| | In today’s edition: A flurry of Kuwait energy deals, and architects in London protest after cuts to ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Kinshasa Kinshasa |   Kuwait City Kuwait City |   London London |

| Gulf |  |

| |

|

- Kuwait steps up energy deals

- UAE lines up critical minerals

- New Saudi defense tech VC

- Architects protest Saudi cuts

- Problem-free living in the Gulf

The Saudi-Emirati ‘divergence’ and other weekend reads. |

|

The third edition of Web Summit Qatar this week was about scale. Some 1,500 startups took part alongside more than 30,000 people, including nearly 1,000 investors — a reflection of Doha’s aim to build a tech and venture capital ecosystem. More than a third of founders were women, a signal of inclusion in an industry where capital still overwhelmingly flows to men. But the hottest ticket wasn’t for the masses. It was the Government Communications Office and Qatar Investment Authority’s private convening of more than 40 investors, including sovereign wealth funds, family offices, and asset managers from Asia, Europe, the US, and the Gulf — representing some $3 trillion in assets — for an invite-only gathering with around 45 of the world’s most promising AI companies. QIA CEO Mohammed Al-Sowaidi opened the event stating that the Gulf is now a hub for AI, and Qatar’s prime minister also dropped by. The off-the-record meeting, which I briefly attended, got technical on code, cooling, and tokens. I can confirm that Elon Musk wasn’t there, but his presence was felt. During panel discussions, many of the guests discussed their exposure to SpaceX and the xAI merger, and were uniformly looking ahead to the company’s IPO. Musk’s plan to launch data centers into space — and build a “Kardashev II-level civilization” — sparked serious debate. Some saw merit in placing compute in colder, energy-abundant orbits, potentially ending the current energy race to power AI infrastructure on Earth. One message I heard repeatedly was how Gulf sovereign wealth funds are viewed differently by Silicon Valley than in previous years: The region is no longer seen as a passive pool of capital. Its funds have built in-house expertise, make quick decisions, and offer patient capital — giving them access to allocations in coveted startups that, until recently, would have come through external managers. |

|

Kuwait inches open oil sector |

An oil rig in California. Mike Blake/File Photo/Reuters. An oil rig in California. Mike Blake/File Photo/Reuters.Kuwait’s tightly controlled energy sector is opening up to international oil companies, as the country looks to raise output by a third within a decade. Prime Minister Sheikh Ahmad Al-Abdullah Al-Sabah said this week that the state-owned Kuwait Petroleum Corp. plans to invite foreign partners to help develop three recent offshore finds, part of efforts to ramp up output to 4 million barrels a day. The country is also weighing a potential $7 billion lease and lease-back deal for its crude oil pipeline network — following similar moves in Saudi Arabia and the UAE in recent years. However, this is not a full-scale liberalization of the sector: International partners are likely to be offered service-based contracts, rather than equity stakes, for upstream assets. This week, Kuwait signed a deal with France’s TotalEnergies to carry out exploration studies, and handed a five-year, $1.5 billion contract to US services company SLB. Other efforts to raise output could prove more controversial. Tenders for the Durra oil and gas field — which Kuwait shares with Saudi Arabia — are due to be offered this year, which could lead to regional tensions given Iran also lays claim to part of it. — Dominic Dudley |

