| | A new critical minerals’ partnership, China’s coal and renewables efforts surge at once, and bets on͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- US critical minerals bloc

- Big Tech capex surges

- Global commodities bump

- Chinese coal v. renewables

- A replacement for lithium

The Trump administration is betting on a Supreme Court intervention in its battle against wind. |

|

US critical minerals bloc |

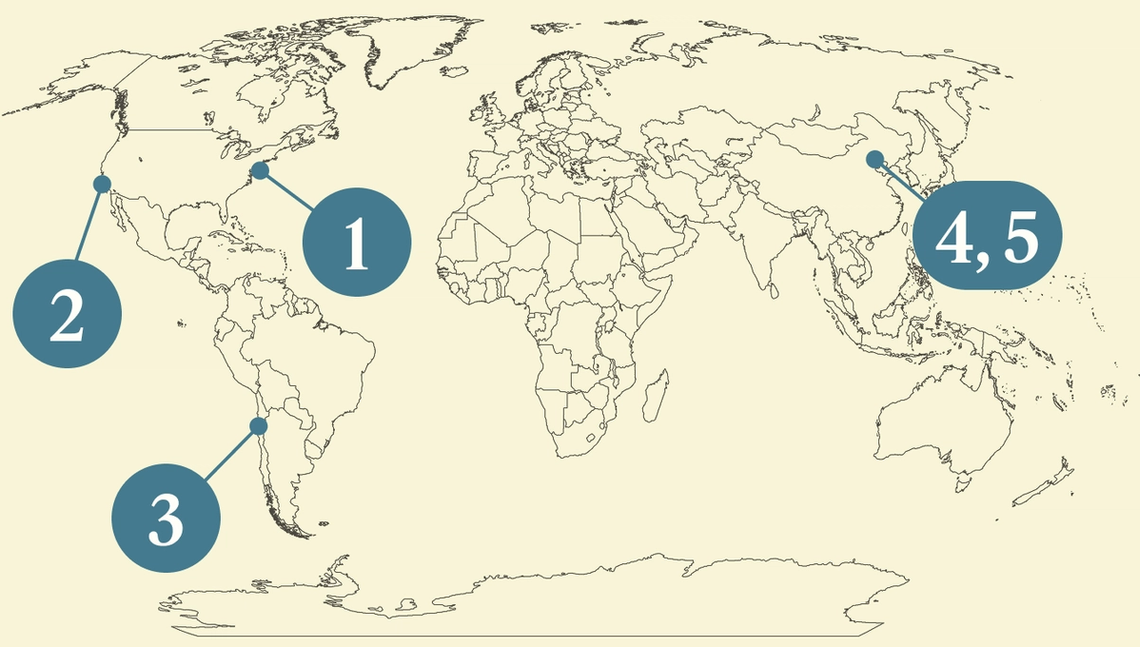

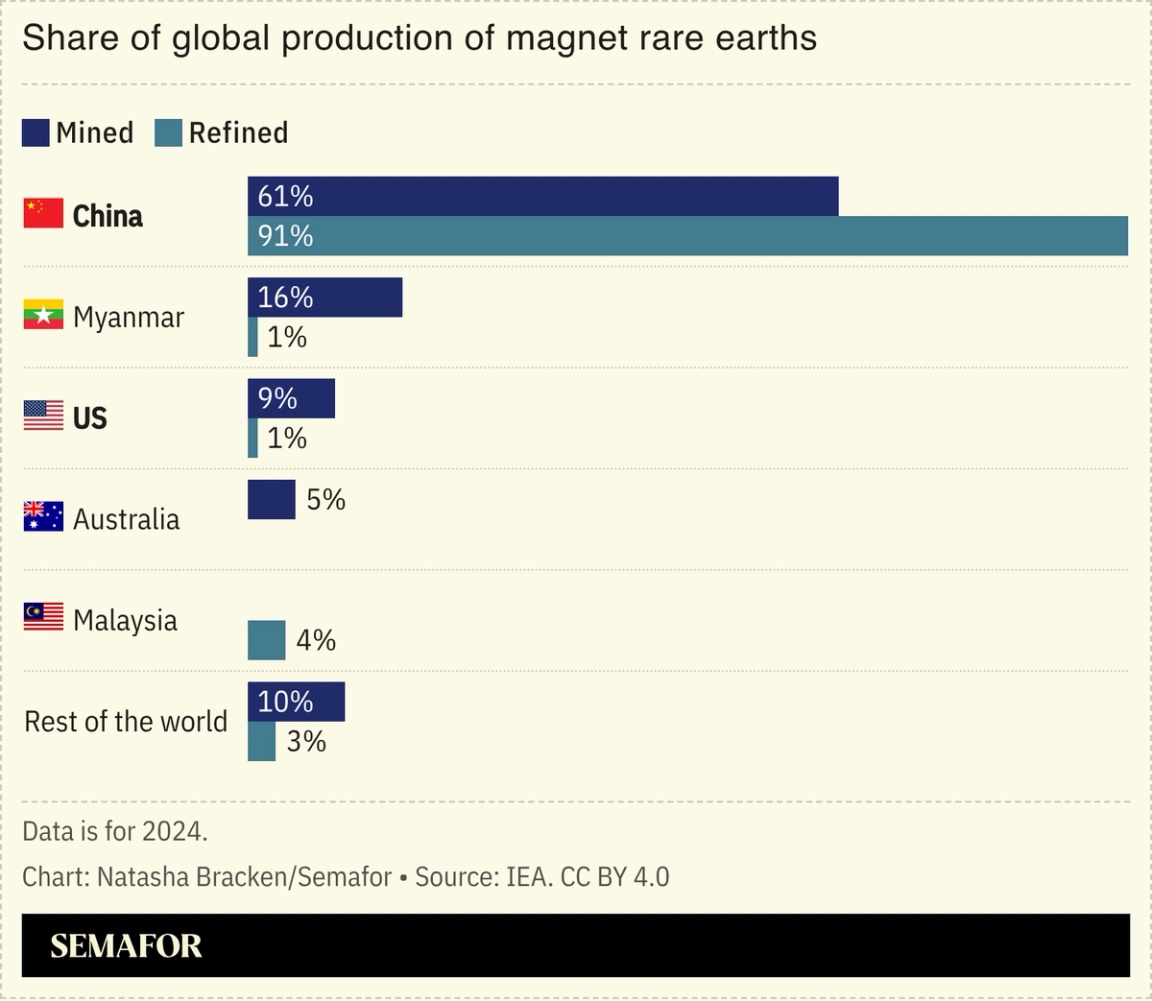

The US unveiled plans to form a trading bloc alongside key allies for critical minerals, proposing coordinated price floors as Washington moves to secure its place in a supply chain long dominated by Beijing. The plan announced Wednesday proposed using tariffs to stabilize mineral prices to prevent “foreign supply” from flooding global markets. Washington also clinched bilateral deals with 11 nations, as US Secretary of State Marco Rubio warned against allowing “one country” to dominate metals vital to defense and AI development, an implicit reference to Beijing. The announcement adds to a broader push by the Trump administration to secure US supplies of critical minerals after China weaponized its rare earths dominance last year during a trade war between the superpowers. This week, the US outlined a $12 billion critical mineral reserve, while Swiss commodities giant Glencore said it would sell 40% of its copper and cobalt mines in the Democratic Republic of Congo to a US government-backed firm. — Natasha Bracken |

|

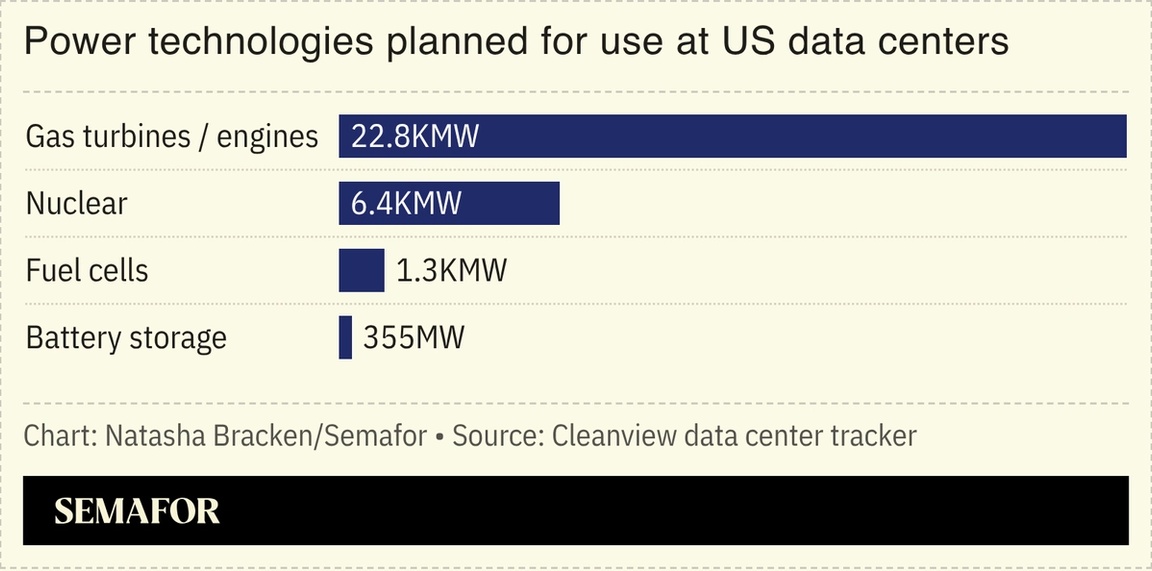

Alphabet said it would double its capital expenditures compared to last year, capping a week in which Big Tech firms pledged to spend half-a-trillion dollars this year — with huge implications for power markets and the energy transition worldwide. Alphabet’s $185 billion spending plan, which far surpassed analysts’ expectations, was the biggest in a series of similar commitments by US firms including Meta and Microsoft, with each arguing their investment spree was necessary in an environment in which rivals are fast building AI infrastructure. “The top question is definitely around compute capacity [and] all the constraints — be it power, land, supply chain constraints,” Alphabet CEO Sundar Pichai said on an earnings call. Increasingly, tech firms are prioritizing speed over efficiency in the construction of data centers and the procurement of power for them, a new report noted. “Speed to power is all that developers care about,” Cleanview wrote, adding that while data center developers made mention of renewables, nuclear, or even hydrogen in their public announcements, a review of permitting documents and site plans for construction in 2025 and 2026 indicated that they were largely opting for gas-fired power. — Prashant Rao |

