|

|

Hi Partner 👋

I’m feeling so good.

Why? Because I know I’m investing in great companies that will continue to make money for me while I sleep.

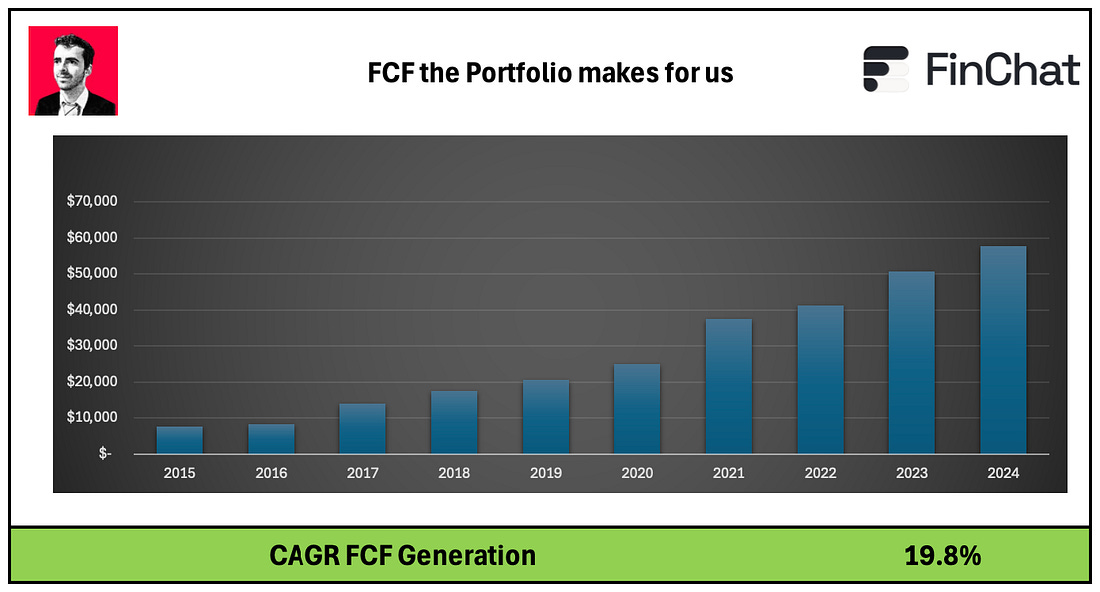

Just look at this chart:

It shows the Free Cash Flow Our Portfolio is generating for us.

This number will only keep going up in the years ahead.

Current environment

In the previous Portfolio Update on April 13th, I wrote that it was a great time to start investing.

There was a lot of uncertainty in the market because of the import tariffs from Donald Trump.

