| | In this edition, Citadel’s Ken Griffin, GM’s Mary Barra, and Germany’s finance minister join global ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Mary Barra on fair play

- American brand equity

- Universities find their backbone

- Make the Balance Sheet Great Again

- CEOs’ flex new skill

- Private markets’ big test

- BHP boss on tariffs

|

|

“The United States is more than just a nation. It’s a brand,” Citadel’s Ken Griffin said at Semafor’s World Economy Summit yesterday. “It can be a lifetime to repair the damage that has been done.” Tough words from the billionaire investor and Republican megadonor who was never exactly a cheerleader of President Donald Trump but was unsparing in his concerns about what the “Liberation Day” fallout means. Hi from Washington, where we’re on Day 2 of the summit and swimming in news. Mastercard CEO Michael Miebach said consumers may be freaked out, but they’re still spending. Germany’s finance minister said the EU is resisting the urge to let the White House wriggle on a hook of market pain: “The longer we wait for an agreement, the longer we let the uncertainty in both of our economies linger.” Steve Bannon is unimpressed with DOGE’s Wall of Receipts: “None of this makes sense.” And Davidson Kempner’s Tony Yoseloff likes distressed credit right now: “Buying debt at 60 or 70 cents on the dollar and often in an upside case, you get paid par.” Don’t panic, he was not talking about US Treasury bonds. But Griffin’s comments stuck with me, and were echoed by many people I talked to on stage and in a lively green room. CEOs are heartened by Trump’s climbdown, but none can envision rewinding the clock to April 1. “It’s like going home and asking your spouse, ‘should we get divorced?’” George Walker IV, CEO of asset manager Neuberger Berman, told me. “Even if three days later, you come back and say, ‘You know what? I’m all into this marriage. I’m committed’... there’s a real cost.” Stephen Miran, the White House’s top economist, urged patience and a focus on a big picture that includes negotiated trade deals, tax cuts, and regulatory reform that makes it easier “to build stuff here.” (Eat your heart out, Ezra.) “All of these, on the other side of the volatility that’s happening right now, are going to create a strong economy,” he said. By the time you get this, Day 2 will be in full swing. You can follow highlights here, and I’ll be back next week with some fully digested thoughts. |

|

Mary Barra on Trump, tariffs and state subsidies |

Shannon Finney/Getty Images for Semafor Shannon Finney/Getty Images for SemaforGM CEO Mary Barra sees some validity to rebalancing US trade with other countries. Speaking just before reports emerged that Trump plans to ratchet down some of his far-reaching auto parts tariffs, she said: “I generally believe in free trade, but I think you have to have a level playing field, and I think that’s what the administration is looking to achieve,” the GM lifer said in an interview with Semafor’s Andrew Edgecliffe-Johnson. Chinese automakers have been gaining share in Europe against US rivals at a steady clip. “I regularly go to China, so I’ve seen the progress,” Barra said. “I think that they’re a formidable competitor. I think we also have to understand that the industry is subsidized by the country.” (GM was also saved by the US government in 2008.) The thousands of parts inside GM vehicles are sourced globally, and thanks to extensive free-trade agreements between the US and our neighbors, those parts can cross the border multiple times before a car is finished. GM is already one of the largest manufacturers in the US, but Barra said she needed “clarity, and then I need consistency” before she was willing to commit to investing more money in the US. “I definitely believe that the US can still win” at onshoring manufacturing, she said, noting that her efforts to try and explain the complexities of her business to the administration in recent weeks had been “productive.” |

|

America’s soft power waning? |

Shannon Finney/Getty Images for Semafor Shannon Finney/Getty Images for SemaforCitadel’s Ken Griffin issued a strident warning on American exceptionalism, saying the Trump administration’s recent economic policymaking risked “eroding” the American brand, which he considers the best in the world. It was the billionaire Republican’s bluntest criticism of Trump’s economic policy, just days after markets went into a tailspin after the president indicated he might fire Fed Chair Jerome Powell, which he’s since walked back. Griffin’s remarks echo concerns that executives are starting to voice, though cautiously. Elliott Management’s Paul Singer reportedly said he was afraid the US dollar would lose its reserve currency status, while Goldman chief David Solomon said the long-hoped IPO resurgence had not materialized. |