|

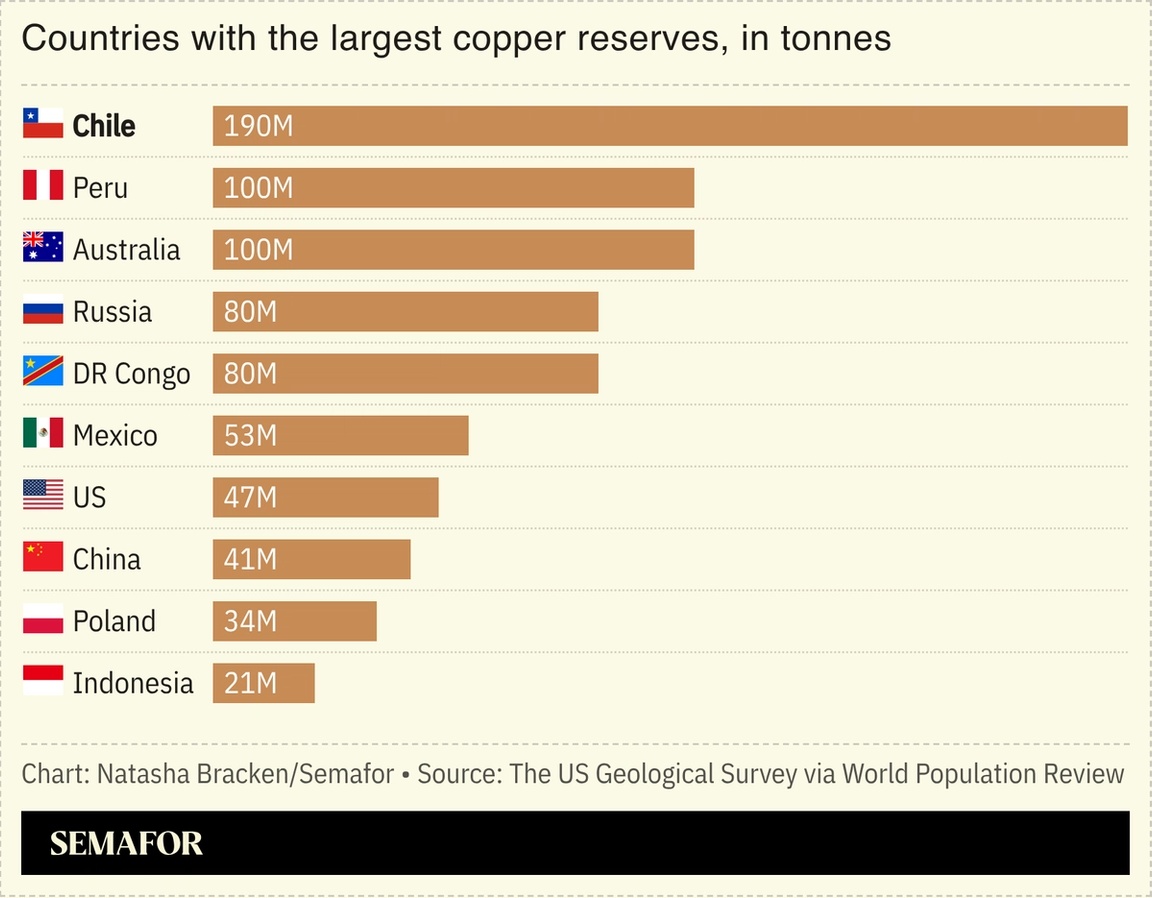

Wild gyrations in commodities prices are having a huge impact on economies the world over. Though copper prices have dipped recently, the metal’s months-long surge — it is essential for many of the key elements of the energy transition, from transmission infrastructure through to EV batteries, as well as wind turbines and solar panels — has been a boon for Chile, where it accounts for around a tenth of GDP. The country’s incoming finance minister intends to use the windfall to eliminate a fiscal deficit while slashing corporate taxes, and Goldman Sachs upgraded its forecast for Chile’s economic growth this year and next. Yet some governments’ exposure to commodity prices also means they are vulnerable to swings in global markets. African stocks, bonds, and currencies all came under pressure this week as gold and silver plummeted, Bloomberg noted, warning that “windfalls can vanish just as fast as they appear.” |

|

Chinese coal v. renewables |

Tingshu Wang/File Photo/Reuters Tingshu Wang/File Photo/ReutersGrowing power demand in China and the sheer size of the country’s market showcased what appeared to be countervailing trends — the persistence of coal, and the rise of renewables. New data from Global Energy Monitor and the Center for Research on Energy and Clean Air found that developers in China submitted applications to build 161 GW of coal-fired power plants last year, a record. The country’s domestic output also reached a new high last year, up 1.2% on 2024 figures, government data showed. Yet solar power capacity is forecast to overtake coal this year, according to the China Electricity Council, demonstrating China’s breakneck addition of clean power: Overall, wind, solar, nuclear, and hydropower will account for about two-thirds of the country’s power mix by the end of the year. In order to strengthen the grid as a result of the addition of intermittent renewables, Chinese authorities have also added utility-scale batteries to a subsidy program aimed at accelerating the green transition. |

