| | In this edition, how Trump’s two-track stimulus is revving an economy that’s just returned to neutra͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Antitrust chief loses MAGA fight

- Bessent’s off-ramp for Powell

- Job market cools

- Scrutiny of dual-class stock

- Venezuela oil plans stall

- Riyadh shuffles its money men

SBF’s audience of one … |

|

The economic punch bowl was barely back in its only-for-special-occasions cabinet. Heading into midterm elections that Democrats are favored to win, the White House is pulling it back out. President Donald Trump’s two-track stimulus is revving an economy that has only just returned to neutral after a painful inflationary run under Biden. Through the front door, we have the One Big Beautiful Bill, a fiscal firehose that is padding bank accounts and pushing tax refunds to record highs. Tips, overtime, Social Security, and interest payments on car loans — a pernicious product that has done just fine without government support — are now tax-free. Americans will likely get a cut of Trump’s tariff revenue one way or another. People tend to spend found money. So do companies, which can now immediately depreciate the cost of new equipment and factories, boosting demand for construction workers we’re already short on. Then there’s the backdoor stimulus. Trump has directed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, growing a federal government balance sheet that’s been shrinking steadily for nearly four years. “I don’t know why we don’t call it QE; it’s QE,” Jamie Dimon quipped last month in Davos, referring to the Fed’s easy-money policy known as quantitative easing. Add in a deregulatory sprint that White House economists say could boost annual economic growth by up to 0.8%, and Trump investment accounts that would put billions of extra dollars into financial assets, and the everything-go-up meter gets cranked to eight. “Later this year the conversation in markets will change from talking about Fed cuts to instead talking about the Fed having to hike,” Apollo’s chief economist, Torsten Slok, wrote this week. And the one corner of the economy that might benefit from the sugar high — a weakening labor market — is facing its own AI-related questions. Supercharged growth will have its academic scolds, but supercharged jobless growth will start mobs. With the Trump administration writing the 2026 economic story on the fly, today’s newsletter is, fittingly, more Washington-heavy than usual. We go where the story is. |

|

US top antitrust cop ousted |

Mattie Neretin/CNP/Sipa USA Mattie Neretin/CNP/Sipa USAThe Justice Department’s antitrust chief was pushed out after a series of lost battles against senior Trump officials pushing a lighter regulatory touch. “It is with great sadness and abiding hope that I leave my role,” Gail Slater announced on X Thursday morning. Semafor has reported on weeks of mounting tensions between Slater’s more populist bent and let’s-make-a-deal DOJ brass. Settlement talks with ticketing giant Live Nation were the latest flashpoint, and Slater was bigfooted last week by Attorney General Pam Bondi on a personnel decision. The administration’s most prominent anti-monopolist, Vice President JD Vance, Slater’s former boss, had stayed out of DOJ’s internal tensions, leaving Slater fighting a lonely battle she lost this week. Whatever happened (if you know, call us) happened fast: A senior official in Deputy Attorney General Todd Blanche’s office dismissed Semafor’s inquiry Wednesday about Slater’s potential departure as “fake news.” |

|

Bessent finds an off-ramp for Powell probe |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersIn a bit of political sleight of hand, Treasury Secretary Scott Bessent has hit on a way to end the Justice Department’s probe into Powell while allowing Trump to save face. In a closed-door meeting this week, Bessent proposed that the Senate Banking Committee investigate Powell — instead of the Justice Department — people in the room told Semafor’s Eleanor Mueller. “What the president wants is an investigation,” and hopefully, “the Banking Committee will satisfy that desire for an investigation,” one GOP member of Congress told Semafor. The added benefit would be persuading Senator Thom Tillis, R-N.C., to lift his blockade on Fed nominees. Of course, all this depends on whether Bessent can broker the deal and convince both the president and the retiring senator that everybody wins. |

