| | In today’s edition: Saudi ports muscle in, Citadel picks a Gulf hub, and 2026 predictions for the oi͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- A non-oil bright spot

- IMF’s Bahrain prescription

- A Citadel in Dubai

- See you in Davos

- ‘Supply’ is the watchword

The $50 billion sisters connecting Saudi Arabia and Wall St., and more weekend reads. |

|

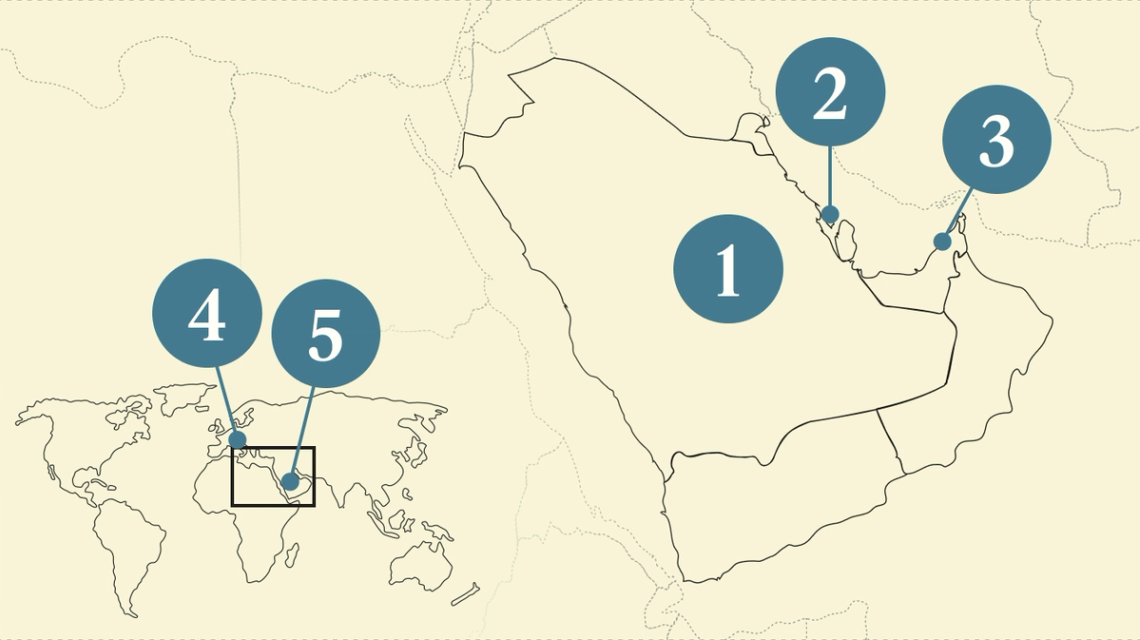

Attention on non-oil trade |

The fall in oil prices below $60 a barrel this week means Saudi Arabia is under growing pressure to curb spending to keep its budget deficit in check, but there is one bright note for the kingdom’s economic outlook: Non-oil exports are surging. New data showed that in the third quarter, non-oil trade neared 100 billion riyals ($26.7 billion) and it could cross that threshold for the first time in Q4. A rush of reexports has helped the picture — they now account for around 40% of all non-oil trade, up from 30% last year — as Saudi ports and logistics hubs muscle in to take a greater share of regional commerce. Domestic industry is also growing, bolstered by an exemption from a levy on foreign workers which was made permanent by the cabinet this week. Since 2019, industrial GDP has risen by 56%. That’s not enough to fully offset the pain of lower oil revenues, though, and Oxford Economics now expects Saudi GDP growth to slow next year. |

|

IMF urges speed in Bahrain |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersBahrain should move faster to diversify government revenue and cut spending in order to bolster its finances, according to a top IMF official. The Gulf’s most-indebted nation needs to “accelerate the program of fiscal reforms” while keeping fiscal policy “tight” in order to signal to investors it is serious about tackling government borrowing, Jihad Azour, IMF Middle East and Central Asia director, said in an interview. S&P Global Ratings downgraded Bahrain further into junk bond status last month, citing its rising debt levels. The IMF says Bahrain’s debt-to-GDP ratio could rise to 139% in 2028. Bahraini officials say the country is attracting foreign investment, growing non-oil revenues, and taking measures to address government debt. But the challenge it faces is how to compete with larger neighbors like Saudi Arabia and the UAE for investment and talent. — Matthew Martin |

|

Marco Bello/Reuters Marco Bello/ReutersCitadel is the latest hedge fund to announce it will set up shop in the Gulf, choosing Dubai as its first location in the region. The move is a win for the UAE’s most populous emirate, which is competing fiercely with Abu Dhabi and Riyadh for global financial hub status. The new office will open sometime next year and is meant to help the $74 billion firm, helmed by Ken Griffin, achieve 24-hour coverage for trading, Bloomberg reported. DIFC, Dubai’s financial district, now hosts more than 100 hedge funds, double the number at the start of last year, though it is still far behind established centers such as New York and Hong Kong. |

