| | In today’s edition: Riyadh is still prepared to invest heavily in gaming deals, while Dubai’s proper͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Saudi’s vocal regional role

- PIF eyes ByteDance unit

- Riyadh sells AI compute

- Dubai real estate peak?

- The Saudi plan for Syria

The UAE launches its first rocket with a hybrid propulsion system. |

|

US Secretary of State Marco Rubio received a standing ovation at the Munich Security Conference after repackaging Vice President JD Vance’s scolding of Europe last year in a more polite tone. Rubio invoked a shared Western civilization rooted in Europe and Christianity, to the relief of many. But the substance was unchanged: If there ever was a values-based alliance, that is gone. What is left are intersecting interests. Europe — already carrying more of the burden in Ukraine and increasing NATO spending — now faces a future that requires rearmament and closer continental coordination. For the Gulf, it’s a familiar position. Its countries already live without dependable, treaty-level security guarantees, and have long been forced to hedge. Gulf leaders prioritize US military and diplomatic backing, but they have also watched as Washington has hesitated in the face of attacks on its allies in the region. With the risk of renewed confrontation with Iran, the dangers are clear. Israel may be relatively fortified, but Gulf energy infrastructure and cities are exposed to Iranian missiles and drones.  Europe was caught off guard by Russia’s invasion of Ukraine, but Gulf states have been building up their militaries for decades. Qatar, Saudi Arabia, and the UAE are among the world’s top defense spenders and have developed ties with Egypt, India, Pakistan, and Türkiye for additional support. What they lack is unity. The European Union is more cohesive than the looser Gulf Cooperation Council, a forum which is becoming less relevant as its two biggest members, Saudi Arabia and the UAE, feud. The Gulf rift was a sidenote in Munich, seen by many attendees as a distraction that doesn’t alter the common security interests in the region. (US Senator Lindsey Graham offered a theatrical “knock it off Saudi Arabia” and urged unity against Iran.) The US is ushering in a new, interest-based order that aligns with the Gulf’s approach, but it doesn’t mitigate the risks. Self-reliance and regional action are ever more crucial when allies only help if and when it suits them. |

|

Saudi sets its regional agenda |

Barth/Munich Security Conference Barth/Munich Security Conference“The system isn’t working — it hasn’t delivered,” Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan said at the Munich Security Conference, referring to the global order. His conclusion was shared by many in the Bavarian capital this weekend, but he also expressed optimism that diplomacy is being stripped of ideals and becoming “more honest and transparent.” For Saudi Arabia, this is both a threat and an opportunity. The potential weakening of US support poses risks, but a vacuum also allows the kingdom to play a larger role in shaping a regional order that advances its interests. In Munich, the Saudi minister was ubiquitous — on stage and in private meetings — as discussions centered on Gaza, Iran, and Sudan, all core to Riyadh’s security priorities. He met the US special envoy on antisemitism to defuse accusations that the kingdom was fomenting antisemitic speech in its feud with the UAE. Stabilization and reconstruction in Syria were also on the minister’s agenda. The kingdom is one of the country’s biggest financial and diplomatic backers, and there is goodwill in Europe and the US toward the former Islamist militants who now lead Syria, which Saudi Arabia hopes to build on. — Mohammed Sergie |

|

Saudi appetite for gaming deals undiminished |

Courtesy of Moonton Courtesy of MoontonSaudi Arabia’s Savvy Games Group is in talks to buy the studio behind videogame Mobile Legends: Bang Bang for around $6 billion — a sign that some Saudi entities still have the capacity to do big deals even as a funding crunch ripples through the kingdom. Savvy, a Public Investment Fund subsidiary which aims to make the kingdom a gaming and esports hub, could seal an agreement to buy Shanghai Moonton Technology from ByteDance by the end of March, according to Reuters. Other PIF companies have had to slow investments or put spending plans on hold, but gaming has remained a key area of focus; Crown Prince Mohammed bin Salman is said to be an avid gamer. Last year, PIF was the main backer of a $55 billion takeover of Electronic Arts. Savvy was allocated $38 billion at its launch in 2021 and it has used some of that to buy firms including Monopoly Go developer Scopely and Pokémon Go developer Niantic. — Matthew Martin |

