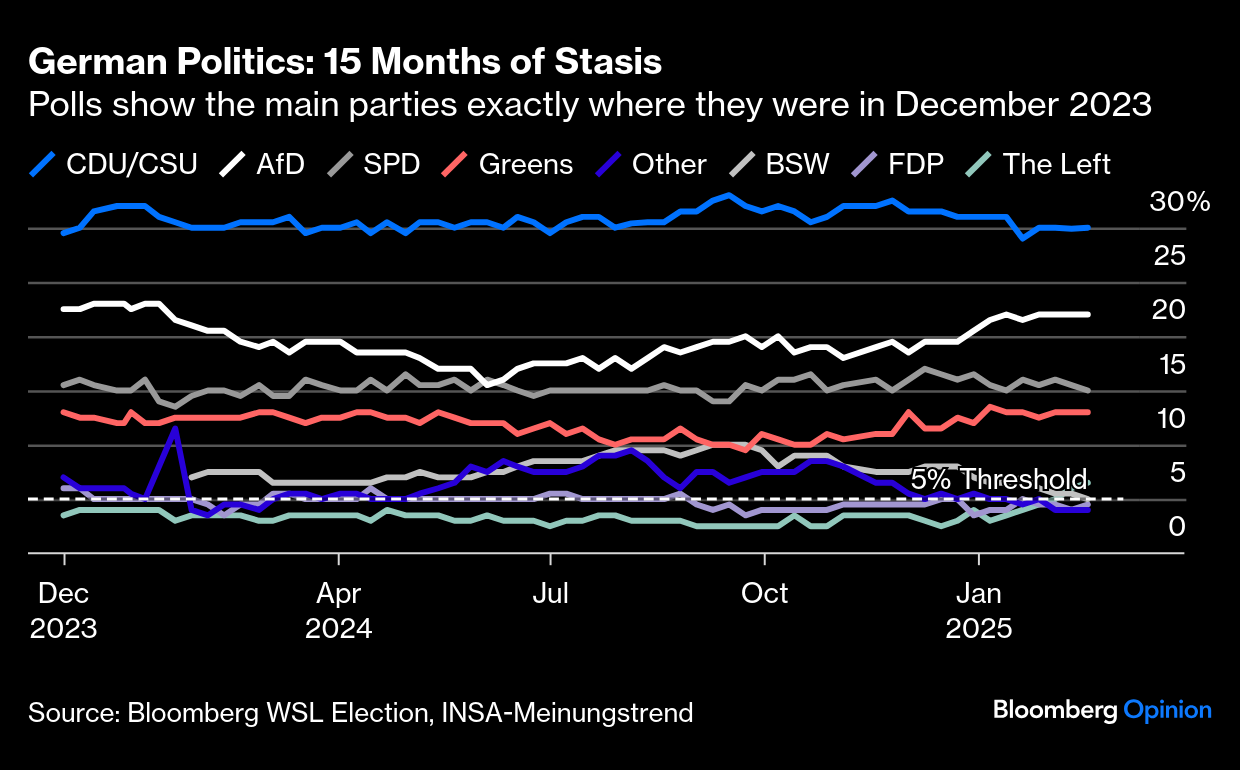

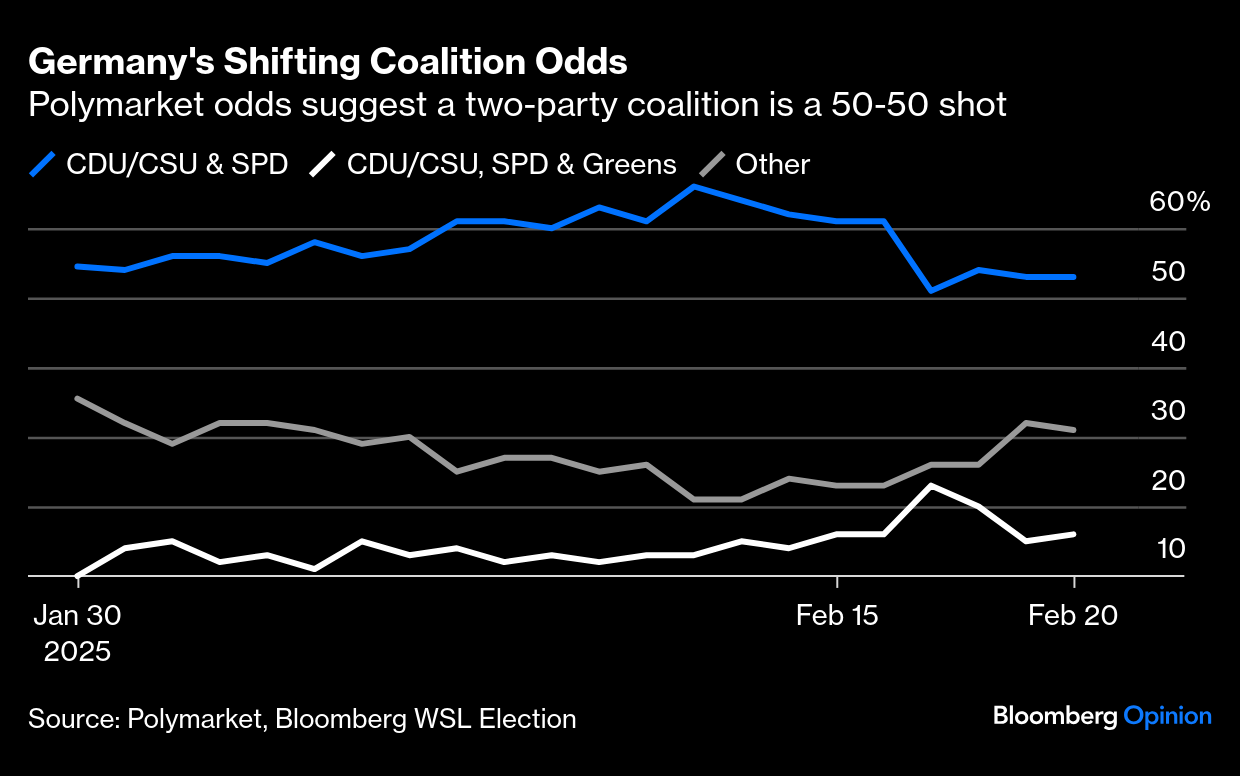

| It’s time for Germany to decide. The election sparked by the collapse of its so-called “traffic lights” [1] coalition is due Sunday. Even before the dramatic rupture in US-European relations, it was bound to be the most consequential in many years. Now comes the complicated part. At one level, there is barely any suspense. The polling numbers for the three biggest parties — the center-right Christian Democrats, anti-immigration Alternative for Germany (AfD) and center-left Social Democrats — are almost exactly where they were 15 months ago. The CDU, led by Friedrich Merz, has been anchored at 30% all that time, with the AfD at a little above 20% and the governing SPD down at about 15%. For all the drama going on around them, German voters appeared to make up their minds a while ago, and nothing has changed it:  Barring an epic shock, it will soon be Chancellor Merz. However, the German proportional representation system makes everything else more complicated. A party needs at least 5% of the national vote to get a share of the seats in parliament. Two far-left groups — BSW and The Left — and the liberal Free Democrats are all close to that threshold. If none of them top 5%, then all the seats are shared between the larger parties, and the Christian Democrats can govern in coalition with the Social Democrats. If all three get seats, then the mathematics mean that the two traditional big parties will need to govern with at least one other — presumably the Greens, as all are unwilling to admit the AfD to government. Prediction markets now think it’s a 50/50 shot whether Merz can put together a two-party coalition:  This matters because a three-party coalition will inevitably be less coherent. Using the Baker Bloom & Davis indexes of economic policy uncertainty, which are derived from press coverage, we see that the start of the three-party coalition under Olaf Scholz three years ago ushered in extreme uncertainty, which remains. Not even the collapse of Lehman Brothers in 2008 or Britain’s referendum prompted such confusion: Meanwhile, the latest measures of German business sentiment, which predate US Vice President JD Vance’s iconoclastic speech in Munich last week, showed extreme pessimism. The long-running ZEW survey suggests things are as bad as they have ever been since the adoption of the euro in 1999, including the Global Financial Crisis and the pandemic: The uncertainty and pessimism don’t as yet show up in the markets. German bund yields have sagged far below US Treasuries ever