But things can change fast…

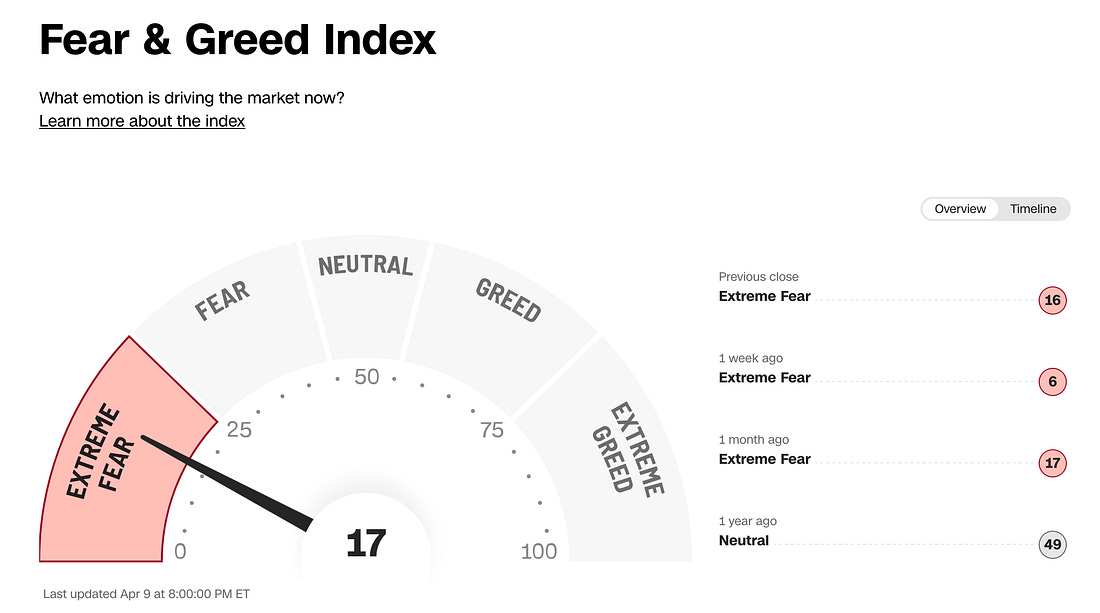

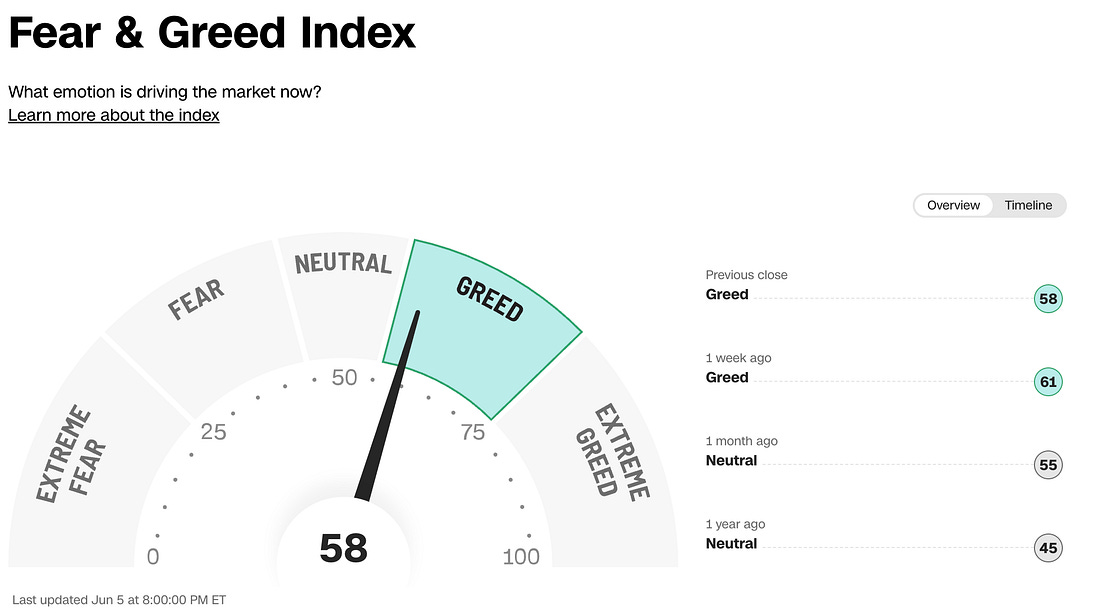

Here’s what the Fear & Greed Index looked like at the beginning of April:

|

And here’s what things look like right now:

|

Since our previous Portfolio Update, the S&P 500 is up +10%.

We added to 6 positions in April. It was the perfect timing in hindsight.

Congratulations if you followed along!

But to be honest, we were just lucky. Nobody can time the market:

"Only liars manage to always be out during bad times and in during good times." - Bernard BaruchThe key lesson? The best returns are generated in times of high uncertainty.

