|

|

Every week, Popular Information shines a light on stories powerful people would rather keep in the shadows. We conduct investigations, uncover new facts, and impact the national political debate. Consider four examples from the first few weeks of 2026:

On January 5, Popular Information revealed how the military ouster of Venezuelan President Nicolás Maduro created a financial windfall for a prominent Trump-supporting billionaire, investor Paul Singer.

On January 20, Popular Information broke the news that ICE had stopped paying for all medical treatment for detainees and would not resume such payments for months.

On February 9, Popular Information uncovered how the Trump administration was rigging immigration courts against Somali migrants, assigning their cases to one Trump-appointed judge who rejects nearly all asylum claims.

On February 17, Popular Information exposed how major corporations — including General Motors, State Farm, JPMorgan Chase, Delta, and Microsoft — were bankrolling a political ad that featured a white supremacist slogan.

Popular Information has over 535,000 readers, but only a small percentage support our work as paid subscribers. We could put up a paywall to encourage more people to pay, but we believe access to crucial information should not be limited by income.

Original reporting is time-consuming and expensive. If you value this work and can afford $6 per month or $50 per year, please consider helping Popular Information fight for the truth by becoming a paid subscriber.

Trump Media and Technology Group (TMTG), the parent company of Truth Social, has an unrivaled free source of publicity. President Trump, who is also TMTG’s largest shareholder, posts extensively on the Truth Social platform, sometimes dozens of times in a single day. He is essentially leveraging the full weight of the presidency, the world’s most powerful office, to drive awareness of TMTG’s offerings.

Yet, by all objective metrics, TMTG is failing.

The stock price, which trades under the ticker symbol DJT, peaked at nearly $62 in March 2024, shortly after the company went public through a merger with a special purpose acquisition company (SPAC). On February 17, DJT stock closed below $10 per share, an all-time low. (It rallied modestly on Wednesday, closing at $10.48.)

What happened?

First, the fundamentals of the business are poor. In the three months ending September 2025, the most recent quarterly data available, TMTG reported $972,000 in revenue and a net loss of $58.4 million. The business is burning money at an alarming rate and has done so since its inception. It has never brought in more than $4 million per year while losing hundreds of millions of dollars.

TMTG’s core business, Truth Social, has remained tiny despite Trump’s frequent promotion. SimilarWeb estimated Truth Social had around 359,000 daily active users in 2025. Its top competitors, X and Threads, each have more than 100 million daily active users.

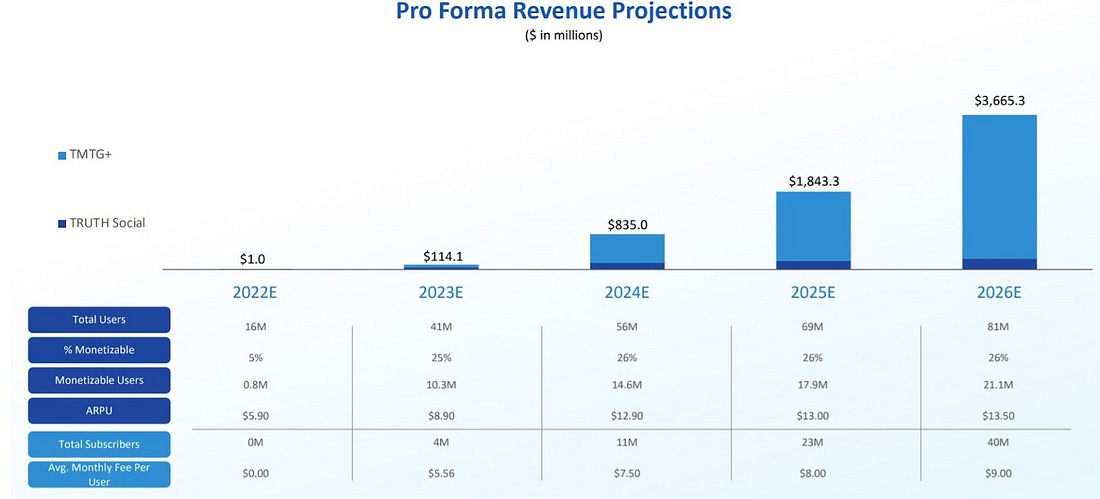

In its 2021 pitch deck to investors, TMTG projected it would have $1.8 billion in revenue in 2025 and 69 million users on Truth Social. It also estimated that it would have 23 million paid users of its TMTG+ video streaming service.

TMTG has launched a video streaming service, Truth+, but most content is available for free. The company has not disclosed how many people have subscribed to its $9.99 premium service. The same pitch deck projected 2026 revenue would double to $3.67 billion

With its core business stagnant, TMTG has sought to diversify its business to prop up its stock price. Its biggest swing came in May 2025 when TMTG announced it was raising $2.5 billion to buy Bitcoin and Bitcoin related securities. The goal was to transform TMTG into a bitcoin treasury company, tying DJT stock to the price of bitcoin, rather than the performance of Truth Social and other business activities.

TMTG executed this strategy by issuing 55.8 million new DJT shares, which diluted the value of existing stock, and issuing $1 billion in zero interest convertible notes.

This turned out to be a massive mistake. By December 2025, TMTG had purchased 11,542 Bitcoin at an average price of $108,000. The price of Bitcoin has since collapsed to about $67,000, generating an unrealized loss of about $472 million.

Beyond buying Bitcoin, TMTG has expanded into a number of other industries with little or no connection to social media.

“America First” investment products

In January 2025, TMTG announced the launch of Truth.Fi, through which it would offer various financial services. Through Truth.Fi, TMTG has created exchange traded funds (ETFs) with themes that match Trump’s political agenda — “Made in America,” “America First,” and “Bitcoin Plus.” It has also offered separately managed accounts (SMAs), a more bespoke investment vehicle for high-net worth individuals. These were pitched by TMTG and its partners as not just as an investment vehicle but as “a declaration of support for businesses essential to our economy, national security, and enduring freedoms” and an endorsement of “America First principles.”

Whether T