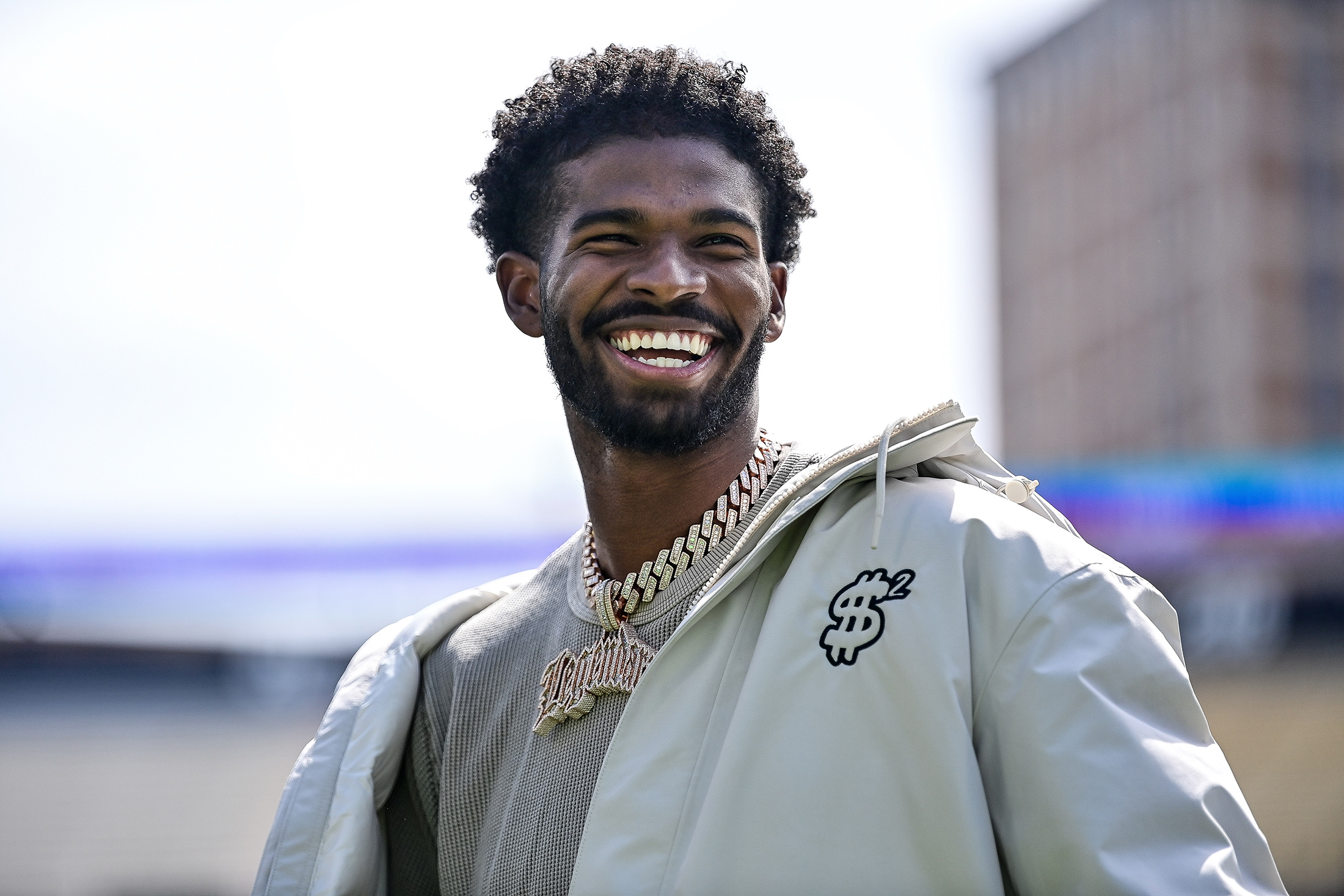

| What's up folks? It's Randall, and I’m back with an update on the NFL. It's been a relatively quiet offseason, even on the business side. But there will be fireworks on Thursday night with the NFL Draft kicking off in Green Bay, Wisconsin. According to numerous reports, scouts around the league are unimpressed with this year's draft class. And the most polarizing prospect is quarterback Shedeur Sanders. He’s the son of NFL Hall of Fame defensive back Deion Sanders, who was his head coach in college, including the past two seasons at the University of Colorado.  Former Colorado Buffaloes quarterback Shedeur Sanders during a ceremony to retire his college jersey on April 19, 2025. Photographer: Dustin Bradford/Getty Images On the field, scouts question Shedeur’s size and arm strength. Off the field, there are doubts about his attitude. I've talked to Shedeur a bunch over the years, dating back to when he was playing at Jackson State University, where he spent his first two seasons. He's his father's son, and what I mean by that he has his dad's work ethic, swagger and confidence.

In the locker rooms at Jackson State and Colorado, he held teammates to a high standard, but I never got the sense he alienated them. All of the teammates I've spoken to respected his game before his name. He'll have to earn that same respect at the pro level, and he knows that. We caught up during the offseason as he prepared for the NFL Draft. What's this offseason been like? It's been consistent, fun, isolated. I've been training just getting my mind and body right. What’s training for the NFL Draft been like? (Current projections have him going as high as the third overall pick to the New York Giants. Others see him being selected later in the first round, or in the second.) This is the first time I've been fully healthy for a long time, so that's what I'm indulging in. Eating more. Getting bigger and stronger and throwing the ball. You have a signature shoe with Nike, making you one of the few football players to have such a deal. Do you see more of your peers going that route? Not everybody can do it. You have to have real influence and be a household name. It takes a lot to get to that place, and I'm thankful for my dad who put us in a situation where we could carry on the legacy. When you're thinking about the draft, do the potential branding and business opportunities in that team’s city come into the process Overall, I'm thinking on the game. I'm going to make it happen in whatever city. We've been in chill cities like Jackson, Mississippi, and Boulder, Colorado, so I know what I'm able to do in any market and any city. What's a team getting out of Shedeur Sanders when you're selected? They're getting a winner. They're getting a leader. And they're getting someone that's able to change another program or franchise. I did it once. I did it twice. It's time to do it for the third time. (Editor’s note: This interview has been edited for clarity.) The Deal: Christine Dorfler | In the latest episode of The Deal, Alex Rodriguez and Jason Kelly talk about the potential #1 pick in the NFL draft and Alex’s report from sitting court-side in LA at a star-studded Timberwolves/Lakers Game 1 of the NBA playoffs. Then, they speak with Christine Dorfler about how she’s rising to the economy’s challenges as the NFL’s chief financial officer. Dorfler tells the hosts how a recession could affect the NFL’s media deal, why she sees so much potential in introducing private equity into team investments, and what she learned about resilience from being a military intelligence officer in the Army. |