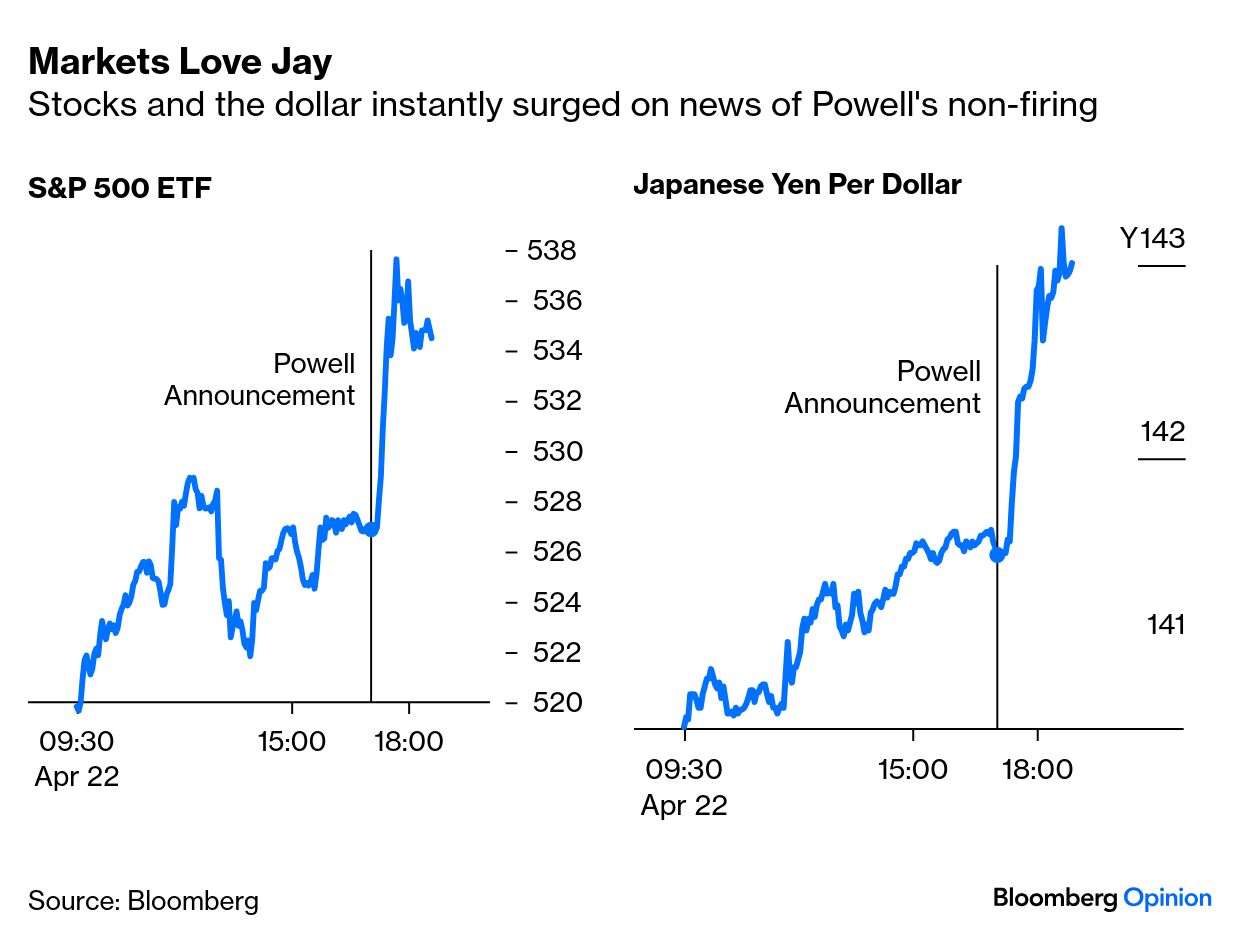

| Tuesday afternoon, Lorde told fans to meet her in the park at 7 p.m. Which park, though? It had to be in New York — she’s recently been spotted at a Nicks game and Paul Mescal’s play. Sleuths determined she’d be at Washington Square Park, where she’d made a TikTok a few weeks prior. By dusk, a massive crowd had assembled in front of the arch, with some fans sprinting down sidewalks and scaling trees to get a better view. But when the clock struck seven, the singer posted on Instagram that the NYPD had shut down the show. Disappointed hoards of fans were seen singing her songs on the street. The chaos didn’t end there, though: A few hours later, Lorde decided to throw caution to the wind and show up at the park to play her new single. In retrospect, the confusing evening couldn’t have fit more perfectly with the name of her song, “What Was That.” That phrase seems to be on the tip of everyone’s tongue. Just look at what’s happening with the White House’s trade war. Treasury Secretary Scott Bessent told a room full of hedge fund types on Tuesday that he expected the US and China to de-escalate the situation. Some people — Paul Krugman included — felt it was unfair and possibly illegal to discuss policies like this in private, but Matt Levine says previous Treasury secretaries have done similar-ish things. The thing is, those secretaries were boring. They didn’t move markets! “When this Treasury secretary tells you that, your reaction is ‘oh wow that is a drastic policy shift from yesterday’ and you rush to buy stocks. When economic policy reverses every day, it’s much more valuable to be in the room when it changes,” Matt argues. Following Bessent’s remarks, President Donald Trump did a similar U-turn, saying he plans to be “very nice” to China and won’t “play hardball” with Xi Jinping. By this morning, the Wall Street Journal was reporting that tariffs could be cut by more than half and the S&P 500 rallied on all the news of US-China tensions easing. So far, so good! But then Bessent went and did this: WHAT WAS THAT!!! Two-to-three years?! At that point, we’ll have another Lorde album. With all the market whiplash and head-fakery, nobody is sure what this tariff chart is gonna look like in a week — or a month or year, even — from now. Ken Griffin is not alone in thinking this trade war has “devolved into a nonsensical place.” Yet another surprising U-turn is the fate of Jerome Powell. Bloomberg’s editorial board is pleased with Trump’s decision to not terminate the Fed Chair. “Challenging the Fed’s independence adds greatly to economic uncertainty, which is already acute,” they write. John