|

👋 Howdy Partner,

Five thousand dollars.

That’s my number.

Not a fortune. But enough to change a life. Enough to buy freedom.

My goal at Compounding Dividends is simple: generate $5,000 a month in passive income. Every month. Rain or shine.

That’s $60,000 a year. A middle-class salary. Without working a single day.

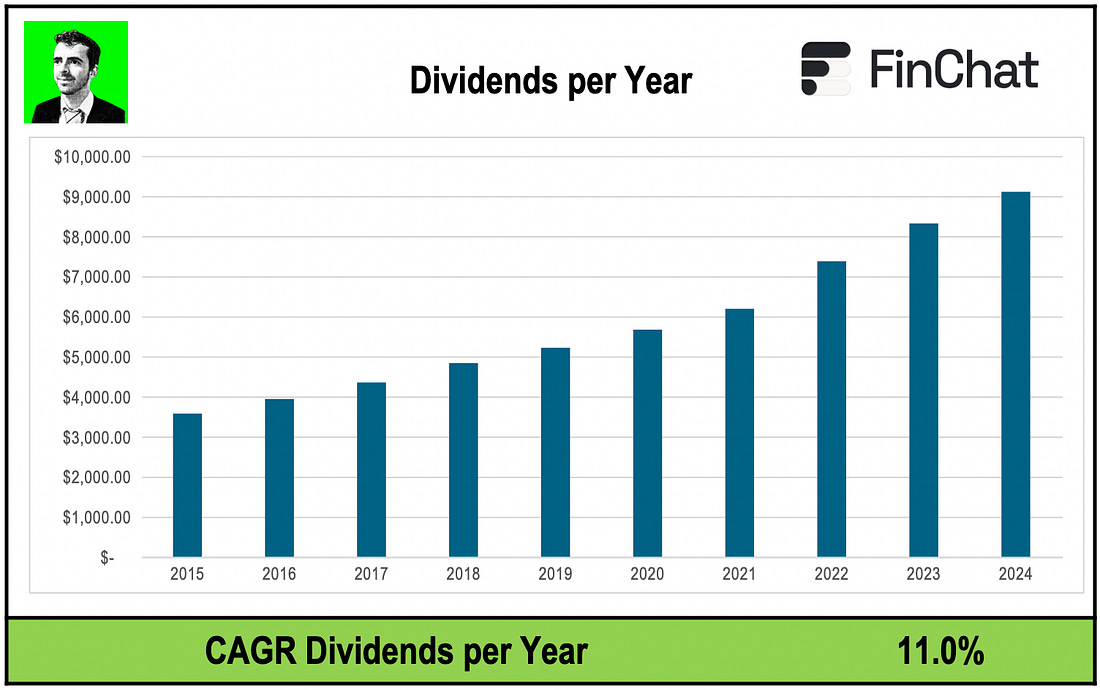

Last year, the portfolio brought in just over $9,000. Not bad. But still a long way to go.

Here’s the thing most people miss… These dividends grow. They grow every year. Like clockwork. The average annual growth? 11%.

At that pace, they double roughly every 6.5 years. Not because I’m a genius. But because the math works.

Let’s say I had a $1 million portfolio. With our current 3.64% yield, that’d give me $36,400 in annual income. No guesswork needed.

And if I let that income grow at the same rate - 11% - I’d hit my target in about five years.

That’s not hope. That’s a plan.

It’s not sexy. There’s no meme stock, no crypto lottery ticket. Just boring, beautiful compounding.

Can ASSA ABLOY Help Me Reach My Goal?

Let’s find out with a Not-So-Deep Dive.

