| | Investors in grid-scale energy storage aren’t worried about the One Big Beautiful Bill Act.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Net Zero |  |

| |

|

- Batteries survive Trump cuts

- Exporting carbon savings

- Chevron’s win

- AI’s record energy costs

- OPEC’s vindication

BP bails on onshore wind, and Shell bails on net zero guidelines. |

|

Batteries survive Trump cuts |

| |  | Tim McDonnell |

| |

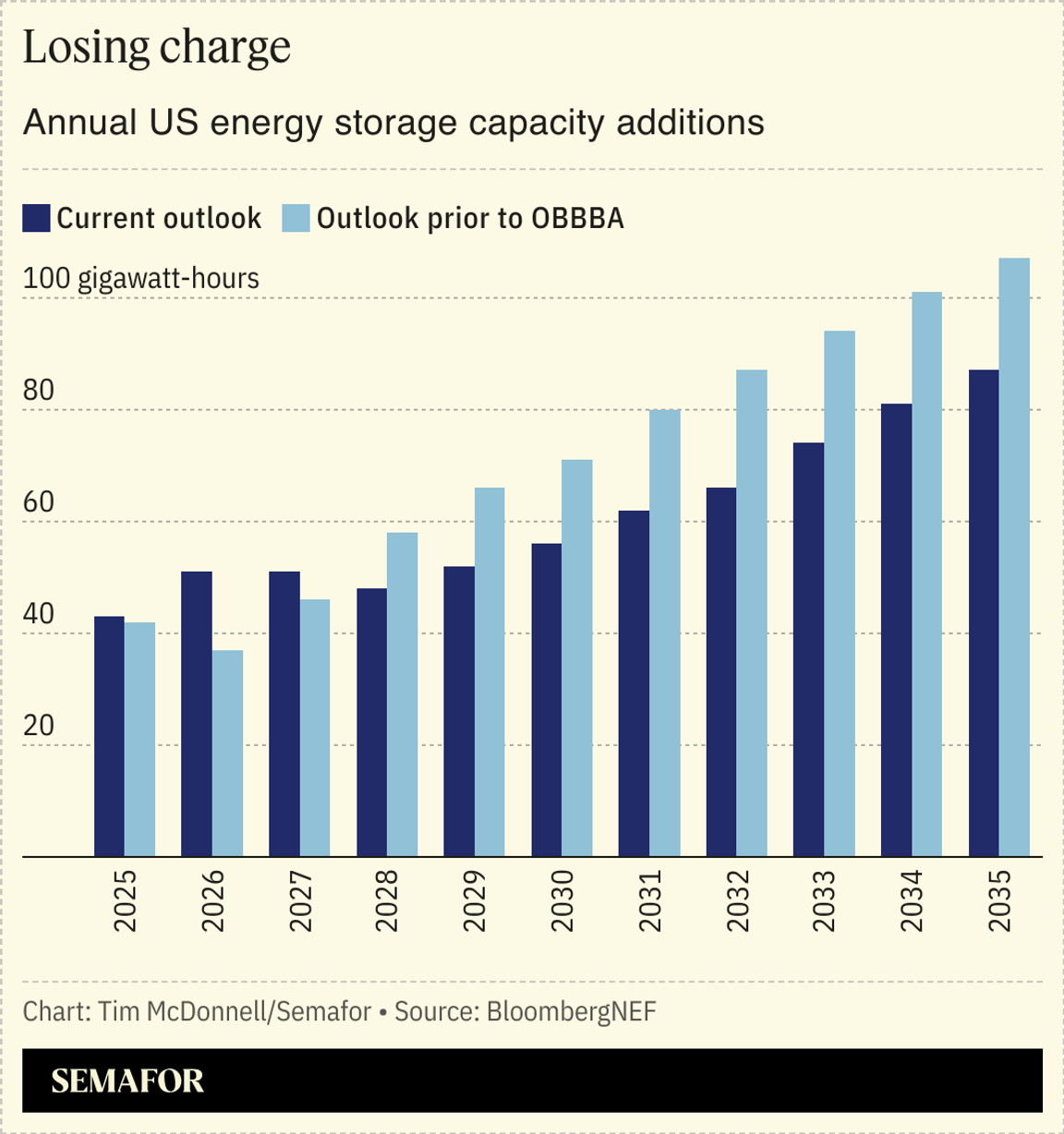

Investors in large-scale batteries say they dodged a bullet in the budget law signed by US President Donald Trump this month, and are planning for a reinvigorated buildout.  While the One Big Beautiful Bill Act significantly pared back tax incentives for wind, solar, and electric vehicles, energy storage projects can still qualify for Biden-era tax credits as long as they’re under construction before 2034. That’s a positive sign for the stability of an electric grid increasingly swamped by data centers, since batteries are now often the most cost-effective way to get more value out of existing power plants. And it’s a win for the firms investing in new battery projects and manufacturing facilities. “Storage came out relatively unscathed” from the OBBBA negotiations, said Gabriel Kra, managing director of Prelude Ventures, a climate tech venture capital firm. Prelude was a major backer of two fast-growing battery startups, Form Energy and Redoxblox. A third, Quantumscape, which went public in 2020, has seen its share price triple in the past month after the rollout of a new technology. “We’re very bullish on storage,” Kra said. “It’s a really exciting place to invest right now.”

