| | A new poll shows Donald Trump supporters overwhelmingly support greater use of solar power.͏ ͏ ͏ ͏ ͏ ͏ |

| |   Tehran Tehran |   Michigan Michigan |   New Delhi New Delhi |

| Energy |  |

| |

|

- Endangerment lawsuits begin

- Trump voters like solar

- EV bust hits clean investment

- Solar consolidation

- Batteries cheaper than ever

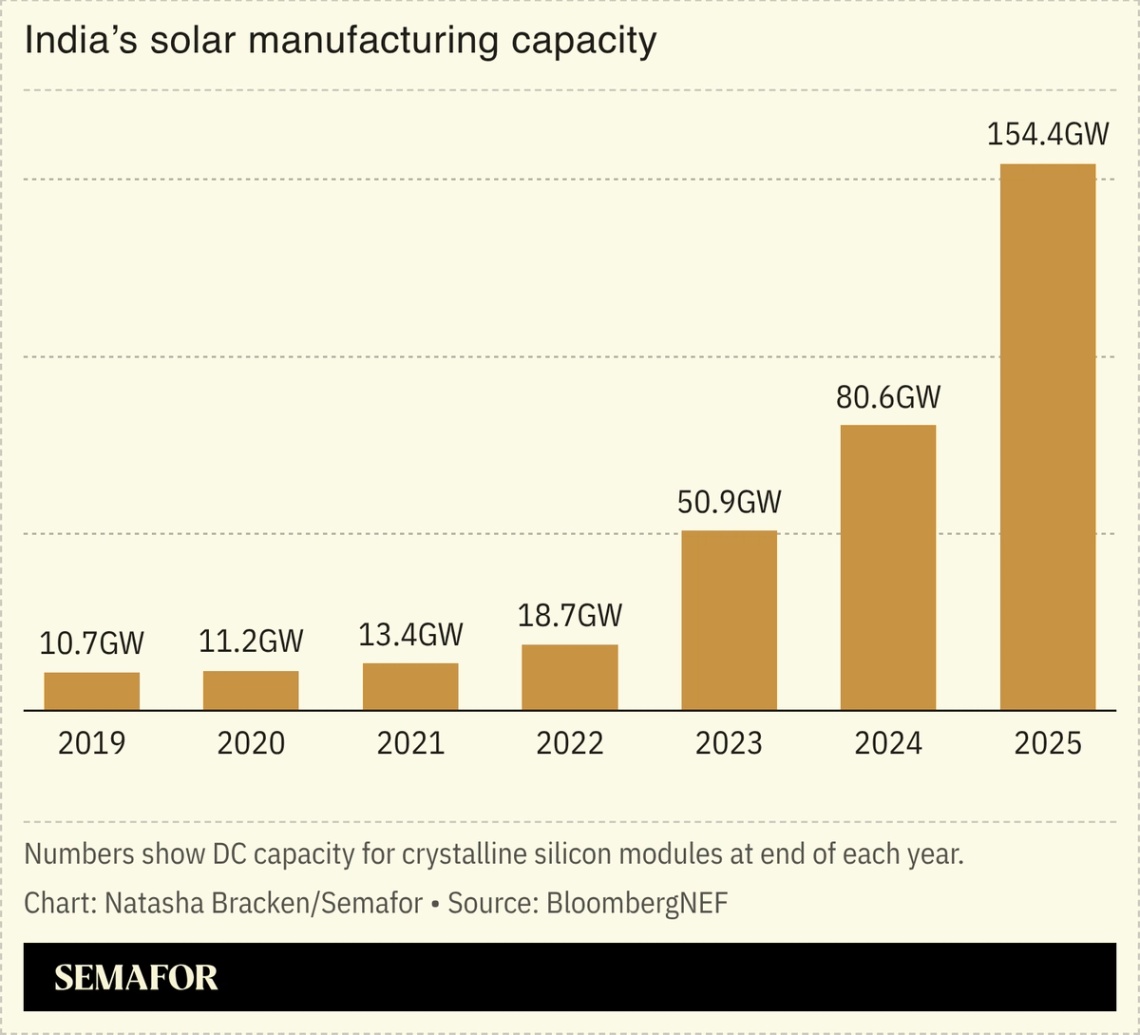

China is still buying a lot of LNG, and India is still cranking out a lot of solar panels. |

