| | In this edition, why Brad Karp losing his seat atop Paul Weiss is less about Jeffrey Epstein and mor͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Mining merger off

- AI’s giant money pit

- Sports investing goes pro

- WaPo parlor game

- Job cuts hit 17-year high

|

|

The downfall of the most powerful managing partner at one of the world’s most powerful law firms isn’t really a story about Jeffrey Epstein. Chummy emails with the wealthy sex offender were the proximate cause of Brad Karp losing his seat atop Paul Weiss, but the distal cause is a problem we’ve all got: overexposure to private equity. Karp came to know Epstein through his legal work for Leon Black, the co-founder of Apollo Global Management. Apollo wasn’t just a client; it was Karp’s vehicle to take Paul Weiss from a respected but niche New York litigation shop to a dealmaking juggernaut. In 2011, Karp lured a group of partners with deep hooks into Apollo and added more from rival firms and Apollo’s own legal department. Paul Weiss lawyers papered Apollo’s aggressive tactics in the world of distressed debt and added debt-financing experts in London and California to provide round-the-clock service. By 2019, Paul Weiss was earning a reported $100 million a year, in addition to fees from advising Black’s family office, Elysium. That courtship brought Karp into Epstein’s orbit, and their correspondence — which shows Karp helped Epstein protect his plea deal on sex-trafficking charges and sought the billionaire’s help getting his son a job on a Woody Allen set — ended his 18-year run atop Paul Weiss when they were released by the Justice Department this week. Would Karp have workshopped a legal brief for a convicted sex offender unconnected to his law firm’s most important client? We’ll never know, but I doubt it. Paul Weiss isn’t alone in its reliance on private equity. Simpson Thacher built its business on work for Blackstone and KKR, Kirkland & Ellis on Bain Capital. These firms now pay their rainmakers like Wall Street stars and have dropped their courtly scruples for relentless commercialism. But of course, this is hardly just about New York lawyers. Indeed, the American economy looks more and more like Big Law, overtorqued toward financial firms that are pushing into our retirement accounts, buying up our ophthalmologists and car washes, and are becoming the largest indirect employers in the country. Even our sexual predators work for private equity now. |

|

Mining megamerger collapses |

A Rio Tinto mine in Guinea. Luc Gnago/File Photo/Reuters. A Rio Tinto mine in Guinea. Luc Gnago/File Photo/Reuters.Bankers’ dreams of ten-figure paydays collapsed this morning as Glencore and Rio Tinto walked away from their megamerger — for the third time. This time, they’re blaming Britain’s takeover laws. While CEOs in the US and other parts of the world are free to negotiate in secret, the UK’s “put up or shut up” code requires companies to quickly confirm their merger talks, and then either ink a deal, update investors, or walk away within 30 days. Negotiating a $250 billion-plus deal with global operations and massive commodity risk is hard enough as it is. A ticking clock can make it near impossible. Rio Tinto and Glencore had held only preliminary discussions about price when they were forced to disclose their flirtation in early January, a person familiar with the matter said. Both companies, in separate statements today, blamed a valuation mismatch. And there is, as is often true in M&A these days, a Trump wrinkle: Glencore’s agreed sale of its stake in some of its copper mines to a US government-backed company placed a higher valuation on the rest of its portfolio than Rio Tinto thought fair, this person said. |

