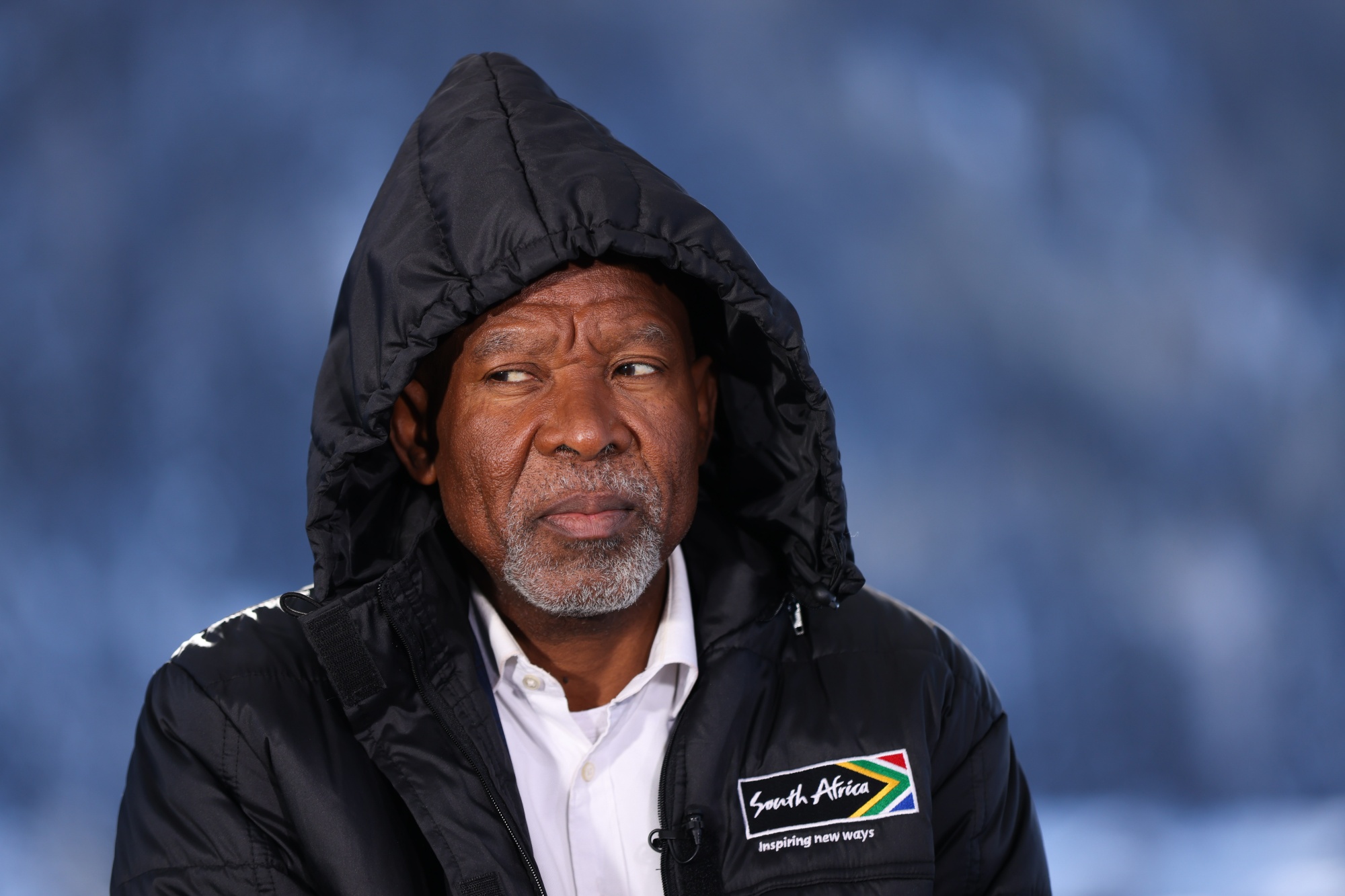

| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. Donald Trump has thrown indebted Africans a curve ball. With inflation cooling across much of the continent, many central banks had signaled interest rates were going to fall and that consumers could look forward to some relief when it came to paying off their credit cards, vehicles and housing loans. But Trump’s US election win this month and his inflationary plans, such as slapping tariffs on everything from cars to computer chips, have fired up the dollar. A stronger greenback is likely to fuel price pressures in African economies that import gasoline, food and other goods, undermining their currencies and leading to higher-for-longer borrowing costs. South Africa is a case in point.  South African central bank Governor Lesetja Kganyago during a Bloomberg TV interview in Davos on Jan. 16. Photographer: Hollie Adams/Bloomberg The rand had been on a roll since the African National Congress formed a coalition government in June with business-friendly parties after losing its outright majority in elections the month before. The rally contributed to a dramatic slowdown in inflation — it slipped through the bottom of the central bank’s target range in October — raising hopes of a longer and steeper policy-easing cycle. That changed with Trump’s win and the currency’s almost 4% slump that followed. Policymakers cut the key interest rate by a meager quarter point on Thursday — and Governor Lesetja Kganyago wasn’t willing to promise much more — a volatile world warrants vigilance, he warned. “The problem that the world economy is in at the moment is that the stars are covered by clouds, the environment is uncertain and it calls for caution,” Kganyago said. That sentiment is likely to be felt across many countries on the continent, with eyes on persistent conflicts and a looming trade war. For consumers awash in debt, it was not what they wanted to hear. — Monique Vanek Key stories and opinion:

South Africa’s Cagey Central Bank to Cut Rates Sparingly in 2025

South Africa Strikes Cautious Tone With Quarter-Point Rate Cut

Griffin Says He’s Wary of Trump’s Tax-Cut and Tariff Agenda

Inflation Needs Subtlety Now. It’s Getting Trump: John Authers

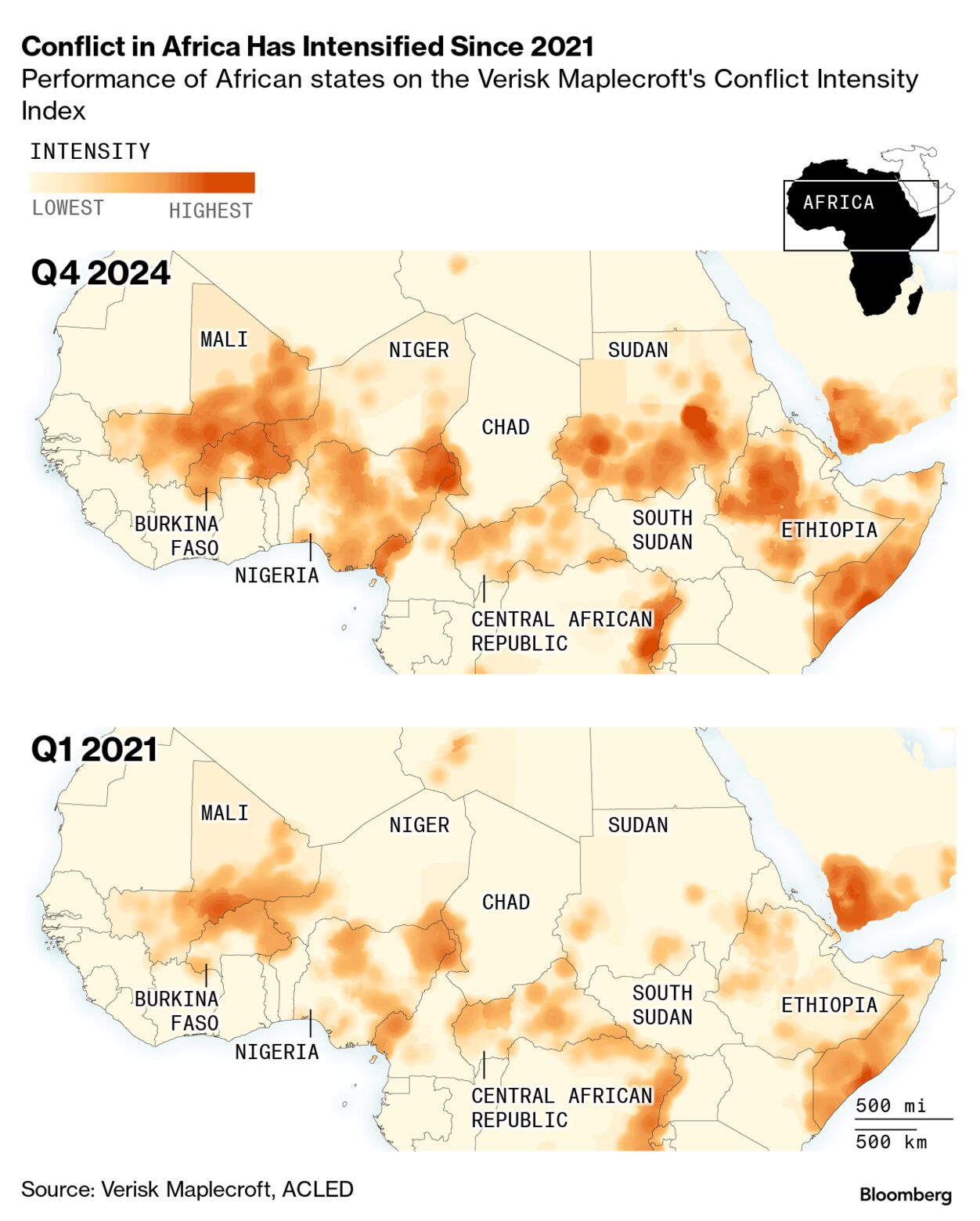

Why Trump’s Plan to Escalate Tariffs Has Many Haters: QuickTake Kenyan President William Ruto canceled two deals with Adani Group worth about $2.6 billion over corruption allegations, hours after its billionaire founder was charged by the US over a $250 million scheme that threatens to plunge his conglomerate into turmoil. Ruto ordered his ministers to “immediately cancel the ongoing procurement process” to manage the nation’s biggest airport and build high-voltage power-transmission lines.  A protest against an agreement for Adani to manage Nairobi’s airport on Sept. 2. Photographer: Kang-Chun Cheng/Bloomberg Mali freed Resolute Mining Chief Executive Officer Terry Holohan and two other employees, just days after the Australian gold mining company agreed to pay about $160 million to resolve a tax dispute with the government. Holohan and his colleagues were detained for more than a week after he traveled to the country to meet with tax and mining authorities. West Africa journalist Katarina Höije and our Africa mining reporter William Clowes delve into the saga with Jennifer Zabasajja in this week’s Next Africa podcast. Separately, Mali’s military leaders fired the entire government after Prime Minister Choguel Maiga criticized the junta’s failure to move to civilian rule. About 10% of Africa is embroiled in conflict, with fighting having spread and intensified over the past three years, according to a new report by risk advisory firm Verisk Maplecroft. As well as a civil war in Sudan, insecurity has worsened across the west of the Sahel region after a series of coups, the report said. “All indicators point towards a further intensification of violence in 2025,” said Hugo Brennan, Verisk Maplecroft’s research director.  Human rights groups accused Kenya of a “pattern” of collaborating with foreign powers over the rendition of political opponents, after a Ugandan opposition leader was detained last week. Kizza Besigye was seized while visiting Nairobi and transported to a jail in Uganda, according to his wife, Winnie Byanyima, the executive director of UNAIDS. The abduction comes just weeks after Kenya admitted to honoring a request by Turkey to deport four asylum seekers, adding to a long line of foreign dissidents that the East African country has helped extradite. Bitcoin enthusiast