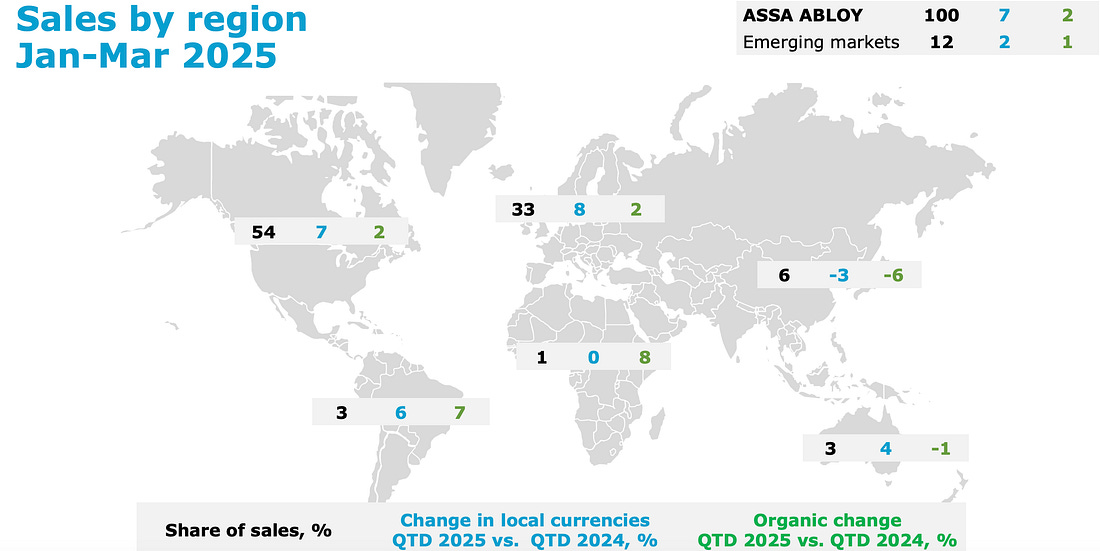

ASSA ABLOY AB is the global leader in door locks, access control systems, and entrance automation.

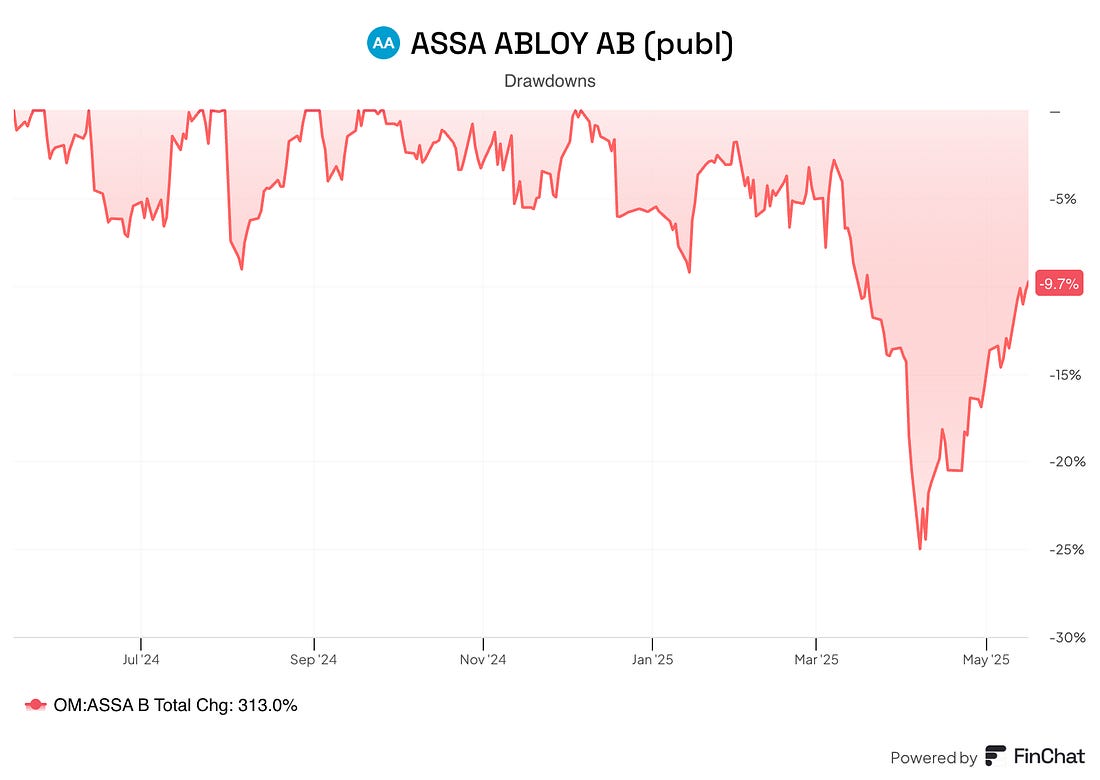

After weaker organic growth in early 2024 and broader European economic slowdown fears, the stock is down about 10% from its highs:

|

Why has Assa Abloy struggled recently?

Slower construction activity in Europe

Higher interest rates have hurt new building starts

Short-term integration costs from recent acquisitions

Some cautious customer ordering patterns

Essentially, growth temporarily slowed while the company continued to invest for the long term.

1. Do I understand the business model?

Assa Abloy manufactures and sells door opening solutions.

They operate in 5 segments:

Opening Solutions (EMEA, Americas, Asia-Pacific): Locks, doors, access control

Global Technologies: Digital access and identity solutions (like keycards, biometric access)

Entrance Systems: Automated doors, industrial entrances

In simple terms:

They make mechanical locks, digital locks, automated doors, and security systems.

They sell products to:

Builders (new construction)

Renovation and retrofit (upgrading existing doors and security)

End-users like offices, hotels, hospitals, airports, and industrial facilities.

70% of sales are from aftermarket/retrofit (recurring), not new construction.

2. Is management capable?

You want to invest in companies led by great managers.

Nico Delvaux has been CEO since 2018.