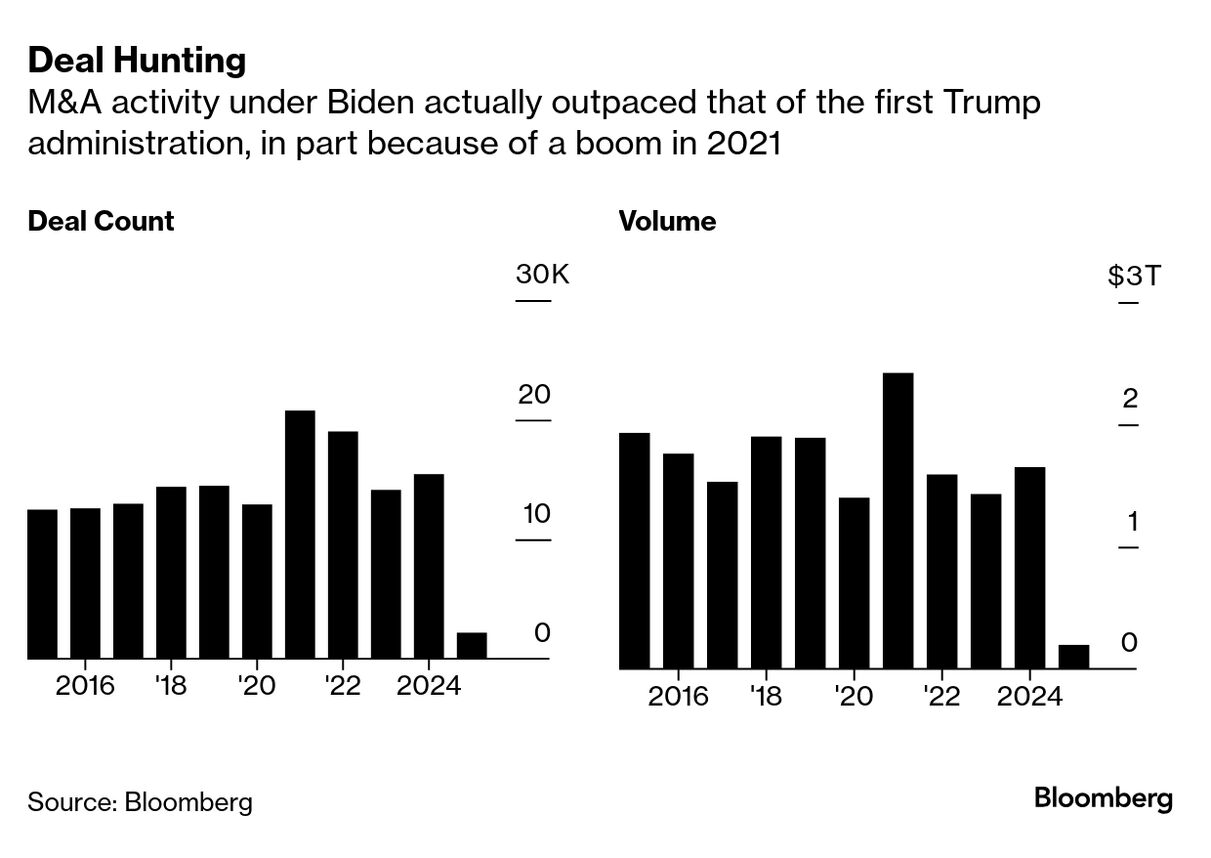

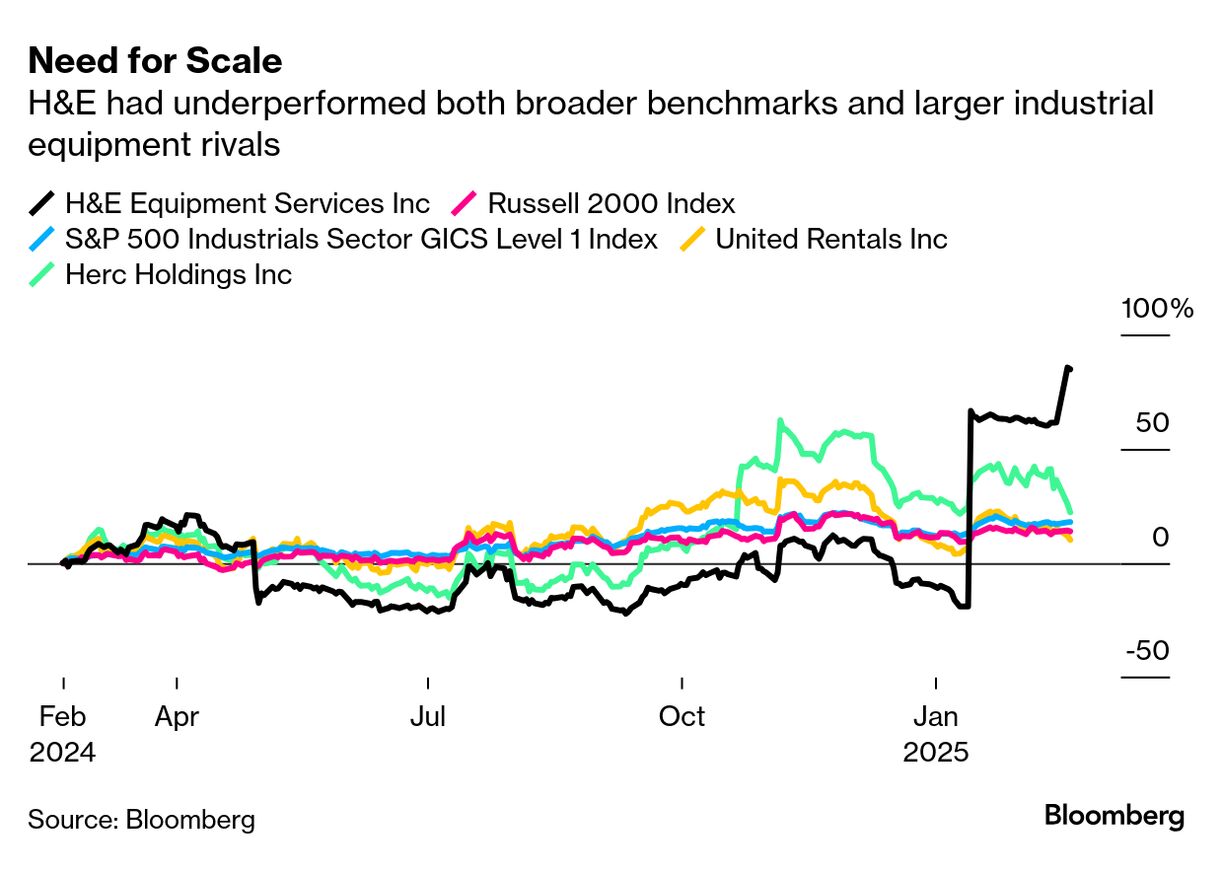

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. To get Industrial Strength delivered directly to your inbox, sign up here. Donald Trump’s return to the White House is widely expected to usher in a corporate takeover bonanza as his anything-goes attitude loosens regulatory oversight and his proposed tax cuts free up cash flow for acquisitions. But dealmaking is off to a slow start this year. US companies have been involved in just shy of $200 billion worth of acquisitions so far this year, down from more than $300 billion at this point in 2024 and an average of about $275 billion over comparable periods across the four years of the Biden administration, according to data compiled by Bloomberg. Interestingly, even though Biden had a reputation for chilling M&A activity and his antitrust regulators did successfully thwart several high-profile deals, there were both a greater number of takeovers and a higher value of acquisitions involving American companies during his time in the White House than there were in Trump’s first term — both on a total and an annual average basis. That partly reflects a surge of big takeovers announced in 2021 after a lull during the pandemic, including a more than $30 billion merger that combined the world’s two largest jet lessors and a separate $30 billion-plus takeover that consolidated the North American railroad industry down to just six major players — deals that got done despite Biden’s more critical stance toward mergers.  It’s very early, and there’s still plenty of time for this year to turn out a bumper crop of deals. Corporate takeovers — particularly the complicated ones that carry big headline valuations — take months, if not years, to coordinate and execute. Still, the risk is that a combination of persistently high interest rates and policy uncertainty over everything from tariffs to defense spending and geopolitical posturing will keep would-be acquirers on the sidelines. The antitrust chiefs that Trump tapped for the Justice Department and the Federal Trade Commission said this week that they will keep in place the tougher merger review rules adopted by the Biden administration — a potential sign that this might not be the free-for-all era that some bankers had been expecting. There’s plenty of appetite for dealmaking among CEOs but “the geopolitical noise is causing a bit of caution,” Citigroup Inc. industrial analyst Andrew Kaplowitz said. Companies may “have to