| | Mike Henry, CEO of BHP, downplayed the possibility of another stab at acquiring rival miner Anglo Am͏ ͏ ͏ ͏ ͏ ͏ |

| |   Washington DC Washington DC |   Berlin Berlin |   Bogotá Bogotá |

| Net Zero |  |

| |

|

- Big Copper’s tariff anxiety

- Power bills go up

- ‘Insane’ oil policies

- LNG stays fluid

- The limits of hydrogen

Power faces a labor shortage, and green groups keep their tax breaks, for now. |

|

Is there more to US energy dominance than “drill, baby, drill”? Here at Semafor’s World Economy Summit, I led a very interesting lunch conversation about the energy transition with a group that included corporate leaders, US and foreign government officials, and independent researchers. We were under Chatham House rules, so I can’t report exactly what was said by whom, but I can tell you that no one has settled on a common definition of what “dominance” — the Trump administration’s purported overarching energy goal — really looks like. It’s clear that the full-speed sprint away from fossil fuels envisioned around the time of the Paris Agreement almost certainly isn’t going to happen, if for no other reason than that global energy demand is now growing so quickly that producers can barely keep up, let alone phase out legacy sources. But it’s equally clear that an exclusive focus on oil, gas, and coal will leave a lot of economic and geostrategic value on the table. In decades past, the US was successful in leveraging its fossil fuel exports and know-how as a cornerstone of its global political influence. President Donald Trump wants to keep that up, pitching liquefied natural gas buys as a way for countries to dodge tariffs. But the energy market is bigger and more complex than it used to be. In order for the US to continue leveraging its energy abundance as a tool for exercising power, it can’t give up being a leader in new technologies, from renewables to carbon management. It needs to extend its access to raw materials and labor by investing in allies, not trying to exist as an island. And it needs to seize the moment of demand growth to clear away permitting obstacles and build more of everything. Energy is the biggest investment opportunity of the next few decades, but it’s also the key to unlocking many other opportunities, from AI to national security. Now’s a bad time to be picky. |

