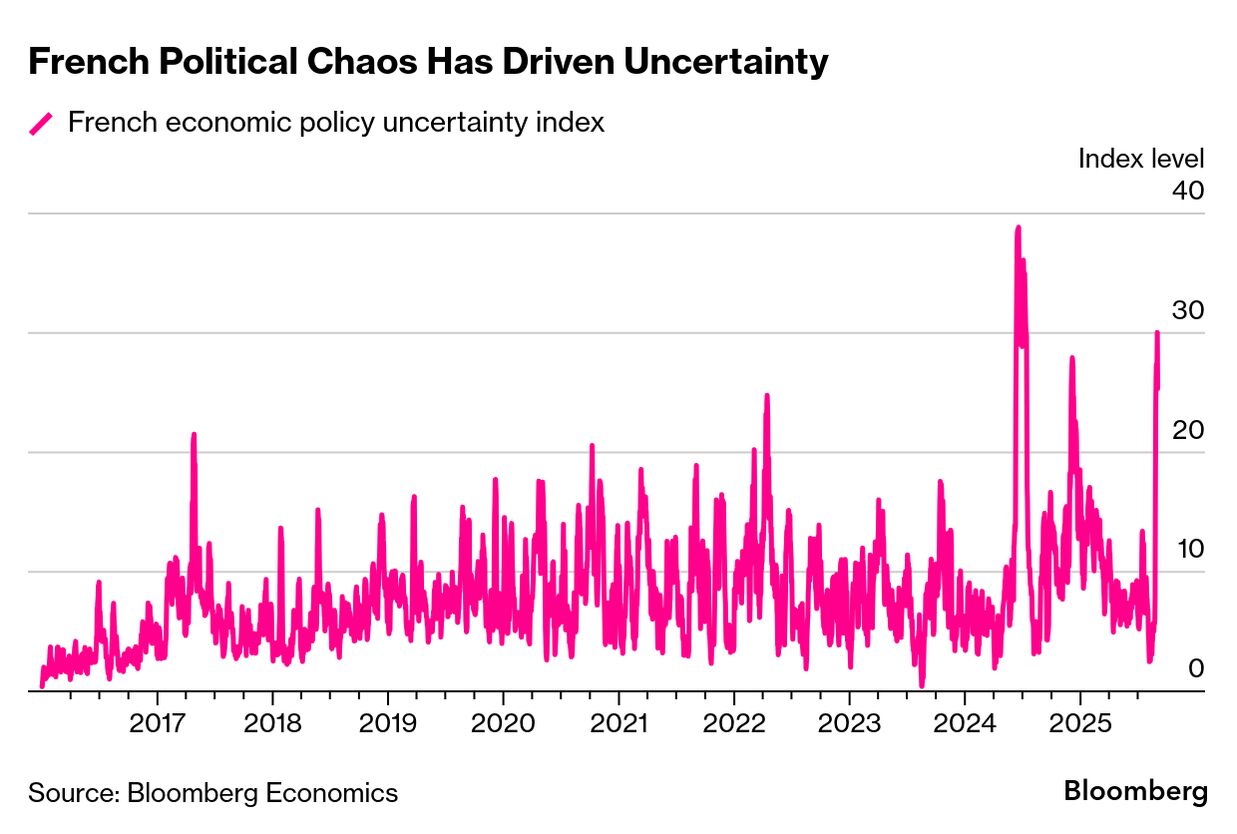

| French Prime Minister Francois Bayrou faces a make-or-break confidence vote on Monday, which in all likelihood will end up going against him. Increasingly unpopular and weakened by domestic issues like a school abuse scandal, Bayrou has fallen victim to the lack of any kind of consensus over how to rein in public spending and curb debt. His call for €44 billion in savings and the scrapping of two public holidays has enraged the center-left and ultimately sealed his fate at a time of rising support for the far-right.  Francois Bayrou Photographer: Benjamin Girette/Bloomberg If Bayrou falls, the focus will shift back to Emmanuel Macron, who doesn’t seem thrilled about being drawn back into the domestic mess left behind by last year’s snap elections. His entourage is pushing back against the likelihood of calling yet another vote – once bitten, twice shy, after all – which means yet more shuttle diplomacy and concessions to ensure whoever replaces Bayrou isn’t immediately brought down again. The optimistic view is that the Socialists can be brought back into the tent – for a price. What that price is remains to be seen. Tack too far left and Macron risks losing the right as well as centrists worried about undoing the legacy of the past decade’s pro-business policies. Yet at the same time ignoring the Socialists’ hobby horses of taxing the rich and a more generous pension will also make it harder for Macron to cobble together a stable government, pass a budget and avoid early elections. An increasingly ungovernable France will reduce Macron’s options on the road to the country’s 2027 presidential elections. (Macron, in his second term, can’t run again).  Meanwhile, far from the egos and ambitions of parliament, the French economy is showing signs of strain. Startup funding has shriveled, corporate debt-restructuring deals are rising and consumers are saving more. There seems to be little urgency in getting public finances under control after the budget deficit reached 5.8% last year. Bloomberg Economics estimates that French debt-to-GDP could rise to 125% in 2030, compared with 115% in 2025. Complacency will carry risks beyond Monday’s vote. Goldman Sachs Group Inc. Paris Co-Head Celine-Marie Mechain expects deal activity in France to accelerate despite the country’s current political turmoil. Former Societe Generale CEO Frederic Oudea has been appointed chairman of Revolut Ltd.’s new Western Europe operation.  Frederic Oudea Photographer: Benjamin Girette/Bloomberg French regulators ordered Alphabet Inc.’s Google to pay nearly $379 million in fines and the Singapore-based online marketplace Shein Group Ltd to pay $175 million for failing to comply with rules on managing cookies. Bank of France Governor Francois Villeroy de Galhau echoed the chorus of alarm from around the world over White House attacks on the Federal Reserve. France welcomed the safeguards proposed by the European Commission to protect the region’s agricultural producers in any trade deal with Mercosur countries. Billionaire Francois-Henri Pinault’s two-decade-long reign at the helm of Gucci owner Kering SA is ending with the group at one of the lowest points in the family company’s history. A key question for investors is whether he’ll give his successor leeway to clean up the mess. Monday: Confidence vote in National Assembly on Bayrou's government; Court sets date for Marine Le Pen’s embezzlement conviction appeal Tuesday: Bank of France monthly economic survey; Industrial production data for July Wednesday: Protests in France over budget proposals Thursday: French statistics agency updates 2025 economic forecasts Friday: Final inflation data for August Moet Hennessy’s partnership with Formula One is expanding into non-alcoholic sparkling wine, via the French Bloom brand, as the zero-proof sector booms.  FreConstance Jablonski, Maggie Frerejean-Taittinger founded French Bloom in 2019. Photographer: Guillaume Perimony |