| I’m Chris Anstey, an economics editor in Washington for the IMF/World Bank meetings. Today we’re looking at fresh hints on the timeline for trade talks. Send us feedback and tips to ecodaily@bloomberg.net. And if you aren’t yet signed up to receive this newsletter, you can do so here. - Donald Trump said he has no intention of firing Federal Reserve Chair Jerome Powell.

- The US president said he plans to be “very nice” to China in any trade talks and that tariffs will drop if the two countries can reach a deal.

- Private sector in the UK suffered its biggest contraction in more than two years and stalled in the euro area because of tariff uncertainty, according to PMI surveys.

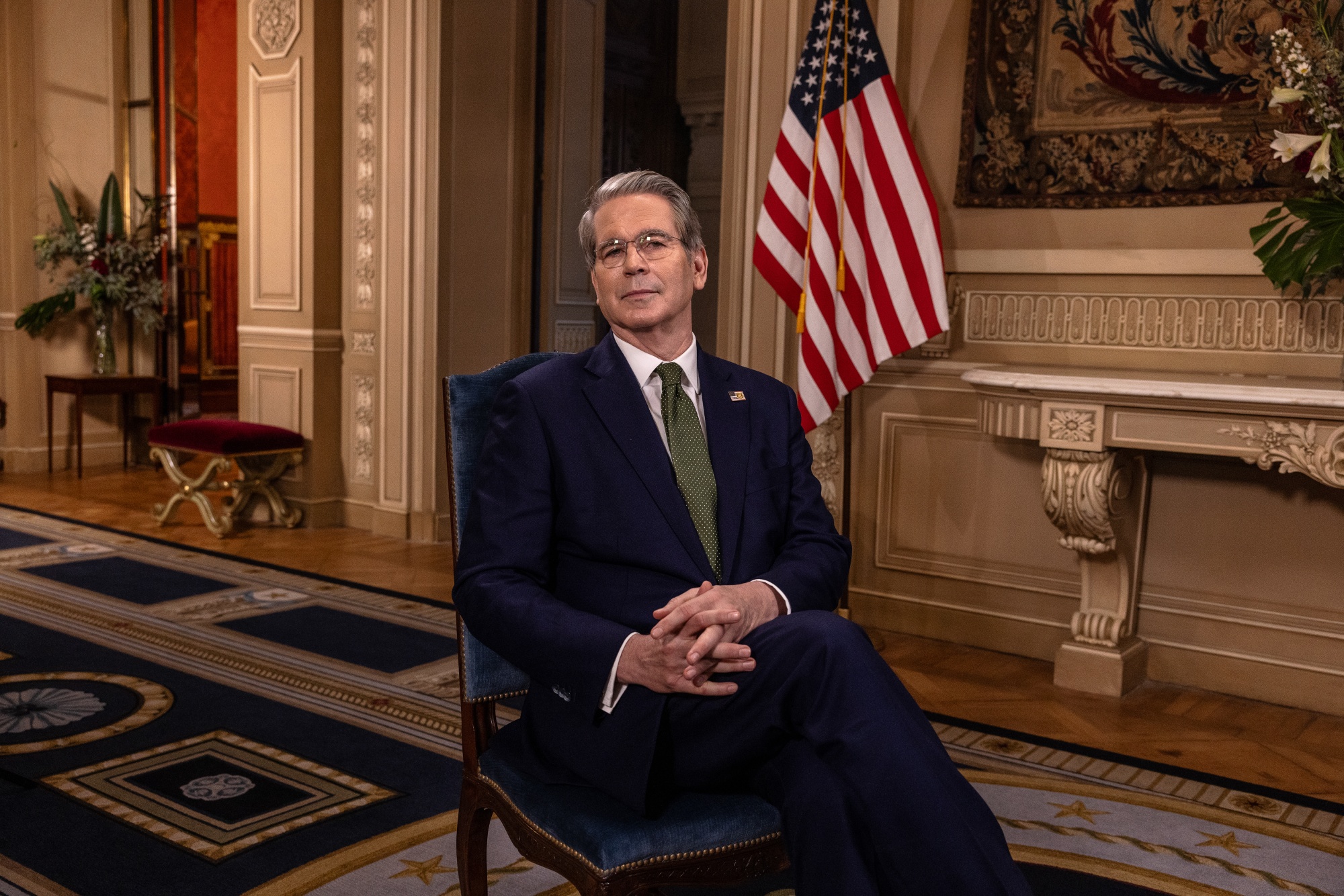

In the supreme volatility that characterizes financial markets under the Trump administration, US stocks climbed on Tuesday on optimism — or reduced pessimism — over trade talks, a day after plunging on fears of Fed independence. One of the elements of this turnaround Tuesday was remarks by Treasury Secretary Scott Bessent at a closed-door investor summit that there would inevitably come some de-escalation with China, given that the tariff rates each side has now slapped on the other essentially amount to a trade embargo between the world’s largest two economies. Bessent said Washington and Beijing will have to find ways to de-escalate, in comments that harken back to his pre-election perspective on Trump’s maximalist-tariff policy being an “escalate to de-escalate” stratagem. The S&P 500 rose about 2.5%, after sinking 2.4% Monday. The White House also telegraphed that talks were making outright progress with other major trading partners. There are now 18 proposals from other nations, and the administration’s team is meeting with representatives of 34 countries more broadly, the press secretary, Karoline Leavitt, said. What some investors may not yet grasp is that a final settlement — if there is one in the offing at all — of trade tensions may be some ways away.  Scott Bessent Photographer: Sarah Pabst/Bloomberg With regard to China, Bessent, at an event hosted by JPMorgan Chase, expressed optimism that tensions could cool in the coming months, which would bring relief to markets. But he cautioned that a comprehensive deal between the two countries could take two-to-three years. The Treasury chief similarly said earlier this month that there may not be an actual trade “document” with trading partners by the end of the 90-day pause period on so-called