| | In this edition: Trump backs the Lobito Corridor, moving beyond aid, South Africa scraps a controver͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Trump backs Lobito Corridor

- Moving beyond aid

- Spain’s W. Africa program

- S. Africa scraps VAT hike

- Kenya boosts China, EU ties

- Africa’s new space agency

- Kenya mobile money drops

- Person of Interest

- Weekend Reads

The growing global impact of Afrobeats. |

|

Hello! Today is the final day of Semafor’s World Economy Summit here in Washington. Alexis and I have heard how industry and government leaders intend to reset for an uncertain global economic environment given the impact of US tariff hikes. But for those who work in Africa, the challenges are still quite fundamental. On Thursday I spoke backstage with former US President Joe Biden’s energy czar Amos Hochstein. He was encouraged by the Trump administration’s continued support of the Lobito Corridor in southern Africa (see below), but noted that the biggest hurdle he faced with getting the project off the ground was attracting capital: “The problem is nobody wants to invest because they attach a risk premium that creates a need for something like 25% to 30% returns.” This is why the US government should continue to use its influence on the continent to help de-risk capital, he argued. Earlier, in a press conference, Samaila Zubairu, chief executive of Africa Finance Corporation, which coordinates the Lobito partners, emphasized the need for African investment to boost infrastructure projects by working with local pension funds and sovereign wealth funds to unlock new sources of capital. Alexis was told something similar during his on-stage interview with James Mwangi, CEO of Equity Holdings and Leslie Maasdorp, CEO of British International Investment. They both highlighted the opportunity for “innovative thinking” to access capital and drive growth on the continent. |

|

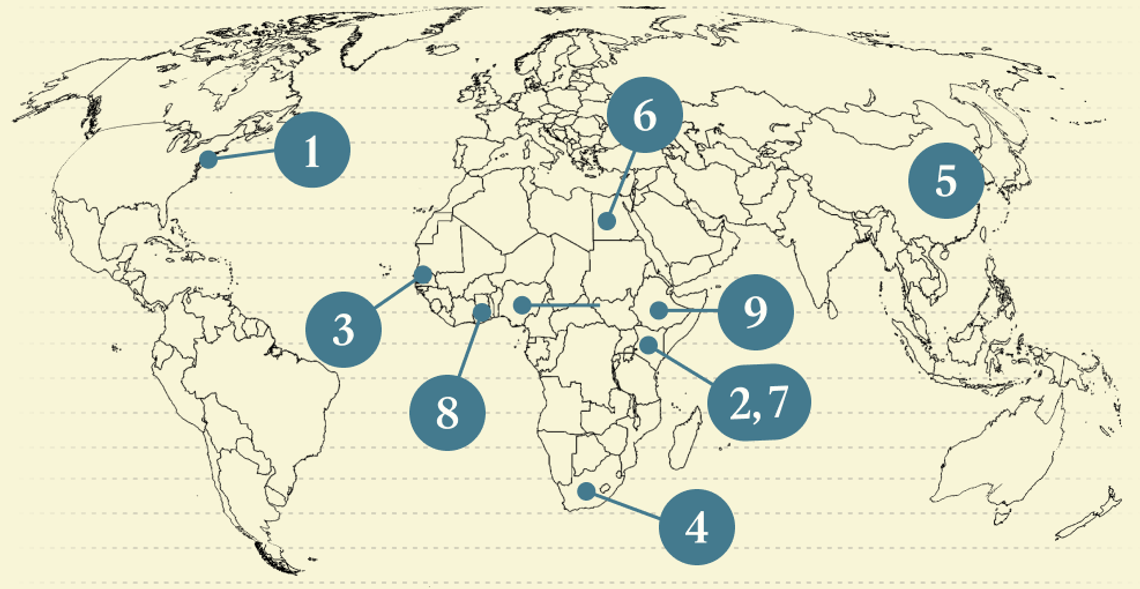

Trump supports Lobito Corridor |

Map of Lobito Corridor rail project and connecting railways/Semafor Map of Lobito Corridor rail project and connecting railways/SemaforAfrican governments welcomed the Trump administration’s endorsement of the $4 billion Lobito Corridor in southern Africa. The project to upgrade rail networks connecting Zambia and DR Congo to Angola’s Lobito port — for the transportation of critical minerals — was the centerpiece of the Biden administration’s efforts to counter China’s influence in Africa. It had not been clear whether US President Donald Trump would give it the nod. But in a statement posted on X on Wednesday, the US State Department said it was an investment Washington “remains committed to” and “feels is very important.” “We are very grateful,” Zambian Finance Minister Situmbeko Musokotwane said of the renewed support during a press conference in Washington, DC. Stressing the importance of the project, Angola’s Transport Minister Ricardo Viegas D’Abreu said: “It is critical for Africa that we are able to improve the quality of our infrastructure and logistics for the promotion of intra-Africa trade.” — Alexis Akwagyiram |

