| Bloomberg Morning Briefing Americas |

| |

| Good morning. Donald Trump’s tariff blitz unleashes delayed shock on the global economy. Amazon trails while Apple surprises. And who says sports and politics don’t mix? Listen to the day’s top stories. | |

| Markets Snapshot | | | | Market data as of 07:12 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

| |

| |

| |

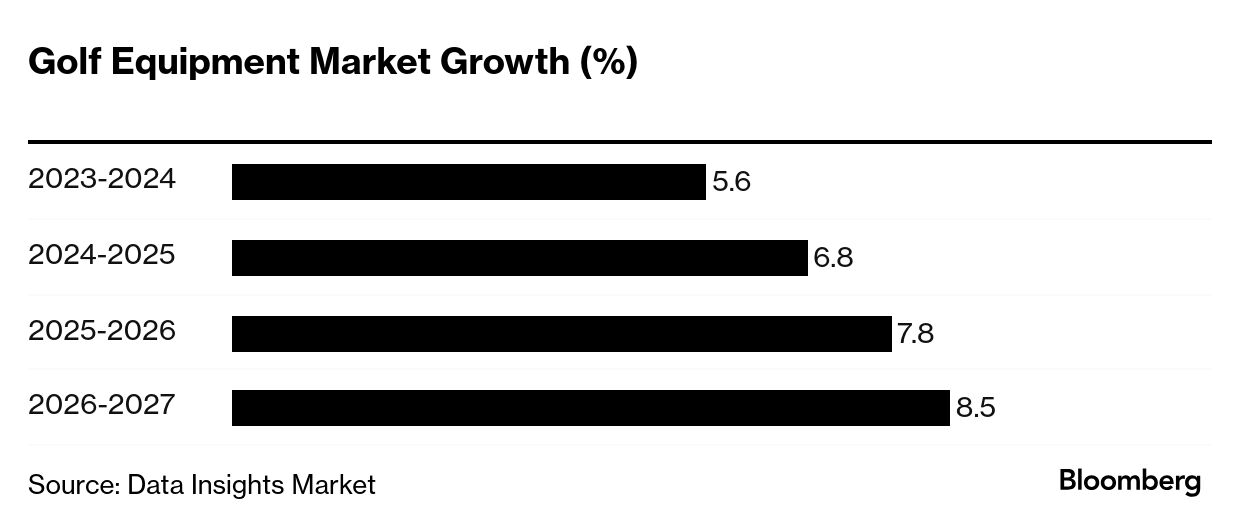

World No. 1, Nelly Korda. Photographer: Michael Reaves/Getty Images TaylorMade Golf has built a name crafting drivers, irons and putters used by stars from Scottie Scheffler to Nelly Korda. Now it’s at the center of an ownership dispute that has become a matter of national pride in South Korea, where the sport is booming.  - The high-stakes battle highlights the allure of a business that has grown to an $83 billion industry, in which South Korea’s Centroid Investment Partners has quietly become a major player.

- TaylorMade rival Topgolf Callaway is also at a crossroads, as it proceeds with plans to split in two, although that may take another while after the head of its golf unit quit on Thursday.

- And US star Michelle Wie West is trying to break the glass ceiling for women’s golf. Last month, she told Bloomberg’s Jason Kelly why she’s promoting the new simulator golf league TGL.

- The sport’s growing popularity has sparked something of an arms race in Scotland, where it was created, and where Donald Trump owns two championship courses.

- The US president opened a second 18-hole links course in Aberdeenshire last week during a not-so-private visit to the country, where his mother is from. Who says sport and politics don’t mix?

| |

| Bloomberg Power Players New York: Set against the backdrop of the US Open Tennis Championships, we'll bring together influential voices from the business of sports to identify the next wave of disruption that could hit this multitrillion-dollar global industry. Join us on Sept. 4. Learn more. | |

| |

American Textile Company, on the site of a former US Steel plant in Duquesne Photographer: Justin Merriman/Justin Merriman/Bloomberg After all Trump’s tough talk on tariffs, his administration has quietly let over $1 trillion in imports off the hook—no formal process, no explanations, just sweeping carve-outs that have saved companies billions. The rules of engagement are ad hoc, bordering on a free-for-all. | |

| Big Take Podcast |  | | | |

| |

| Did tariffs help Apple to a blowout quarter? That was one theory that emerged as the company disclosed a surprising surge in iPhone sales in the April-June quarter, and it makes some sense, writes Dave Lee. Talk of CEO succession will surely now quiet down: It’s time to let Tim cook. | |

| More Opinions |  | |  | | | |

| |

Tom Sosnoff trades options live during an event in Milan Photographer: Davide Brenna 10% in 17 minutes. Winning small but often was Tom Sosnoff’s bread and butter strategy for years. Now, with a show that blends performance art with proof of concept, the former open-outcry trader is teaching how complex options trading might enrich the retail crowd, not just Wall Street pros. For a small fee, of course. | |

| A Couple More |  | | | |