September, leaving hundreds of thousands of jobs at risk as uncertainty brewed over its renewal. The Trump administration’s imposition of hefty tariffs on African imports last year, as part of an overhaul of its global trade policy, added to the precarity. While AGOA “consistently contributed” to US goals, including boosting access to critical minerals, the 12-month extension — rather than the usual multi-year renewal — “discourages sustained, long-horizon investment,” an expert wrote in Foreign Policy. |

|

DR Congo strikes new minerals deal |

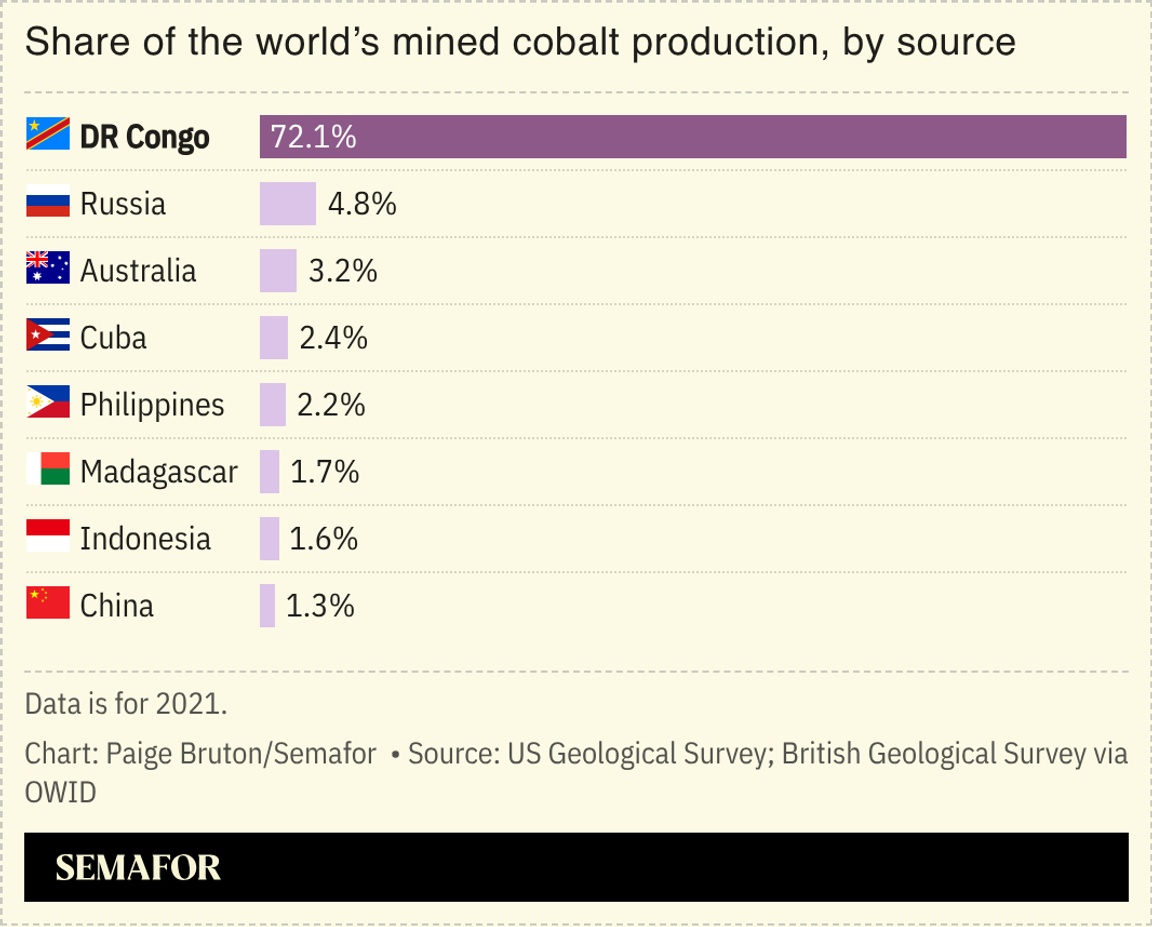

Swiss commodities giant Glencore agreed to sell 40% of its stake in its DR Congo copper and cobalt mines to the Washington-backed Orion Critical Mineral Consortium, intensifying the Trump administration’s effort to counter China’s global dominance of metals and mining on the continent. It lands alongside a US–DR Congo agreement to prioritize American interests in DR Congo’s supply chain, and ahead of a critical-minerals summit in Washington on Wednesday with Congolese President Félix Tshisekedi, and ministers from other African countries. This week, the White House also launched a $12 billion critical minerals stockpile as part of its efforts to counter Chinese dominance over key metals and support domestic manufacturers during shortages and emergencies. The US is hoping that backing transactions like the Orion deal — which valued the Glencore assets at $9 billion — will help it move quicker on the continent: The top US State Department official responsible for Africa policy told Semafor recently that Washington need not match China “dollar for dollar” in Africa, and should instead ensure it is “actively competing” in priority supply chains. — Ruben Nyanguila |

|

South Africa’s DA leader to stand down |

| |  | Sam Mkokeli |

| |

Outgoing Democratic Alliance leader John Steenhuisen. Nic Bothma/Reuters. Outgoing Democratic Alliance leader John Steenhuisen. Nic Bothma/Reuters.The leader of the second-largest party in South Africa’s ruling coalition announced he will not seek another term, raising fresh questions about the durability of the government. John Steenhuisen said he had accomplished his political goals — including establishing the nearly 20-month-old coalition — and would not stand for election in the Democratic Alliance’s leadership election in April. Though he did not explicitly say why he was leaving, his departure follows months of internal rows: The business-friendly DA was expected to provide policy discipline to boost investor confidence in Africa’s biggest economy. And while its presence in government has helped reassure markets, the party has been increasingly consumed by leadership battles and strategic disagreements. Geordin Hill-Lewis, the mayor of Cape Town, is the front-runner to succeed Steenhuisen. The 39-year-old, a rising star in the party, has secured strong support from key DA figures since becoming the city’s mayor five years ago. |

|

MTN targets fintech acquisitions |

| |  | Yinka Adegoke |

| |

MTN CEO Ralph Mupita. Lluis Gene/AFP via Getty Images. MTN CEO Ralph Mupita. Lluis Gene/AFP via Getty Images.MTN is on the hunt for fintech startups it can acquire and plug directly into its platform, as Africa’s largest telecom group looks to accelerate growth, its CEO told Semafor. Ralph Mupita said the Johannesburg-headquartered company is actively looking out for acquisitions across payments, lending, and remittances that could be integrated into MTN’s fast-growing fintech business. “This is not about buying things and flipping them,” Mupita said. “It’s about strengthening the platform. If an acquisition helps us grow faster, improve the customer experience or bring new capabilities into the group, that’s what we’re interested in.” Mupita declined to give a budget for its M&A targets, but MTN had more than $2 billion in cash on its books as of November. The push comes as Africa’s once-booming fintech sector grapples with a prolonged funding slowdown, forcing startups to rethink growth plans and giving early-venture investors fewer paths to exit. |

|

Ethiopia’s bond controversy |

The value of Ethiopia’s sole eurobond at the center of a fraught debate between a key investor group and the country’s bilateral creditors. Addis Ababa agreed with a group of international investors last month to restructure the bond after the government defaulted in December 2023. Still, some investors said they would take legal action after a creditor committee chaired by China and France blocked the initial restructuring agreement. The committee said the draft deal did not meet a threshold intended to ensure commercial and official creditors share losses fairly, while the investor group described the decision as “completely unreasonable.” Ethiopia has been among Africa’s fastest-growing economies in recent years, but delays in restructuring its debt has deterred international investors. |