|

US firm shifts AI to Saudi |

Amit Jain, CEO of Luma AI. Steve Marcus/Reuters. Amit Jain, CEO of Luma AI. Steve Marcus/Reuters.Winning approval to buy “monstrous” numbers of advanced US artificial intelligence chips has made Saudi Arabia an attractive place for compute activities, video AI startup Luma AI’s chief executive told Semafor. The company — which secured backing from Saudi Arabia’s HUMAIN in a $900 million funding round last year — will begin using Saudi compute capacity within weeks as it looks to use the kingdom as a global center for AI inference, CEO Amit Jain said. Luma AI is opening a regional headquarters in Riyadh and will work with HUMAIN on building an Arabic language AI model. HUMAIN, an arm of the Saudi government’s Public Investment Fund, won approval to import 35,000 Nvidia chips last year, although that’s just a fraction of the 400,000 the company says it will need by 2030. “The pipes are clear” for the kingdom’s access to AI chips, Jain said. The next stage is ensuring there are users for the data centers the kingdom is spending billions of dollars building. — Matthew Martin |

|

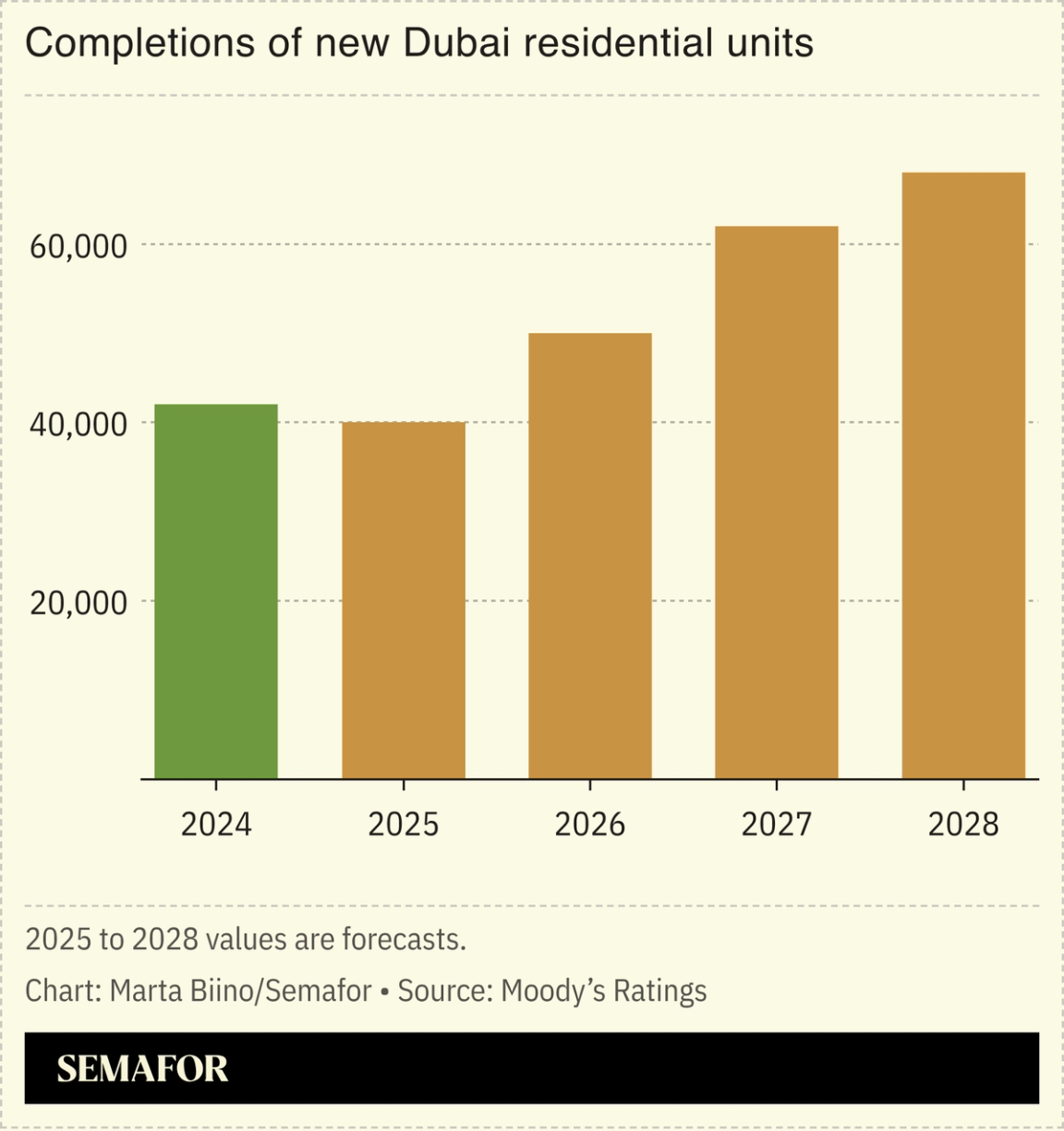

Dubai property nears a peak |

The UAE property market may be heading towards a peak. Moody’s Ratings expects there could be a slowdown over the next year or so, with a “mild softening of prices” as more villas and apartments come to the market — 180,000 units will be completed in Dubai alone from 2026-28. The market seems relatively well placed to handle a downturn. Moody’s says larger developers have solid balance sheets and local banks have reduced their exposure to the sector in recent years. Even so, the analysis adds to other, similar warnings: Last year, UBS Group said the Dubai market looked “increasingly overheated.” The ultra-high-end segment looks brighter than most though. These days Dubai is a global leader for properties worth more than $10 million and a luxury developer told Bloomberg that over the past two years prices have increased. |

|

View: Saudi’s delicate long game in Syria |