|

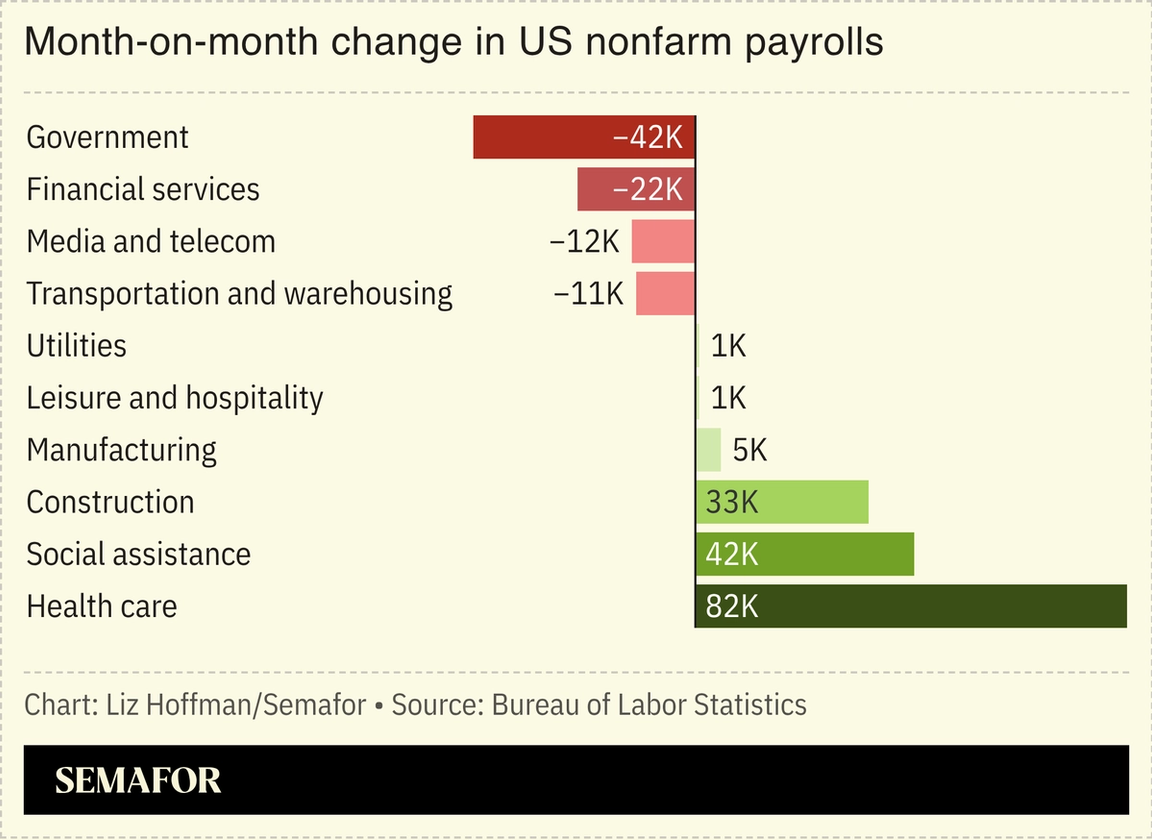

A split-screen jobs market |

White House economic officials touted the 130,000 jobs added in January as a sign that the administration’s policies are paying off. But revisions to 2025’s labor numbers showed the US added far fewer jobs than we thought, and January’s strong-but-uneven hiring narrows the gap between the data and the malaise everyday Americans have felt about the economy for months. It’s a vindication for Fed Chair Jerome Powell, who in December said that jobs numbers were likely overstated and that the “labor market has continued to cool gradually.” And that cooling is uneven: Health care and education, which tend to grow no matter how the economy is doing, added 137,000 jobs last month. The rest of the economy lost 7,000, and Trump priorities like manufacturing barely grew. |

