| Thanks for reading Hyperdrive, Bloomberg’s newsletter on the future of the auto world. Read today’s featured story in full online here. Stellantis in Survival Mode | Carlos Tavares, the combative boss of Stellantis, barely hung onto his job after a shock profit warning in late September that laid bare the troubles at the maker of Jeeps, Fiats, Chryslers and Peugeots. At the time, he jettisoned the manufacturer’s finance chief and convinced the board to let him see through the end of his contract in 2026. As it turned out, he didn’t even survive the year. Over the past weekend, Chairman John Elkann and the board made it clear to Tavares that they had enough. In the end, one of the most divisive executives in the industry, who drives rally cars in his spare time, uncharacteristically went down without a fight, said people familiar with the situation, who asked not to be identified because the matter is confidential. Tavares, whose resignation was announced on Sunday after a Bloomberg News report, declined to comment. Tavares’ downfall owes much to what his colleagues describe as an abrasive style and strategic miscues years in the making. Even after his near-career death experience two months ago, Tavares doubled down on his trademark hard-knuckle approach that had got the 66-year-old into trouble in the first place, demanding deeper cost cuts to meet financial targets, according to the people.  John Elkann Photographer: Nicolò Campo/LightRocket/Getty Images He also faced more skepticism at the board level. Several executives, including the newly appointed chief financial officer, Doug Ostermann, presented some members of the board with a more negative picture of the automaker’s troubles in the key US market than what Tavares had shared, contributing to their loss of confidence, some of the people said. The messy exit and the tumultuous recent months leave deep scars at the company that has been led by Tavares since it was created in a 2021 merger. The search for a successor and interim leadership is now in the hands of Elkann, and the scion of the Agnelli industrial dynasty that founded predecessor Fiat has almost no margin for error. While Tavares’ divisive nature made him the focus of frustration for investors, dealers and auto workers in recent months, his rise and fall reflect the jeopardy facing legacy automakers as they seek to transition to a new era of electric-powered, software-laden vehicles. With a long list of problems that span lackluster models and frayed relations with shareholders, governments and suppliers, “Elkann needs a problem solver,” says Pierre-Olivier Essig, a London-based equities analyst at AIR Capital. The 48-year-old is now in damage control mode. After alerting Italy’s government of Tavares’ late-Sunday departure, Elkann flew to Detroit to address senior management. It’s a sign that his top priority is to stabilize US operations, where the carmaker is hemorrhaging market share, dealers are angry and workers have been in more or less open revolt. In a call with top managers from Detroit on Monday, Elkann took a swipe at Tavares, who was known for describing the auto industry as going through a Darwinian transition as a justification for his aggressive management style. “Darwin no longer exists because we will still exist,” Elkann said, according to a person