reciprocal tariffs. There may be an “agreement in principle” that allows the US and the partner nation to move forward with more detailed negotiations, he said. Also Tuesday, Politico reported the White House was close to announcing high-level agreements with Japan and India, though they were expected to largely signal a willingness to negotiate on specific topics, with details to be worked out over months or even years. For her part, Leavitt declined to say whether those framework announcements would be enough to stave off the resumption of tariffs at the end of the 90-day pause. All of which suggests investors and economists will be well advised to gird for a lot more volatility to come. The Best of Bloomberg Economics | - The IMF sharply lowered its forecasts for world growth and it chief warned that risks of a recession are rising if trade uncertainty drags on. The global economy is now much more reliant on China and India, it said.

- Trump wants legal challenges to his sweeping tariffs to be heard by a specialized trade court, an approach that worked in his favor during his first term.

- Fed Governor Adriana Kugler said tariffs will likely put upward pressure on prices and have a bigger economic effect than previously expected.

- UK government borrowing exceeded official forecasts made just last month.

- The cost-slashing campaign by Trump and his billionaire ally Elon Musk is expected to throw a wrench into the economic engine that built modern Washington.

As the Trump administration seeks to re-shore manufacturing chains to the US, a key question is the capacity of American industries and their workforces to accomplish the task. CIBC economists Andrew Grantham and Avery Shenfeld took a look at the situation in a note on Tuesday. There seems to be “room at the inn” in some sectors, including primary metals such as steel and aluminum, motor vehicles, aerospace and furniture, the duo wrote. Their operating capacities are at “below long-term norms.” Even then, “major additions to current capacity” would be needed over a period of years to achieve balanced trade, they said. “Labor would be the greater challenge,” Grantham and Shenfeld wrote. “Those who pine away for the good old days when factory towns were more plentiful need to remind themselves that, in the period since then, American real incomes have risen, workers have moved on to other employment, and now face a labor market in which manufacturing jobs are no longer providing higher than average pay.” |