|

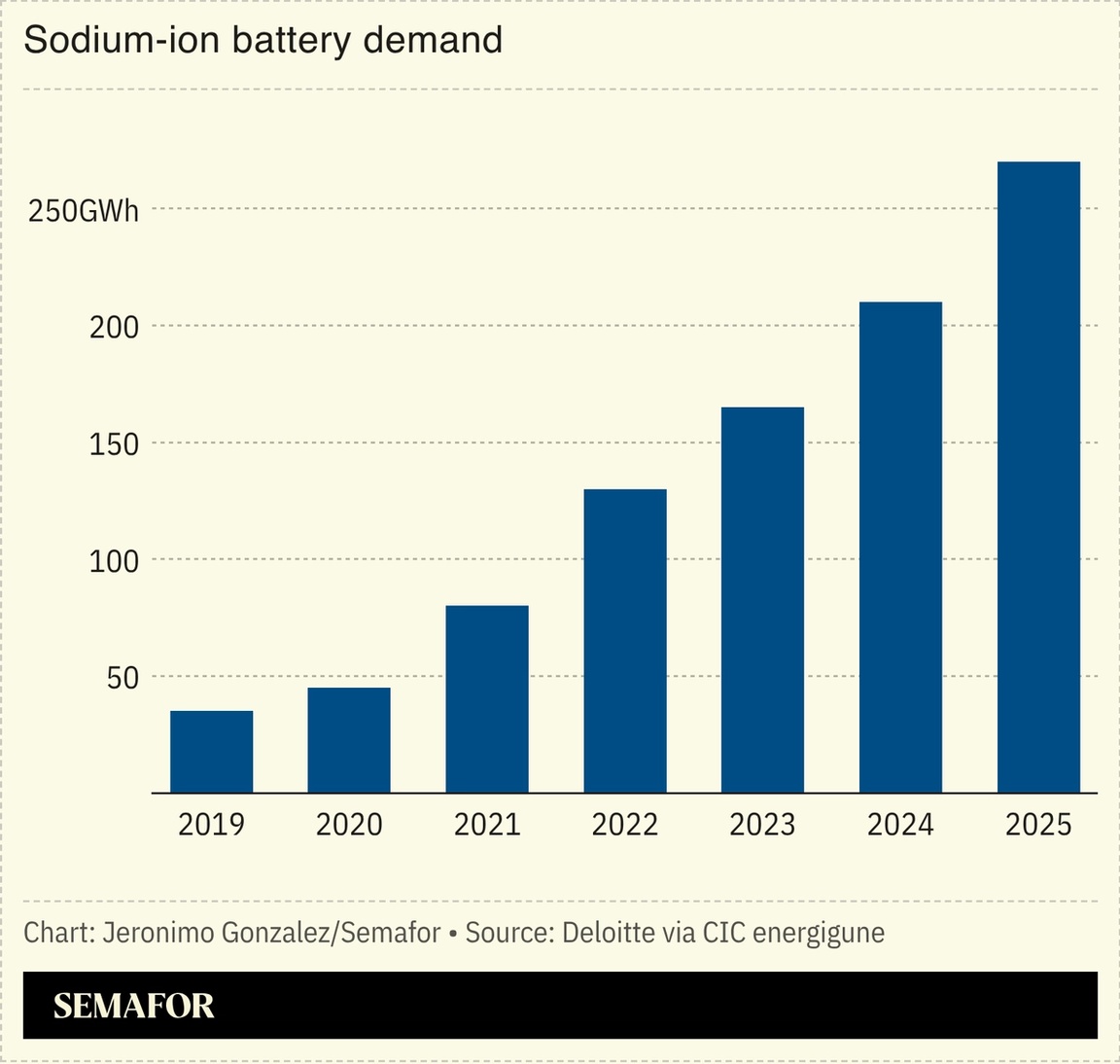

A replacement for lithium |

Rising lithium prices could create an opening for sodium batteries. Lithium batteries drive much of the modern economy: EVs, personal devices, and grid energy storage all use them. But lithium is scarce and expensive. Sodium batteries are a potential alternative; they are less energy-dense, limiting their capacity, but sodium is much more abundant and so could drive down prices, especially in situations — such as utility-scale batteries — where size and weight are less important, MIT Technology Review noted. A shift to sodium will not, however, reduce reliance on China, which dominates the industry, notably through battery giants BYD and CATL. |

|

New EnergyFossil Fuels- Siemens Energy announced it will invest $1 billion to make more electricity equipment in the US, including gas turbines, amid a growing need for power from data centers.

