| | In this edition, will history repeat itself with the typical late summer financial crisis? And Harbo͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Intel’s two lifelines

- PE’s great jumble sale

- Shein calls London’s bluff

- Mark Cuban is everywhere

- Ex-DOJ targets MAGA

Taylor Swift’s throwback cassette … |

|

August is a great time for a financial crisis. The 1997 Asian crash, 1998 Russian crash, 2007’s “quant quake,” 2008’s mortgage meltdown, 2011’s Greek debt crisis, and 2015’s collapse in Chinese stocks all began or deepened in the dog days of late summer. Last August, the volatility gauge colloquially known as Wall Street’s fear index recorded its biggest one-day spike. The culprit is a perfect storm of thin liquidity and jittery psychology. While computers can trade without vacation time, the humans programming them disappear in August. Portfolio managers sitting on year-to-date gains turn conservative without their bosses around to share credit — or blame. Those still plugged in tend to be less experienced and operating on hair triggers. As The Bulwark noted recently, August has also become a “cauldron for controversies” in politics, too, where fewer people are paying attention but those who remain are deeply committed to amplifying daily noise. This August’s kindling is already stacked high, and there is no shortage of sparks. Fed Chair Jerome Powell’s speech on Friday at Jackson Hole paints a juicy target for President Donald Trump. The market has priced in an 85% chance of an interest rate cut next month, and will react badly to any hawkish undertones. AI enthusiasm has papered over pockets of corporate weakness as tariffs continue to bite. Trade tensions with Mexico, Canada, and India simmer as tariffs chip away at corporate margins. You might think that 2021 was the peak of retail investor mania, but you would be wrong. Add warnings from prominent Wall Street strategists about overvalued stocks, and you have all the ingredients for another summer meltdown. Bosses in the Hamptons may want to mind the store more closely this year. |

|

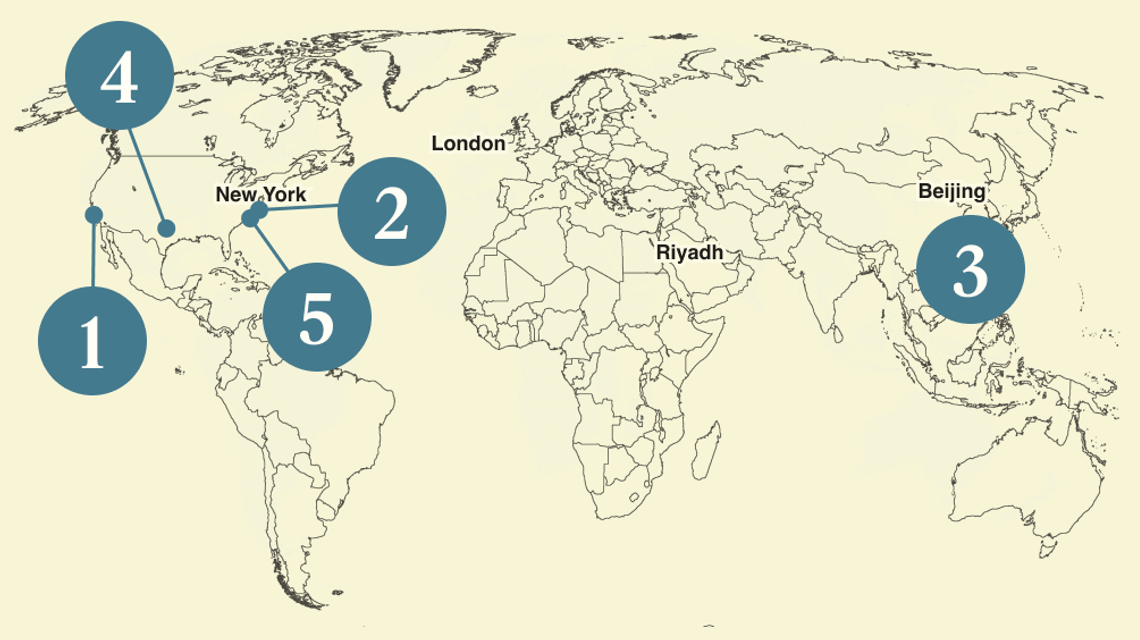

Laure Andrillon/File Photo/Reuters Laure Andrillon/File Photo/ReutersIntel may get two lifelines — one of them welcome, one perhaps not — as it tries to reverse a long slide that threatens the US’s lead in the AI race. SoftBank announced a $2 billion investment in the company as the White House weighs taking its own stake by converting billions of dollars of grant money Intel received under last year’s CHIPS Act into shares. The Trump administration’s push, first reported by Bloomberg and confirmed by Semafor, is nearly unprecedented outside of deep financial panics and cuts against Republican orthodoxy. But it may find some bipartisan support in Washington, where officials on both sides of the aisle have been growing nervous about Intel’s prospects. The White House’s legal footing is unclear, and the contract providing Intel’s grant money doesn’t include an option for shares. But CEO Lip-Bu Tan may be reluctant to fight a president who previously called for his ouster. Money alone won’t fix Intel, which needs better technology, a manufacturing roadmap, and corporate customers. It’s behind in both cutting-edge chips and the more prosaic ones that power everyday devices. But cash will shore up its balance sheet — its credit rating is hovering just above junk status after a downgrade from Fitch earlier this month — and help pay for upgrades to its foundry business. Elsewhere in chips: Beijing is merging two of its largest chip players, though both mainly make legacy components rather than advanced AI chips. |