familiar with the situation. For weeks, the United Auto Workers union had carried out a public campaign to have Tavares fired. After the news broke, President Shawn Fain called the move “a major step in the right direction for a company that has been mismanaged and a workforce that has been mistreated for too long.” There were also tensions in Italy, where Tavares had clashed repeatedly with Prime Minister Giorgia Meloni’s government over electric vehicle incentives and the CEO’s plan to shift production to lower-cost countries. Cost-cutting at Italian factories sparked pushback from unions and riled officials. On Monday, Stellantis halted output at its Mirafiori complex in Turin. At the center was poor performance that was largely hidden from view. In the years after the merger, Tavares, a protégé of disgraced former Renault-Nissan boss Carlos Ghosn, won praise from investors. His efficiency drive made the former Fiat Chrysler and France’s PSA leaner, bolstering returns. In the months following the pandemic, Stellantis also benefited from pent-up demand and high vehicle prices, with the shares peaking in late March. But as the company started losing market share, Tavares tried to keep prices high to protect margins. At the same time, he was intent on meeting emissions guidelines despite slumping demand for electric vehicles, and responded by slowing production of combustion-engine models, hitting profit and deliveries further. It was a sudden fall from grace for Tavares, who was made the highest-paid executive of a traditional automaker in mid-April. Just two weeks later, then-CFO Natalie Knight told analysts that slowing demand in Europe would continue to squeeze margins in the coming months, a warning that wasn’t part of the first-quarter report and caused the stock to slump 10%. And then on Sept. 30, Stellantis surprised investors with a major profit warning, citing plans to lower production and spend more on promotional incentives in a slowing and more competitive auto market. Tavares had resisted the profit warning for as long as he could, the people said. The automaker slashed its operating income margin forecast to as low as 5.5% this year, down from a previous expectation for a double-digit percentage. It also projected a cash drain of as much as €10 billion — a dramatic pullback from prior guidance for a positive result. Oddo BHF analyst Michael Foundoukidis said the magnitude of the warning raised “significant questions” about management’s visibility on its business. The darker outlook sent the company’s stock plunging and dragged on shares of European and US rivals. Stellantis is one of the world’s worst-performing auto stocks this year, with its US shares down around 47%. A few days later, Stellantis reported that its US sales slumped 20% in the third quarter, to a record low. Sales declined at five of its six brands, including a 6% slide at Jeep and 19% drop in the Ram truck division. Following the board showdown in October, Knight was ousted in a management shuffle, joining a growing list of high-profile departures. But Tavares had his wings clipped with Elkann pushing for more autonomy for the US operations. At the Los Angeles auto show last month, Antonio Filosa — who took charge of North America in the reshuffle — rolled out his comeback plan for Jeep, including lower prices