Authers agrees, but urges caution: “It would be unwise to think of this as a true turning point. Raising the possibility of firing Powell was an unforced error in the first place, and the messaging suggests chaos.” And with chaos comes volatility, of course:  Some nations watching America’s stock market soap opera unfold from the sidelines never want its “What Was That” era to end. “Many countries would be happy to see the current structure of Trump’s tariffs — disproportionately targeted at China — continue indefinitely,” Mihir Sharma writes. “Everyone in Asia already wanted to reduce China’s footprint in the manufacturing sector,” he explains, and this offers them the perfect opportunity to decouple. In Europe, too, the spat could create a window of opportunity. Lionel Laurent says Trump’s slash-and-burn strategy is sending investors, scientists and researchers overseas to the EU. China isn’t too worried about all this, though. Catherine Thorbecke says not even a trade war could slow down Beijing’s progress on AI. “Not only does the industry’s domestic focus shield it from tariff blows, the sector is also buoyed by government support,” she writes. The US can’t say the same: “On the other side of the Pacific, fears that the tariff turbulence could cost Silicon Valley’s AI dominance are are piling up.” Big Tech better pull a U-turn before it’s too late. While Nathan Fielder is hard at work trying to answer one of humanity’s most burning questions — how to stop airplanes from crashing — in HBO’s The Rehearsal, Boeing is … well, what is it doing? It’s not doing business with China anymore, that’s for sure. It’s looking to increase production of a plane that’s been riddled with problems (the 737 Max). And it’s selling its flight navigation and aircraft diagnostics business so that it can raise money and reduce debt. “Boeing was able to reach an agreement to sell Jeppesen and its ancillary units to the private equity firm Thoma Bravo for $10.6 billion, a price that surpassed Wall Street estimates,” writes Thomas Black. Although having an extra 10 yards in the piggy bank is nice, Thomas worries Boeing may have some regrets. You see, Jeppesen wasn’t some struggling side-hustle for the aircraft manufacturer. It’s one of the few things that Boeing actually makes money on: “The division had sales of $20 billion and operating income of $3.6 billion, which is an 18% profit margin. This compares with operating losses of $8 billion for commercial airplanes and a $5.4 billion loss for the defense, space and security division.” Letting go of your only green asset when everything else is blinking red seems like the wrong thing to do, but I’m no pilot. |