|

Private sector offers post-USAID hope |

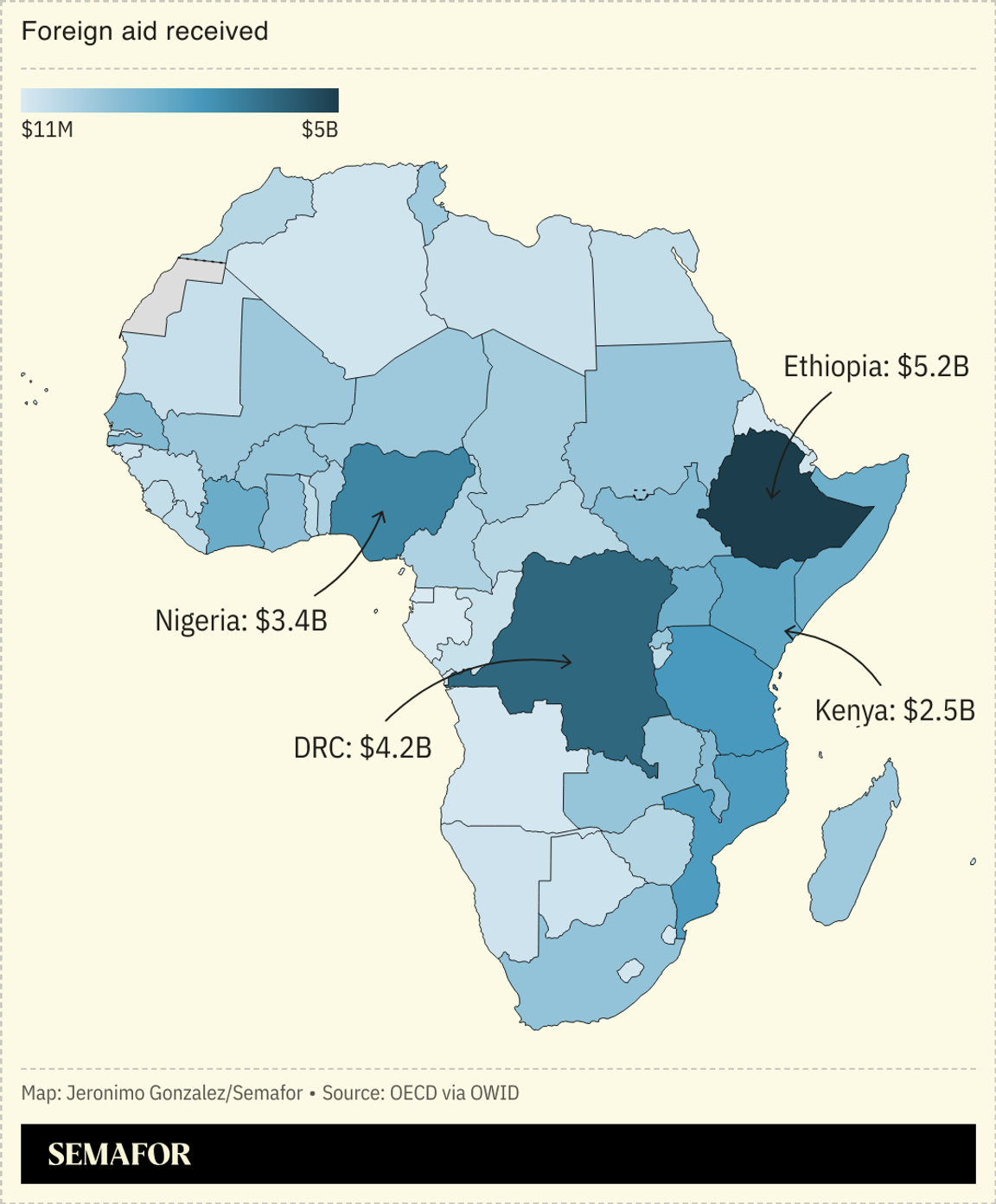

Africa’s private sector has the potential to generate the economic growth needed to minimize the impact of Western cuts to development aid, two of the continent’s top bankers told Semafor. The slashing of US aid spending has created funding shortfalls for African countries that relied heavily on American assistance for health and energy programs. South African banker Leslie Maasdorp, CEO of the UK’s development agency British International Investment, said ending the era of “aid dependence” was a positive development. Maasdorp, speaking at Semafor’s World Economy Summit in Washington, DC, added that private capital could replace some of the funding that used to come from governments. “We need to mobilize third-party money from pension funds, insurance companies, sovereign wealth funds, from the institutional investor community,” he said. James Mwangi, CEO of East Africa’s largest banking group Equity Holdings, said a ready supply of minerals needed for the energy transition and a youthful labor force were sources of optimism: “Africa is in a very good position to reorganize the global market,” he told the World Economy Summit. — Alexis |