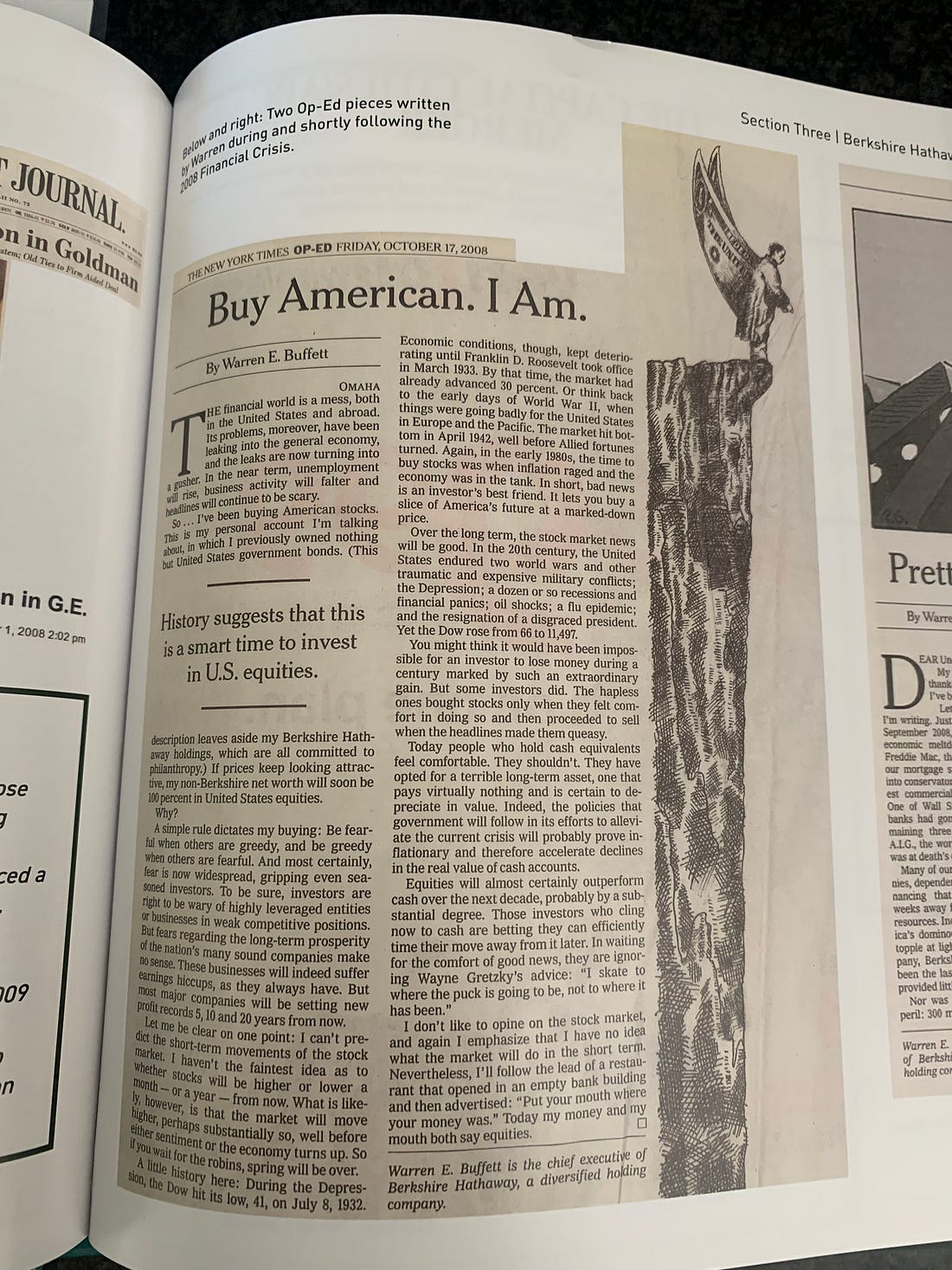

In Omaha, I received the book ‘Celebrating 60 Years of a Profitable Partnership (Berkshire Hathaway)’ from my friend Pavel.

Pavel is a very loyal reader. You can read an interview with him here.

I loved this piece where Warren Buffett mentioned it was an amazing time to invest during the Financial Crisis:

While what happened earlier this year is nothing compared to the Financial Crisis, it’s still great to always keep the following in mind:

"Be fearful when others are greedy and to be greedy only when others are fearful.” - Warren BuffettPortfolio Fundamentals

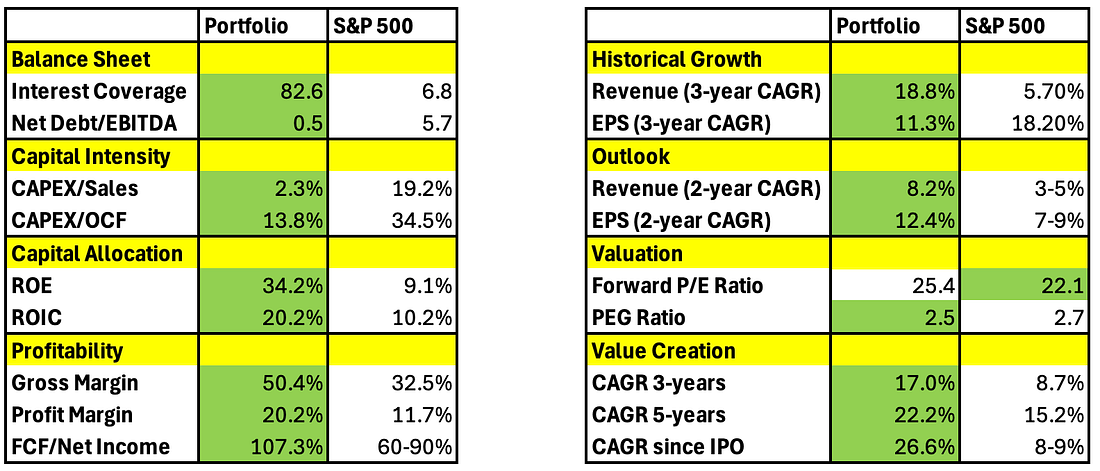

Our goal is simple.

We want to beat the S&P 500 by 3% per year in the very long term.

I am comfortable that we can achieve this.

Why? We own fundamentally healthier companies that are trading at more or less the same valuation level as the index.

Free Cash Flow

Earnings are an opinion, (Free) Cash Flow is a fact.

As shareholders, we are the owners of the companies we invest in.

As a result, we should look at the cash a company generates for us.

Here’s an overview of how much Free Cash Flow each position is generating:...