|

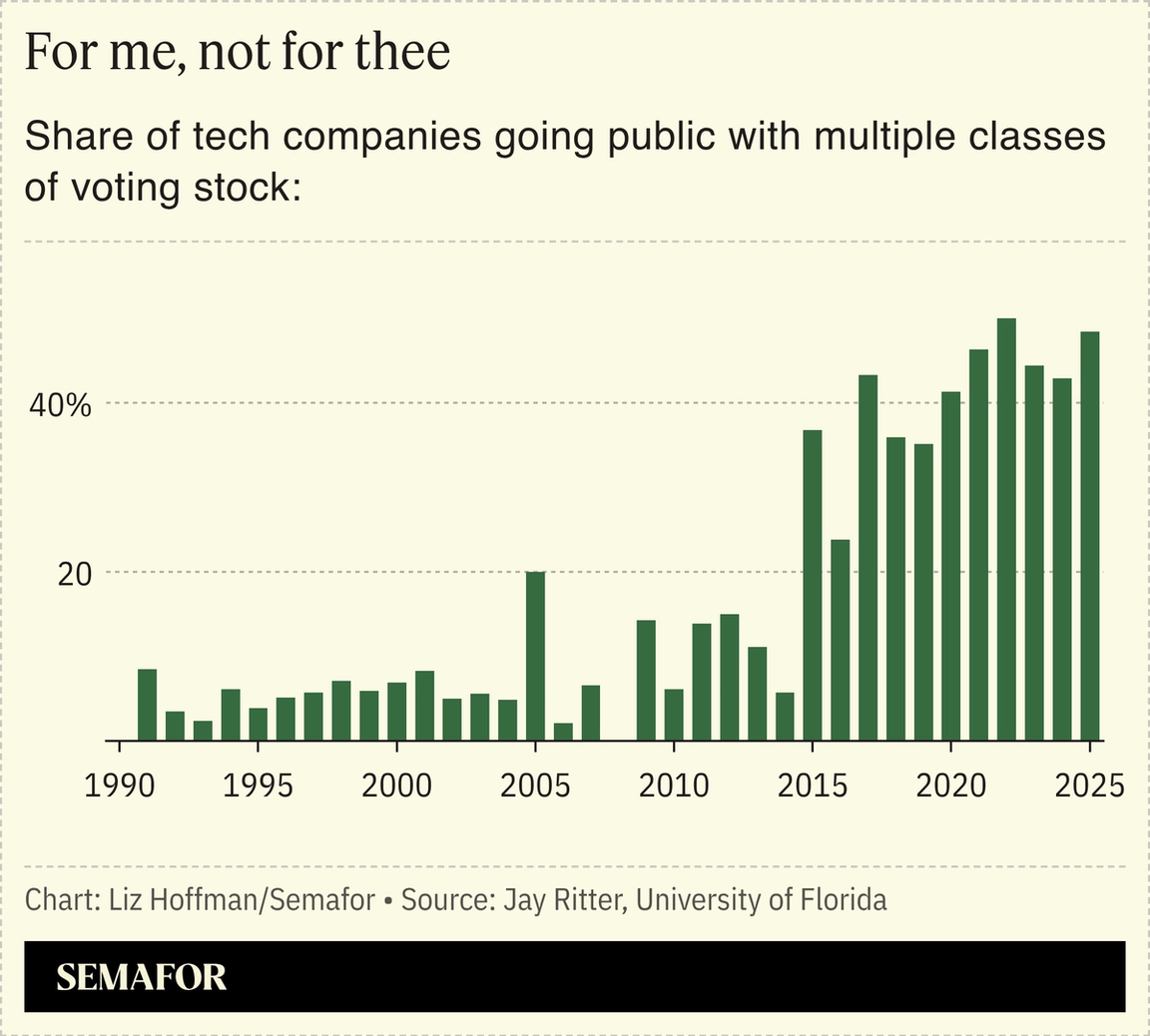

Senate takes aim at supervoting stock |

A bipartisan Senate bill is taking gentle aim at setups popular among tech companies that give insiders voting control, pouncing on the building mistrust over how AI is being wielded. The bill, introduced by Sens. Ruben Gallego, D-Ariz., and Mike Rounds, R-S.D., would require companies to give shareholders more information about separate classes of stock that carry extra votes in corporate elections. A record 41% of companies that went public last year carried such dual-class setups, according to data compiled by Jay Ritter, a professor at the University of Florida.  One obstacle to more regulation, Ritter said, is that dual-class stocks outperform their more democratic rivals. “If investors had gotten burned, they would demand a big discount” to hold shares with less voting power, he told Semafor. “But it’s worked out great for everyone.” |

|

Trump’s approach to Venezuela gets cloudier |

Leonardo Fernandez Viloria/Reuters Leonardo Fernandez Viloria/ReutersThe Trump administration’s attempt to use its arrest of Nicolás Maduro to jumpstart oil sales and revitalize Venezuela’s economy appears to be sputtering. A month after the first US-brokered sale of Venezuelan oil, there are no signs of a second, Semafor’s Eleanor Mueller and Shelby Talcott report. Nor have Western oil companies lined up to invest the tens of billions of dollars needed to upgrade the country’s drilling and refining infrastructure. Outside auditors haven’t been appointed to oversee how the Venezuelan regime is using oil proceeds, a sticking point for some Republicans in Washington. US Energy Secretary Chris Wright is in Caracas this week to assess progress, but businesses and investors eager to work on the effort remain in a holding pattern. “I keep hearing unofficially that we just need to be patient,” Winston & Strawn’s Cari Stinebower, a former Office of Foreign Assets Control counsel who advises clients on the licensing process, told Semafor. |