|

Economic fears top new poll |

| |  | Alexander Onukwue |

| |

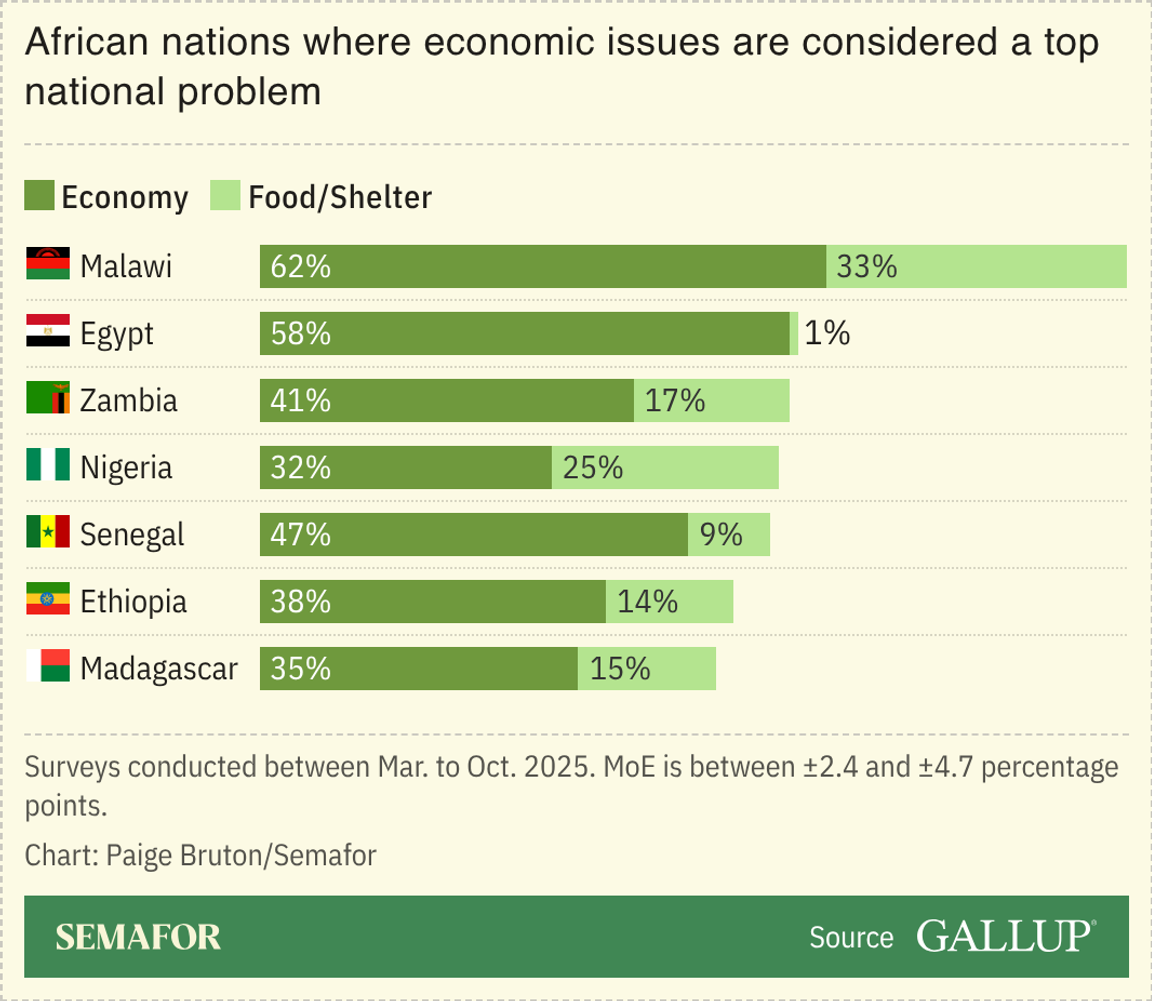

Economic wellbeing topped a list of concerns in sub-Saharan Africa, a new Gallup survey found. Anxiety about the cost of food and other basic needs superseded worries about political, governance, and security issues. Almost a quarter of respondents in sub-Saharan Africa ranked the economy as their country’s biggest national concern, reflecting a broader global trend that emerged from a survey of 107 nations conducted last year. Some concerns reflected in Gallup’s survey overlapped with the impact of recent economic policies. Nigeria’s reforms to stabilize its economy, including eliminating fuel and electricity subsidies, has sparked a cost-of-living crisis that is still hurting Nigerians. Zambians, whose country defaulted on its sovereign debt in 2020, are facing a similar challenge, with more than six in 10 residents living below the poverty line. Despite a wave of military coups and disputed election results in parts of the continent in recent years, only 6% of people in sub-Saharan Africa ranked political and governance issues as their most important problem, Gallup found, echoing “a hierarchy of needs.” |

|

Business & Macro

|

|

|