|

HarbourVest CEO on PE’s next act |

Igor Golovniov/SOPA Images/LightRocket via Getty Images Igor Golovniov/SOPA Images/LightRocket via Getty ImagesPrivate equity today is unrecognizable from the buyout business that launched it 50 years ago. The premise of a single shareholder buying, fixing, then selling a company has been replaced by what is, if not quite a shadow stock exchange, at least a thriving jumble sale of stakes, slices, and side deals. HarbourVest is one of the biggest players in that great Yankee swap — officially known as secondaries — in which private equity funds are rejiggered to let old investors out and new ones in. Its $150 billion of assets, invested across dozens of private funds and directly alongside managers into individual deals, is perhaps the closest thing we have to an index of the $10 trillion private investing world. “I don’t see why the private capital industry can’t be two, three times the size than it is today,” CEO John Toomey told me in a wide-ranging interview about the state of the industry. He says fees will come down — “look at what the index fund did to the mutual fund industry” and extrapolate — but returns will stay high. “Public markets are around $100 trillion, and by the way, they are really skewed [toward a few big tech stocks]. Private markets are 10% of that.”

|

|

London calling, but few listening |

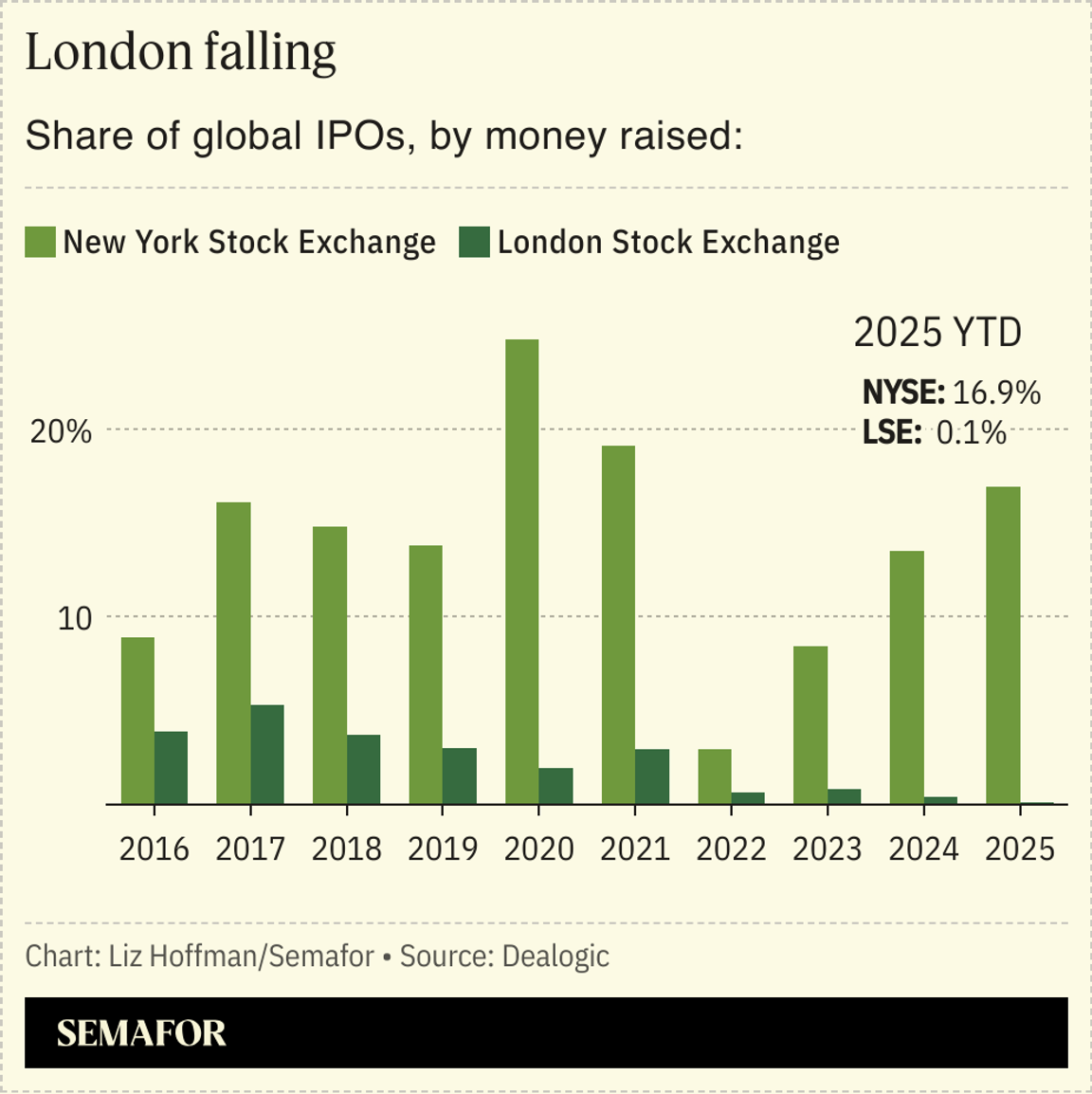

A month ago, Britain’s finance ministry said it would roll out a “concierge service” to lure international companies and ramp up IPOs in London. The early results are not promising. Only six companies have gone public in the British capital so far this year, according to Dealogic data. And one company that London had been hoping to attract may now have its sights set elsewhere: Shein is mulling moving its headquarters back to mainland China from Singapore in order to clear a path for a stock-market debut in Hong Kong, Bloomberg reports. The fast-fashion retailer — still under the purview of Chinese regulators — has so far failed to win Beijing’s go-ahead for an IPO in New York or London.  This one isn’t London’s fault, but it highlights the stiff competition the city faces in courting foreign companies, to say nothing of retaining existing ones. The number of public companies on the London Stock Exchange has fallen by a fifth in five years, according to The Wall Street Journal. And while London once saw itself as a peer and competitor to New York, the entire market capitalization of all companies on the LSE is now barely more than that of a single American one: Nvidia. — Prashant Rao |

|

Cuban’s sales strategy: Be everywhere |

“If you’re trying to reduce the cost of medications, there’s no such thing as overexposure,” the Texas billionaire tells Semafor’s Mixed Signals podcast. Perhaps the business world’s most accessible man — his willingness to weigh in on any number of issues helped my colleague Max Tani hit traffic goals in his baby-reporter days at Business Insider — says ubiquity is key to breaking through today’s fragmented media world. “Grandmas knew who I was because I was on Dancing with the Stars,” he said. “If you’re going to start a business and you think you have the ability of personality, starting a podcast, starting a YouTube channel, starting a Twitch channel” is the move. (He added a caveat: “No one starts a podcast thinking they suck.” And another: The algorithm always wins.) Listen to the episode here. → |