|

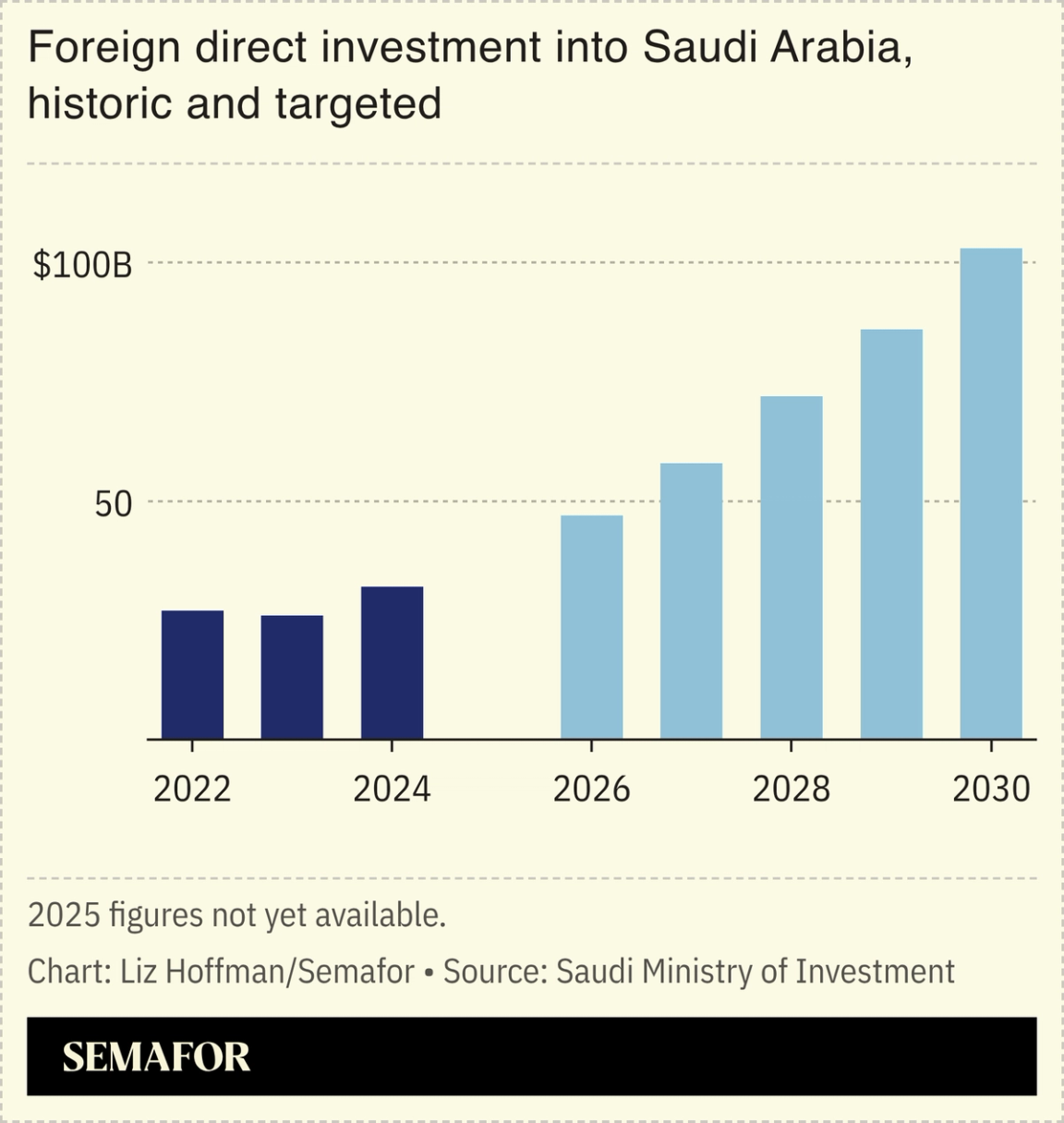

Saudi shuffles its money men as cash needs grow |

Saudi Arabia on Thursday replaced its investment minister as the kingdom scraps investment projects and steps up efforts to lure foreign cash. Khalid Al-Falih, one of the government’s longest-serving and internationally known officials, had questioned the feasibility of Saudi Arabia’s most futuristic projects. He’ll retain ministerial rank, making it unclear if he’s being pushed aside or given other responsibilities. His replacement is Fahad Al-Saif, a veteran banker who built Saudi Arabia’s borrowing capabilities and sold global investors on the kingdom’s bonds. His next task may prove harder: Hawking highly rated Saudi debt, which is poised to join widely tracked bond indexes, is easier than attracting the kind of long-term foreign investment the kingdom needs to build its economy. Getting there will require more work on making Saudi Arabia a country where people want to invest, rather than one where they feel they have to. — Matthew Martin |

|

Semafor is proud to announce its first slate of speakers for the 2026 Annual Convening of Semafor World Economy, taking place April 13-17 in Washington, DC. This global cohort of senior leaders from every major sector across the G20 are just some of the 400 top CEOs joining Semafor World Economy for five days of onstage conversations and in-depth interviews on growth, geopolitics, and technology. See the first lineup of speakers here. |

|

➚ BUY: Warmth of collectivism. Wall Street’s bumper-year bonuses are helping to shrink New York City’s budget gap, giving Mayor Zohran Mamdani more room to work. ➘ SELL: Rugged individualism. American outdoors giant Eddie Bauer filed for bankruptcy for the third time (that’s a “Chapter 33” for our restructuring nerds) in just over two decades. |

|

|