|

US President Donald Trump’s brinksmanship with Iran will test how much pressure the global oil market can withstand before American consumers start to pay the price. Oil prices jumped to their highest point in nearly a month on Wednesday, after the White House press secretary warned Tehran would be “very wise” to make a deal on its nuclear program and the Iranian military conducted live-fire drills in the Strait of Hormuz, through which nearly 20% of the world’s oil passes. It’s become a working assumption in the Trump administration that military activity or geopolitical tensions in oil-producing regions no longer carry much risk of market blowback; US Energy Secretary Chris Wright said as much to Bloomberg’s Javier Blas this week. There’s plenty of evidence from the past year to support that theory, from the ouster of Nicolás Maduro in Venezuela, to attacks on Russian shadow fleet vessels by Ukrainian special forces, to the brief Israel-Iran conflict last summer, all of which produced a collective shrug from oil traders. Some analysts took to calling this the “Houthi paradox” after Yemeni militias attacked tankers in the Red Sea. The idea is that mild global oil demand plus record-high US production have created conditions in which each successive disruption — events which in past years would have reliably jolted prices up — only reinforces leaders’ conviction that oil price volatility is no longer a side effect they need to worry about. That rule is hardly written in stone, however, and could be overturned. Iran’s leaders have repeatedly threatened to intervene more forcefully to choke off oil supplies; regime change there could have a similar outcome, if the resulting internal turmoil disrupts production. It’s also not clear how long drillers in the US shale patch will be willing or able to keep pumping as much as they are with prices that are still close to their lowest since the pandemic. To the extent that energy affordability is a critical issue for Trump ahead of this year’s midterm elections, the administration seems to be betting the Houthi paradox will hold up. The next few weeks will show if that confidence is well-founded. |

|

Endangerment lawsuits begin |

Jim Urquhart/File Photo/Reuters Jim Urquhart/File Photo/ReutersThe wave of legal opposition to the Trump administration’s latest climate regulation rollback is gaining momentum. A coalition of more than a dozen environmental and public health groups filed suit against the Environmental Protection Agency on Wednesday to challenge its scrapping last week of the “endangerment finding” that undergirds most US climate regulation. The EPA’s move “will have disastrous consequences for the American people, our health, and our shared future,” and seeks to rehash arguments that have already been settled in prior Supreme Court decisions, Joanne Spalding, director of the Sierra Club’s Environmental Law Program, said in a statement. The attorneys general of California and Connecticut, meanwhile, said they are preparing their own “plan of attack” against the EPA. In the meantime, numerous Democrat-led states are accelerating plans to replace EPA regulations with their own new restrictions on emissions from vehicles and power plants. But the administration isn’t done with its rollback; on Friday, EPA officials are expected to announce plans to scrap restrictions on emissions of mercury and other toxic air pollutants from coal-fired power plants. |

