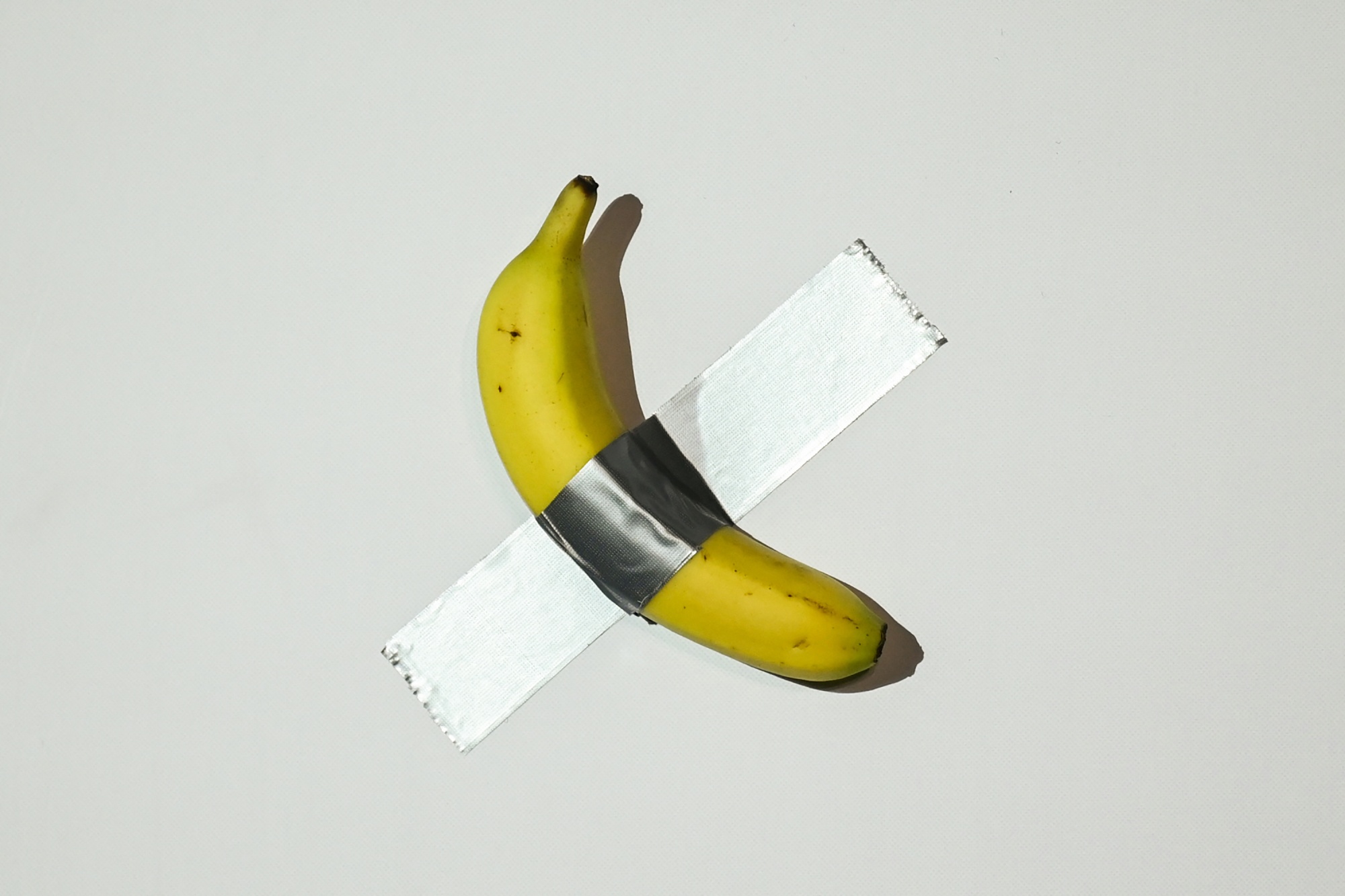

| This is Bloomberg Opinion Today, the full faith and credit of Bloomberg Opinion’s opinions. On Sundays, we look at the major themes of the week past and how they will define the week ahead. Sign up for the daily newsletter here. The buying and selling of art is an expensive, confusing and intimidating business, but at its heart lies a simple truth: A painting is worth exactly as much as somebody is willing to pay for it. Same goes for sculpture, photographs, ceramics, installations, conceptual art, jewelry and bananas. (But not NFTs, which are worthless no matter how much some clown was willing to pay for it.) So here’s a question: Can you buy art — even nonexistent art — with nonexistent money created by a nonexistent person? I mused on this last night at an art opening, when I asked the gallerist [1] if she ever had a buyer propose paying for a piece — a three-dimensional object made of, y’know, atoms and molecules and stuff — with a digital currency. Yes, she said, it had happened recently, and she told the customer she preferred something backed by the full faith and credit of the US Treasury. The collector then whipped out a checkbook and paid her. Talk about analog! And it didn’t bounce, physically or metaphorically. I guess, however, I just wasn’t into the spirit of CRYPTO WEEK,™ which will go down as yet another time Congress passed a law — the GENIUS act — that many of its supporters and detractors seemed to grasp no better than I did. Two other bills didn’t make the cut (yet): the CLARITY Act and the not-so-catchy Anti-CBDC Surveillance State Act. [2] Luckily, John Authers and Richard Abbey understand all this so we don’t have to. [3] “The Genius proposal is part of a raft of crypto-centric bills being debated during so-called ‘Crypto Week.’ It aims to create a federal regulatory framework for stablecoins,” they wrote before the vote. “More crucially, the new regime will be responsible for setting guidelines for the issuance and use of digital assets. The goal is to complete building a comprehensive process for regulating digital assets.” In other words, it looks like the Wild West of digital currency is being roped into the corral. And the gunslingers are all in favor. “Does that mean upcoming friendlier regulations and increasing institutionalization bode well?” John and Richard ask. “As Bitcoin sheds its libertarian roots and clamors for government help, the risks in a volatile environment only multiply. Crypto Week will need to be judged in months and years ahead — but for now, crypto bros can celebrate their wins.” Allison Schrager doesn’t think we need to wait that long for judgment. “The bill would introduce a tremendous amount of risk to the financial system and to consumers. And for what purpose? The US already has a means of payment — it’s called the dollar — and it works pretty well,” she writes. “The Bank of International Settlements has a better suggestion: To get the benefits of cryptocurrency while minimizing the risks, and to better integrate technology into central banking, just tokenize the dollar.” OK, this is the point where you tell me I’m hopelessly unsophisticated and cryptocurrencies aren’t simply invented out of thin air but are a real thing — reaped from (invented) mines and with price stability from (invented) stablecoins beloved by (actual) money launderers and, sometimes, terrorists. Welp ... “This year is proving to be something of a ‘ChatGPT moment’ for stablecoins. But while the excitement is palpable, their utility is still unclear. They are useful to exchange fiat money for speculative assets like Bitcoin. However, outside the world of cryptocurrencies, why would anyone want to hold tokens that are prohibited from paying their users anything?” Andy Mukherjee asks. “To turbocharge mass adoption, and propel the market to $3 trillion or more by 2030, requires precisely what authorities nearly everywhere, including the US, will not allow: yield-bearing stablecoins.” OK, let’s go out on a limb and say these authorities fold just like Congress. How would actual mass adoption fit into my “a work of art is worth exactly as much as someone is willing to pay for it” theory? Turns out that, kind of like a nonpainting, nonexistent money is worth a hell of a lot less than somebody is willing to pay for it. “The basic situation is that the US stock market will pay $2 for $1 worth of cryptocurrency,” writes Matt Levine. “If a small public company has a $100 million pot of Bitcoin or Ethereum or Trumpcoin or what have you, its stock will be worth at least $200 million. This trade is baffling and magical.” Just like this?  