since the euro zone financial crisis, ended when the European Central Bank pledged in 2012 to do whatever it took to save the currency. That in practice involved massive intervention to keep yields low, and a protracted period of slow growth. Germany’s sluggishness (good for bonds) for now more than counteracts the bond-unfriendly threat that it will soon be forced to spend far more on defense: Indeed, the issue is almost the inverse. At this point, Germany’s problem is perceived to be that its fiscal policy is too conservative, rather than than overstretched. Bond vigilantes haven’t attacked because the country’s finances are far more prudent than those of its neighbor France (which very much does face pressure to reduce its deficit), or problematic ally the US: Indeed, the key reform that could come from a two-party coalition is a release of Germany’s post-2009 constitutional “debt brake,” which limits increases in the deficit and caused a divergence from the other major economies. With the two big parties looking ever more amenable to do a deal, and to accept more borrowing — in particular for defense spending — the hour of need has been converted into an argument that it’s time to buy stocks. The hope of that fiscal impulse has much to do with Germany’s remarkable outperformance over the rest of Europe in the last few months: German stocks’ performance relative to the US is even more counterintuitive. As might be expected, the political chaos in France, and then the US election result, both drove the DAX down relative to the S&P 500. But since November, it’s outstripped the S&P by the 15%, with reaction to the Vance speech weighing it down only slightly: This is an anomaly that needs a lot of explanation. The best might be that the market is calling Trump’s bluff on tariffs. On several issues, he has taken actions that go beyond what he promised on the campaign trail, but on tariffs, so far, there is barely anything concrete. Rightly or wrongly, markets are working on the assumption that US trade policy won’t be as aggressive as feared, and that means a recovery. The hope that the need to splurge on defense spending could be the making of Germany also helps the DAX, as do hopes that it can relieve its fiscal policy. But none of this alters the fact that a few fractions of percentage points for relatively minor German parties could make the difference between a stable technocratic coalition and an awful fractious mess to rival France as parties desperately try to avert handing any legitimacy to the far right. It will take a while for any coalition to become clear, but it