| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. In the half century since it gained independence, Mozambique has failed to meet its potential. Civil war, corruption and more recently a Jihadist insurgency and post-election violence have kept it rooted near the bottom of world poverty tables. Now, the development of two megaprojects that have been on the table for years and could change the nation’s economic trajectory finally seem to be gaining momentum.  Mozambican President Daniel Chapo. Photographer: Alfredo Zuniga/AFP/Getty Images The World Bank has committed to helping finance a $6.4 billion electricity project that would include one of the biggest hydropower plants to be built in southern Africa in five decades. And President Daniel Chapo told us in an interview he expects talks about restarting construction of TotalEnergies’ $20 billion gas project in the restive north to conclude next month. That prospect — four years after militant attacks shut the site — has already piqued investor interest, making the nation’s bonds among the world’s best performers. Even if the investment does flow in, Mozambique still has huge challenges to overcome. Discontent continues to simmer over last year’s disputed elections that handed victory to Chapo and his Frelimo party, and sparked riots in which hundreds of people died. Businesses complain about foreign-exchange shortages, and while the insurgency in the northern Cabo Delgado region has abated, it hasn’t been quashed. The six-foot-eight Chapo (the tallest serving global leader) was clearly riding high when he accompanied World Bank President Ajay Banga on a visit to the dam site over the weekend. He was greeted by a cheering crowd and dancers in the central town of Tete, a chaotic scene that was repeated in Songo, a short helicopter flip away. The $5 billion Mphanda Nkuwa power plant on the Zambezi river and an associated $1.4 billion transmission project should be operational by about 2031, according to Banga. “I think there is a real chance here,” he said in an interview about the possibility of a turnaround. It’s an opportunity Mozambique can’t afford to miss. — Antony Sguazzin Key stories and opinion:

Mozambique Wins World Bank Backing for $6.4 Billion Hydro Plan

Mozambique Nears Deal to Revive $20 Billion Total Gas Project

Multibillion Dollar Hopes for Gas Riches Fuel Mozambique’s Bonds

Total Edges Closer to Restart Work on $20 Billion Mozambique LNG

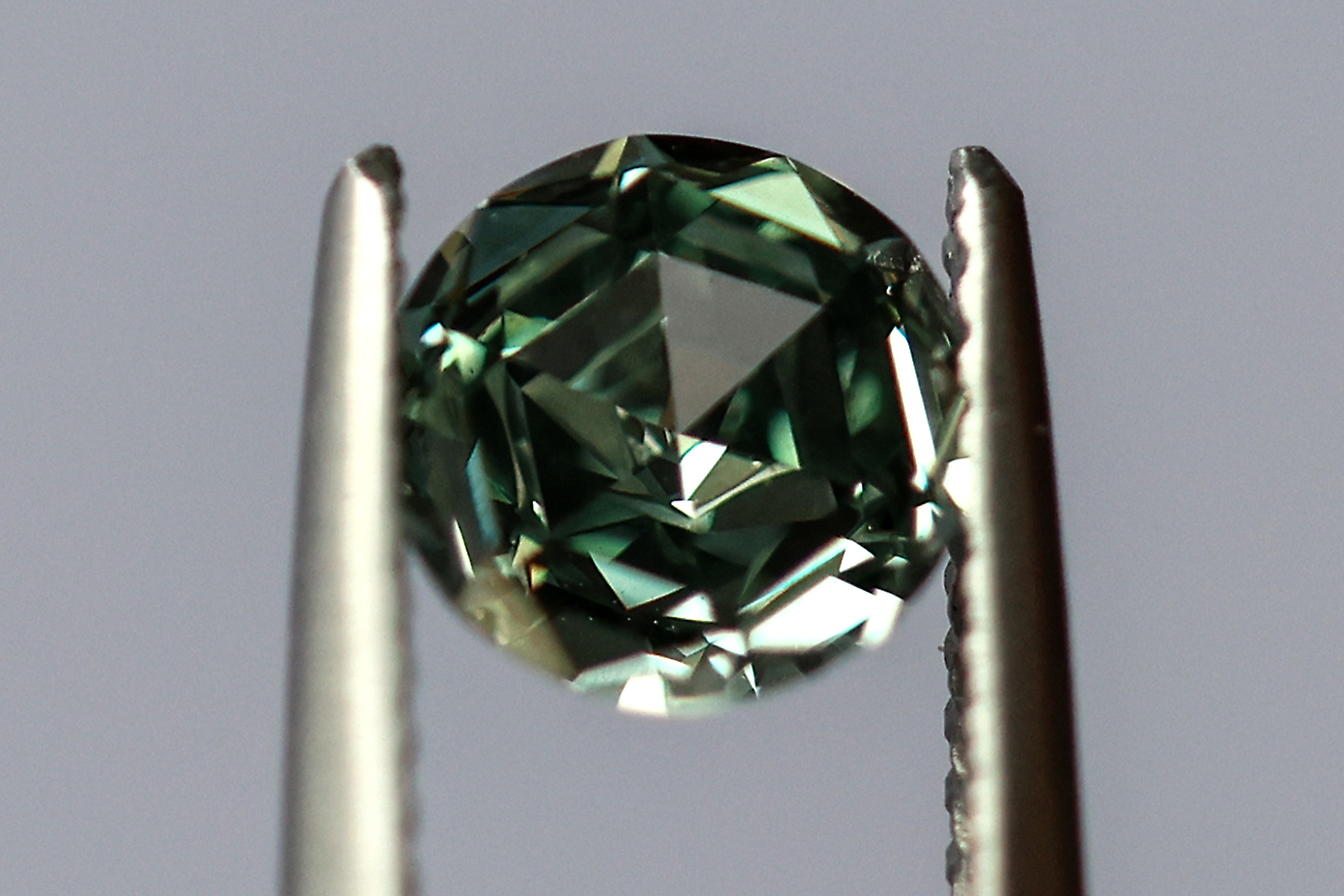

Southern Africa’s Leaders Have Failed Mozambique: Justice Malala Democratic Republic of Congo and the Rwanda-backed M23 rebel movement agreed to a declaration of principles aimed at ending nearly four years of fighting. The signing took place in Doha on Saturday with Massad Boulos, the US special envoy for Africa, as a witness. Both parties agreed to find a way to peacefully resolve disputes and start negotiating a lasting deal no later than Aug. 8.  A member of the M23 rebel group in Bukavu in eastern Congo. Photographer: Luis Tato/AFP/Getty Images Revego Africa Energy Fund plans to raise as much as 1 billion rand in additional financing to help bankroll five wind-powered facilities in South Africa and several others elsewhere on the continent. The open-ended fund currently has a 2-billion-rand portfolio. While it has a wider focus, all of its 10 investments so far are in South Africa, which has the region’s biggest renewable-energy industry. South African President Cyril Ramaphosa fired an embattled member of his executive, easing tensions within his 10-party administration. Higher Education and Training Minister Nobuhle Nkabane will be replaced by her deputy. Nkabane faced allegations of lying to parliament, which she denied. The Democratic Alliance, the second-biggest group in the ruling coalition, threatened to withhold support for Nkabane’s departmental budget unless Ramaphosa acted against her.  Nobuhle Nkabane. Photographer: Dwayne Senior/Bloomberg Zambia’s state-owned Industrial Development Corp. signed a memorandum of understanding with China’s Fujian Xiang Xin to develop a new oil refinery. The $1.1 billion project will be built in the northern town of Ndola, the IDC said. It didn’t specify where crude feedstock would come from or how it would be transported to the plant. Meanwhile, a unit of Chinese state-owned conglomerate Citic will develop large-scale soybean and corn farms in Angola to secure long-term supplies of the crops. Citigroup expects Botswana to devalue its currency again as the southern African nation contends with a sharp collapse of the diamond market, its main source of revenue. The Bank of Botswana this month announced that it will allow the pula to weaken as much as 2.8% against a basket of other currencies in 2025, almost double its initial target, to boost exports. The global downturn in diamond prices is partly due to increased competition from lab-grown gems.  A lab-grown diamond at the Diam Concept laboratory in Paris. Photographer: Valeria Mongelli/Bloomberg Angolan taxi drivers will stage a three-day strike at the end of the month to voice their anger over rising gasoline prices. The protests will be held in seven of the biggest cities, according to the New Alliance of Taxi Drivers of Angola, and follow government cuts to fuel subsidies. The support cost Angola’s government about $3 billion last year, equivalent to what it spent on health and education, according to the International Monetary Fund. Thank you for your responses to our weekly Next Africa Quiz and congratulations to Gail Lutz, who was first to identify FlySafair as South Africa’s biggest airline facing a pilots’ strike. Nigeria’s statistics agency changed the way it determines the size of the economy and added new sectors into its calculations. Gross domestic product stood at 372.8 trillion naira, or $243 billion, last year — almost 30% larger than the IMF’s forecast. The economy is still Africa’s fourth-biggest, lagging South Africa, Egypt and Algeria. Thanks for reading. We’ll be back in your inbox with the next edition on Friday. Send any feedback to mcohen21@bloomberg.net |