and a new hybrid mid-size SUV to plug the hole left by the discontinued Jeep Cherokee. The attention now turns to the CEO search and how a 10-person committee can manage a multinational, multi-brand carmaker through one of the most difficult periods in the history of the auto industry. To succeed Tavares in one of the toughest jobs in the sector, there’s already a tentative short list being discussed, the people said, adding that one of the key criteria will be US experience. Successor Candidates Here is a partial list of contenders: Antonio Filosa is a prominent insider and seen as an early front-runner. He took charge of the Jeep brand last year and was appointed to run the entire North American business during the October management shakeup. Born in Naples, the 51-year-old former Fiat executive — who speaks English and Portuguese — has started visiting US plants and meeting dealers.

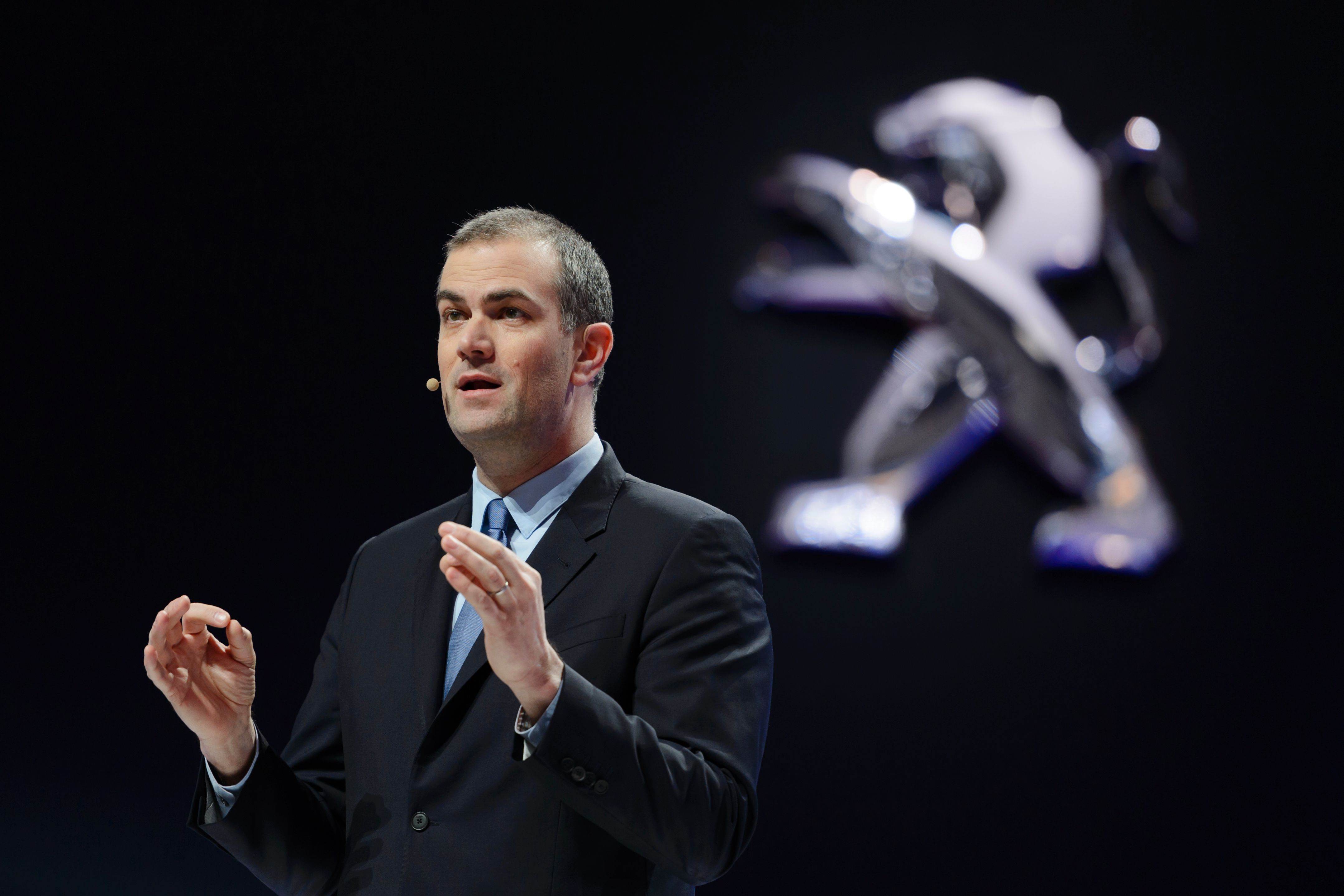

Antonio Filosa Photographer: Etienne Laurent/AFP/Getty Images Maxime Picat is another internal candidate. The 50-year-old Frenchman currently heads purchasing and held various positions within Stellantis. He comes from the Peugeot side of the organization and has close ties to one of the founding families.  Maxime Picat Photographer: Fabrice Coffrini/AFP/Getty Images Mike Manley could also make a return. The 60-year-old served as CEO of Fiat Chrysler before the merger that created Stellantis. He now runs US dealer AutoNation.  Mike Manley Photographer: Bill Pugliano/Getty Images Also, under discussions are a couple long-shot external candidates, which would need to be pried away from other high-profile jobs. Jose Munoz was a North American executive for Nissan before joining Hyundai in 2019. Last month, the Spanish-born 59-year-old was anointed to become the first foreigner to lead the Korean automaker. Luca de Meo, the 57-year-old CEO of French rival Renault, might be an option, given his success in the French automaker’s turnaround and his close relations with both the French and Italian governments and his experience working for Volkswagen and Fiat.

While the future for one of the world’s largest automakers is uncertain, there was hope that Tavares’ departure could offer a new start. “It’s time for change,” said Kevin Farrish, the head of Stellantis’ US dealer council who contributed to an open letter this summer accusing Tavares of destroying the company’s historic brands. Tavares played an “essential” role in bringing Stellantis into being as one of the biggest global automakers, but “now we’re on to stage two and let’s find a CEO that’s going to help take us back to where we belong and go beyond that hopefully.” — By Albertina Torsoli and Gabrielle Coppola  Elon Musk Photographer: Nathan Laine/Bloomberg Elon Musk’s record-setting Tesla pay package was struck down once again by a Delaware judge, threatening to wrest billions of dollars from the world’s richest person and one of Donald Trump’s closest confidants. Delaware Chancery Court Judge Kathaleen St. J. McCormick ruled Monday that Tesla’s board was improperly influenced by Musk when it adopted the billionaire’s plan in 2018. It was the second time she rejected the pay package as excessive, sticking with her original finding in January even after shareholders backed the plan and Musk asked her to reconsider. |