|

|

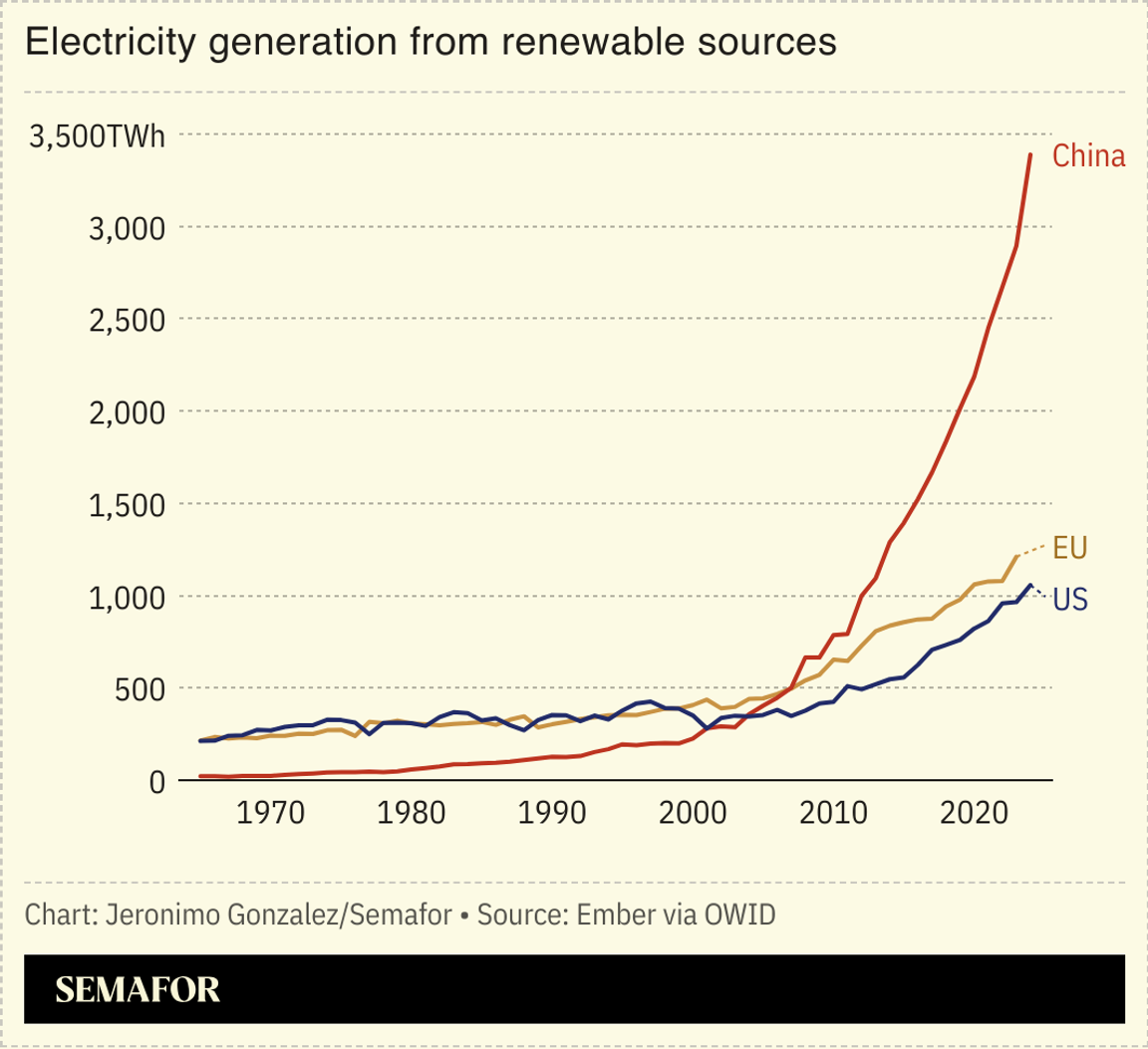

China’s booming clean energy industry is making a major dent in emissions outside the country’s borders. The solar panels, wind turbines, and EV batteries exported by China in 2024 shaved 1% off the world’s carbon footprint that year, according to a new analysis by Carbon Brief. Add in emissions saved by products manufactured at Chinese-owned clean tech factories worldwide, and the figure rises to 1.5%, equal to the annual emissions of Australia. Clean tech is increasingly foundational to China’s overall economy; in 2024, it contributed more than 10% of the country’s GDP for the first time. China maintains a wide lead globally in clean tech manufacturing, and its exports unlock not just emissions savings but economic growth in importing countries, since more of the value in clean tech is in building and operating projects than in manufacturing hardware. And while Europe and especially the US are putting up new trade barriers for Chinese clean tech exports, countries in the Middle East, South Asia, and Africa are throwing open their doors. |

