|

Would you rather have cheap energy, or stupid culture wars?

Trump's "Big Beautiful Bill" is an attack on American energy production.

|

There are many things to despise about Trump’s deeply unpopular budget bill, known as the One Big Beautiful Bill, or BBB. It would expand the national debt to dangerous levels with irresponsible and unnecessary tax cuts. It would shift the distribution of income upward. But perhaps the most ridiculous, pointless, and downright insane feature of the BBB is its attack on American energy supply.

Previous versions of the BBB eliminated government subsidies for solar and wind energy. The new version now being debated in the Senate would actually add a tax on solar and wind energy. Politico reports:

Senate Republicans stepped up their attacks on U.S. solar and wind energy projects by quietly adding a provision to their megabill that would penalize future developments with a new tax…The new excise tax is another blow to the fastest-growing sources of power production in the United States, and would be a massive setback to the wind and solar energy industries since it would apply even to projects not receiving any [tax] credits…

Analysts at the Rhodium Group said in an email the new tax would push up the costs of wind and solar projects by 10 to 20 percent — on top of the cost increases from losing the credits…

The provision as written appears to add an additional tax for any wind and solar project placed into service after 2027…if a certain percentage of the value of the project’s components are sourced from prohibited foreign entities, like China. It would apply to all projects that began construction after June 16 of this year.

The language would require wind and solar projects, even those not receiving credits, to navigate complex and potentially unworkable requirements that prohibit sourcing from foreign entities of concern — a move designed to promote domestic production and crack down on Chinese materials.

In keeping with GOP support for the fossil fuel industry, the updated bill creates a new production tax credit for metallurgical coal, which is used in steelmaking.

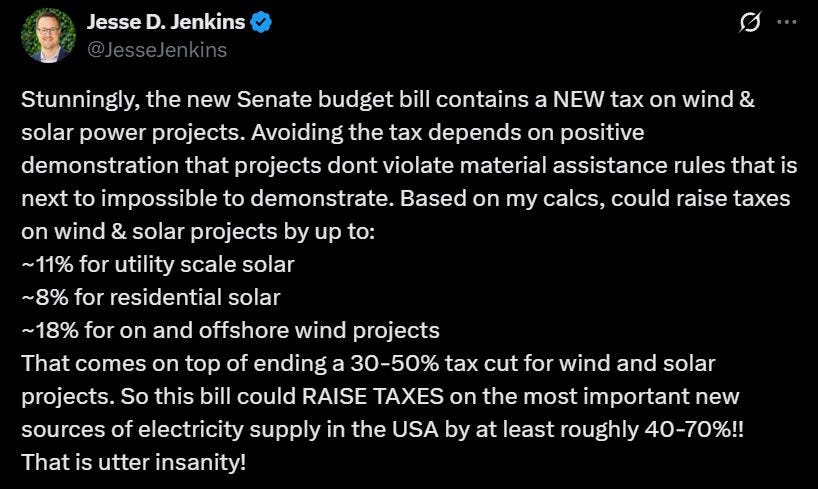

Jesse Jenkins, a widely respected energy modeler and Princeton engineering prof, has estimated how much this GOP bill would raise taxes on solar energy, and it’s a lot:

Later in his thread, he explains how he arrived at these estimates.

But it gets worse! As Jenkins notes, the bill would also tax nuclear and geothermal energy and battery storage, and subsidize the coal industry:

The new draft of the 'One Big Beautiful Bill'…now contains FOUR tax increases on wind & solar projects — and two facing nuclear, geothermal, and batteries.

It ends tax cuts for wind & solar projects…

It kills accelerated depreciation available to wind & solar investments since 1986…

It imposes a new tax on wind & solar projects…

Raises taxes on US wind manufacturers…

The bill ALSO raises taxes on batteries, geothermal and nuclear projects that can't meet significant, burdensome requirements to prove not a drop of Chinese content as well. And they all lose accelerated depreciation too it seems…

The kicker: the bill raises taxes on the electricity technologies of the future while ALSO creating a new subsidy for coal used for steel making, coal that we…export to China so they can dump cheap dirty steel on the global market! THAT is the GOP's plan for energy dominance??…

And of course, it does that while murdering 100s of US manufacturing projects set to employ 100s of thousands of Americans in good paying jobs building the energy technologies of the future.

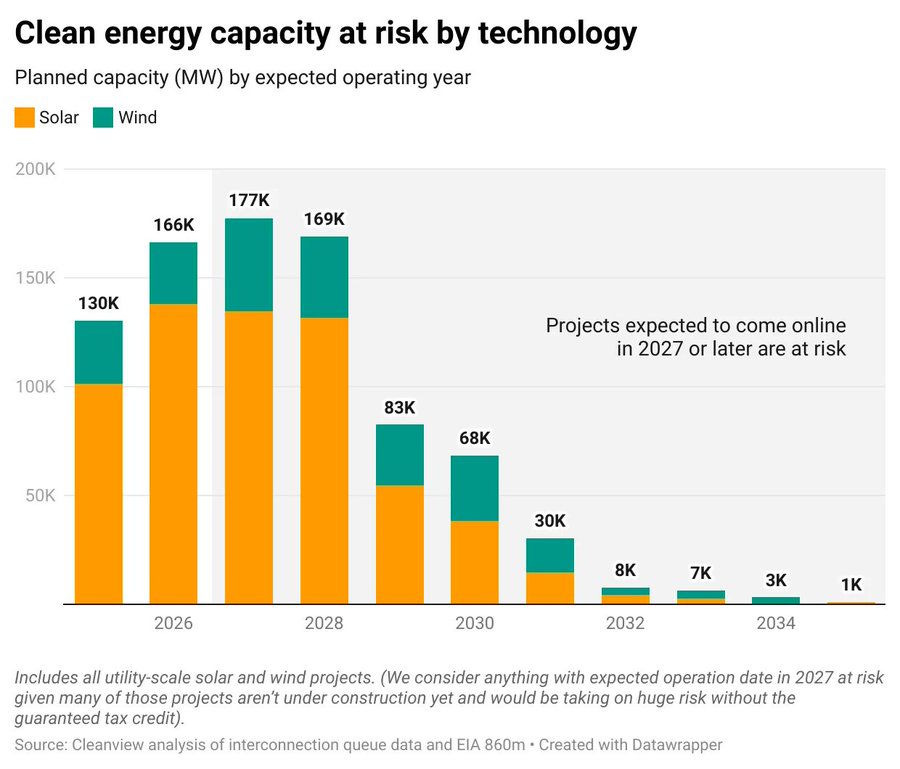

Michael Thomas of Clearview Energy, a company that tracks energy-related data, estimates that this bill will lead to the cancellation of more than 500 GW of planned energy supply in the U.S.:

|

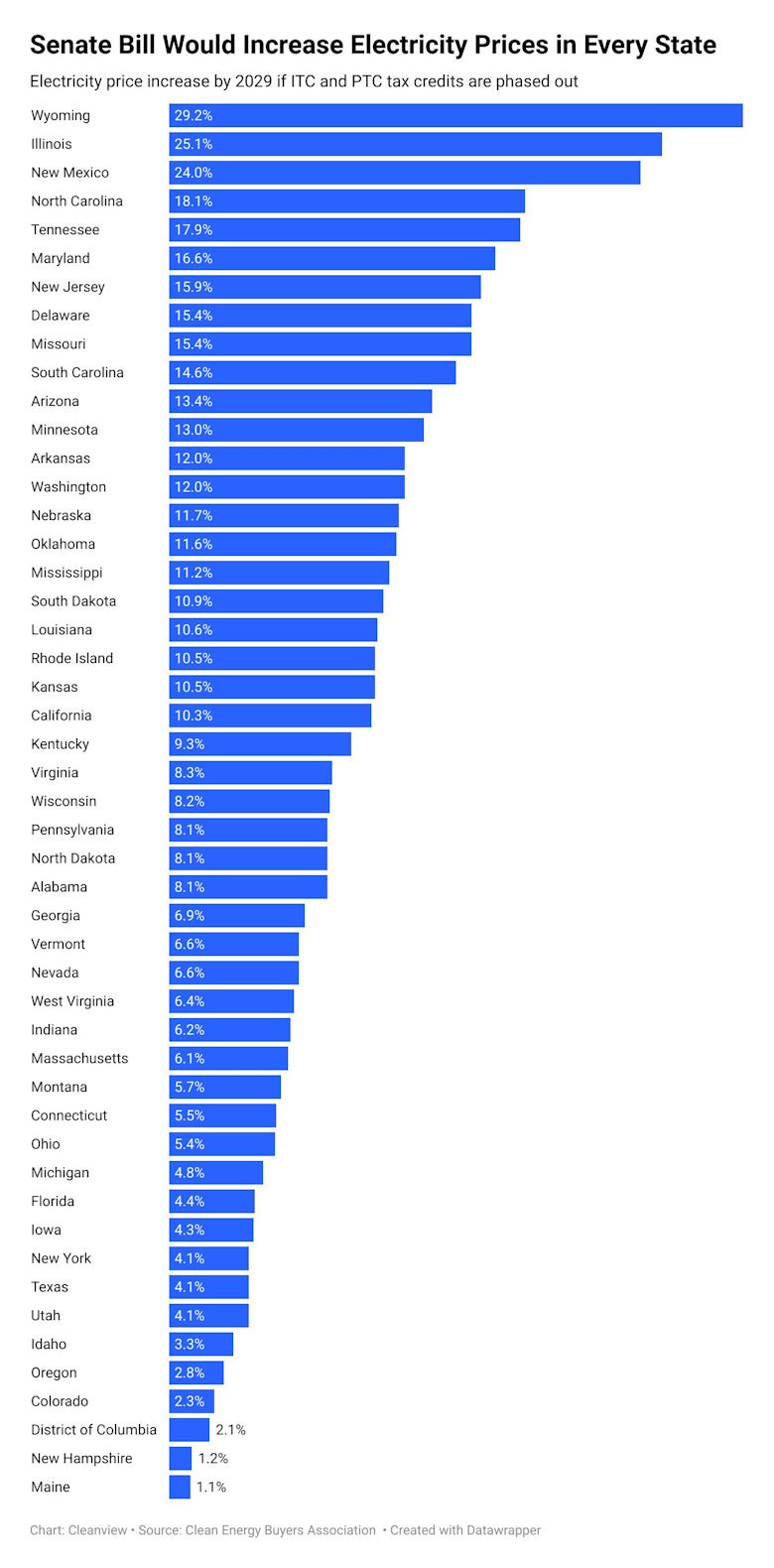

That would have represented more than a 42% increase in U.S. electricity production, and it would have gone to power homes, factories, offices, data centers, and more. Now, under Trump’s budget, that will all be gone. Thomas estimates that this will lead to substantial increases in electricity bills for Americans:

|

CNN has an interactive tool that allows Americans to see how much their energy bills could go up if Trump’s BBB passes, according to estimates from the think tank Energy Innovation. They write:

Red states including Oklahoma, South Carolina and Texas could see up to 18% higher energy costs by 2035 if Trump’s bill passes, compared with a scenario where the bill didn’t pass…Annual household energy costs could rise $845 per year in Oklahoma by 2035, and $777 per year in Texas. That’s because these states would be set to deploy a massive amount of wind and solar if Biden-era energy tax credits were left in place. If that goes away, states will have to lean on natural gas to generate power.

Trump’s bill wouldn’t just make energy more expensive; it would make it less reliable too. In Texas, adding solar and batteries to the grid has allowed it to avoid blackouts. This is from the New York Times last year:

During the scorching summer of 2023, the Texas energy grid wobbled as surging demand for electricity threatened to exceed supply. Several times, officials called on residents to conserve energy to avoid a grid failure.

This year it turned out much better — thanks in large part to more renewable energy.

The electrical grid in Texas has breezed through a summer in which, despite milder temperatures, the stat