| | In today’s edition: Saudi reshuffles its government, and a construction slump continues to bite in t͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Washington, DC Washington, DC |   San Francisco San Francisco |

| Gulf |  |

| |

|

- Saudi government shakeup

- Gulf construction slump

- DP World boss ousted

- Laying cables for AI boom

- Preparing for the AI crash

- Arabian leopards in DC

Saudi’s foreign policy, domestic economy, and palace intrigue in weekend reads. |

|

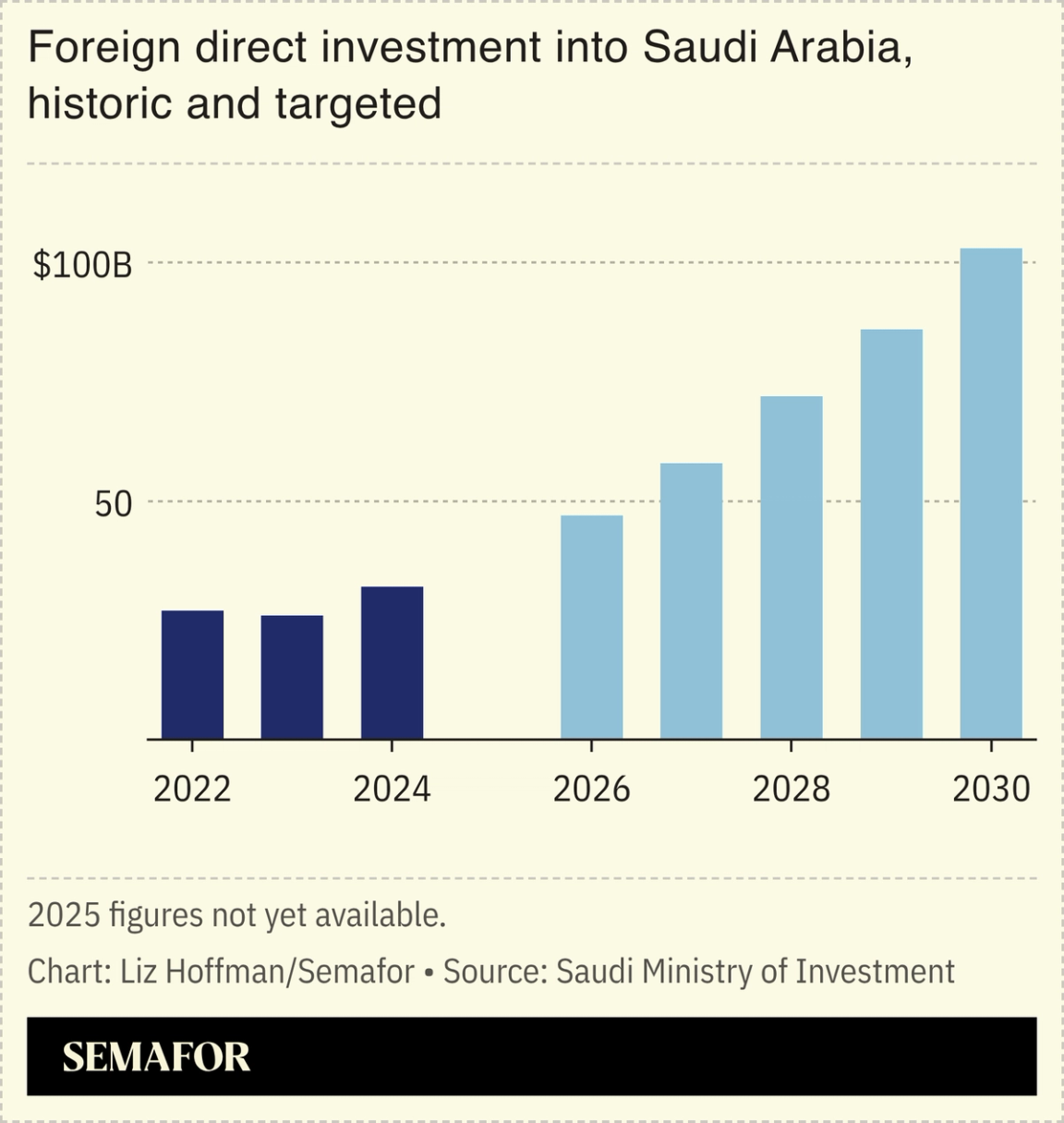

Riyadh shuffles its money men |

Fahad Al-Saif. Courtesy of Future Investment Initiative. Fahad Al-Saif. Courtesy of Future Investment Initiative.Saudi Arabia on Thursday replaced its investment minister as the kingdom scraps or scales back gigaprojects and steps up efforts to lure foreign cash. Khalid Al-Falih, one of the government’s longest-serving and internationally best-known officials, had questioned the feasibility of Saudi Arabia’s most futuristic projects. He’ll retain ministerial rank, making it unclear if he’s being pushed aside or given other responsibilities. His replacement is Fahad Al-Saif, a veteran banker who built Saudi Arabia’s borrowing capabilities and sold global investors on the kingdom’s bonds. His next task may prove harder: Hawking highly rated Saudi debt is easier than attracting the kind of long-term foreign investment the kingdom needs. Getting there will require more work on making Saudi Arabia a country where people want to invest, rather than one where they feel they have to.  Overall, more than 40 senior posts were reshuffled in the biggest government overhaul since 2022, according to AGBI. Notably, one of the crown prince’s brothers, Prince Rakan bin Salman, was appointed governor of Diriyah, where Public Investment Fund is backing a $63 billion development around the UNESCO heritage site that was the ancestral home of the Saudi ruling family. — Matthew Martin |

|

Gulf construction slowdown hits US contractor |

The decline in revenue from the Middle East unit of US infrastructure consultant Aecom over the past year, in the latest sign of how cuts to Saudi gigaproject spending are hitting the construction industry. In November, Aecom secured a design-services contract for the Mukaab, a giant cuboid skyscraper in Riyadh. That project was shelved in January, as part of a wider government review of spending commitments. Architects’ Journal said Aecom had also been working