|

| |  | Tim McDonnell |

| |

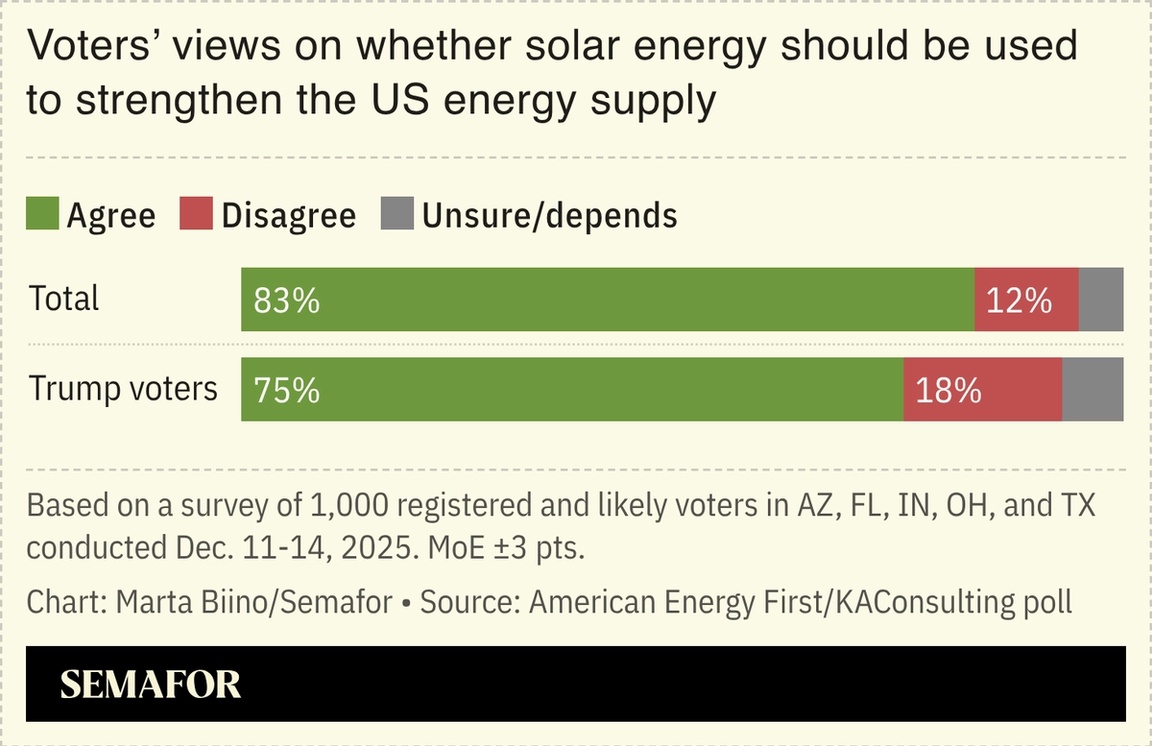

US voters who supported President Donald Trump in the last election overwhelmingly support greater use of solar power, according to a poll by former Trump adviser Kellyanne Conway first shared with Semafor. The survey covered 1,000 voters in Arizona, Florida, Indiana, Ohio, and Texas, and concluded that 83% of all voters, and 75% of Trump supporters agree that “solar energy should be used in the US to strengthen and increase our energy supply.” Majorities also agree that solar is key to making power more affordable, and to closing the gap between electricity generation in China and the US. “Solar should be seen not as government-favored or ideological,” Conway wrote in a summary of the poll results. Yet 74% of Trump voters also said they support scrapping solar tax credits, as the One Big Beautiful Bill Act did, which could make widespread solar adoption harder to achieve. |

|

EV bust drags clean investment |

Declining electric vehicle sales caused US clean investment to experience its largest quarterly drop in nearly a decade, part of a larger pullback caused by the elimination of Inflation Reduction Act tax credits. Total investment — including in clean tech manufacturing facilities and retail spending on things like EVs and solar panels — reached a record annual high of $277 billion in 2025, according to the latest data from the Clean Investment Monitor, a joint project of MIT and the Rhodium Group. But that sum masks a sharp drop in the fourth quarter, which Hannah Hess, Rhodium’s associate director of climate and energy, attributed primarily to plunging EV sales. Manufacturing also took a major hit: Since the group started tracking this data in 2018, $29 billion in announced manufacturing investments have been cancelled, and 79% of those cancellations happened in 2025 — erasing 18,000 potential jobs. In the fourth quarter alone, $8 billion in projects were scrapped, compared to just $3 billion worth of new project announcements. “That means the pipeline of new investment is shrinking,” Hess said. “Usually, even when we see quarterly fluctuations, from a zoomed-out view we continue to see sustained momentum. That’s no longer true.” |

|

A new acquisition in the US community solar sector starkly illustrates the changing dynamics in the broader industry, and underscores growing efforts by key players to scale. Perch Energy this week said it was buying Solstice, leaving it with over 3 GW of solar capacity across 16 states, the second significant deal within a year for Perch, which in March merged with Arcadia, another community-solar firm. “At the end of the day, scale matters,” Perch CEO Bruce Stewart said in an interview. Overall heft is increasingly required, he continued, in order to secure better borrowing costs — renewables are more reliant on leverage as a proportion of overall project costs than fossil fuels — and to work out any supply chain bottlenecks. “As our partners are consolidating and scaling,” he added, “so too should we.” The end of zero-interest rates several years ago combined with the removal of tax incentives and other federal support programs has driven a consolidation in the solar-power sector in particular: The CEO of the Gulf renewables giant Masdar told Semafor last month, for example, that it was looking to pick up struggling East coast assets. —Prashant Rao |

|

This April, President and CEO of United States Steel Corporation, David Burritt, will join global leaders at Semafor World Economy — the premier convening for the world’s top executives — to sit down with Semafor editors for conversations on the forces shaping global markets, emerging technologies, and geopolitics. See the first lineup of speakers here. |