Maurizio Cattelan’s “Comedian” was a bargain at just $6.2 million. Photographer: Peter Parks, AFP/Getty Images Except that a $6.2 million banana at least has potassium. Anyway, this strategy was pioneered by a company called Strategy (natch), and Matt explains: “If the story is ‘giant asset managers want Bitcoin exposure, and Strategy is the only convenient way for them to get Bitcoin exposure, so they are willing to pay a 100% premium to buy Strategy and get Bitcoin exposure,’ then that’s … super weird?” So more like this?  Crypto king Justin Sun finds $6.2 million easy to digest. Photographer: Peter Parks, AFP/Getty Images Investment banks, it turns out, have an insatiable appetite for the nonexistent. “We talk a lot around here about small public companies that get gobbled up by crypto entrepreneurs so they can pivot to being crypto treasury companies. But this is inefficient and haphazard,” Matt writes. “Why shouldn’t an investment bank just be in the business of supplying pristine public listings, so instead of pivoting some biotech/toy/liquor/whatever company to crypto, you can just start with a blank slate? Of course banks are in this business. This business — the business of supplying a publicly listed shell company — is the SPAC business.” Oh goodie: We are turning the economy over to Chamath Palihapitiya. At least we can be confident that our elected officials will safeguard our financial security. You know, the same folks who just fed the GENIUS Act to the Magic Sharpie. “With the price of digital assets testing the boundaries of plausibility, and Congress promising legislation to boost the industry further, now might be a good time for bank regulators to take notice,” write the Bloomberg Opinion Editors. “Why worry about banks? It wasn’t so long ago — less than three years — that banks catering to the cryptocurrency industry failed after prices tumbled and a raft of companies went bankrupt. Regulators had to take emergency steps to prevent a wider loss of confidence and promised reforms to make the industry more resilient.” Of course, none of that has happened. “Under pressure from the White House, the industry and lawmakers — regulators have rescinded guidance that sought to limit banks’ involvement in crypto or blockchain companies,” the Editors warn. “Before the traditional banking system gets further intertwined with the blockchain-based economy, regulators should make some prudent adjustments.” If banks keep slipping into conceptual finance, who knows who might come along and eat their lunch. Bonus Invisible Bank Reading by Paul J. Davies: What’s the World Got in Store ? - Conference Board leading index; July 21: Never Fully Beaten, Inflation Is Coming Back to Life — John Authers

- Alphabet, Tesla, IBM earnings; July 23: Big Tech ‘Acquihiring’ Is an Ugly But Useful Trend — Parmy Olson

- EU-China summit; July 24: Don’t Make a Dumb Trade War Any Dumber — the Editors

While CRYPTO WEEK™ was more or less a success, the preceding Amazon Prime Week was tougher to figure out. “The results of the Amazon super sale are infamously hard to parse. The company didn’t provide any figures, saying only that last Tuesday to Friday was ‘the biggest Prime Day event ever,’” writes Andrea Felsted. One would hope so, given that previous Prime Weeks had lasted just two days rather than four. “There were signs that neither Amazon — nor observers of consumer spending — should take too much comfort,” adds Andrea. “One such signifier is what shoppers were putting in their carts. Many Americans used the markdowns not to treat themselves to nice-to-have items, but to replenish the things they needed. Among the most popular purchases were clothing, household essentials, pet products and groceries, according to data provider Numerator. Two-thirds of items sold on Prime Day were priced under $20, while only 3% were over $100.” Pajamas, Purina and Procter & Gamble: It’s nice to know real things still have some value. Note: Please send banana bread and feedback to Tobin Harshaw at tharshaw@bloomberg.net. |