should be evident Sunday night whether Germany is returning to something like typical consensus-style politics, or following France into instability and deadlock. US pressure to accommodate the AfD only makes things tougher. This will be a consequential election night. Staple goods are essential, and often inelastic. Typically, if consumers are cutting budgets on everyday goods like food and toiletries, that’s a harbinger of economic distress. While such correlation does not necessarily mean causation, the dull economic outlook for consumer staple businesses cannot be discounted. The unparalleled strength of the consumer post-pandemic has turbocharged the US economy, making its growth a standout among its peers. As the markets parse vast data for signs of weakness after interest rates rose to multi-decade highs, the evidence has largely been inconclusive — leaning more toward consumer resilience. With the Federal Reserve looking ever more likely to keep interest rates on hold for a while, the consumer’s health comes into sharp focus again, with the mainstay staples companies now regarded as a crucial bellwether. Of late, that has translated into massive outperformance for the S&P 500 Hypermarkets & Supercenters sector: It’s broader than just those key players, and the wider S&P 500 staples index has climbed by as much as 15%. Walmart Inc. surged by more than 80% in 12 months. But that took a hit Thursday after the 2025 profit forecast for Walmart fell short of expectations. It dropped 6.5% in early Thursday trading, dragging Costco Wholesale Corp., which doesn’t announce earnings until March, with it: Why does this matter? A streak like this could never carry on indefinitely, but investors evidently found something savagely disappointing. The selloff adds to evidence of complacency about some of the tailwinds helping the US economy. Although the chief financial officer, John David Rainey, argues the guidance is consistent with past years, he admits that “there are still uncertainties related to consumer behavior and global economic and geopolitical conditions.” The jury is out on consumer health despite the much-heralded resilience. Bloomberg Intelligence’s Jennifer Bartashus and Jibril Lawal argue: Walmart’s conservative full-year outlook for sales, adjusted operating income and adjusted EPS may reflect concerns about the state of today’s consumers. Shoppers could turn more cautious amid US government policy changes, though a sustained need for value might favor Walmart. Growth in traffic and tickets are aiding market-share gains, especially from upper-income households.