|

Penny Pritzker on Harvard’s duty to resist |

Faith Ninivaggi/Reuters Faith Ninivaggi/ReutersPenny Pritzker, who sits on Harvard’s top governing board, said Thursday that the university is advocating for institutions across the country unable, for financial or structural reasons, to oppose the administration. “In general, across the country, people don’t want our federal government running our universities and our colleges, [given] the research, the contributions to innovation, the important scholarship that’s done at Harvard,” Pritzker said in an interview at WES. Harvard sued the administration this week after the White House cut billions in federal funding. Trump on Thursday decried the university as an “Anti-Semitic” institution that was ripping the country apart — and urged his sons to fire Quinn Emanuel attorney Bill Burck, who is representing Harvard and is a lawyer for the Trump family business. Pritzker conceded that changes were needed in the wake of pro-Palestinian protests that paralyzed campuses across America last year. “Harvard is very committed to addressing issues and combating antisemitism, to having a community that is strengthened by viewpoint diversity, that’s free from hate and harassment,” Pritzker said. But she also said that Harvard could not fight alone. “I see the momentum building,” she said of the hundreds of universities that signed an AAUC letter to the administration. |

|

America’s natural resources headed for the auction block? |

Thisisjacobcardel/Wikimedia Commons/CC BY-SA 4.0. Thisisjacobcardel/Wikimedia Commons/CC BY-SA 4.0.Monetizing — or at least slapping price tags on — America’s natural resources is an idea dating back to at least the Obama administration, Ariel co-CEO John Rogers said Wednesday on stage at WES. “You think about the Grand Canyon or the White House, things like that that are out there that are part of our nation,” said Rogers, a close advisor to the 44th president. “The value of those assets have grown and compounded over the years, and if you ever did find a way to monetize them, it could have a meaningfully positive impact on our debt.” Using proceeds from asset sales — more likely government buildings than the Grand Canyon — to pay down the $36 trillion national debt is an option, though unclear whether it’s Trump’s preference. It could seed a sovereign wealth fund, pay for tax cuts, or buy bitcoin — financial engineering moves typical for corporate America to boost balance sheets. “Just because the government owns assets, doesn’t mean the government is always the right owner of those assets,” Davidson Kempner investing chief Tony Yoseloff told Semafor. He pointed to New York’s public-private partnerships on Governors Island, while Rogers noted Chicago had pursued a similar privatization push with, in some cases, disastrous results. |

|

CEOs apply their Covid lesson to trade war pricing |

Kris Tripplaar/Semafor Kris Tripplaar/SemaforCEOs worldwide are deploying a skill they picked up during Covid to looming tariff uncertainty. “Most companies around the world didn’t even know how to manage price elasticity,” Carlyle CEO Harvey Schwartz said of the Covid-induced supply shock. “They didn’t know they had pricing power.” They do now: pandemic shortages and post-pandemic inflation taught CEOs exactly how, and when, to squeeze suppliers and customers. “I actually think companies are really well positioned to be dynamic,” Schwartz said. |

|

Rich investors can’t get enough of private markets |

Kris Tripplaar/Semafor Kris Tripplaar/SemaforMarket volatility is a big test for private markets, two of the largest investors told Semafor. Firms that make private loans and do corporate buyouts hold themselves out as insulated from gyrations, but critics say firms are too slow to recognize losses. In Blackstone’s recent earnings, for example, its publicly traded bonds and loans were essentially flat, while its private credit holdings rose 3%. “Our client base is high net worth and ultra high net worth, primarily American families,” Rockefeller Capital CEO Greg Fleming said. Those investors are willing to accept the illiquidity that comes with private markets in return for their smoothed-out returns — on paper anyways. “In times of stress, there is actually a premium value to the fact that it’s permanent capital,” Franklin Templeton CEO Jenny Johnson said. |