|

Tariffs won’t help US copper: BHP CEO |

| |  | Tim McDonnell |

| |

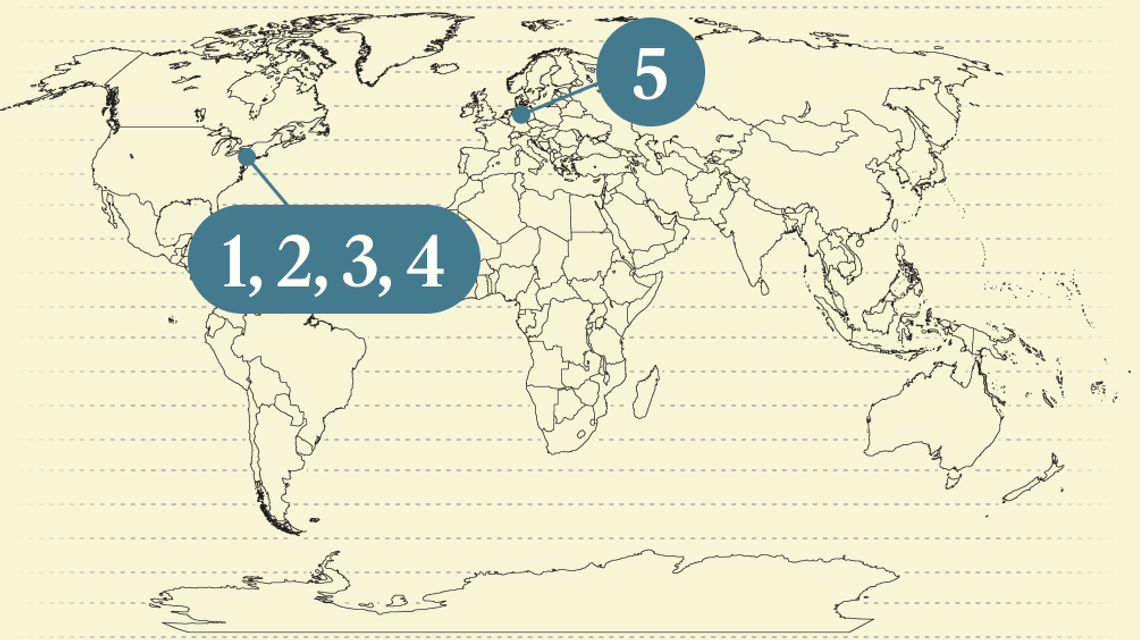

Tariffs that the US is planning to potentially impose within weeks on imports of copper won’t help speed up domestic mining, the CEO of the world’s largest mining company and copper producer told Semafor.  Speaking at Semafor’s World Economy Summit, BHP boss Mike Henry said permitting delays and red tape are still the main constraints on new mines in the US. President Donald Trump has threatened to impose a tariff of up to 25% on copper imports as a way to cut US reliance on imports, primarily from Latin America. But for a mining project that will operate for decades and cost billions of dollars, tariffs don’t offer enough security to be the basis for an investment decision, Henry said: “It’s a vexed question. Trying to do that on the back of an executive order tariff can be hard. There’s not enough certainty.” Demand for copper — a critical component for transmission lines, batteries, motors, and other energy transition hardware, as well as for data centers — is rising much faster than supply, and US production lags significantly behind Chile, the Democratic Republic of Congo, China, and others. That makes copper a major vulnerability for US energy and AI ambitions. The tightening market is already driving copper prices to near-record highs, which will soar even higher in the US if tariffs do take effect. But for a company like BHP, there’s no quick and easy way to seize that market. Henry, who has led the mining giant since 2020 and is rumored to be stepping down soon, has made a pivot to copper a signature part of his legacy: Under his leadership, BHP sold its oil and gas business and much of its coal mining operations in the interest of focusing more tightly on copper. But scaling up the copper business hasn’t been easy. A $52 billion bid last year to acquire rival miner Anglo American didn’t pan out. And a major new mine BHP is developing in Arizona as a joint venture with Rio Tinto has faced legal challenges, opposition from local Indigenous rights groups, and slow permitting. The Trump administration did nudge that process forward last week, but Henry said the mine is still at least five years away from a final investment decision. |

|

Big Apple’s rising power bills |

Semafor SemaforBuilding out a bigger and cleaner grid will definitely raise power bills for households and businesses, the CEO of the electricity utility serving New York City and some of upstate New York said. Tim Cawley, who leads Consolidated Edison, said at Semafor’s World Economy Summit that the company plans to invest $7 billion per year in building out its grid. While some of Cawley’s peers are scrambling to keep up with a deluge of data centers, in ConEd’s territory the bigger challenge is the electrification of buildings and vehicles. That capital spending will cause bills to increase, Cawley warned, but he added the company hasn’t yet seen a change in the share of its customers — about 14% — who qualify for low-income subsidies. As for making the grid cleaner, Cawley is less optimistic: New York state’s goal to get 70% of its power from renewables by 2030 is “really unachievable by everybody’s reckoning,” he said. |

|

Semafor SemaforColombian President Gustavo Petro’s oil and gas policies are “absolutely insane,” the country’s former leader said Wednesday. Speaking at the Semafor World Economy Summit, former Colombian President Iván Duque said Petro was wrong to stop exploration of new oil drilling and exploration contracts. “When you stop exploration, you’re giving the wrong signals to the market. [The] market moves somewhere else and now we’re paying the cost of a reduction in our reserves,” Duque said. Petro, elected in 2022 as Colombia’s first leftist president, announced last month that the country will buy gas from Qatar. “Imagine the cost of importing oil and gas from Qatar. So those decisions are absolutely insane,” Duque said. “I think his own team is telling him, ‘Mr. President, if you shut down the oil and gas, there won’t be even a penny to be invested in the environment.’” — J.D. Capelouto |

|

Business as usual no longer works — today’s challenges are moving too fast. AI is redrawing entire industries. Economic volatility is rising, and long-established trade patterns are fracturing. To make sense of this moment, we convened some of the world’s sharpest minds to create The Semafor View — a new annual guide for navigating global uncertainty. This year’s edition breaks down the businesses, policies, and technologies reshaping the global economy. |

|

Number of times a typical shipment of liquefied natural gas is traded before reaching its final destination. At Semafor’s World Economy Summit, Domenic Dell’Osso, CEO of the gas producer Expand Energy, said the highly fluid nature of LNG trading will help the market stay resilient to trade wars. Most shipments originally destined for China were quickly rerouted to Europe after Beijing slapped a retaliatory tariff on US LNG, he said. And even though decarbonization is politically unpopular, he said, US gas companies are still keen to cut their methane emissions in the interest of maintaining access to ESG-conscious customers in the global market. |