|

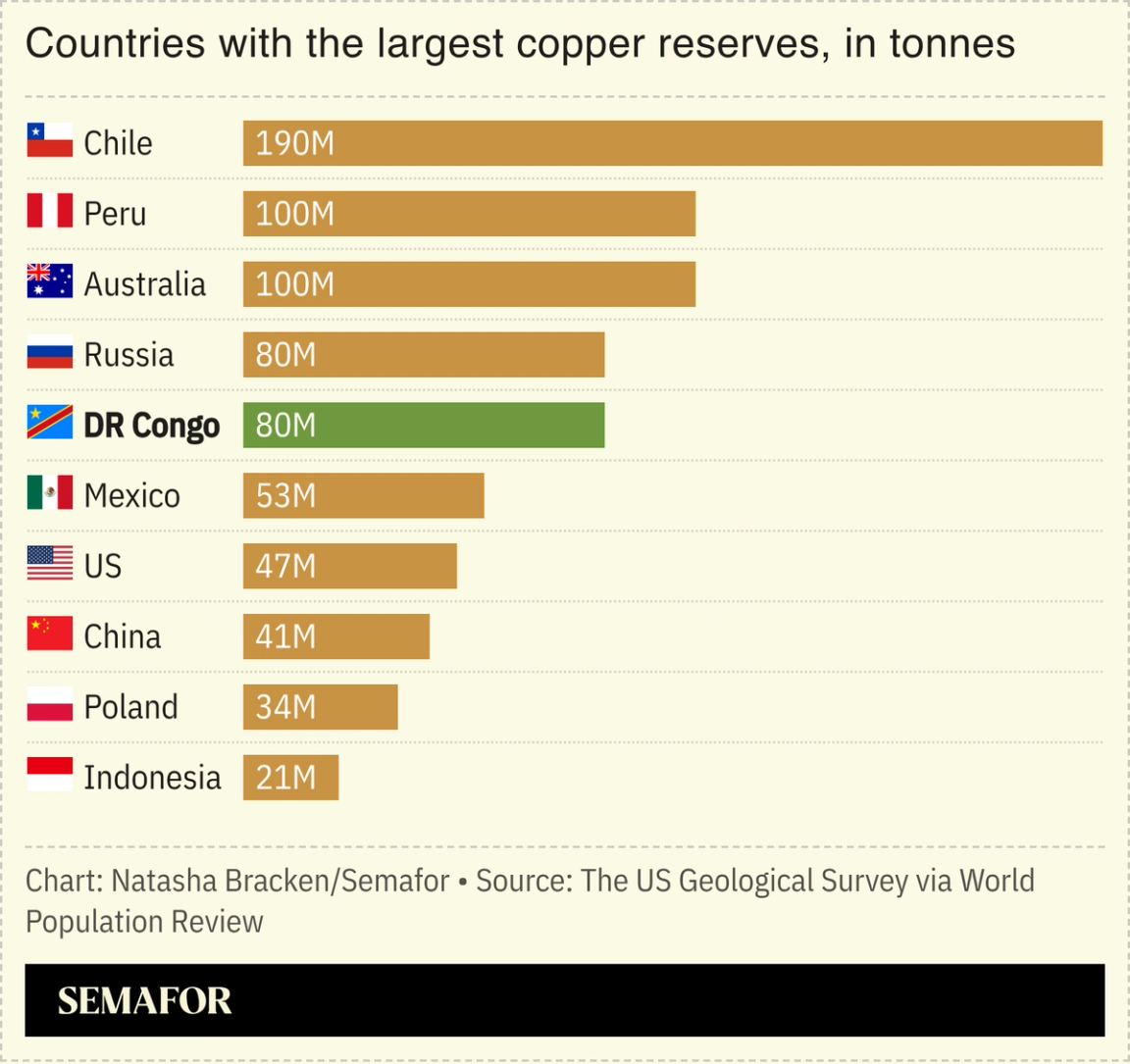

UAE targets critical minerals deals |

The UAE signed a series of agreements with the Democratic Republic of the Congo and a wide-ranging investment deal with the US, both designed to bolster its position in the global critical minerals supply chain. The US framework covers mining, processing, recycling, and downstream activities and will see Washington and Abu Dhabi identify and finance projects to close supply chain gaps. The deals with the DRC — the world’s biggest producer of cobalt and a major supplier of copper and other minerals essential for the energy transition — include one on investment cooperation in the mining sector and a comprehensive economic partnership agreement. Abu Dhabi’s AD Ports Group also agreed to develop and operate a multipurpose terminal at the DRC’s Matadi Port, adding to its presence in nearby Angola and the Republic of Congo. |

