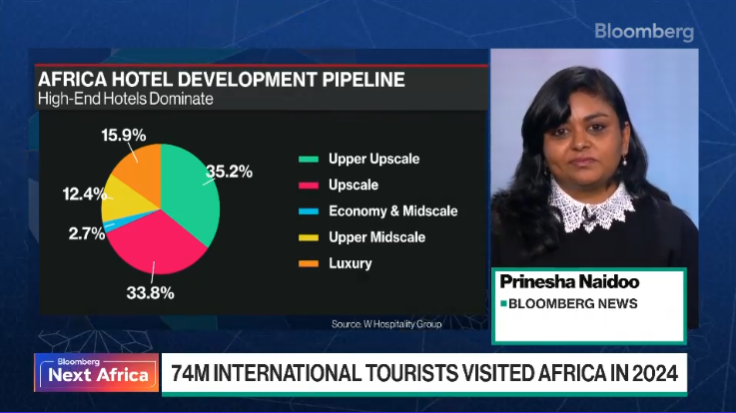

| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. Luxury hotels in Africa are emerging as a hot asset class for the rich and powerful. Money from Gulf royals to billionaires, tech tycoons and top global hotel chains is flowing into a continent seen as one of the last under-penetrated tourism destinations. A post-pandemic appetite for wellness travel, eco-friendly escapes and bucket-list experiences is also fueling the development of high-end resorts.  A Jumeirah Privé private island retreat off Tanzania’s coast. Source: Jumeirah Thanda Island For some, funding hospitality projects offers an opportunity to flaunt trophy assets such as private islands and vineyards, and build the skylines of emerging cities — all while charging top dollar. For Africa, harnessing these investments could prove transformational. In supporting this boom and spotlighting rich cultures, interesting landscapes and wildlife, African governments can showcase a different and more dynamic side to tourism, creating much-needed jobs in a sector that accounts for about 10% of global GDP. Many obstacles remain, though, not least the conflicts in many regions and concerns about crime — even for the adverturous. National policies can also deter travelers.  WATCH: Bloomberg’s Prinesha Naidoo reports on the interest in African hotel developments. Countries need to improve visa processing and be less protectionist of their national airlines, according to JLL Africa CEO Wayne Godwin. Lower airport taxes would also go a long way to increase travel. “Capital and investment will undoubtedly follow into infrastructure like hotels,” he said. Still, the rush to develop should be carefully managed to avoid the kind of backlash recently seen in Europe. Over-tourism has triggered protests by locals fed up with congestion and increasing housing costs. As a new high-end travel frontier, Africa likely has some way to go before that happens. — Prinesha Naidoo Key stories and opinion:

Dubai Royal’s $50,000-a-Night Resort Anchors Africa Travel Boom

Qatar-Backed Kasada Targets First North Africa Hotel Deal

The $30 Million Plan to Overhaul Tourism Around Egypt’s Pyramids

The American Hotel Disruptors Aiming to Shake Up African Safaris

A Brief 700-Year History of Overtourism: Howard Chua-Eoan South Africa’s parliament gave a final stamp of approval to the national budget, defusing the latest crisis to embroil President Cyril Ramaphosa’s 10-party administration. The Democratic Alliance, the coalition’s second-largest member, withdrew a threat to withhold support for allocations to some departments headed by those implicated in wrongdoing after Ramaphosa fired his higher education minister who was accused of misleading parliament.  Cyril Ramaphosa. Photographer: Mauro Pimentel/Getty Images Senegal’s foreign bonds were among the top performers in emerging markets as the International Monetary Fund said it will start discussions with the country on a new loan program from next month. The IMF suspended a $1.8 billion lending facility after President Bassirou Diomaye Faye’s administration discovered a $7 billion hole in public finances for 2023, blamed on underreporting during predecessor’s rule. Democratic Republic of Congo is seeking a cobalt price that encourages domestic processing as the government considers its next steps to follow a ban on exports of the battery metal. The central African nation, which accounts for about three-quarters of global cobalt supply, has suspended shipments since February to try boost its value. The move coincided with Congo and the US working toward a strategic partnership to bring more American investment.  A cobalt nugget. Photographer: Cole Burston/Bloomberg Ghana plans to license crypto platforms as authorities seek to capture revenue as well as regulate the asset class used by millions in the West African nation. Separately, the government lowered its 2025 budget-deficit target after raising its revenue forecast and trimming projected spending, underscoring the government’s commitment to fiscal discipline. Its targets are in line with an IMF requirement of 3.7% of GDP for the overall fiscal shortfall and a 1.5% surplus for the primary balance. A week after tycoons Foluke Oyeleye and Ayoola Otudeko sold their stake in the owner of Nigeria’s oldest bank, the identity of the new investor is still under wraps, spurring queries by the market regulator and investors. While the shares are being held by RC Investment Management, a special-purpose vehicle, the name of the owner is unknown. That prompted speculation that the government was behind the purchase, which President Bola Tinubu’s administration denied.  Headquarters of First Bank of Nigeria (right) in Lagos. Photographer: Benson Ibeabuchi/Bloomberg The new CEO of South Africa’s biggest bank by customers has a unique problem. Since Capitec made its public debut 23 years ago, its shares have soared by more than 200,000%. That’s made it the country’s best-performing stock since then and the continent’s second-most valuable lender, boasting more than 24 million customers. Graham Lee is betting on an improved services offering to lure in more affluent customers. Next Africa Quiz — Which African nation’s main stocks index went through the 100,000 mark for the first time this week? Send your answers to gbell16@bloomberg.net.  In this week’s Next Africa podcast, Bloomberg’s Matthew Hill joins Jennifer Zabasajja to explain what’s behind the dispute between African lenders and governments restructuring their debt. Data Watch - Malawi’s reserves will plunge $2 billion into negative territory in 2025, according to the IMF — an amount that’s equivalent to almost a fifth of the nation’s total economy.

- South Africa’s tame inflation — 3% in June — has created room for the central bank to cut interest rates at least three more times, according to economists.

- Nigeria’s central bank kept its benchmark interest rate unchanged at 27.5% and signaled it will maintain a tight monetary policy stance until inflation risks subside.

- Sinohydro will invest more than $100 million in Angola to develop new sources of grain imports — the second agriculture-related deal agreed between China and Angola this week.

Coming Up - July 29 South Africa money-supply & private-credit data for June

- July 30 Ghana interest-rate decision, South Africa budget balance for June

- July 31 Interest-rate decisions for South Africa, Malawi and Mozambique, South Africa June trade & producer-inflation data, July inflation for Kenya and Uganda, Zambia inflation for July & trade data for June, Namibia and Morroco money supply for June, Zimbabwe mid-term budget

- Aug. 1 Eswatini interest-rate decision, Nigeria PMI for July, Angola reserves, South Africa manufacturing PMI & new-vehicle sales for July

|