|

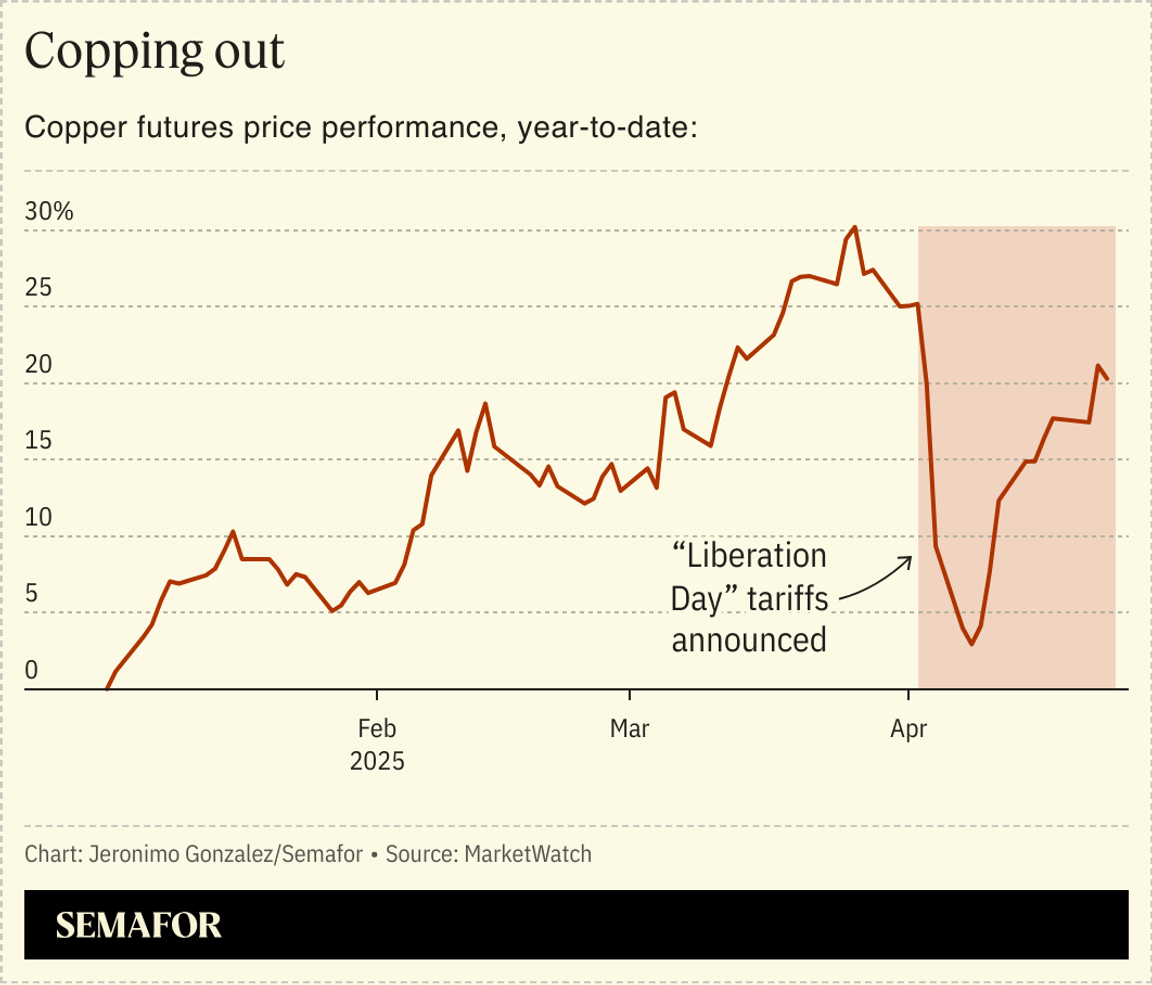

BHP’s chief ‘vexed’ by copper tariffs |

Potential US tariffs on copper imports won’t boost domestic mining, the CEO of the world’s largest mining company and copper producer told Semafor’s Tim McDonnell, capturing a message many executives are trying to get to the White House: the help isn’t that helpful. BHP boss Mike Henry said red tape is still the main constraint on new mines in the US. Trump has threatened to impose a tariff of up to 25% on copper imports, primarily from Latin America. But for a mining project that will operate for decades and cost billions of dollars, tariffs don’t offer enough security to be the basis for an investment decision, Henry said: “There’s not enough certainty.” The White House has promised to pair permitting reform with tariffs and tax cuts as part of a broader pro-business agenda, but has taken little action so far. “We need to get the government out of the way,” Miran said, “so that businesses have certainty and foresight over the fact that they’re going to be able to break ground.” |

|

|