|

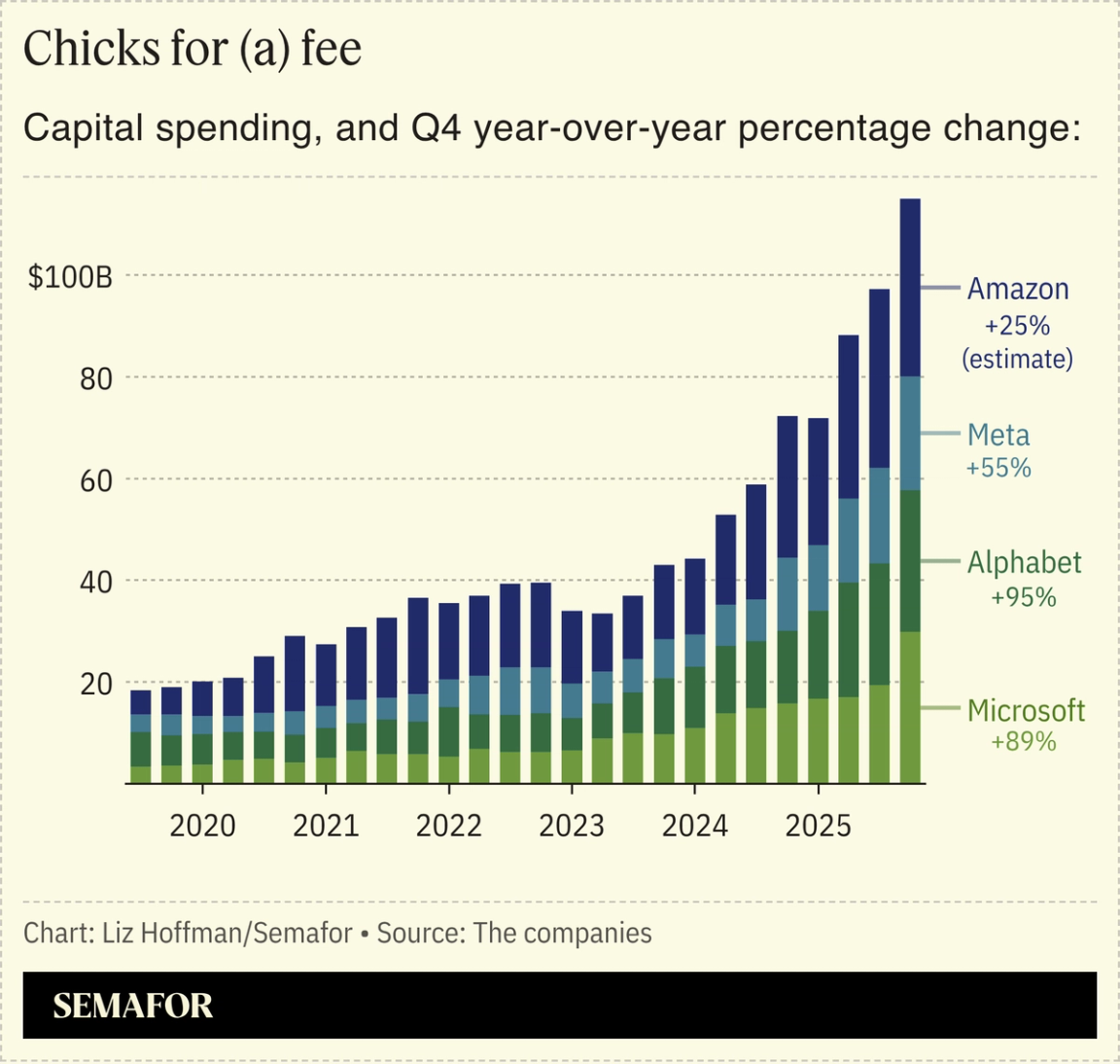

Big tech companies’ AI spending is crowding out everything else — including their precious stock buybacks — and raising questions about how long shareholders will underwrite their ambitions. Investors are torn — dumping software names on fears that AI will be so good it’ll destroy the sector, while growing nervous that hyperscalers’ bets won’t pay off. Alphabet shares fell 3% Thursday morning after it said it planned to more than double its annual AI spending, even though its revenue and profits beat investors’ expectations. The company spent the smallest percentage of its cash flow buying back its stock — just 16% — since 2018. “Every tech company right now is being judged on the delicate dance between industry transformation and business preservation,” Semafor’s Reed Albergotti notes. |

|

Ron Chenoy-Imagn Images Ron Chenoy-Imagn ImagesKKR’s $1.4 billion purchase of Arctos, which owns stakes in more than two dozen professional sports teams, removes all doubt: sports investing is going pro. The sale gives Arctos, which helped pioneer the business of buying stakes in sports teams, deeper pockets as franchise prices continue to soar and leagues themselves flirt with taking outside money. “I used to joke that a minority stake in a sports team was like really, really, really expensive season tickets, and it’s now an investment,” Gregg Lemkau, co-CEO of BDT & MSD Partners, which advised on the recent sales of the Boston Celtics and Philadelphia Eagles, said at Semafor’s The Ledger finance summit in December. Big law firms are also jumping in downstream: The companies’ press release this morning noted Kirkland & Ellis served as “sports counsel” to KKR, which had separate deal lawyers from Simpson Thacher & Bartlett. |