at Neom in the northwest of the kingdom, where projects such as The Line and the Trojena ski resort have been scaled back or face delays. Aecom is far from the only company affected by the slump in Saudi project spending. London-based staff of architecture firm Bjarke Ingels Group recently held a protest over redundancies linked to the cancellation of Saudi projects. — Dominic Dudley |

|

Dubai replaces DP World leadership |

Former DP World Chairman Sultan Ahmed bin Sulayem. Henry Nicholls/File Photo/Reuters. Former DP World Chairman Sultan Ahmed bin Sulayem. Henry Nicholls/File Photo/Reuters.Dubai moved to end the negative publicity swirling around one of its most prominent companies by appointing a new leadership team to ports group DP World. Essa Kazim was today named as the group’s new chairman and Yuvraj Narayan as its CEO, replacing Sultan Ahmed bin Sulayem who had held both roles and who had come under pressure over his links to Jeffrey Epstein. In recent days both Canada’s second-largest pension fund La Caisse and UK development finance agency British International Investment said they would not make any new investments with DP World until action was taken. The new leadership at DP World is drawn from the emirate’s business elite but also provides institutional continuity. Kazim is chairman of Borse Dubai and governor of the Dubai International Financial Centre, while Narayan has been chief financial officer of DP World since 2005. — Dominic Dudley |

|

Gulf expands data connectivity |

“Submarine Cable Map,” via TeleGeography, licensed under CC BY-SA 4.0. “Submarine Cable Map,” via TeleGeography, licensed under CC BY-SA 4.0.The world’s largest subsea cable system has come ashore in the UAE. The 45,000-kilometer 2Africa cable, which links 33 countries across Africa, Asia, Europe, and the Middle East, has been connected to UAE telecom giant e&’s SmartHub data center. Its rival in the UAE, Du, is also working on landing the Singapore-India-Gulf submarine cable in the country. The moves reinforce the Gulf’s role as a central node in global data networks, not just a transit route. The region’s advantage lies in its dense connectivity as cloud and AI demand grows, Enterprise News reported. More regional links are underway. The 1,400-km Al Khaleej subsea cable, a branch of a system connecting Southeast Asia to Europe, will link the UAE with Bahrain, Oman, and Qatar to strengthen regional capacity. — Manal Albarakati |