|

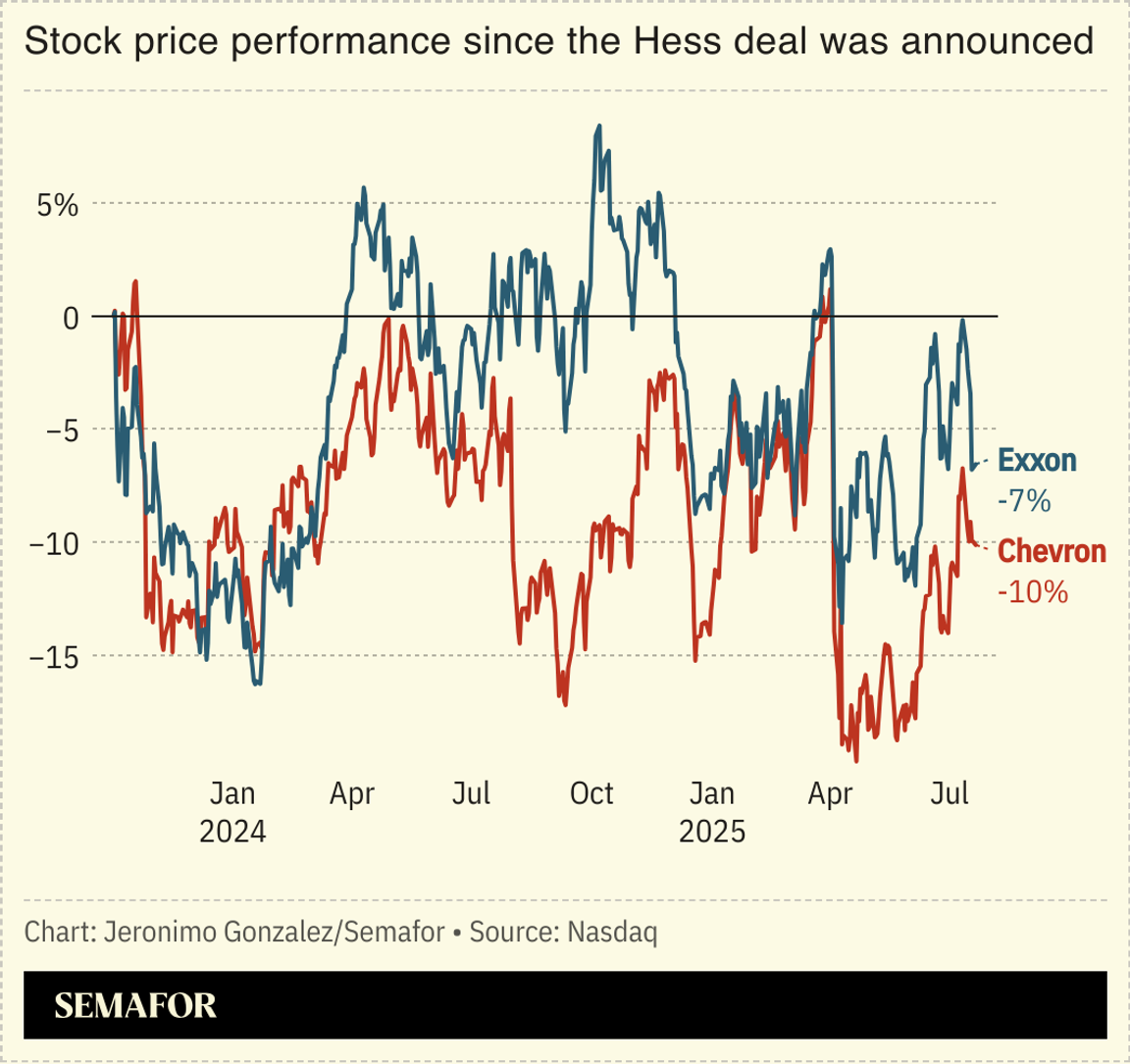

Chevron prevailed in the oil industry’s biggest legal showdown in a generation — but still faces the challenge of regaining investors’ confidence and operating a new oil field in partnership with its chief rival. An arbitration court in Paris ruled that Chevron could proceed with its $53 billion acquisition of Hess, which had been on hold since 2023 as ExxonMobil contested the deal on the grounds that it had first dibs on Hess’s share in a vast, lucrative offshore field in Guyana. It was a much-needed win for Chevron, which had seen its share price dragged below most of its peers as it confronted not just the Guyana case but also difficulties with its operations in Texas, Venezuela, and Kazakhstan. Exxon might have lost, but as Javier Blas writes in Bloomberg, its delay tactic was successful in putting Chevron CEO Mike Wirth on the defensive for two years and giving Exxon shares a decisive advantage on Wall Street. Exxon remains a partner in the Guyana project, meaning both companies must now put hard feelings aside and get to work on drilling together — at a time when weak oil prices are making the economics of big offshore projects more challenging than they’ve been since the pandemic. |

|

Combined rate increase requested by regulated US utilities in the first half of 2025, double last year’s amount. Data center demand is driving record US power price increases. The next major signal for how much AI is adding to household power bills will come later today, when the country’s largest grid network, PJM Interconnection — which also hosts the world’s largest concentration of data centers — releases the results of its annual power auction. Over the past decade, PJM has paid about $6.5 billion annually to power generators, costs that are ultimately borne by homes and businesses in its territory. That sum leaped to $14.7 billion last year, and is expected to reach up to $16 billion this year. |