|

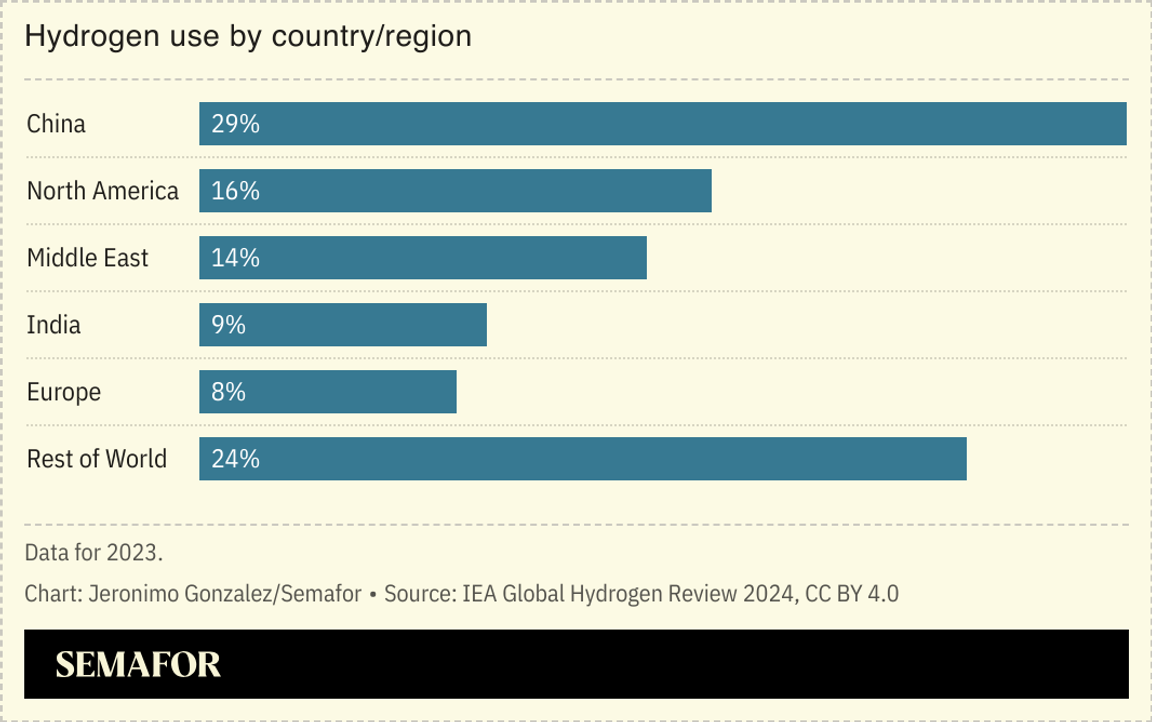

The potential of hydrogen — once a catch-all solution to replacing fossil fuels — is fast being reassessed, with an array of reports pointing to its limits.  A joint Germany-UK feasibility study published this week on the fuel’s trade noted limits to the repurposing of gas pipelines in order to transport hydrogen, while one senior German official noted hydrogen’s price “is still higher than many expected a couple of years ago.” A separate paper in Nature, co-authored by prominent hydrogen skeptic Michael Liebreich, warned that hydrogen was unlikely to make inroads in cars or home heating, that future cost estimates varied by a factor of five, and that hydrogen’s overall climate impact was uncertain. In the business world, Airbus has delayed a project to develop a hydrogen-powered aircraft by as much as a decade. Still, hydrogen retains significant positives. The Nature study pointed to potential applications in long-duration energy storage, long-haul transport, and heavy industry, while the German official, speaking on condition of anonymity, noted geopolitical upsides for fossil-fuel importers who would be able to draw more on allies and domestic production: “That’s a huge advantage in terms of economics and politics.” — Prashant Rao |

|

New Energy Phil Noble/File Photo/Reuters Phil Noble/File Photo/Reuters- Shares in Danish offshore wind company Orsted dropped almost 10% on the first day of trading since the Trump administration ordered Norway’s Equinor to halt construction of a wind farm.

- China generated a record nearly 951 TWh of clean electricity in the first quarter of 2025.

Fossil FuelsFinance- Public pension funds are prepared to drop asset managers that don’t comply with New York City’s goal to reach net zero emissions by 2040, comptroller and mayoral candidate Brad Lander warned.

Politics and Policy |

|

|