|

VC fund eyes Saudi defense deals |

MASNA Ventures co-founder Lucien Zeigler. Courtesy of MASNA Ventures. MASNA Ventures co-founder Lucien Zeigler. Courtesy of MASNA Ventures.A new venture capital fund aims to raise $100 million from US and Saudi investors to back defense technology companies setting up in the kingdom. MASNA Ventures plans to do about 10 deals, initially targeting drone and counter-drone systems, precision-guided munitions, and AI-enabled defense systems, co-founder Lucien Zeigler told Semafor. The fundraise aims to capitalize on increased defense cooperation between the two countries; Saudi Arabia was named by the US as a major non-NATO ally in November, when Crown Prince Mohammed bin Salman met President Donald Trump at the White House. Saudi Arabia is the world’s fifth-biggest military spender, with $64 billion earmarked for defense this year. Three-quarters of that is spent abroad, making it one of the biggest arms importers in the world. Prince Mohammed has set a goal of cutting imports to 50% of defense spending by 2030 in a push to localize manufacturing and create jobs. — Matthew Martin |

|

Saudi project cuts reach London |

A building by Bjarke Ingels Group in Amsterdam. IMAGO/viennaslide via Reuters. A building by Bjarke Ingels Group in Amsterdam. IMAGO/viennaslide via Reuters.Cutbacks at Saudi projects are having a ripple effect around the world. Employees at the London office of architect Bjarke Ingels Group held protests this week against planned redundancies, after the firm’s work on a Saudi project was cancelled. The company is reportedly planning to lay off about half its London workforce after its largest project — thought to be a resort on Saudi Arabia’s Red Sea coast — was cancelled in November. BIG, set up by Danish star architect Bjarke Ingels, has also been linked to other Saudi projects, including Neom and Qiddiya. Saudi Arabia’s Vision 2030 economic diversification plan had created a booming industry for architects and consultants around the world as they looked to cash in on projects that could have cost trillions of dollars. As the kingdom now reins in some of those ambitions, its would-be partners are being forced to scale back their own workforces. |