|

View: The Gulf isn’t ready for the AI bust |

Stephen Nellis/Reuters Stephen Nellis/ReutersGulf countries’ massive AI bets may pay off in boom times but they will face challenges if the investments aren’t accompanied by a deeper tech ecosystem, Judah Taub, founder of the Tel Aviv-based venture capital firm Hetz Ventures, writes in his debut Semafor column. “An AI correction is inevitable. And when it comes — whether as a crash or simply a painful repricing — the countries that treated AI as a trophy will get crushed,” Taub wrote. “The ones that built real infrastructure, attracted real talent, and focused on unsexy fundamentals will survive.” |

|

Saudi brings Arabian leopards to DC |

Courtesy of the Smithsonian National Zoo Courtesy of the Smithsonian National ZooSaudi Arabia is extending its wildlife conservation push from the desert all the way to DC. On International Day of the Arabian Leopard this week, the Royal Commission for AlUla and the Smithsonian’s National Zoo confirmed the next phase of a long-term program to save the critically endangered big cat; fewer than 120 Arabian leopards are believed to remain in the wild. Backed by $51.6 million from the Saudi commission, a new Arabian leopard habitat is being built in Washington, DC, which should open in 2029. A breeding pair will be housed under a 15-year agreement, with any cubs eventually transferred to Saudi Arabia to support rewilding efforts. The initiative sits within a wider reintroduction drive at home. Saudi conservation efforts have already brought back Arabian oryx and Persian onagers, and the Prince Mohammed bin Salman Royal Reserve is studying the return of Asiatic lions more than a century after they disappeared from the region. — Manal Albarakati |

|

Checking In- Dubai International Airport is upgrading more than 100 hand-luggage screening machines this year, so that passengers will no longer need to take off their shoes, unpack their laptops, or limit themselves to 100 milliliters of liquids when passing through security. — The National

- Singapore Airlines is returning to Riyadh, 12 years after the Asian carrier halted flights to the Saudi capital. Flights will resume in June, with four services a week. Singapore Airlines also has a codeshare agreement in place with the recently launched Riyadh Air. — Aviation Week

Crypto- International Holding Co. (IHC), Sirius International Holding, and First Abu Dhabi Bank won approval from the UAE central bank to launch DDSC, a dirham-backed stablecoin that will run on an Abu Dhabi-developed blockchain. Units of the $240 billion conglomerate IHC, chaired by Sheikh Tahnoon bin Zayed, plan to embed the token across their operations, potentially reaching millions of users outside traditional financial systems.

Tech- Abu Dhabi’s AI investment platform MGX co-led Anthropic’s latest $30 billion funding round, valuing the maker of the Claude AI model at $380 billion post-money. Qatar Investment Authority also participated, adding to its stake after investing in September when the company was valued at $183 billion.

- Qatar Investment Authority joined a $520 million fundraising round for Apptronik, a humanoid robotics startup that has now raised about $1 billion. The Austin-based company plans to debut its Apollo robot this year, targeting logistics and manufacturing before expanding into retail and health care.

|

|

- Saudi Arabia’s “zero-conflict” policy, adopted after an Iranian-linked strike on the kingdom’s oil facility in 2019, is unlikely to hold as regional alliances shift and a new axis emerges, according to Sultan Alamer, senior fellow at Washington-based New Lines Institute, who traces five decades of developments up to the current rift with the UAE.

- The opening of Mecca real estate to foreign investors has pushed the cost of land near the Grand Mosque to among the highest globally, at $87,000 per square meter. There are plenty of buyers, and the city is expected to bring in billions of dollars that Saudi Arabia needs to diversify its economy, writes Bloomberg’s Zainab Fattah.

- Saudi Arabia’s crown prince remains “full of confidence that he can transform his country into a top 10 global economy by 2050.” Despite domestic and foreign policy challenges, Mohammed bin Salman’s eventual ascension is expected to be uneventful. What “occupies Saudis now is who will be the next crown prince,” Karen Elliott House — author of The Man Who Would Be King — writes for The Wall Street Journal after a two-week visit to Riyadh.

|

|

|