|

The biennial OPEC Seminar served as a victory lap of sorts for the group’s strategy to boost output, which had been at odds with analysts’ predictions that peak oil demand is near, Amena Bakr, head of Middle East Energy & OPEC+ research at global commodities data firm Kpler, wrote in a Semafor column. While prognosticators at the International Energy Agency and elsewhere continue to argue that the oil market is oversupplied and will continue to be for the foreseeable future, OPEC has stuck to its guns in pushing for more drilling. And so far, that strategy has paid off: “The belief that OPEC — and producers outside of the group that make up OPEC+ — couldn’t boost output without sinking prices has been proven false,” Bakr argued. Some 1.9 million barrels per day of production were added without denting prices. “Officials noted that this was a ‘gotcha moment,’ proving its strategy was driven by fundamentals.” |

|

New Energy A solar panel manufacturing facility in India. Priyanshu Singh/File Photo. A solar panel manufacturing facility in India. Priyanshu Singh/File Photo.Fossil FuelsPolitics & PolicyMinerals & MiningCOP30 |

|

Kim Kyung-Hoon/Reuters Kim Kyung-Hoon/ReutersOpenAI is opening its first Washington, DC, office, Semafor’s Reed Albergotti scooped. The space, which the company is dubbing “The Workshop,” will be a place for policymakers, educators, and nonprofits to try out OpenAI’s current tools and get early demos of new ones. It’s also emblematic of the AI juggernaut’s ongoing efforts to win hearts and minds in Washington. |

|

|