|

|

Ex-DOJ hed fires back at MAGA lobbyists |

Al Drago/File Photo/Reuters Al Drago/File Photo/ReutersA US Justice Department deputy who was fired last month over the review of a large tech merger said lobbyists are polluting antitrust enforcement. Roger Alford’s comments draw the starkest battle lines yet between competing factions inside the Trump administration, pitting a populist mistrust of corporate consolidation against a dealmaking impulse toward light regulation. “I am talking about the battle between genuine MAGA reformers and MAGA-In-Name-Only lobbyists,” Alford, a two-time Trump appointee, said in a speech at the Technology Policy Institute in Aspen, Colo. “It’s a fight over whether Americans will have equal justice under law, or whether preferential access to our justice system is for sale to the wealthy and well-connected.” (The full text is here and worth reading). Alford was dismissed after he objected to HPE’s use of lobbyists close to Trump to push through its $14 billion takeover of Juniper Networks, Semafor and others have reported. In his remarks Monday, he urged a federal court to examine whether influence-peddling pushed through the deal, which closed last month. “If you knew what I knew, you would hope so too.” “Roger Alford is the James Comey of antitrust — pursuing blind self-promotion and ego, while ignoring reality,” a DOJ spokesman said. |

|

➚ BUY: PIMCO. It outmuscled Apollo and KKR to land Meta’s $29 billion data-center financing, a big coup for a traditional bond shop with lofty ambitions in private credit. ➘ SELL: Aramco. The Saudi state oil giant had to borrow to pay its dividend as oil prices stay low. Its stock is the worst-performing among energy giants, and it “doesn’t have a plan,” Bloomberg’s Javier Blas writes. |

|

Companies & DealsTuning in: Nexstar will buy its smaller TV-station rival Tegna for $6.2 billion, expanding Nexstar’s coverage to 80% of TV households and ridding the media world of one regrettable name just as MSNBC’s rebrand gifts it another. Betting on beauty: With luxury sales slumping, Louis Vuitton is looking to the beauty counter, launching its long-awaited makeup line. Members only, again: Soho House is going private in a $2.7 billion deal, just four years after its IPO. The club network struggled as a listed company, but private clubs are enjoying a resurgence as an outlet for extravagant wealth that avoids the public gaze. WatchdogsPost facto: Jay Clayton, Trump’s interim appointee as US Attorney in Manhattan, can stay in the job, a district court ruled against a block by Senate Democrats. The former Sullivan & Cromwell attorney and Apollo chairman is a familiar face for Wall Street, having previously run the Securities and Exchange Commission and advised many of their biggest players on deals. MarketsOutside the box: The market for cardboard boxes — more specifically, the corrugated paper that makes them — has been a shadow recession metric for decades, and it’s flashing warning signals. In or out? A Japanese startup is launching the first yen stablecoin, which it hopes to make a token for international commerce. Meanwhile in China, where crypto trading is banned, regulators have told big local brokers to stop publishing research endorsing stablecoins. ‘Pump and dump’ panic: A handful of Nasdaq-listed Chinese companies were heavily promoted on social media, and then their value crashed last month — costing investors billions. |

|

|