|

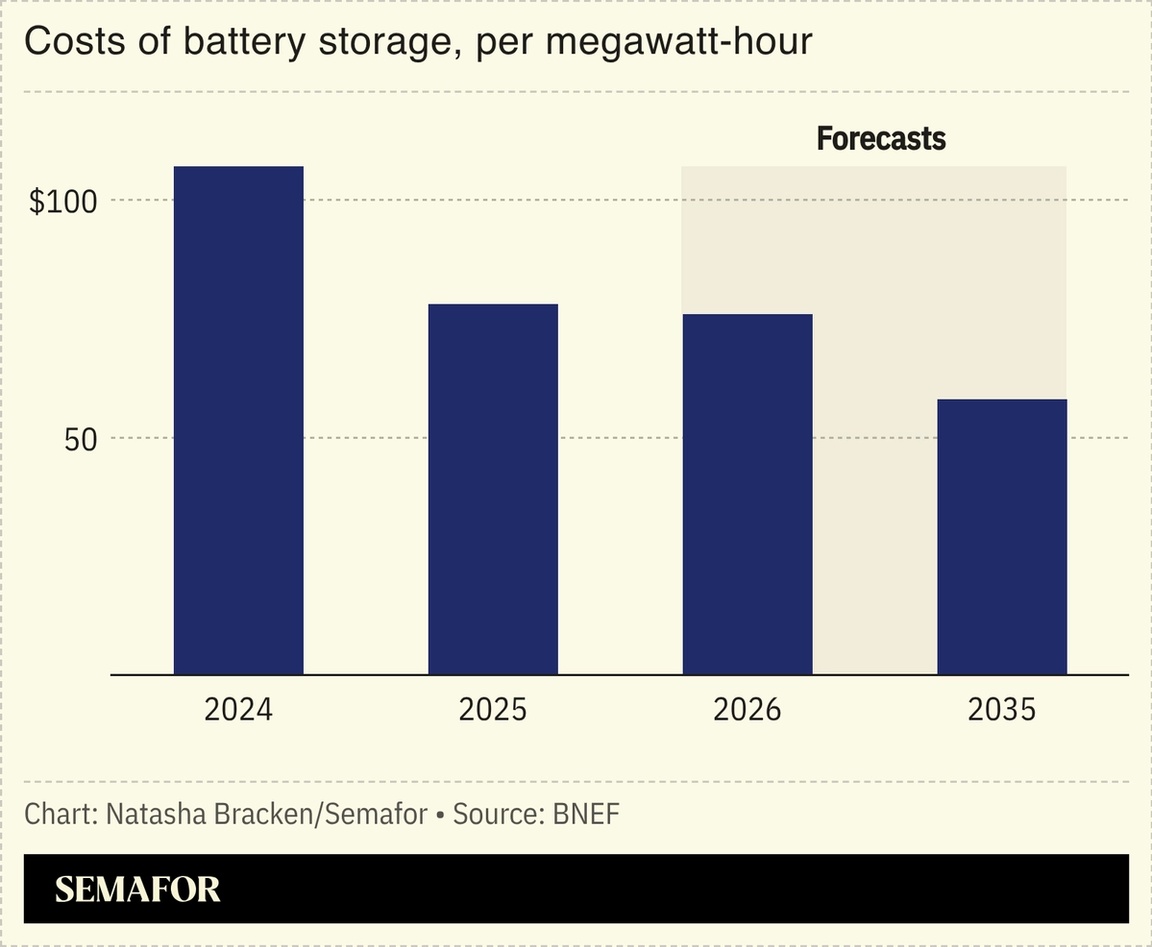

Batteries cheaper than ever |

Battery storage prices dropped more than a quarter last year to a record low, a boon for grids straining under rising electricity demand, a new BloombergNEF report found. For renewables in particular, cheaper battery storage means energy from wind and solar, which tends to be periodically abundant, can be stored and saved for later, relieving grids from an influx of power. Costs were higher for other energy technologies, however: Prices for wind farms, fixed-axis solar projects, and combined-cycle gas turbines — the latter hitting record highs in the US to meet surging energy demand from data centers — all crept up, driven by supply chain constraints, poorer resource availability and market reforms in China. Still, BNEF expects innovation and competition to drive further price reductions across clean energy by 2035, potentially totalling 30% for solar, 25% for battery storage, and around 20% for wind. —Natasha Bracken |

|

New Energy- India’s push to expand its solar manufacturing output resulted in a 13-fold jump in capacity since 2020, while capacity utilization at module-assembly plants has decreased to around 40% from more than 70% in the year through March 2023.

Fossil FuelsFinance- Apple removed an “ESG modifier” from its executive compensation packages for 2025, eliminating a mechanism that allowed the board to adjust annual bonuses based on performance on environmental measures.

Politics & Policy- The US once again threatened to withdraw from the IEA over its climate advocacy and lack of focus on energy security.

- Europe should treat energy security as defence policy, effectively managing supply chain risks for fossil fuels while fortifying, modernising, and decentralising its electricity infrastructure, rather than focusing on decarbonisation alone, a former NATO commander argued in the FT.

|

|

|