see the tweets die down” before they move forward with transactions, he said. At the same time, Republicans’ push for large-scale tax cuts is colliding with concerns about rising deficits and the impact of cutting safety net programs that are popular with their constituents. While Senate Republicans this week backed a narrower budget proposal that adds funds for immigration enforcement and military spending, Trump has instead backed a House plan that would wrap many of his priorities into one bill. That proposal includes $4.5 trillion in tax cuts offset by $2 trillion in spending reductions — about 44% of which would affect Medicaid, the government insurance program for low-income people. The Department of Government Efficiency, the Elon Musk-linked effort to purportedly tackle waste, has claimed $55 billion in spending cuts but has only accounted for $16.5 billion of that, roughly half of which reflected an error that mislabeled a contract by a factor of a thousand. Proposals to eliminate taxes on tips and social security benefits and send dividend checks to Americans based on DOGE’s savings will further complicate the scramble to fund tax cuts. Interestingly, among the 10 largest deals announced so far this year, half of them have ties to the industrial world. That includes Constellation Energy Corp.’s bid to create the largest fleet of US power stations through the acquisition of Calpine Corp.; QXO Inc.’s hostile pursuit of Beacon Roofing Supply Inc.; Emerson Electric Co.’s push to acquire the shares it doesn’t already own in industrial software company Aspen Technology Inc.; an asset sale by trash hauler GFL Environmental Inc.; and then lastly, Herc Holdings Inc.’s agreement this week to acquire construction equipment rental peer H&E Equipment Services Inc. Herc wrestled H&E away from United Rentals Inc., which had initially agreed to acquire the lessor of bulldozers, skid steers and forklifts in January but declined to counter Herc’s higher offer. Herc’s cash and stock bid was worth about $105 a share based on trading values as of Feb. 14, or about $5.6 billion including the assumption of debt. That implies a whopping nearly 140% premium to where H&E shares were trading before it announced the initial sale agreement with United Rentals. The company’s stock has been under pressure as high interest rates dampen demand across parts of the non-residential construction industry.  “The shares just got too cheap,” Melius Research analyst Rob Wertheimer wrote in a note. And that was an opportunity that a buyer couldn’t ignore, particularly in a rental equipment industry that’s been rapidly consolidating and in an environment where it makes more sense to grow by acquisition than risk a supply glut with the addition of new machinery in a slowing market. Herc is targeting $240 million of revenue benefits, reflecting the opportunity to sell its broader range of products and specialty items — think trenching tools, power generation and floor care equipment — to customers that H&E has primarily served only through rentals of traditional construction machinery. It’s Herc’s largest acquisition since the 2016 separation from the Hertz Global Holdings Inc. rental car business and will help give the company the kind of scale that resonates with investors. But it’s tricky to extrapolate much from this deal for the broader M&A market. “It's a unique opportunity,” Herc Chief Executive Officer Larry Silber said this week at a Barclays Plc industrial conference. “There were only really one of two assets of this size remaining in the industry.” United Rental’s bid to take H&E off the market didn’t give Herc much choice but to make its own proposal, lest it relinquish another asset to a larger rival that’s been steadily gobbling up targets for a decade. The bigness of this deal adds risks, both on the balance sheet and in the pressure to actually achieve all of these synergies Herc says are possible. Industrial companies have generally shied away from such large outlays in recent years, preferring to focus on bolt-on acquisitions of complementary technology. Many CEOs have expressed an interest in pursuing more deals or bigger ones but have held off because valuations are higher than they can stomach. For the most part, the industrial businesses worth having aren’t getting radically cheaper. “The best deals for Lennox in 2024 were the deals that we decided not to pursue, thus safeguarding long-term shareholder value,” Alok Maskara, CEO of heating and air conditioner maker Lennox International Inc., said on the company’s earnings call in late January. There’s an array of assets currently owned by private equity firms that appeal to manufacturers, but a disconnect on price is gumming up the system, Kaplowitz said. Sellers are holding out for higher valuations, despite a changed landscape of higher interest rates and economic risks such as tariffs. Someone needs to move first and then that will make it easier to price subsequent deals, but it’s hard to do that when there’s so much uncertainty, Kaplowitz said.

