Hi friend 👋

TJ is doing an amazing job at Compounding Dividends.

His best investments so far?

The Portfolio pays a dividend yield of 3.5%.

This means that per $100.000 you invest, you receive $3.500 in yearly dividends.

And guess what?

TJ just added to a stock in the Portfolio.

The stock I’m talking about? Wolters Kluwer.

Here’s why TJ thinks it’s an interesting buy right now:

Market overreaction: The stock is down ~30% this year. Mr. Market seems to be very pessimistic about Wolters Kluwer.

Already an AI company: 70% of Wolters Kluwer’s digital revenues come from AI-enabled products, up from 50% two years ago. They’ve been using AI for over a decade.

Proprietary data moat: Wolters Kluwer owns unique, gold-standard content databases that cannot be replicated. This includes 7,600+ medical experts validating their health platform and processing 300,000 regulatory changes per year in tax & accounting.

High switching costs: Once professionals like doctors, lawyers, and CPAs are embedded in Wolters Kluwer’s tools, they rarely leave.

Recurring revenue: Over 80% of revenue is subscription-based.

Shareholder-friendly management: The company has a 5-year dividend growth CAGR of 14% and continues to buy back shares.

Attractive valuation: The stock is trading at 13x earnings, which is historically cheap.

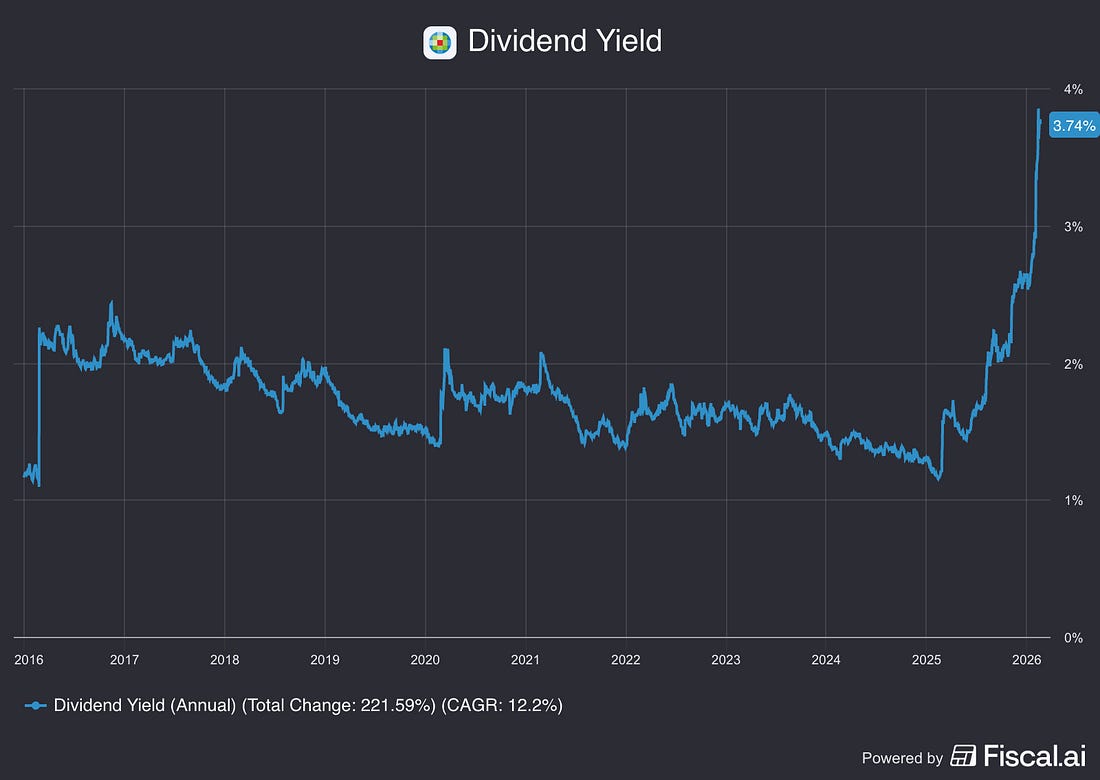

High dividend: The dividend yield is 3.75%, compared to a historical average of 1.74%.

You want to learn more?

TJ will provide investors with a lot of Dividend Investing Wisdom this week.

To start, grab this list with 27 companies that paid a dividend for over 100 (!) years:

27 Dividend Kings

Everything In Life Compounds

Team Compounding Quality

As a reader of Compounding Quality, you agree with our disclaimer. You can read the full disclaimer here.