|

Spain pushes W. Africa investment |

Spain’s Economy Minister Carlos Cuerpo. Shannon Finney/Getty images for Semafor. Spain’s Economy Minister Carlos Cuerpo. Shannon Finney/Getty images for Semafor.Spain has launched a program of private sector investment aimed at fostering economic development and job creation in West Africa, its economy minister told Semafor. Carlos Cuerpo, speaking at the World Economy Summit, said the Africa Forward Alliance program was rolled out first in Senegal and would later be extended to The Gambia and Mauritania. “We want to create economic development in countries that are the origin of big migration flows for Europe, and Spain in particular,” Cuerpo said, adding that the aim was to “align the interests of the African countries with those of private and multilateral investors.” Cuerpo also said Spain had released $1.9 billion to a fund that provides support to the world’s poorest countries through the reallocation of the country’s holdings at the International Monetary Fund and urged other advanced economies to support low-income nations amid Western cuts to development aid. — Alexis |

|

S. Africa scraps VAT hike |

Esa Alexander/File Photo/Reuters Esa Alexander/File Photo/ReutersSouth Africa’s finance minister scrapped a controversial VAT hike that had threatened to collapse the coalition government. The climbdown by Enoch Godongwana of the African National Congress came after the center-right Democratic Alliance, the second-biggest party, said it would quit over the issue. Following the policy shift — which effectively maintains the VAT rate at 15% — Goldman Sachs lowered its 2025 inflation forecast for South Africa, bringing it down to 3.1% from 3.3%. The result is a “victory for all South African taxpayers,” the head of the DA said of a move that had been unpopular among many voters. Bonds also saw gains as investors welcomed the U-turn, Bloomberg noted. |

|

Kenya boosts China, EU ties |

Iori Sagisawa/Reuters Iori Sagisawa/ReutersKenya bolstered trade ties with both the European Union and China in the face of tariff threats from the US — its second-biggest export market. The EU said it expects trade between the bloc and Africa’s sixth-biggest economy to double after signing a duty-free trade agreement. Meanwhile Nairobi upgraded its ties to Beijing to “a new level” after a meeting between the countries’ leaders in China. Over the past two decades, Beijing has become Africa’s biggest lender and trade partner, while Chinese firms have outmuscled American and European competitors across the continent. This item first appeared in Flagship, Semafor’s daily global affairs newsletter. Subscribe here. → |

|

|

AU launches African Space Agency |

Ahmed Gomaa/Xinhua via Getty Images Ahmed Gomaa/Xinhua via Getty ImagesThe African Union launched the inaugural African Space Agency in Cairo, the second such regional body after Europe’s, in a sign of the continent’s growing space ambitions. AfSA will coordinate the space exploration efforts of the AU’s 55 member countries as well as collaborations with international space partners. In an initial partnership with the European Space Agency, the body will work on climate-based Earth observation missions. A second partnership with the United Arab Emirates Space Agency will be centered around developing small satellites. More than a dozen African countries have satellites in space but none have deployed an astronaut mission. The continent also largely depends on foreign space launch facilities for its activities. AfSA marks “a pivotal step” in “consolidating the continent’s role as an active player in the global race for technological advancement,” the Egyptian minister of foreign affairs and migration said at the body’s launch on Sunday. |

|

Mobile money falls in Kenya |

The drop in the value of mobile money transactions in Kenya in the 12 months to February 2025, the Kenya National Bureau of Statistics said. The year-on-year decrease came despite a rise in the number of both mobile money agents and subscriptions, with more than a million subscribers added between January and February this year alone. Kenya’s annual mobile money transaction value has fallen for two consecutive years, dropping 17% year-on-year to close at $51 billion in 2024 due to rising prices amid shrinking incomes. Mobile network operator Safaricom remains the leading provider of mobile money services in Kenya, with a 91% market share. |

|

Person of Interest: Gertrude Torkornoo |

Ernest Ankomah/File Photo/Getty Images Ernest Ankomah/File Photo/Getty ImagesGertrude Torkornoo, the chief justice of Ghana’s Supreme Court, was suspended this week in an unprecedented move. No explanation has been offered for why the 62-year-old was removed from the job but the announcement by Ghana’s President John Mahama has drawn outrage: A former attorney general called it “a complete charade” and “the biggest assault on the [judiciary] in the nation’s history.” Alex Vines, director of the Africa program at think tank Chatham House, told Semafor the suspension was “an alarming development.” A change in government has in the past seen the removal of individuals appointed during an earlier administration — Torkornoo was nominated in 2023 by former President Nana Akufo-Addo — but never before has a chief justice been suspended. Without any details, “it’s impossible to assess whether this is a political move or based on evidence of a serious lapse of professional conduct,” Vines said. |

|

|