|

Introduction

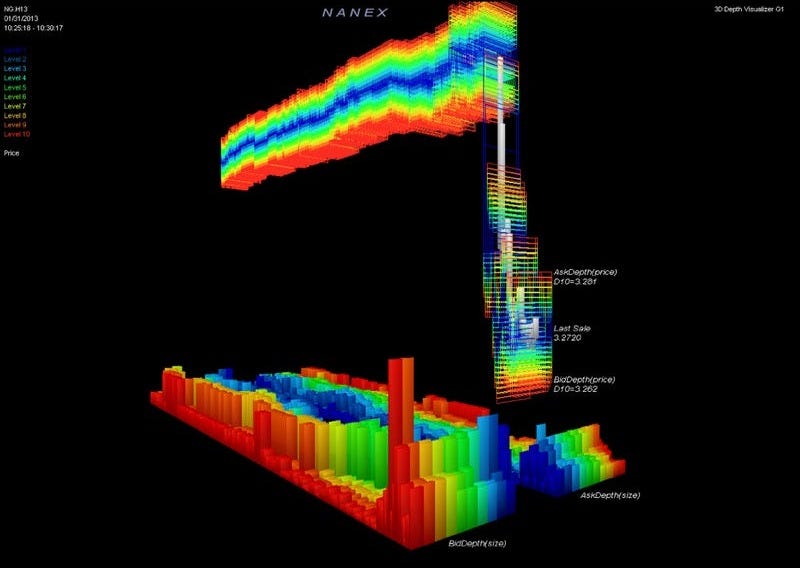

When it comes to HFT strategies, you often reach a point where latency cannot be ignored. Simply having great alphas and modelling is not enough — you also need to be competitive on the latency front. Most of this is concentrated on the cloud network engineering front, so in today's article, we catalogue many different latency tricks.

We will dive into >10 different latency optimisations in this article to help you improve your latency setup.

Latency touches all elements of HFT strategies. For arbitrage strategies you are often competing against a couple other participants on any given market and having even a mild latency edge is often enough to thrash the competition, ensuring you aren’t left picking up their crumbs. It’s not just arbitrage strategies that need low latency, market making (which most arbitrage strategies eventually lead to since making into opportunities is the optimal approach), needs low latency in order to ensure your quotes are up to date with the latest estimates of global fair value (which a large part is just data feeds of various exchanges and getting that fast). Even statistical strategies often have latency requirements when they’re run on the HFT timescales.

This is all to say that latency is extremely important in the HFT world, and by not learning how to optimize it — you are missing out on a valuable skill which can make the difference between thrashing your competition.

Index

Latency Tricks:

WS Rotate

FIX feed

Machine Gun Orders...

Subscribe to The Quant Stack to unlock the rest.

Become a paying subscriber of The Quant Stack to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive |