| Bloomberg Evening Briefing Asia |

| |

| President Donald Trump is keeping up the pace with seemingly a new tariff development every day. This time, he flagged that levies are coming on pharmaceuticals as soon as the end of the month and semiconductors could be next. That would tee them up to hit alongside broad “reciprocal” rates set for implementation on Aug. 1.

He reiterated a threat of “very high” import taxes kicking in eventually — he previously flagged tariffs as high as 200% after giving companies a year to move manufacturing to the US. Drugmakers like Eli Lilly, Merck and Pfizer could be impacted immediately, risking higher costs for US consumers. The inflationary threat is compounded by the semiconductor tariffs, which are expected to affect not only the chips themselves but popular products like Apple and Samsung laptops and smartphones. —Balázs Penz | |

What You Need to Know Today | |

| Nvidia boss Jensen Huang anticipates getting the first batch of US licenses to export H20 AI chips soon after he won a sudden reprieve to do business in China. That would formally allow the company to resume sales of a much sought-after component in the world’s top semiconductor arena. The billionaire, who is visiting Beijing, said the company had plenty of orders to fill.  Jensen Huang in Beijing on July 15. Photographer: VCG/VCG | |

|

| Kevin Hassett, one of Trump’s longest-serving economic aides, is the early frontrunner to replace Jerome Powell as Federal Reserve chief next year, according to people familiar with the process. Hassett, director of the National Economic Council, and Kevin Warsh are the top two contenders in an Apprentice-like contest run by Trump out of the White House. Treasury Secretary Scott Bessent is advising on selection — but could get the job himself if others fail to impress — while Fed governor Christopher Waller remains the dark horse, said people familiar with the deliberations. | |

|

| Huawei took the top spot in China’s smartphone market for the first time in more than four years, a comeback fueled by new designs and software that appealed to users in a slowing market. The hardware giant held on to a roughly 18% share of the market in the June quarter, while other leading competitors like Vivo and Oppo slumped.  Huawei Pura X. Photographer: Zhongjia Sun/Bloomberg | |

|

| SoftBank founder Masayoshi Son and OpenAI chief Sam Altman see insatiable demand for AI that makes it imperative to keep building ever more computing capacity. The two business partners in a teleconference argued that advancing artificial intelligence would lead to new jobs that are not yet imagined, and the advancement of robotics will help kickstart a “self-improvement” loop. | |

|

| Larry Ellison is the world’s second-wealthiest person for the first time ever, according to the Bloomberg Billionaires Index, as a red-hot rally in Oracle shares catapulted his net worth to $251.2 billion. Oracle has been a key winner as investors have piled into AI stocks. The stock price has nearly tripled since ChatGPT was released to the public in November 2022, but it’s been on a particular tear over the past three months, with the stock gaining more than 90% since late April as the computing provider recorded surging revenues and inked key partnerships.  Larry Ellison. Photographer: Aaron Schwartz/Sipa | |

|

| BNP Paribas is betting an army of 500 coders will be able to help it grab more market share in the growing business of prime brokerage. The French bank has been adding dozens of software engineers to help it develop a new platform that determines how much margin it requires hedge fund clients to keep on hand. The explosive growth of prime brokerage — the business of lending hedge funds cash and securities to help execute their trades — mirrors the surge in both the number and size of hedge funds around the world. The product has been a boon for Wall Street revenues in recent years. | |

|

| A mysterious entity based in the heart of Singapore’s financial district emerged as the biggest shareholder in International Flavors & Fragrances nine years ago. It turned out that the owner was the Rausing family, which hails from Sweden and made a fortune from Tetra Pak cartons. It’s now also clear that the stake was one of the first public disclosures about how the media-shy clan deploys its billions. | |

What You’ll Need to Know Tomorrow | |

| |

| |

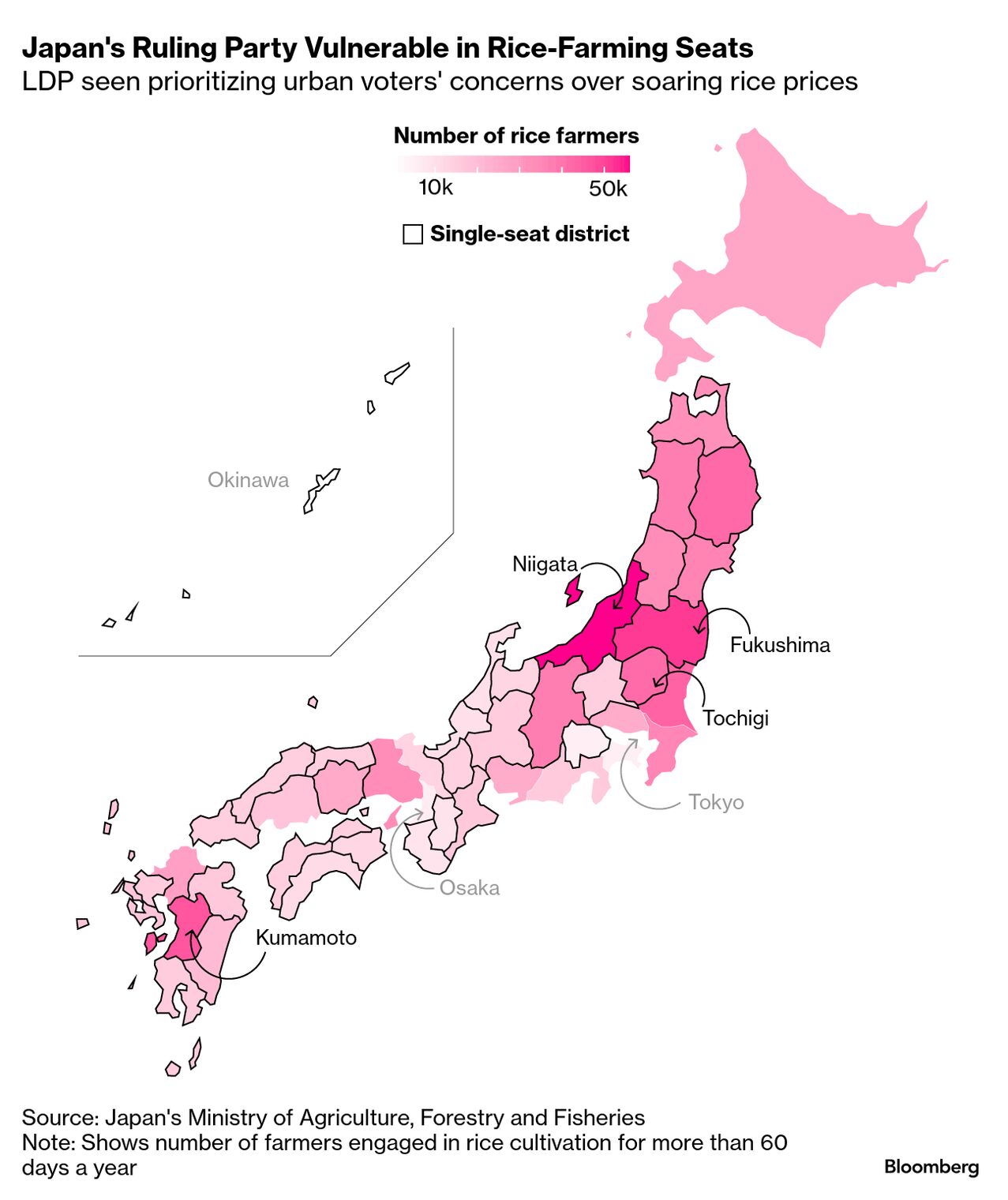

| In Japan, where politicians usually favor caution over confrontation, Shinjiro Koizumi is proving to be an exception. Dressed in a sharp navy suit and crisp white shirt, the 44-year-old son of a former prime minister showed up in the rice-growing heartland of Yamagata this month with a message few farmers wanted to hear: The price of rice must come down. Only two months into his role as agriculture minister, Koizumi has become the face of a risky political bet by Prime Minister Shigeru Ishiba. With inflation eating into household budgets and approval ratings sinking, the ruling Liberal Democratic Party is counting on Koizumi’s reformist drive — and his famous surname — to win back frustrated urban voters in an election for Japan’s upper house on Sunday.  Bloomberg Sustainable Business Summit: Business leaders and investors from around the world will gather in Singapore on July 30 for solutions-driven discussions on the future of climate goal setting, Asia's energy mix in the era of artificial intelligence, the global sustainable finance race and many other critical topics that are driving resilience and long-term value. Click here for more details. | |

| Enjoying Evening Briefing? Check out these newsletters: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Balance of Power for the latest political news and analysis from around the globe

- India Edition for an insider’s guide to the emerging economic powerhouse

- Hong Kong Edition for what you need to know from the Asian finance hub

Explore all newsletters at Bloomberg.com. | |

| |