|

The end of media’s Medici era |

Aaron Schwartz/Reuters Aaron Schwartz/ReutersIt didn’t take long after the layoff carnage at the Washington Post for the parlor game to start up on which billionaire would buy the storied newspaper — if Bezos would ever sell. Would the Graham family come back? What about perma-acquirer and German billionaire Matthias Döpfner, Washington booster (and Baltimore Orioles owner) David Rubenstein, or tech investor Robert Smith? It may not matter, as people familiar with Bezos’ thinking told Semafor’s Max Tani that he’s not a seller. As Semafor’s Ben Smith has written, the media’s modern Medici era, in which billionaires promised to reinvent newsrooms old and new, has been a flop. Patrick Soon-Shiong’s flailing fundraise at the Los Angeles Times and Time Magazine’s continued relevancy slide under Marc Benioff show not much has changed since that 2023 column. If that’s indeed the case, it raises a bigger concern: Nobody is better at selling things on the internet than Bezos. If he can’t figure out how to profitably run a digital media business at a moment when the entire world obsesses over Washington, it suggests the industry is more troubled than we thought. |

|

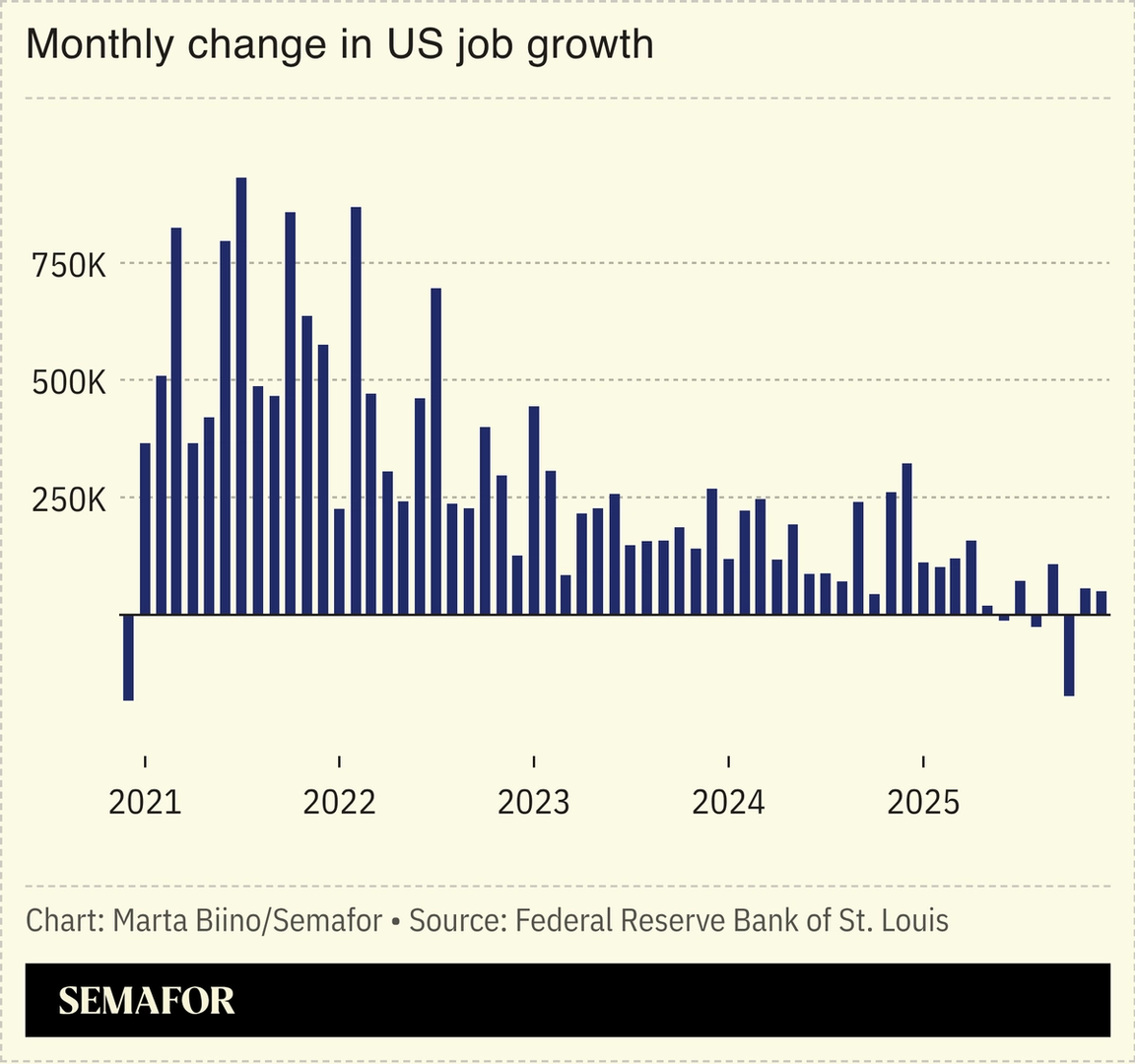

US layoffs hit 17-year high |

US employers cut more jobs last month than in any period since 2009. More than 100,000 workers were fired at Amazon, UPS, and Dow, and hiring was the slowest for any January on record, according to outplacement firm Challenger, Gray & Christmas. The low-fire, low-hire dynamic that has kept the US labor market in an anxious balance appears to have tipped. Amazon alone was directly or indirectly responsible for more than 40% of the losses, including 16,000 cuts at UPS after the carrier ended its Amazon delivery contract. (The 300 jobs eliminated at Jeff Bezos’ Washington Post will show up in February’s numbers.) AI was blamed for only around 7% of the losses and, as White House tech czar David Sacks noted, that self-reported number is likely high. Tech investor Orlando Bravo said in a recent interview that CEOs are using AI as a “cover” for margin-padding layoffs; the real AI job losses are all still ahead. |