A store in Martinez, California. Photographer: David Paul Morris/Bloomberg Walmart’s revision isn’t necessarily the canary in the coal mine, but the stress signs are hard to ignore. Barclays analysts expect the boost to buying to fade this year, due to the brewing policy storm. Their proprietary spending tracker points to a 2.5% gain in personal consumption during the current quarter, as it appears people have brought forward purchases of durable goods ahead of potential tariffs: Our analysts think this boost will prove transitory, and that expected tariffs, alongside the effects on production and income from tighter immigration policies, could slow consumption to 2% in the second quarter and 1.5% in the third.

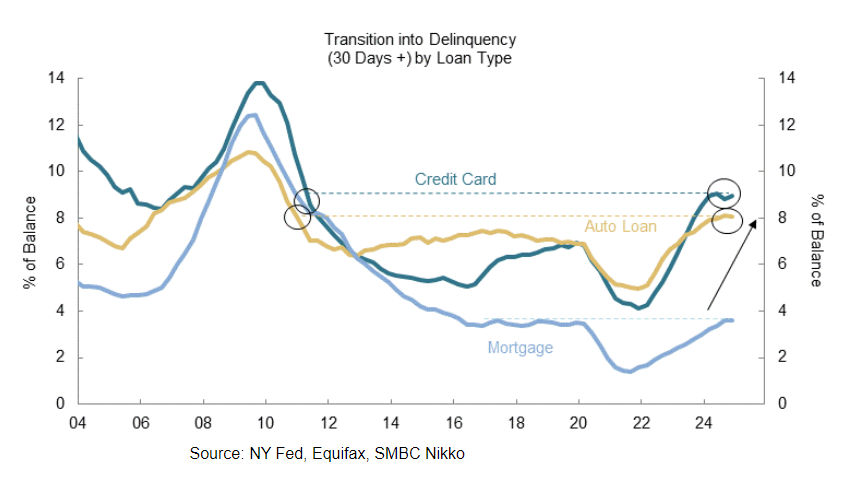

Stress signs are increasing for lower-income consumers. The New York Fed’s data showed record shares of loans, including auto (8.1%), credit cards (9%), and mortgages (3.6%) transitioning into delinquency during the fourth quarter. SMBC Nikko details the historical context:  Source: SMBC Nikko Where do consumers go from here? SMBC Nikko’s Troy Ludtka says further degeneration is likely. October’s end to the Biden administration’s student loan on-ramp program could see a rise in late or non-payments. If borrowers attempt to avoid that kind of financial distress, it’s likely to weigh on discretionary income and spending. Walmart’s guidance, which presages its first quarterly earnings decline in three years, didn’t include the potential impact of tariffs, which the company argues remains largely unpredictable. It sources some food from Mexico and general merchandise products like microwaves from China, so it certainly wouldn’t be immune. The surge in the retailer’s sale of blockbuster obesity drugs offers another explanation for the diminished outlook. While grocery sales grew in the mid-single-digit percentage range, health and wellness, powered by GLP-1 drug sales, surged in the the mid-teens range. Retailers evidently suspect that more weight-loss drugs now could mean fewer grocery sales later. It’s one to watch; for the moment, it’s probably healthy that the stock has been reined in after such a run. —Richard Abbey I learned earlier this week that there are a lot of Blackadder fans out there, and also an unfortunate contingent who haven’t a clue who Blackadder is. This documentary should help the uninitiated. Briefly, the saga starts with “The Black Adder,” played by Rowan Atkinson, who is a useless 15th-century prince who has to have an arranged marriage; the second season finds him as a courtier to Queen Elizabeth and still unlucky in love; in his third season, he’s the Machiavellian butler to the Prince Regent; and in “Blackadder Goes Forth,” he was a captain in the trenches of the Great War, bringing the series to conclusion in one of the most beautiful moments of television ever made. There were also specials in which Blackadder became a courtier to Charles I, and Blackadder’s Christmas Carol, in which Ebenezer Blackadder starts out a nice guy and is transformed into a horrible miser. If you haven't made Blackadder’s acquaintance yet, you have a lot of fun ahead of you. Have a great weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Marc Champion: Ukraine Is Just a Pawn in a Russian Reset

- Tyler Cowen: Stagflation Is Poised for a Comeback

- Robert Burgess: Something Is Rotten in Canada

Want more Bloomberg Opinion? OPIN . Or you can subscribe to our daily newsletter. |