Saudi Press Agency via Reuters Saudi Press Agency via ReutersSaudi Arabia has core national security interests at stake when it comes to propping up the new Syrian government, but — as with other countries and international organizations — the kingdom is proceeding cautiously, Alaa Shahine Salha, a senior executive at Saudi Research & Media Group and an economics contributor for Asharq Business with Bloomberg, writes in his debut Semafor column. “Riyadh is putting more emphasis on rebuilding state institutions and insists that large-scale financing must be done under the watchful eye of the IMF and the World Bank,” Salha wrote. “While that by no means guarantees success, it may give Syrians a better fighting chance.” |

|

On Tuesday, March 24, Semafor will convene with leaders in Nairobi to advance financial inclusion at the intersection of long-term capital, policy, and financial infrastructure. Bringing together investors, policymakers, and financial system leaders, the conversation will move beyond ecosystem-building toward action — mobilizing capital, strengthening infrastructure, and closing persistent access and affordability gaps. Join us as we dive into how coordinated public-private efforts can accelerate inclusive growth across East Africa and other emerging markets. March 24 | Nairobi | Request Invitation |

|

Crime- Cyber criminals defrauded residents in Dubai Marina and Palm Jumeirah by jamming mobile signals and setting up a parallel network to trick victims into accessing their bank accounts. — The National

Energy- ADNOC’s investment arm is backing a project to export LNG from Argentina’s Vaca Muerta shale basin, one of the world’s largest untapped sources of gas. XRG signed a development agreement with Italy’s Eni and Argentina’s YPF.

Logistics- Abu Dhabi is developing a new cargo terminal at a critical trade hub in Central Africa. AD Ports Group joined Africa Ports Development’s 30-year concession to build and operate two berths at the Port of Douala in Cameroon to handle building materials, fertilizer, and grain.

Trump- US President Donald Trump is expected to attend a dinner at the Miami leg of Saudi Arabia’s flagship investment conference. The president has fostered close ties with the kingdom while in office. — Reuters

|

|

|