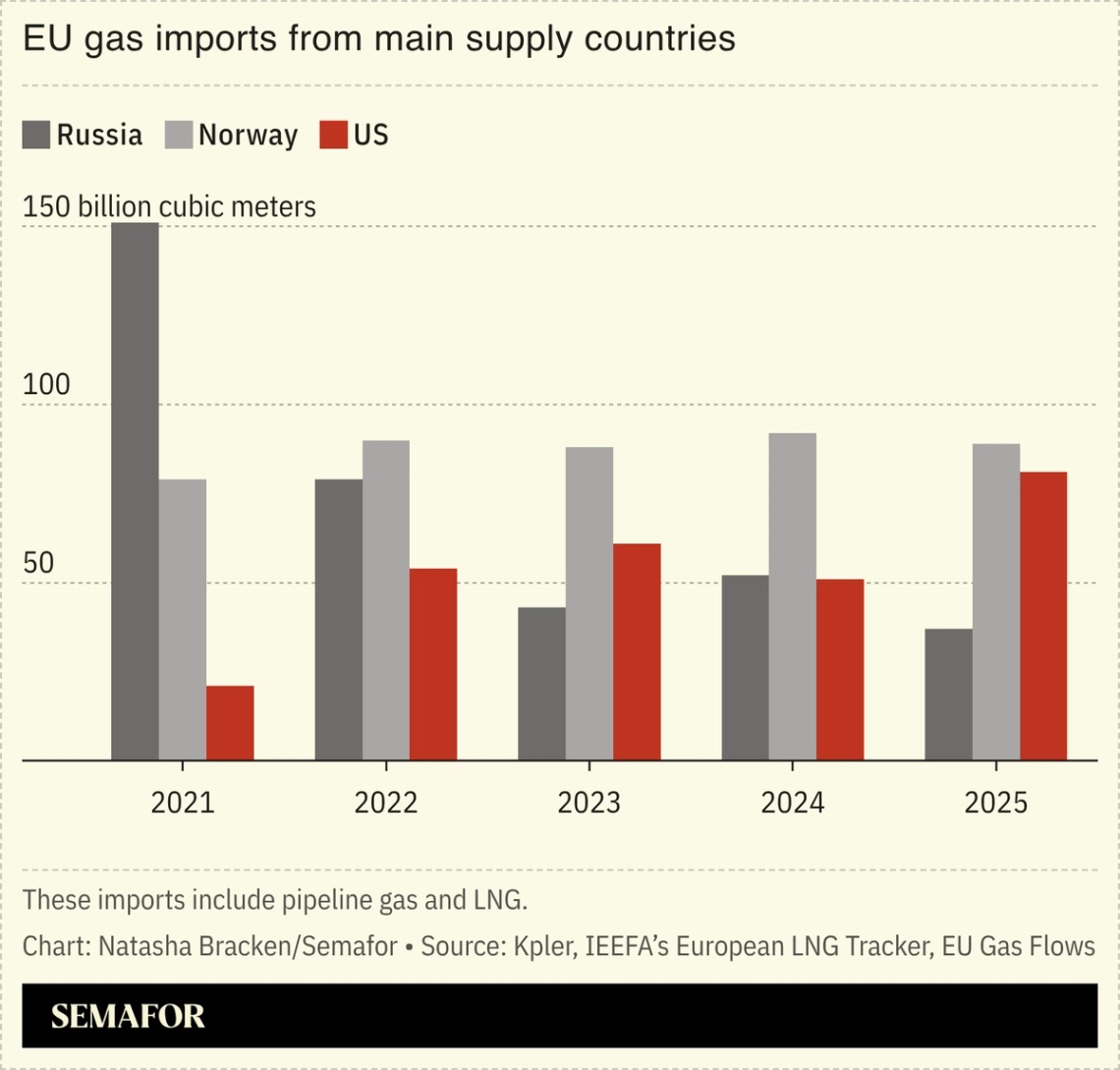

- Germany’s Chancellor Friedrich Merz travelled to the Gulf this week with hopes of diversifying the country’s energy imports away from an increasingly unreliable Washington.

FinancePolitics & Policy- US Secretary of the Interior Doug Burgum suggested the Supreme Court could intervene after the Trump administration lost all five cases brought by offshore wind developers challenging its attempts to halt turbine construction.

EVs |

|

| |