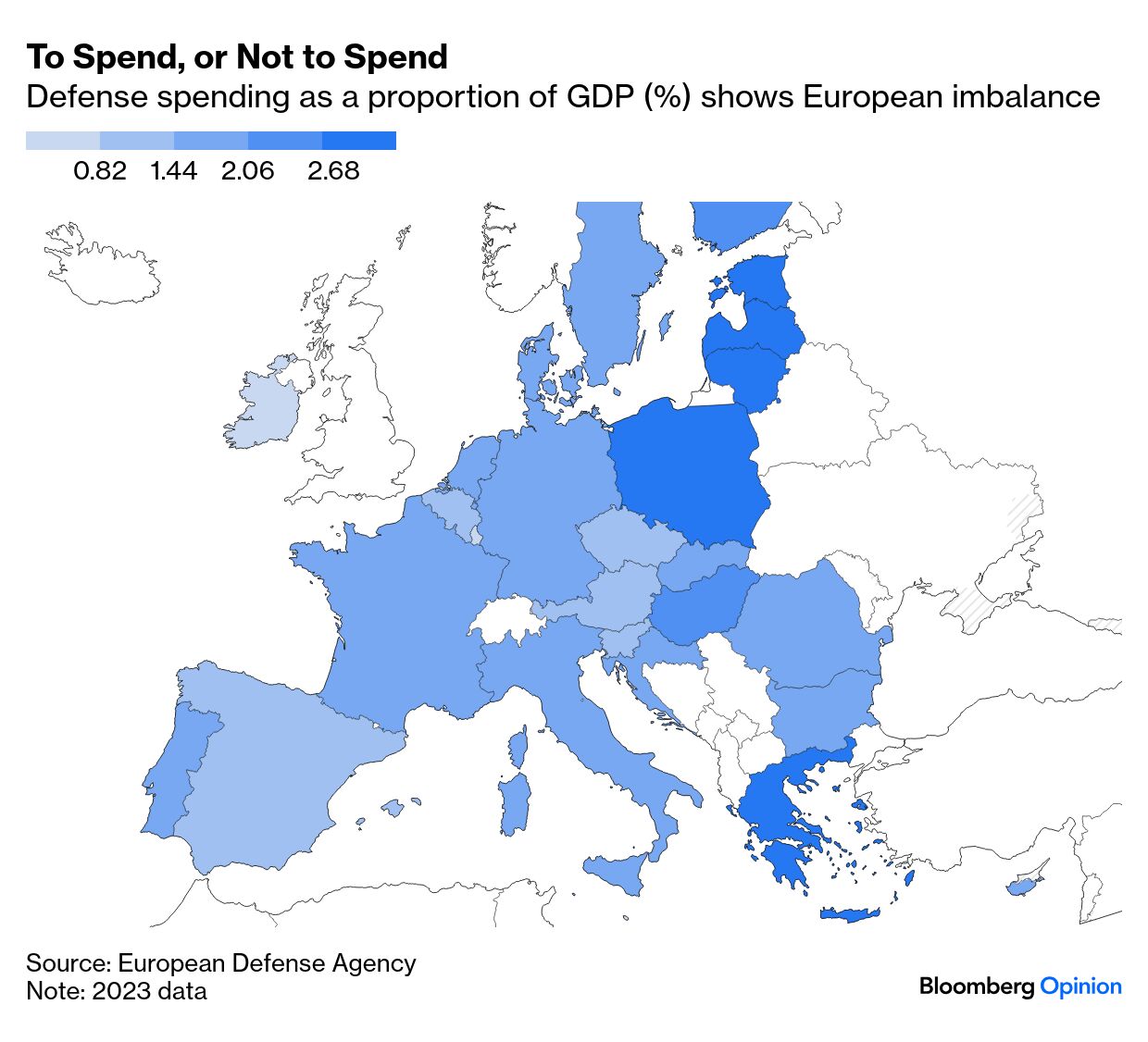

| This is a pivotal moment for France and the European project it relies on for influence, power and prosperity. Donald Trump is threatening to leave European leaders out of Ukraine ceasefire negotiations and abandon US-led commitments to continental security, setting up a security shock that could be as significant as the fall of the Berlin Wall in 1989. As the European Union’s sole nuclear power and a permanent member of the UN Security Council, France is in the hot seat. One message French leaders are already broadcasting to Europe is that it’s time for the continent to take on more of the defense burden from the US, which is increasingly willing to use its status as the world’s biggest military spender as a bargaining chip. Paris has been a broken record on this point for years: De Gaulle worried about France becoming a US vassal state in the 1960s, and Emmanuel Macron warned of NATO “brain death” during Trump’s first term in office. While France’s partners have in the past been unmoved by this rhetoric, the actions of the Trump administration are spurring a re-think across Europe, especially in the Eastern and Baltic states closest to Russia.  Should Europe come around to the French view, it would require a concerted push on defense spending in the years ahead — something the European Union, with its focus on soft power, isn’t programmed to do. To ensure that the future of Ukraine and the EU don’t depend on the whims of Washington, Macron called on countries across the continent this week to ramp up spending, even as most NATO members edge towards spending 2% of GDP on defense. In a message designed to reverberate in Berlin, where big changes could be afoot after German elections on Sunday, he also reiterated the need for joint debt to fund these outlays. To get a sense of the scale of investment needed for Europe to reach a 4% GDP spend, Bloomberg Economics estimated the bill over the next decade at $2.7 trillion for NATO’s five biggest members (including the UK, France and Germany). This isn’t an impossible sum to reach and could be divided between national and EU finances. Still, it won’t come without consequences: Macron is warning voters that tough budgetary choices lie ahead and purchasing power may suffer as a result. The sorry state of France’s economy and budget deficit will also keep up the need for reform. The big unknown is whether the political willpower exists to support all of this. Unlike Covid-19 or the euro crisis, former French ambassador to the US Pierre Vimont tells me that this crisis hides many others – including Europe’s difficulty in formulating a strategic vision, defining its interests and taking a stance, such as on Russian sanctions, that might require opposing the US. Macron’s prime minister, Francois Bayrou, boiled it down to a Hamlet-esque question: “To be, or not to be.” Europe has yet to decide. France and the UK are drawing up plans for a European-led reassurance force for Ukraine, which would ensure that Russia doesn’t attack the country again if a ceasefire is negotiated. Private-sector business activity in France unexpectedly slumped to its lowest level since 2023 as a prolonged political crisis weighs on the Eurozone’s second-biggest economy. Parisian finance is also feeling the pinch. JPMorgan Chase & Co. has dismissed around nine workers in the French capital since November, citing “economic reasons,” while asset-manager Tikehau Capital SCA is planning to transfer some Paris-based employees to offices abroad. Far-right leader Marine Le Pen is keeping her distance from Donald Trump, despite their shared populist attitudes and hardline stances on immigration. France’s state auditor said the public pension system’s deficit is set to widen sharply in coming years, sounding an alarm ahead of negotiations crucial to the survival of Francois Bayrou’s government. Government officials took issue with EDF’s plan to build six nuclear plants, citing cost estimates and reactor designs, according to people familiar with the talks. Saturday – Agriculture fair Wednesday – Feb consumer confidence; Danone, Stellantis results Thursday – Feb PPI; AXA, Engie results Friday – Feb preliminary CPI; final Q4 GDP; Jan consumer spending; S&P scheduled France rating update French Polynesia is unfairly known for being prohibitively expensive for tourists. Read all about how to explore it in a cost-effective way, courtesy of a French travel hacker.  The views in Bora Bora, French Polynesia. Photographer: Michele Westmorland/Corbis Documentary RF |