Chris Maurice founded Yellow Card after discovering the high costs of wire transfers while chatting with a Nigerian student at Auburn University in Alabama who was struggling to send a few hundred dollars back home. For Maurice, this was the type of problem with the financial system that proved the value of cryptocurrencies, which can be sent around the world almost instantly at a fraction of the cost of traditional transfers. Today, the crypto-trading firm employs about 270 people and operates in 20 African countries, trading more than $3 billion worth of crypto this year.  Maurice in Bangui, Central African Republic, in August 2022. Source: Chris Maurice Senegalese President Bassirou Diomaye Faye’s party won an overwhelming majority in parliamentary elections, paving the way for the country’s new leader to deliver on a reform agenda that’s targeted at stabilizing the state’s finances and creating jobs. The Pastef party won 130 of 165 seats in the National Assembly up from just 29 seats before. His predecessor Macky Sall, whose alliance held a slim majority in the previous legislature, conceded defeat after unofficial tallies from last week’s vote were reported. Next Africa Quiz — Which African country will host the next Group of 20 nations summit, in 2025? Send your answers to gbell16@bloomberg.net. Data Watch - South Africa’s inflation rate declined to a more than four-year low of 2.8% in October, while business confidence rose to its highest level since the first quarter of 2022.

- The International Monetary Fund said it made “substantial progress” in discussions with Egypt on the latest review of the nation’s $8 billion program, although further talks are needed.

- JBS, the world’s largest meat producer, plans to invest about $2.5 billion to build its first meatpacking facilities in Africa.

- Kenya plans to draw down on a $1.5 billion loan agreed with Abu Dhabi in tranches to remain within borrowing thresholds set in an IMF program.

Coming Up - Nov. 25 Ghana interest-rate decision, Nigeria third-quarter GDP data

- Nov. 26 Interest-rate decisions for Nigeria and Lesotho, South Africa central bank’s leading economic indicator

- Nov. 27 Mozambique interest-rate decision, Namibia presidential election, Tanzania local-government elections

- Nov. 28 Gambia interest-rate decision, Zambia inflation for November & trade data for October, South Africa producer inflation for October, Zimbabwe budget speech

- Nov. 29 Kenya and Uganda inflation for November, South Africa money supply data for October, monthly trade & budget data also for October, Morocco October money supply

|