|

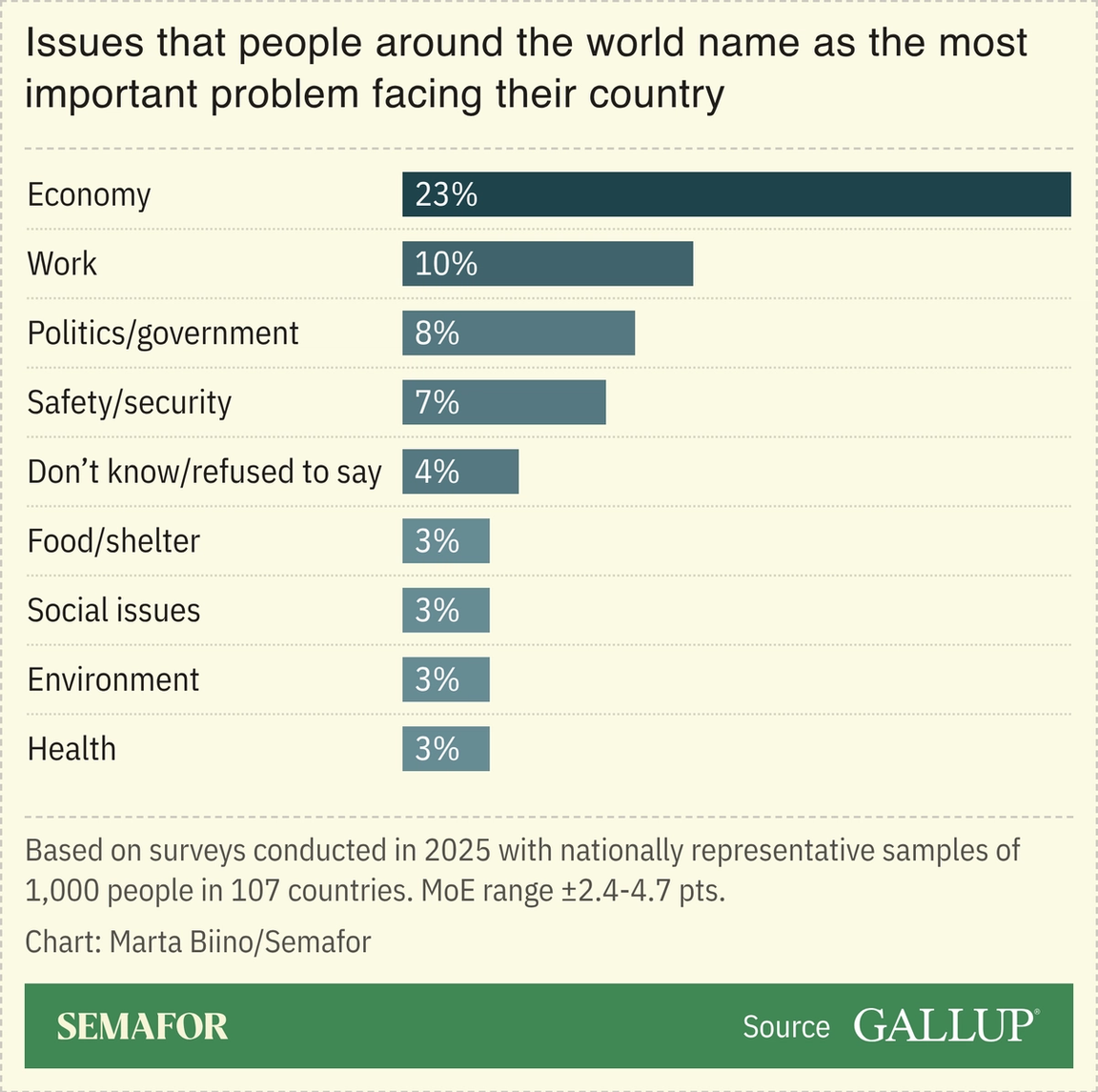

No worries in the Gulf? That’s according to a Gallup survey which asked people in 107 countries what they thought was the world’s most important problem. Some 32% of UAE residents reported “no problems” when asked to rank their top concerns — higher than any other country in the world — with carefree Kuwait and Bahrain ranked second and third. The Emirates largely shrugged off the economic uncertainty which topped concerns globally. Still, environmental issues loomed large for nearly a fifth of UAE respondents: 19% called the environment a top concern, second only to Denmark. Infrastructure, however, is a bigger concern in the UAE than in any other country in the region. One possible cause: Flooding in 2024 after a major rainstorm was a vivid reminder of just how vulnerable the Gulf is to increasingly dramatic weather events. — Kelsey Warner |

|

Finance- Nearly 2,000 new companies registered in Dubai’s financial hub last year, marking a record 28% increase. The Dubai International Financial Center expects similar growth this year as it advances plans to more than double its size by 2040.

FDI- India led in greenfield foreign direct investment into the UAE last year with $12.6 billion poured into the economy, while UK investors topped the project count. Ras Al Khaimah drew the most capital, fueled by a $10 billion industrial hub. — AGBI

Energy- Chevron, Qatar’s Power International Holding, and Syria’s state-run petroleum company have agreed to work on developing offshore oil and gas, the country’s first field in the Mediterranean. — AP

- Germany’s Chancellor Friedrich Merz travelled to the Gulf this week with hopes of diversifying the country’s energy imports away from an increasingly unreliable Washington. — Bloomberg

Gems- Prices for Bahrain’s natural pearls have risen by 40% in the past year, according to officials. It points to the potential revival of an industry that was a mainstay of the local economy in the pre-oil era, before being undermined by the emergence of lab-grown gems. — Zawya

|

|

- Gulf geopolitics are being shaped by the UAE’s “pre-emptive activism” and Saudi Arabia’s “de-escalatory developmentalism” and US and European policymakers with interests in the Gulf will have to adapt to this reality, according to H.A. Hellyer, senior associate fellow at the Royal United Services Institute in London.

- The new sovereign fund led by Sheikh Khaled bin Mohammed, Abu Dhabi’s crown prince, will likely become the “first point of contact for international investors” and give the 44-year-old an economic role to match his rising stature on domestic and national security issues, Bloomberg reported.

- As Western art markets stall, galleries are chasing new buyers in the Gulf… and landing in Doha. Art Basel Qatar opened this week with hopes the region’s wealth can offset a global sales slump and demonstrate the region’s growing soft power, Scott Reyburn writes in The New York Times.

|

|

|