That’s not to say there won’t be more industrial tie-ups. The continued unraveling of manufacturing conglomerates creates an opportunity for mixing and matching their various assets. JetBlue Airways Corp. keeps hinting at a possible reboot of its failed attempts at striking deals with other airlines. But that may not be enough to create a real boom in activity.  | | | “If you have a crystal ball and let me know where the administration is going to go, it'd be very helpful.” — Johnson Controls International Plc Chief Financial Officer Marc Vandiepenbeeck Vandiepenbeeck made the comments at a Citigroup conference this week in reference to the near-constant stream of frequently changing tariff proposals coming out of the Trump administration. So far this week, that has included the suggestion of 25% tariffs on lumber, automotive, semiconductor and pharmaceutical imports, potentially starting in early April. That would add to a 10% levy on Chinese imports that has already gone into effect, a threatened 25% tax on Mexican and Canadian goods that has been deferred, orders for sweeping 25% tariffs on steel and aluminum that are set to take effect in mid-March and a demand that the administration start exploring reciprocal tariffs on countries that tax US products. Johnson Controls’ guidance factors in some concern that tariffs “will force people to pause a little bit and maybe delay or defer certain investment,” Vandiepenbeeck said. While the company isn’t currently accounting for the impact of tariffs on Mexican imports, “we've been fairly transparent that as a company, a tariff in Mexico would have some form of impact,” he said. North American orders jumped 18% at Johnson Controls in the most recent quarter and about a third of that activity reflected customers pulling forward purchases to try to avoid the impact of tariffs. Roughly 40% of the production capacity for the US heating, ventilation and air conditioner industry is now in Mexico, Lennox has estimated. Read more: American Made Risks Becoming America Alone While some companies are stockpiling inventory, others are starting to push through surcharges or price increases and a select few are already making supply-chain changes. But many are in “wait-and-see mode,” John Kuhlow, CFO of trucker J.B. Hunt Transport Services Inc., said this week at the Barclays conference. “One day a tariff is announced and then 24 hours later, it's paused and delayed. So I just think the domestic and global economy is not set up to react on some of these tariff things instantaneously. These are big operations that just don't have the ability to pivot that quickly.” Deals, Activists and Corporate Governance | Southwest Airlines Co. has shunned layoffs throughout its more than five-decade history — until now. The carrier, which is under pressure from activist investor Elliott Investment Management to improve its performance, this week announced it would cull about 15% of its corporate staff in an effort to cut costs. Southwest has already abandoned other long-held policies that underpinned its business model, including one-size-fits-all seating and an open boarding process. The company also overhauled its board, adding six new directors in a pact with Elliott. Southwest says it has too many employees for its current operating environment as airlines dial back capacity growth in an attempt to stabilize prices and the company adjusts to lengthy delivery delays for its Boeing Co. 737 Max aircraft. Still, “we thought headcount would be whittled down but through traditional channels like early retirements, exit packages and natural attrition,” Melius Research analyst Conor Cunningham wrote in a note. The boarding and seating changes were one thing and largely reflected a need for Southwest to keep pace with peers and embrace an operational approach that has proven more profitable. The question raised by Southwest’s first ever round of layoffs is if corporate culture will change as a result and “thus make other initiatives more difficult to achieve,” Cunningham wrote. “Culture has long been viewed as the special sauce that makes everything possible.” Southwest shares fell on the first trading day after news of the job cuts, an unusual reaction for cost-cutting measures.

Roper Technologies Inc. is exploring a sale of its Neptune Technology Group Inc. water meter business in a transaction that could be valued at as much as $4 billion, Bloomberg News reported, citing people with knowledge of the matter. A deal, should one be reached, would continue Roper’s pivot away from its traditional manufacturing background toward niche software businesses that span industries such as law firms, movie visual effects, campus payments and construction. The company in 2022 sold a majority stake in its industrial pumps and compressors business to private equity firm CD&R for $2.6 billion. At the time, Roper said it made sense to retain the Neptune water meter operations along with its medical products business because customers have to replace those items regularly, ensuring smooth revenue. But as Roper increasingly gobbles up software businesses, the so-called technology enabled products division that houses Neptune and its medical businesses is the odd man out. Roper’s effort to rebrand itself as a software company hasn’t been a perfect process; technology investors tend to have a higher bar for growth than industrial ones. Roper shares have climbed about 7% in the past year, compared with a 31% jump for the S&P 500 Information Technology Index through Thursday. Potential buyers for the Neptune business could include Honeywell International Inc. and Veralto Corp., the water technologies spinoff of Danaher Corp., Melius Research analyst Scott Davis wrote in a note. |