|

Davos has spent the last few years adjusting to a world that’s grown hostile to an optimistic, globalist vision. Its recent annual themes sometimes read like the stages of grief: From Denial (2017: Responsive and Responsible Leadership) to Anger (2018: Creating a Shared Future in a Fractured World) to Bargaining (2022: Working Together, Restoring Trust). Last year’s theme, for a change, was Artificial Intelligence, but this year I think the Forum, and the business-minded elite for which it speaks, has reached something like acceptance, and organized the event around “A Spirit of Dialogue.” The theme is a bet that what Davos still has to offer is the thing its regulars value most: One another. Sure, there’s a main stage, but what’s kept the key CEOs, bankers, and politicians coming back is a dense, largely off-the-record summit to exchange ideas on how to survive — and, ideally, thrive — in the new world economy. Semafor will be on the ground at Davos this January, hosting headline-worthy live journalism that explores AI and infrastructure with Tech Editor Reed Albergotti, how leaders are redefining resilience with CEO Editor Andrew Edgecliffe-Johnson, and of course Semafor’s can’t-miss Media Party, all taking place at the Vinothek in the Grandhotel Belvédère. You can find out more about these gatherings here. |

|

View: Long-term oil winners and losers |

An oil refinery in Germany. Hannibal Hanschke/File Photo/Reuters. An oil refinery in Germany. Hannibal Hanschke/File Photo/Reuters.As we head into 2026, the most important factor in the oil market remains the age-old balance of supply and demand, Amena Bakr, head of Middle East Energy & OPEC+ research at global commodities data firm Kpler, writes in a Semafor column. “Looking beyond next year, the global oil system faces a widening gap between rising demand and the slow pace of new supply additions,” says Bakr. “Countries with the ability to increase and sustain production will be positioned to benefit from higher prices. The rest of the world will face the challenge of adjusting to a market that operates with very little margin for error.” |

|

AI- First Abu Dhabi Bank (FAB) signed a deal to use advanced artificial intelligence solutions from local AI company Presight to identify and engage high-potential corporate clients.

- Saudi Arabia’s Ministry of Interior partnered with Humain, the AI subsidiary of sovereign wealth fund PIF, to support the ministry’s data analysis and other operational and administrative activities. — Asharq Al-Awsat

Technology- UAE investment firm MGX, along with US partners Oracle and Silver Lake, are set to each take 15% stakes in TikTok’s US operations from January, after striking a deal with ByteDance, the app’s Chinese owner. ByteDance will retain 19.9%, while 30.1% will be held by affiliates of existing ByteDance investors. — ABC

Energy- Qatar’s Al Mana Holding will invest $200 million in a plant making sustainable aviation fuel from used cooking oil in Egypt’s Suez Canal Economic Zone. The first phase will produce 200,000 tonnes a year. — Reuters

- ADNOC secured $11 billion in financing from 20 banks to develop its offshore Hail and Ghasha gas projects, which it is developing with Italian and Thai partners. Gas should start flowing by the end of the decade. — The National

Trade- Oman signed a trade pact with India on Dec. 18, the first by Muscat since its 2006 free trade deal with the US. The new agreement gives India zero-duty access for its gems, textiles, pharmaceuticals and automobiles, but some items such as dairy, tea, and rubber are excluded. — Reuters

Health care- The UAE government took steps to allow for medical uses of cannabis, while banning any personal or recreational use of the drug. A federal decree law announced on Dec. 18 covers industrial hemp, which, like marijuana, is derived from the cannabis plant but with far lower levels of the psychoactive compound THC. Each emirate can set its own rules.

Macroeconomy- “An incipient recovery is underway” in Kuwait, with robust non-oil growth and muted inflation, according to the IMF. However, it also warned of “an excessive reliance on oil exports and inadequate public saving of oil revenue” in its latest review of the economy.

|

|

- Take a look inside the very private, very wealthy lives of Lubna and Hutham Olayan — two Saudi sisters whose sprawling Olayan Group conglomerate rivals sovereign wealth funds in its scale, and which provides a valuable bridge between Wall St. and Riyadh, as detailed by a team of Bloomberg reporters.

- Saudi Arabia’s planned acquisition of Electronic Arts could tighten the kingdom’s grasp on global video games, but the industry’s hit-driven nature makes it a risky investment option, writes Mikhail Klimentov in The Washington Post.

- The “51st state” for American AI may well be the UAE, writes Kevin Xu in a post on his Interconnected Substack after visiting the Emirates to learn more about the country’s ambitions — and to see if there’s still a US-China fight for Gulf tech alliances.

|

|

|