|

Stay ahead of the moves that shape tomorrow. The Daily Upside delivers sharp, clear-eyed analysis you can actually use. Written by ex-investment bankers and top journalists, it gives you the same insights Wall Street follows — in under 5 minutes a day. Subscribe for free. |

|

➚ BUY: Metal. A Chinese trader who made $3 billion on gold has big plans to cash in on a potential silver collapse. ➘ SELL: Pedal. Peloton shares tanked after an earnings miss and much-hyped innovations in its products failed to boost demand for the struggling home workout company. |

|

Companies & Deals- Spanish imposition: Madrid-based giant Santander is buying American bank Webster for $12 billion, making “the big leap” into the US that it’s long wanted at a time other European players are retreating, El País writes. Rival BBVA sold its US operations in 2021.

- Sneak peek: SpaceX is pushing Nasdaq to include its shares in a widely tracked tech index without the normal waiting period, once it goes public later this year, WSJ reports.

- Caught up: In another Epstein casualty, David, the buzzy protein bar startup, parted ways with Chief Science Office Peter Attia after his name appeared in the latest tranche of Epstein files.

Watchdogs- No comment: Taking a lesson from no-comment Powell himself, Treasury Secretary Scott Bessent managed to dance his way out of answering lawmakers questioning whether Trump can fire Fed officials over policy disagreements, Semafor’s Eleanor Mueller writes. “I’m not a lawyer and I don’t have an opinion,” he said.

- On target: Speaking of the Fed, Trump said Wednesday he wouldn’t have picked Kevin Warsh to lead the central bank if Warsh intended to hike interest rates. The president added he was confident the bank would cut rates because “we’re way high in interest” but now “we’re a rich country again.”

Markets- Knock off : Novo Nordisk was counting on the launch of its new weight-loss pill to bring it back from the brink. But a copycat version from Hims and Hers — priced about $100 less than Novo’s — puts that comeback in danger.

|

|

|